Selecting Health Coverage Through The State Health Plan

advertisement

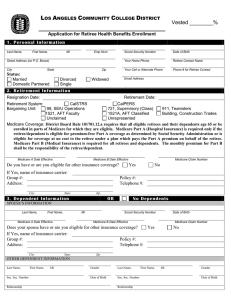

Selecting Health Coverage Through The State Health Plan Please print or type in black ink. Section A. FIRST NAME Tell us about yourself. MI LAST NAME SSN DATE OF BIRTH MAILING ADDRESS MEMBER ID CITY Marital status: Section B. STATE COUNTY SINGLE MARRIED ZIP CODE GENDER MALE WIDOWED Optional Retirement Program Legislative Retirement System SEPARATED ST CON OFF DEDUCT OFF ST CURRENT ST RETRO RET . DATE DCT. CURRENT DEDUCT RETRO EFF. DATE TOTAL TOTAL RSD USE ONLY Consolidated Judicial Retirement System FEMALE DIVORCED Please check appropriate box for eligibility. Teachers' and State Employees' Retirement System TELEPHONE NO. Disability Income Plan of North Carolina Surviving Spouse Section C. Please indicate the reason you are updating your coverage. Please check one of the following and comply with the special instructions. I am choosing coverage for the first time as a new retiree or recipient of extended short-term or long-term disability benefits. Complete all sections except Section F. I have existing coverage, but I want to choose my coverage for the 2007-2009 plan year during Annual Enrollment (March 1 through March 30, 2007). Complete all sections. I want to cancel or decline coverage for myself. The only other sections you need to complete are Sections F and J. I have existing coverage, but I want to change who in my family is covered. Skip to Section E. Section D. Please check one: Section E. Please check one: Please check the type of coverage you desire, if applicable. Indemnity Plan PPO 70/30 Plan SM (NC SmartChoice Basic) PP0 80/20 Plan SM (NC SmartChoice Standard) PPO 90/10 Plan SM (NC SmartChoice Plus) Please choose which family members you will cover. RETIREE ONLY RETIREE AND CHILD(REN) Spouse not included RETIREE AND SPOUSE Children not included RETIREE AND FAMILY Spouse and dependent children, if any, included. Note: For the Indemnity plan, the rate for RETIREE AND SPOUSE is the same rate as RETIREE AND FAMILY. Please continue to the next page. REV 20070928 HM Page 1 of 3 SSN Section F. Please give the events that caused you to modify your coverage, if applicable If adding, changing, or canceling coverage, please give the event that caused your change and its date (mm-dd-yyyy). Annual Enrollment Death Foster child Other coverage Student No longer student Marriage Newborn Max student age 26 Separation Step/Adopted Max child age 19 Divorce Other (Specify:) Section G. Please list any family members to be added, continued, or removed from coverage. For anyone added or removed from coverage, be sure to give the reason in Section F. SPOUSE ADD OR CONTINUE FIRST NAME REMOVE MI LAST NAME Gender SSN MALE FEMALE DATE OF BIRTH ELIGIBLE FOR MEDICARE? YES NO CHILDREN (You must attach documentation to prove legal guardianship or custody for children not added by birth or marriage.) ADD OR CONTINUE FIRST NAME REMOVE MI LAST NAME Gender: SSN MALE FEMALE DATE OF BIRTH IF CHILD IS OVER 19: STUDENT HANDICAPPED NATURAL STEPCHILD ADD OR CONTINUE FIRST NAME FOSTER REMOVE MI LAST NAME ADOPTED Gender: SSN ELIGIBLE FOR MEDICARE? MALE FEMALE DATE OF BIRTH YES NO IF CHILD IS OVER 19: STUDENT HANDICAPPED NATURAL STEPCHILD ADD OR CONTINUE FIRST NAME FOSTER REMOVE MI LAST NAME ADOPTED Gender: SSN ELIGIBLE FOR MEDICARE? MALE FEMALE DATE OF BIRTH YES NO IF CHILD IS OVER 19: STUDENT HANDICAPPED NATURAL STEPCHILD ADD OR CONTINUE FIRST NAME FOSTER REMOVE MI LAST NAME ADOPTED Gender: SSN ELIGIBLE FOR MEDICARE? MALE FEMALE DATE OF BIRTH YES NO IF CHILD IS OVER 19: STUDENT HANDICAPPED NATURAL STEPCHILD ADD OR CONTINUE FIRST NAME FOSTER REMOVE MI LAST NAME ADOPTED Gender: SSN ELIGIBLE FOR MEDICARE? MALE FEMALE DATE OF BIRTH YES NO IF CHILD IS OVER 19: STUDENT HANDICAPPED NATURAL STEPCHILD FOSTER ADOPTED ELIGIBLE FOR MEDICARE? YES NO Please continue to the next page. REV 20070928 HM Page 2 of 3 SSN Section H. List yourself and any other persons who are eligible for Parts A and B of Medicare. Medicare Parts A and B are required to continue the same level of coverage when you or dependents become Medicare eligible. YOURSELF Are you eligible for Medicare? FIRST NAME YES NO If YES, then please give the following: MI LAST NAME ELIGIBILITY IS DUE TO: AGE MEDICARE CLAIM NO. DISABILITY DATES OF ENROLLMENT PART A PART B RENAL DISEASE If eligibility is due to renal disease, please give the date that dialysis began OTHERS Is anyone you listed in Section G eligible for Medicare? FIRST NAME YES MI LAST NAME ELIGIBILITY IS DUE TO: AGE NO If YES, then please give the following: MEDICARE CLAIM