Document 13998149

advertisement

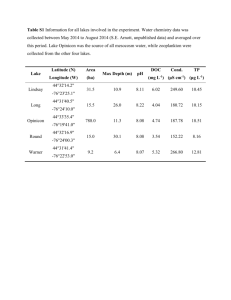

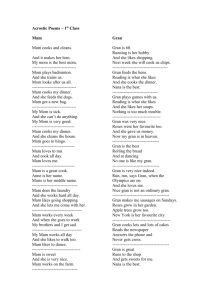

Monthly Market Detail - August 2014 Single Family Homes Florida August 2014 August 2013 Percent Change Year-over-Year 21,252 20,630 3.0% 8,195 8,524 -3.9% Median Sale Price $180,000 $175,000 2.9% Average Sale Price $255,701 $246,697 3.6% $5.4 Billion $5.1 Billion 6.9% 94.8% 95.5% -0.7% Median Time to Contract 56 Days 50 Days 12.0% Median Time to Sale 101 Days 99 Days 2.0% New Pending Sales 23,707 23,249 2.0% New Listings 27,047 27,043 0.0% Pending Inventory 42,013 47,708 -11.9% Inventory (Active Listings) 103,508 92,232 12.2% Months Supply of Inventory 5.4 5.0 8.0% Closed Sales Percent Change Year-over-Year 21,252 21,980 22,621 22,355 21,103 19,597 15,657 14,591 19,035 16,210 18,098 17,892 20,630 3.0% 3.8% 10.9% 0.9% 2.5% 0.5% 0.1% 3.3% 5.7% -3.8% 2.5% 15.1% 10.7% Summary Statistics Closed Sales Paid in Cash Dollar Volume Median Percent of Original List Price Received Month Closed Sales The number of sales transactions which closed during the month Economists' note : Closed Sales are one of the simplest—yet most important—indicators for the residential real estate market. When comparing Closed Sales across markets of different sizes, we recommend comparing the percent changes in sales rather than the number of sales. Closed Sales (and many other market metrics) are affected by seasonal cycles, so actual trends are more accurately represented by year-over-year changes (i.e. comparing a month's sales to the amount of sales in the same month in the previous year), rather than changes from one month to the next. Closed Sales 25,000 2010 2011 August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 2012 2013 2014 20,000 15,000 10,000 5,000 0 J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Produced by Florida REALTORS® with data provided by Florida's multiple listing services. Statistics for each month compiled from MLS feeds on the 15th day of the following month. Data released on Monday, September 22, 2014. Data revised on Friday, February 26, 2016. Next data release is Tuesday, October 21, 2014. Monthly Market Detail - August 2014 Single Family Homes Florida Month Cash Sales The number of Closed Sales during the month in which buyers exclusively paid in cash Economists' note : Cash Sales can be a useful indicator of the extent to which investors are participating in the market. Why? Investors are far more likely to have the funds to purchase a home available up front, whereas the typical homebuyer requires a mortgage or some other form of financing. There are, of course, many possible exceptions, so this statistic should be interpreted with care. 12,000 2010 2011 August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 2012 Cash Sales Percent Change Year-over-Year 8,195 8,254 8,885 9,323 9,151 8,893 7,492 7,125 8,095 7,047 7,955 7,429 8,524 -3.9% -7.6% 0.5% -8.5% -7.2% -5.5% -6.0% 0.6% -4.6% -9.8% -2.8% 8.1% 6.8% 2013 2014 Cash Sales 10,000 8,000 6,000 4,000 2,000 0 J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Month Cash Sales as a Percentage of Closed Sales The percentage of Closed Sales during the month which were Cash Sales Pct. of Closed Sales Paid in Cash Economists' note : This statistic is simply another way of viewing Cash Sales. The remaining percentages of Closed Sales (i.e. those not paid fully in cash) each month involved some sort of financing, such as mortgages, owner/seller financing, assumed loans, etc. 60% 2010 2011 August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 2012 2013 Percent of Closed Sales Paid in Cash Percent Change Year-over-Year 38.6% 37.6% 39.3% 41.7% 43.4% 45.4% 47.9% 48.8% 42.5% 43.5% 44.0% 41.5% 41.3% -6.5% -10.9% -9.2% -9.3% -9.4% -6.0% -5.9% -2.6% -9.8% -6.2% -5.2% -6.1% -3.5% 2014 50% 40% 30% 20% 10% 0% J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Produced by Florida REALTORS® with data provided by Florida's multiple listing services. Statistics for each month compiled from MLS feeds on the 15th day of the following month. Data released on Monday, September 22, 2014. Data revised on Friday, February 26, 2016. Next data release is Tuesday, October 21, 2014. Monthly Market Detail - August 2014 Single Family Homes Florida Month Median Sale Price The median sale price reported for the month (i.e. 50% of sales were above and 50% of sales were below) Economists' note : Median Sale Price is our preferred summary statistic for price activity because, unlike Average Sale Price, Median Sale Price is not sensitive to high sale prices for small numbers of homes that may not be characteristic of the market area. Keep in mind that median price trends over time