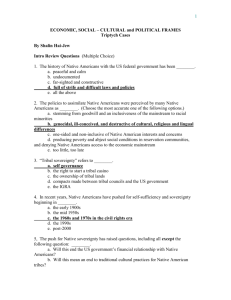

GAO TAX POLICY A Profile of the Indian Gaming Industry

advertisement