NO. DISABILITY DATES OF ENROLLMENT PART A PART B RENAL DISEASE If eligibility is due to renal disease, please give the date that dialysis began Section I. Please complete if you or your dependents are covered by another group health policy. Coverage type: Self only POLICY NUMBER Parent/Child(ren) Self/Spouse POLICY HOLDER'S NAME Family SSN Effective date: DATE OF BIRTH NAME OF INSURANCE COMPANY NAME OF EMPLOYER PROVIDING THE POLICY ADDRESS OF INSURANCE COMPANY ADDRESS OF EMPLOYER CITY Section J. STATE ZIP CITY STATE ZIP Please authorize with your signature. Unsigned forms cannot be processed. I hereby elect coverage under the plan listed above for myself and eligible family dependents listed, if any, and I agree that the information provided is correct. I further agree that I/we shall abide by the provisions of the Agreement of the plan in which I/we are enrolling. I hereby authorize the Retirement System, until I revoke by written notice, to deduct from my benefit payment the retiree contribution, if any, required for the above indicated coverage. I authorize any licensed physician, medical practitioner, hospital, clinic, or other medically related facility, insurance company, or other organization or institution that has any records or knowledge of the health of myself or any other covered member of my family to exchange such information with the plan I have selected. I certify by my signature that I have completed pages 1, 2, and 3 of this form. Desired effective date of change, if applicable (mm-01-yyyy): Signature _________________________________________________________________________ Date ________________ Section K. Please submit this form by mail or fax. This form is also available online at www.myncretirement.com. • You may mail the completed form(s) to the address below. • You may fax the completed form(s) to (919) 508-5350 Thank you. N.C. Department of State Treasurer, Retirement Systems Division 325 North Salisbury Street, Raleigh, North Carolina 27603-1385 (919) 733-4191 in the Raleigh area or (877) 733-4191 toll free www.myncretirement.com REV 20070928 HM Page 3 of 3 This page is intentionally blank. Please continue to the Guides. Guides to Selecting Health Coverage Through the State Health Plan Guide A. Am I or my dependents eligible for coverage? Am I eligible for coverage? If you belong to the Teachers' and State Employees' Retirement System, the Consolidated Judicial Retirement System, or the Legislative Retirement System, and have five (5) or more years of retirement membership service credit, and you were hired prior to October 1, 2006, you are eligible for coverage if: first full month of benefits. Please consult your employer about the date your prior health insurance coverage will end. • You are a retiree. Under current law, the State pays for all of your individual coverage.* Your coverage is effective the first day of the next month following the effective retirement date. For example, if your effective date of retirement is July 1, 2007, your retired group health coverage will be effective August 1, 2007. If you are actively serving at the time you enter retirement, your System employer provides coverage for the thirty (30) days following the effective retirement date. If you begin coverage when first available to you as a retiree, there are no pre-existing condition clauses, but you should be careful not to cancel prior-retirement coverage too soon. If you are a member of the Local Governmental Employees' Retirement System, you should check with your employer about the availability of health insurance coverage, if any, for its retirees. • You are receiving extended short-term or long-term disability benefits through the Disability Income Plan of North Carolina (DIPNC) and you have met the requirement of having five (5) or more years of retirement membership service. Under current law, the State pays for all of your individual coverage.* However, if you have not met the retirement membership requirement, you are eligible for coverage, but the cost of the coverage is entirely your responsibility. If you are receiving DIPNC benefits under transitional clauses, you are eligible for coverage, but the cost of the coverage is entirely your responsibility. Regardless, your coverage is effective the first of the following month if your disability benefit period begins between the 1st and the 14th of the month. If your benefit period begins between the 15th and the 31st of the month, your coverage is effective the first of the month following the Guide B. If you are retired under the Optional Retirement Program, you are also eligible for coverage, provided you met the requirement of having five (5) years of membership service under the Optional Retirement Program. Under current law, the State pays for all of your individual coverage.