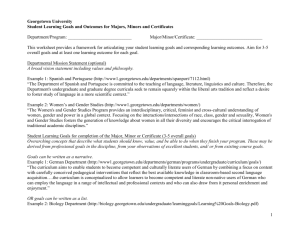

Preface

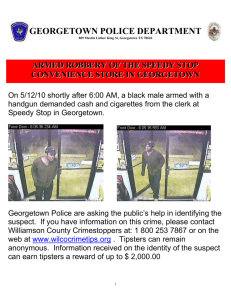

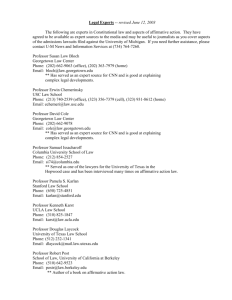

advertisement