are not always solely caused by changes in the general value of local real estate. Median sale price only reflects the values of the homes that sold each month, and the mix of the types of homes that sell can change over time. Median Sale Price $200K 2010 2011 August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 2012 Median Sale Price Percent Change Year-over-Year $180,000 $185,000 $185,000 $180,000 $175,000 $174,000 $165,000 $163,000 $173,000 $170,000 $169,900 $170,000 $175,000 2.9% 3.9% 5.7% 4.7% 6.1% 8.1% 10.0% 12.4% 12.3% 13.3% 17.2% 17.2% 19.0% 2013 2014 $150K $100K $50K $0K J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Month Average Sale Price The average sale price reported for the month (i.e. total sales in dollars divided by the number of sales) Average Sale Price Economists' note : Usually, we prefer Median Sale Price over Average Sale Price as a summary statistic for home prices. However, Average Sale Price does have its uses—particularly when it is analyzed alongside the Median Sale Price. For one, the relative difference between the two statistics can provide some insight into the market for higher-end homes in an area. $300K 2010 2011 August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 2012 2013 Average Sale Price Percent Change Year-over-Year $255,701 $265,731 $273,363 $278,107 $263,189 $257,335 $260,275 $251,249 $252,251 $239,864 $240,094 $241,019 $246,697 3.6% 4.0% 2.5% 7.3% 3.3% 5.9% 11.6% 18.6% 3.2% 7.3% 13.0% 13.2% 12.9% 2014 $250K $200K $150K $100K $50K $0K J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Produced by Florida REALTORS® with data provided by Florida's multiple listing services. Statistics for each month compiled from MLS feeds on the 15th day of the following month. Data released on Monday, September 22, 2014. Data revised on Friday, February 26, 2016. Next data release is Tuesday, October 21, 2014. Monthly Market Detail - August 2014 Single Family Homes Florida Dollar Volume The sum of the sale prices for all sales which closed during the month Economists' note : Dollar Volume is simply the sum of all sale prices in a given time period, and can quickly be calculated by multiplying Closed Sales by Average Sale Price. It is a strong indicator of the health of the real estate industry in a market, and is of particular interest to real estate professionals, investors, analysts, and government agencies. Potential home sellers and home buyers, on the other hand, will likely be better served by paying attention to trends in the two components of Dollar Volume (i.e. sales and prices) individually. Dollar Volume $8 B 2010 2011 Month Dollar Volume Percent Change Year-over-Year August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 $5.4 Billion $5.8 Billion $6.2 Billion $6.2 Billion $5.5 Billion $5.0 Billion $4.1 Billion $3.7 Billion $4.8 Billion $3.9 Billion $4.3 Billion $4.3 Billion $5.1 Billion 6.9% 8.1% 13.7% 8.3% 5.8% 6.5% 11.6% 22.5% 9.2% 3.2% 15.9% 30.4% 25.0% 2012 2013 2014 $6 B $4 B $2 B $0 J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Median Percent of Original List Price Received The median of the sale price (as a percentage of the original list price) across all properties selling during the month Med. Pct. of Orig. List Price Received Economists' note : The Median Percent of Original List Price Received is useful as an indicator of market recovery, since it typically rises as buyers realize that the market may be moving away from them and they need to match the selling price (or better it) in order to get a contract on the house. This is usually the last measure to indicate a market has shifted from down to up, so it is what we would call a lagging indicator. 120% 2010 2011 Month August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 2012 2013 Med. Pct. of Orig. List Price Received Percent Change Year-over-Year 94.8% 94.8% 94.7% 94.3% 94.2% 94.1% 94.0% 94.1% 94.6% 94.8% 95.2% 95.5% 95.5% -0.7% -0.6% -0.8% -0.7% -0.5% -0.2% 0.2% 0.4% 0.7% 1.3% 1.7% 2.2% 2.0% 2014 100% 80% 60% 40% 20% 0% J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Produced by Florida REALTORS® with data provided by Florida's multiple listing services. Statistics for each month compiled from MLS feeds on the 15th day of the following month. Data released on Monday, September 22, 2014. Data revised on Friday, February 26, 2016. Next data release is Tuesday, October 21, 2014. Monthly Market Detail - August 2014 Single Family Homes Florida Month Median Time to Contract The median number of days between the listing date and contract date for all Closed Sales during the month Economists' note : Like Time to Sale, Time to Contract is a measure of the length of the home selling