* Is my family eligible for coverage? If you are eligible for health insurance coverage, then your spouse and your eligible dependents are also eligible for coverage. An eligible dependent child can be covered until age 19 or until age 26, if a full-time student. Eligible dependents include your natural children, your children through marriage, or your adopted and foster children. However, you are responsible for the cost of the coverage for any dependents covered. What happens to my dependents' coverage at my death? If you were providing your spouse and/or eligible dependents with health insurance at the time of your death, then they are eligible for continued coverage (child coverage would continue based on the conditions above) after your death. At that time, they would be wholly responsible for the cost of the coverage. Please inform your spouse and eligible dependents to immediately report your death to the Retirement Systems Division with a death certificate. If they want to continue coverage, they must also submit an Form HM at that time; they will later be contacted with further instructions. *The enhanced coverage offered through the 90/10 PPO plan is available at additional cost. Does the cost of my coverage change? When do my choices become effective? What impact does Medicare have on the cost of coverage? If you are receiving disability benefits, or if you are a retiree under the age of 65, the cost of coverage begins at a certain rate. Under current provisions, the rate decreases when you become eligible for Medicare. You will only notice this decrease if you choose a level of coverage in which you pay part of the cost. Under current provisions, the rates also decrease when your spouse or dependents become eligible for Medicare. Please be sure they too apply for Medicare as soon as they are eligible. At any time your spouse or dependents become eligible for Medicare, you must inform the Retirement Systems Division by completing a new Form HM, available at www.myncretirement.com. You must apply for Medicare coverage, both Parts A (hospital coverage) and B (medical coverage) through the Social Security Administration, as soon as you are eligible, in order to maintain the same level of coverage you enjoyed prior to becoming eligible for Medicare. To learn about applying for Medicare, visit www.medicare.gov or call 1-800-MEDICARE. Part A of Medicare is free, but Part B is not. When you begin coverage, you will choose (a) one of four plans to cover you (or your family) and (b) whether to provide coverage for your spouse and/or dependents. You may drop and add eligible dependents from coverage at any time by completing another Form HM. However, a pre-existing condition waiting period may apply if there is no qualifying Please continue to the next page. What if I change my mind about the coverage I want? GUIDES HM PAGE 1 OF 4 REV 20070928 Guide B. (Continued) event. The change can be made as early as the first day of the month following the date the form is signed. However, Form HM should be submitted to the Retirement Systems Division by the 10th of the month in order for the change to be processed on the first day of the following month. You have a choice among four health plans: the Indemnity plan and three PPO plans. See Guides C and G for a comparison of these. You will have a period of time each year (annual enrollment) in which you may change between the four plans offered. The information in Guides B, E, G, is provided to you on behalf of the State Health Plan. Please contact State Health Plan Customer Services at 1-800-422-4658 with any questions you may have about the Idemnity plan or 1-888-234-2416 for the PPO plans. The Retirement Systems Division cannot provide further information about these plans or guide you in choosing one. You have a choice among four plans. This choice includes the three preferred provider organization (PPO) plans and the Indemnity plan. First you should consider if you prefer the PPO or Indemnity. What are the key features of the PPO plans? As a NC SmartChoiceSM Blue OptionsSM PPO member you will receive services at reduced out-of-pocket costs when you use in-network providers. Also, you decide when to visit a specialist and whether to select a provider from in-network or out-of-network. Referrals are never required for visits to your provider even when you use an out-of-network provider. PPO Plan Name Guide C. What type of plan is best for