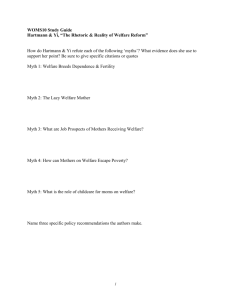

The Growing Problem of Disconnected Single Mothers

advertisement