process calculated for sales which closed during the month. The difference is that Time to Contract measures the number of days between the initial listing of a property and the signing of the contract which eventually led to the closing of the sale. When the gap between Median Time to Contract and Median Time to Sale grows, it is usually a sign of longer closing times and/or declining numbers of cash sales. Median Time to Contract 120 2010 2011 August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 2012 Median Time to Contract Percent Change Year-over-Year 56 Days 56 Days 56 Days 57 Days 60 Days 65 Days 68 Days 61 Days 54 Days 52 Days 49 Days 50 Days 50 Days 12.0% 12.0% 9.8% 1.8% 5.3% 4.8% 0.0% -7.6% -16.9% -18.8% -23.4% -23.1% -24.2% 2013 2014 100 80 60 40 20 0 J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Month Median Time to Sale The median number of days between the listing date and closing date for all Closed Sales during the month Median Time to Sale Economists' note : Time to Sale is a measure of the length of the home selling process, calculated as the number of days between the initial listing of a property and the closing of the sale. Median Time to Sale is the amount of time the "middle" property selling this month was on the market. That is, 50% of homes selling this month took less time to sell, and 50% of homes took more time to sell. Median Time to Sale gives a more accurate picture than Average Time to Sale, which can be skewed upward by small numbers of properties taking an abnormally long time to sell. 200 2010 2011 August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 2012 2013 Median Time to Sale Percent Change Year-over-Year 101 Days 101 Days 101 Days 101 Days 103 Days 110 Days 113 Days 109 Days 103 Days 98 Days 96 Days 99 Days 99 Days 2.0% 1.0% -1.0% -3.8% -1.0% -3.5% -5.0% -8.4% -13.4% -17.6% -20.7% -19.5% -18.2% 2014 150 100 50 0 J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Produced by Florida REALTORS® with data provided by Florida's multiple listing services. Statistics for each month compiled from MLS feeds on the 15th day of the following month. Data released on Monday, September 22, 2014. Data revised on Friday, February 26, 2016. Next data release is Tuesday, October 21, 2014. Monthly Market Detail - August 2014 Single Family Homes Florida Month New Pending Sales The number of listed properties that went under contract during the month Economists' note : Because of the typical length of time it takes for a sale to close, economists consider Pending Sales to be a decent indicator of potential future Closed Sales. It is important to bear in mind, however, that not all Pending Sales will be closed successfully. So, the effectiveness of Pending Sales as a future indicator of Closed Sales is susceptible to changes in market conditions such as the availability of financing for homebuyers and the inventory of distressed properties for sale. 2010 Pending Sales 30,000 2011 August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 2012 New Pending Sales Percent Change Year-over-Year 23,707 24,250 24,252 26,105 26,679 26,297 22,718 22,577 17,595 19,041 22,013 20,373 23,249 2.0% 2.0% 1.8% -2.3% -1.9% 0.2% -6.2% -3.7% -6.6% -8.5% -0.8% 8.1% 15.8% 2013 2014 25,000 20,000 15,000 10,000 5,000 0 J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Month New Listings The number of properties put onto the market during the month Economists' note : New Listings tend to rise in delayed response to increasing prices, so they are often seen as a lagging indicator of market health. As prices rise, potential sellers raise their estimations of value—and in the most recent cycle, rising prices have freed up many potential sellers who were previously underwater on their mortgages. Note that in our calculations, we take care to not include properties that were recently taken off the market and quickly relisted, since these are not really new listings. New Listings 40,000 2010 2011 August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 2012 2013 New Listings Percent Change Year-over-Year 27,047 28,022 27,262 28,668 29,059 29,127 26,898 28,210 20,455 23,197 27,413 25,255 27,043 0.0% 4.5% 8.4% 10.1% 8.2% 14.4% 10.0% 7.3% 20.0% 12.6% 14.2% 18.0% 17.5% 2014 30,000 20,000 10,000 0 J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Produced by Florida REALTORS® with data provided by Florida's multiple listing services. Statistics for each month compiled from MLS feeds on the 15th day of the following month. Data released on Monday, September 22, 2014. Data revised on Friday, February 26, 2016. Next data release is Tuesday, October 21, 2014. Monthly Market Detail - August 2014 Single Family Homes Florida Inventory (Active Listings) The number of property listings active at the end of the month Economists' note : There are a number of ways to define and calculate Inventory. Our method is to simply count the number of active listings on the last day of the month, and hold this number to compare with the same month the following year. Inventory rises when New Listings are outpacing the number of listings that go off-market (regardless of whether they actually sell). Likewise, it falls when New Listings aren't keeping up with the rate at which homes are going off-market. 