me, one of the PPO plans or the Indemnity plan? The State Health Plan has contracted with Blue Cross Blue Shield to use their BlueOptions® program. The BlueOptions® program has contracted with most primary care physicians, specialists, and hospitals in North Carolina. In-network providers are located in all 100 counties in North Carolina. If you are not a NC resident or frequently travel outside of North Carolina, you can receive care from any participating Blue Cross Blue Shield provider at the same in-network benefit level through the BlueCard® program. This program also provides you with worldwide coverage. To find out if your provider participates in the BlueOptions® program you can visit the State Health Plan at www.shpnc.org and click on “Find a Doctor,” or you can call 1-800-810-BLUE (2583) for out-of-state providers. Sample Plan coDeductible insurance Compared to other PPO SmartChoice SM Basic $600 70% lowest cost SmartChoice SM Standard $300 80% mid cost SmartChoice SM Plus $150 90% highest cost What are the key features of the Indemnity plan? The Indemnity plan offers the traditional coverage. At each office visit and specialist visit, you pay a copay and then you pay the remainder of the bill for that visit and each visit there after until the cumulative amount you have paid for treatment reaches a certain limit (your deductible) for that plan year. After you reach your deductible, your health insurance pays a percentage of the remaining bill and you pay the rest (these percentages are called plan coinsurance and member coinsurance, respectively). You pay the coinsurance for each treatment until you reach another limit (coinsurance maximum). How else can the PPO and Indemnity plans be compared? Comparatively the monthly cost to you (premiums) for dependents under the Indemnity plan is more than the basic and standard PPO plans, but less than the PPO Plus plan. You may prefer a PPO plan if: • You want to cover your spouse only, at a rate that is not the same as covering your entire family. • You are looking for reduced premiums because you cover more than just yourself. • You want lower out-of-pocket costs each time you seek care. • You want your health insurance to offer less restrictive coverage for wellness and preventative health. The three available PPO plans are chiefly differentiated by their copays, deductibles and coinsurance rates. Higher deductibles and lower (plan-paid) coinsurance means lower monthly costs (lower premiums) for you, but possibly higher portions of your medical bill for which you are responsible (higher out-of-pocket costs). In contrast, lower deductibles and higher (plan-paid) coinsurance mean higher monthly costs to you, but possibly lower out-of-pocket costs and visits. You may prefer the Indemnity plan if: • You already have a relationship with a physician who is out-of-network under the PPO plan Premiums for health insurance coverage are paid one month in advance. For example, a deduction from the January benefit is for coverage effective for the month of February. If you are receiving a disability benefit or receiving a retirement benefit, your premiums are automatically deducted from your benefit check. If the premiums for which you are responsible exceed the amount of your benefit, then the North Carolina State Health Plan will bill you directly each month for the total premiums. If you are covered on the basis of being a spouse or dependent of a deceased member, you may have the premiums deducted from a survivor's benefit you are receiving from the Retirement System. Or, the State Health Plan will bill you directly. Under all cases, premiums are not tax-deferred. Guide D. For a detailed comparison of all plans, see Guide G. For a quote of all current rates, see Guide E. If you have questions regarding which plan to choose, please contact State Health Plan Customer Services at 1-800-422-4658 for the Idemnity plan or 1-888-234-2416 for the PPO plans. How will I pay for additional premiums not paid by the State? Please continue to the next page. GUIDES HM PAGE 2 OF 4 REV 20070928 Guide E. What are the monthly premiums for Plan Year 2007/2009? Plan Year 2007-2009 Preferred Provider Organization (PPO) Plans 70/30 PPO Plan 90/10 PPO Plan 80/20 PPO Plan SM SM SM Indemnity Plan SmartChoice SmartChoice SmartChoice Basic Plus Standard Before you are Medicare eligible, and before your spouse or dependents, if any, are eligible: October 1, 2007 - June 30, 2009 Retiree Retiree + Child(ren) Retiree + Spouse Retiree + Family $0 $223.00 $534.88 $534.88 $0 $150.66 $388.18 $413.46 $0 $200.36 $461.64 $489.44 $43.98 $269.78 $564.22 $595.52 $0 $200.36 $461.64 $489.44 $33.48 $259.28 $553.72 $585.06 $0 $152.52 $344.64 $372.44 $43.98 $215.86 $432.36 $463.68 $0 $152.52 $344.64 $372.44 $33.48 $205.36 $421.86 $453.18 After you are Medicare eligible, but your spouse or dependent(s), if any, are not: Retiree Retiree + Child(ren) Retiree + Spouse Retiree + Family $0 $223.00 $534.88 $534.88 $0 $158.18 $395.70 $420.98 Before you are Medicare eligible, but after your spouse or dependent(s) are: Retiree Retiree + Child(ren) Retiree + Spouse Retiree + Family $0 $169.52 $406.52 $406.52 $0 $107.18 $281.84 $307.10 After you are Medicare eligible, and your spouse and dependents are too: Retiree Retiree + Child(ren) Retiree + Spouse Retiree + Family $0 $169.52 $406.52 $406.52 $0 $114.70 $289.34 $314.62 For more information, visit the State Health Plan on the web at www.shpnc.org or call 1-800-422-4658 contact State Health Plan Customer Services at 1-800-422-4658 for the Idemnity plan or 1-888-234-2416 for the PPO plans. The Retirement Systems Division cannot provide additional information about these plans or guide you in choosing one. Guide F. Whom can I contact with questions? Contact the Retirement Systems Division at the address or number below, or visit online at www.myncretirement.com, if you have questions about (a) your enrollment under the retiree group, (b) determining your or your family member's eligibility under the retiree group of the State Health Plan or (c) which premium rate you will pay. Please continue to the next page. Contact the State Health Plan Customer Services if you have questions about: (a) which plan to choose, (b) a specific claim, (c) your coverage as a spouse or dependent of a deceased member (d) insurance cards or benefits booklets, or (e) finding a provider. Indemnity plan members call 1-800-422-4658. NC SM SmartChoice Blue OptionsSM PPO members call 1-888-234-2416. GUIDES HM PAGE 3 OF 4 REV 20070928 Guide G. What are the plan choices offered by the North Carolina State Health Plan for the Plan Year 2007/2009? The Retirement Systems Division cannot provide further information about these plans or guide you in choosing one. Preferred Provider Organization (PPO) Plans Plan Year 2007-2009 October 1, 2007- June 30, 2009 Plan Design Feature Lifetime Maximum Annual Deductible (Ind/Fam) Plan Coinsurance Primary Care Specialist Urgent Care 70/30 PPO Plan SM SmartChoice Basic 80/20 PPO Plan SM SmartChoice Standard 90/10 PPO Plan SM SmartChoice Plus (Indemnity Plan) In-Network Out-of-Network In-Network Out-of-Network In-Network Out-of-Network $5 million Unlimited Unlimited Unlimited Unlimited Unlimited Unlimited $300/$900* $600/$1800* $150/$450* $300/$900* 80% 60% 90% 70% $450/$1350 80% Coinsurance Maximum (Ind/Fam) Physician Office Visits Indemnity Plan $2,000/$6,000 $25 plus D&C (see notes below) $25 plus D&C -- $600/$1800* $1,200/$,3600* 70% 50% $2,500/$7,500 $5,000/$15,000 $1.750/$5,250 $3,500/$10,500 $1,000/$3,000 $2,000/$6,000 $25 $50 $75 Covered after D&C Covered after D&C $75 $20 $40 $50 Covered after D&C Covered after D&C $50 $15 $30 $50 Covered after D&C Covered after D&C $50 Inpatient copay $150, then D&C $200, then D&C $150, then D&C $100, then D&C Outpatient Hospital and Ambulatory Surgical Center copay $75, then D&C D&C D&C D&C Emergency Room copay $150, then D&C $250, then D&C $200, then D&C $150, then D&C Wellness Benefits (annual) $150 Generic Rx copay Preferred Rx copay Prescription (no generic equivalent) Drug Benefits Preferred Rx copay (generic equivalent) Non-preferred Rx copay $10 $30 $10 $30 $10 $30 $10 $30 $40 $40 $40 $40 $50 $50 $50 $50 Per benefits Not covered Per benefits Not covered Per benefits Not covered • D&C stands for deductible and coinsurance. • For the PPO options, in most cases, there are no deductibles for physician office visits. Only the copayment applies. Some in-network hospital owned/operated practices may be subject to deductible and co-insurance. Please call your physician or see the Provider Directory to determine if his/her practice is hospital owned or operated. • For the PPO Options, for Wellness/Preventative Health Coverage, please refer to the Summary of Benefits provided by the State Health Plan. • NC HealthSmart, the State Health Plan's healthy living initiative, is available at no additional cost, but those eligible for Medicare are not eligible for the initiative. • The current drug benefit does not change under any of the plans, except for diabetic supplies. Diabetic supplies are covered under the PPO plans for a copayment. For more information, see Guides E and F for complete contact information. Thank you. GUIDES HM PAGE 4 OF 4 REV 20070928