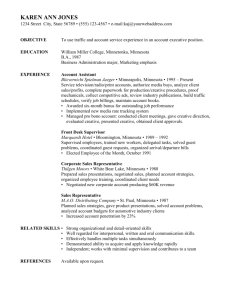

Document 14000038

advertisement