200,000 2010 2011 Month Inventory Percent Change Year-over-Year August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 103,508 104,850 104,155 104,405 105,154 104,925 105,884 103,269 100,661 101,650 98,870 95,736 92,232 12.2% 16.7% 18.4% 18.3% 16.9% 15.1% 13.0% 9.6% 9.1% 6.6% -2.6% -9.2% -15.3% 2012 2013 2014 Inventory 150,000 100,000 50,000 0 J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Month Months Supply of Inventory An estimate of the number of months it will take to deplete the current Inventory given recent sales rates Months Supply of Inventory Economists' note : MSI is a useful indicator of market conditions. The benchmark for a balanced market (favoring neither buyer nor seller) is 5.5 months of inventory. Anything higher is traditionally a buyers' market, and anything lower is a sellers' market. There is no single accepted way of calculating MSI. A common method is to divide current Inventory by the most recent month's Closed Sales count, but this count is a usually poor predictor of future Closed Sales due to seasonal cycles. To eliminate seasonal effects, we use the 12-month average of monthly Closed Sales instead. 15.0 2010 2011 August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 October 2013 September 2013 August 2013 2012 2013 Months Supply Percent Change Year-over-Year 5.4 5.5 5.5 5.5 5.6 5.6 5.6 5.5 5.4 5.4 5.3 5.1 5.0 8.0% 12.2% 12.2% 12.2% 9.8% 5.7% 3.7% 0.0% -1.8% -5.3% -14.5% -21.5% -26.5% 2014 10.0 5.0 0.0 J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A Produced by Florida REALTORS® with data provided by Florida's multiple listing services. Statistics for each month compiled from MLS feeds on the 15th day of the following month. Data released on Monday, September 22, 2014. Data revised on Friday, February 26, 2016. Next data release is Tuesday, October 21, 2014. Monthly Market Detail - August 2014 Single Family Homes Florida Closed Sales Percent Change Year-over-Year Less than $50,000 1,302 -0.1% $50,000 - $99,999 2,994 -5.0% $100,000 - $149,999 3,857 -0.5% $150,000 - $199,999 3,645 8.3% $200,000 - $249,999 2,617 3.7% $250,000 - $299,999 1,901 6.7% $300,000 - $399,999 2,177 5.0% $400,000 - $599,999 1,593 9.6% $600,000 - $999,999 749 6.1% $1,000,000 or more 417 6.1% Sale Price Closed Sales by Sale Price The number of sales transactions which closed during the month Economists' note: Closed Sales are one of the simplest—yet most important—indicators for the residential real estate market. When comparing Closed Sales across markets of different sizes, we recommend comparing the percent changes in sales rather than the number of sales. Closed Sales (and many other market metrics) are affected by seasonal cycles, so actual trends are more accurately represented by year-over-year changes (i.e. comparing a month's sales to the amount of sales in the same month in the previous year), rather than changes from one month to the next. August 2013 August 2014 Closed Sales 4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 Less than $50,000 $50,000 $99,999 $100,000 $149,999 $150,000 $199,999 $200,000 $249,999 $250,000 $299,999 The median number of days between the listing date and contract date for all Closed Sales during the month Median Time to Contract Economists' note : Like Time to Sale, Time to Contract is a measure of the length of the home selling process calculated for sales which closed during the month. The difference is that Time to Contract measures the number of days between the initial listing of a property and the signing of the contract which eventually led to the closing of the sale. When the gap between Median Time to Contract and Median Time to Sale grows, it is usually a sign of longer closing times and/or declining numbers of cash sales. August 2013 Less than $50,000 $50,000 $99,999 $300,000 $399,999 $400,000 $599,999 $600,000 - $1,000,000 or $999,999 more Median Time to Contract Percent Change Year-over-Year Less than $50,000 57 3.6% $50,000 - $99,999 55 10.0% $100,000 - $149,999 51 21.4% $150,000 - $199,999 49 6.5% $200,000 - $249,999 56 24.4% $250,000 - $299,999 59 43.9% $300,000 - $399,999 54 