PAGER/SGML ❏

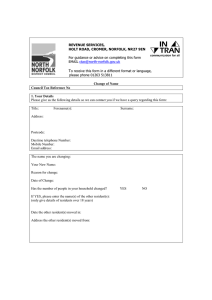

advertisement