Draft – March 18, 2005

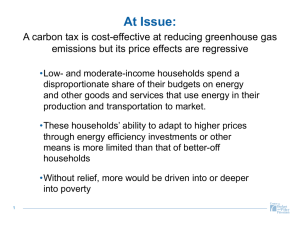

advertisement