3.8% $400,000 - $599,999 72 4.3% $600,000 - $999,999 90 -9.1% $1,000,000 or more 133 -15.3% Sale Price Median Time to Contract by Sale Price 180 160 140 120 100 80 60 40 20 0 4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 August 2014 $100,000 $149,999 $150,000 $199,999 180 160 140 120 100 80 60 40 20 0 $200,000 $249,999 $250,000 $299,999 $300,000 $399,999 $400,000 $599,999 $600,000 - $1,000,000 or $999,999 more Produced by Florida REALTORS® with data provided by Florida's multiple listing services. Statistics for each month compiled from MLS feeds on the 15th day of the following month. Data released on Monday, September 22, 2014. Data revised on Friday, February 26, 2016. Next data release is Tuesday, October 21, 2014. Monthly Market Detail - August 2014 Single Family Homes Florida New Listings by Initial Listing Price The number of properties put onto the market during the month Economists' note: New Listings tend to rise in delayed response to increasing prices, so they are often seen as a lagging indicator of market health. As prices rise, potential sellers raise their estimations of value—and in the most recent cycle, rising prices have freed up many potential sellers who were previously underwater on their mortgages. Note that in our calculations, we take care to not include properties that were recently taken off the market and quickly relisted, since these are not really new listings. August 2013 New Listings 5,000 Initial Listing Price New Listings Percent Change Year-over-Year Less than $50,000 1,224 -17.2% $50,000 - $99,999 3,357 -19.1% $100,000 - $149,999 4,603 -3.3% $150,000 - $199,999 4,551 4.4% $200,000 - $249,999 3,235 4.8% $250,000 - $299,999 2,704 6.3% $300,000 - $399,999 3,128 11.5% $400,000 - $599,999 2,271 12.5% $600,000 - $999,999 1,176 6.5% $1,000,000 or more 798 8.9% August 2014 5,000 4,000 4,000 3,000 3,000 2,000 2,000 1,000 1,000 0 0 Less than $50,000 $50,000 $99,999 $100,000 $149,999 $150,000 $199,999 $200,000 $249,999 $250,000 $299,999 The number of property listings active at the end of the month Inventory Economists' note : There are a number of ways to define and calculate Inventory. Our method is to simply count the number of active listings on the last day of the month, and hold this number to compare with the same month the following year. Inventory rises when New Listings are outpacing the number of listings that go off-market (regardless of whether they actually sell). Likewise, it falls when New Listings aren't keeping up with the rate at which homes are going off-market. August 2013 Less than $50,000 $50,000 $99,999 $400,000 $599,999 $600,000 - $1,000,000 or $999,999 more Inventory Percent Change Year-over-Year Less than $50,000 3,567 -16.3% $50,000 - $99,999 10,636 -12.9% $100,000 - $149,999 13,538 6.3% $150,000 - $199,999 14,523 18.1% $200,000 - $249,999 11,258 25.5% $250,000 - $299,999 9,978 24.3% $300,000 - $399,999 12,593 28.3% $400,000 - $599,999 11,384 22.7% $600,000 - $999,999 7,877 13.0% $1,000,000 or more 8,154 6.4% Current Listing Price Inventory by Current Listing Price 16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 $300,000 $399,999 August 2014 $100,000 $149,999 $150,000 $199,999 16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 $200,000 $249,999 $250,000 $299,999 $300,000 $399,999 $400,000 $599,999 $600,000 - $1,000,000 or $999,999 more Produced by Florida REALTORS® with data provided by Florida's multiple listing services. Statistics for each month compiled from MLS feeds on the 15th day of the following month. Data released on Monday, September 22, 2014. Data revised on Friday, February 26, 2016. Next data release is Tuesday, October 21, 2014. Monthly Distressed Market - August 2014 Single Family Homes Florida Closed Sales August 2014 August 2013 Percent Change Year-over-Year 15,424 14,500 6.4% $214,000 $211,000 1.4% 4,524 3,556 27.2% $115,000 $104,900 9.6% 1,304 2,574 -49.3% $141,750 $130,000 9.0% Traditional Median Sale Price Closed Sales Foreclosure/REO Median Sale Price Closed Sales Short Sale Median Sale Price 2010 2011 Traditional 2012 Foreclosure/REO 2013 2014 Short Sale 100% 90% Closed Sales 80% 70% 60% 50% 40% 30% 20% 10% 0% J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A $250,000 Median Sale Price $200,000 $150,000 $100,000 $50,000 $0 J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A S O N D J F MAM J J A 2010 2011 2012 2013 2014 Produced by Florida REALTORS® with data provided by Florida's multiple listing services. Statistics for each month compiled from MLS feeds on the 15th day of the following month. Data released on Monday, September 22, 2014. Data revised on Friday, February 26, 2016. Next data release is Tuesday, October 21, 2014.