Space IGS 2013: Official Consultation Response Survey

advertisement

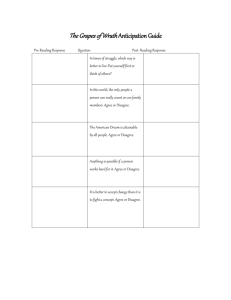

Space IGS 2013: Official Consultation Response Survey Following on from Andy Green's presentation of the Space Innovation and Growth Strategy (IGS) 2013, this questionnaire is a key part of the consultation process which is being used to capture your views on the headlines and their coordinating actions. How does the survey work? The Space IGS consultation paper: Accelerating Space-enabled Growth sets out seven headline areas which contain specific actions aimed at facilitating growth in the sector. For each of these headline themes we are asking you to 'agree' or 'disagree' with each action. Under each action please underline/highlight the box that best reflects your views. If you feel the action is not applicable to the specific work you do please use 'Not Applicable.' There is also a comment box provided after each set of actions for additional feedback. Any contact details you provide will be used by the Space IGS Team and will not be given to a third party. We estimate the survey may take around 20-30 minutes to complete. About You - Contact details Name: David Pincott, head of political research, policy & briefing Organisation: BT Email Address: david.pincott@bt.com Phone Number: 0207 356 6585 I am responding to this survey: (Please underline/highlight one) On behalf of my organisation With my own individual views 1 Headline 1: Enhance the finance strategy and leadership of the UK’s space sector by launching a National Space Programme and empowering the Space Leadership Council to drive implementation, ensuring resources are available to deliver the specific actions identified. Action 1.1: The UK Space Agency should establish a comprehensive and balanced National Space Programme, complementary to its ESA investments, to invest in national capabilities and facilities and to provide the flexibility to embark on national or multi-lateral programmes in accordance with UK policy. Agree Disagree Not Applicable Action 1.2: UKspace should demonstrate how industry has leveraged increased Government spending into economic growth by undertaking an economic review of supported projects by the end of 2014. Agree Disagree Not Applicable Action 1.3: The UK Space Agency should continue with a targeted and selective increase in the UK contribution to ESA optional programmes in parallel with the creation of a National Space Programme. Agree Disagree Not Applicable Action 1.4: The Minister for Science and Universities and the President of UKspace should agree to revise the operation of the Space Leadership Council into a plenary forum and establish a subgroup of the SLC meeting quarterly focused solely on championing delivery of the ‘IGS2013: Accelerating Space Enabled Growth’ actions. Agree Disagree Not Applicable Action 1.5: The UK Space Agency, UKspace, Technology Strategy Board and Satellite Applications Catapult should establish a Space Growth Partnership Implementation Team (SGPIT) to drive through the implementation of the IGS ASEG actions. Agree Disagree Not Applicable 2 Action 1.6: The UK Space Agency should publish an overarching National Space Policy, taking into account the growth targets and recommendations contained in this report and ensuring a joining up between civil and defence and security policies for Space. Agree Disagree Not Applicable Action 1.7: The Technology Strategy Board should build on the success of the Space Special Interest Group and evolve this into a permanent Space Knowledge Transfer Network. Agree Disagree Not Applicable Action 1.8: The UK Space Agency should revise its methodology for measuring the revenues and employment in the UK space economy to fully account for value-added applications and also provide a like-for-like comparison of growth with previous years. Agree Disagree Not Applicable Please use the area below to add any additional feedback regarding this set of actions. Action 1.1: the proposed national programme should be focused on: development of new applications and services aligned to the key market opportunities identified by the IGS; and radically new underlying technology required to deliver those services effectively. Action 1.2: no additional comments. Action 1.3: the UKSA will need to carefully coordinate the ESA and National Programme activities in order to avoid duplication. The national programme should be focused on integrated satellite applications. Action 1.4 and the ‘sub group’ element of Action 1.5: These actions appear to have the same objective (delivery of the IGS recommendations) and could cause some confusion among stakeholders because of the potential for overlapping membership. It may be more practical to create the SGPIT with a designated SLC Rapporteur to act as the conduit between the SLC and the SGPIT. Action 1.5: Agree in principle for the short-term, but the wording suggests that the SGPIT would exist effectively in perpetuity or at least until all IGS Actions are delivered (possibly 20 years). It would be better if, as part of its work, the SGPIT could identify ways for the IGS Actions to be absorbed into business as usual activities for existing entities and identify a point in time where the SGPIT itself would shut down. Action 1.6: Can the Space Security Policy be published (albeit on a controlled basis)? 3 Action 1.7: BT agrees in principle, but there is potential for overlap with the role of the Satellite Applications Catapult in terms of bringing potential partners together. There needs to be clarity over the role of each entity. Action 1.8: The measurement methodology and metrics would need to be published. 4 Headline 2: Develop the high-value priority markets identified to deliver £30 billion per annum of new space applications by promoting the benefits of Space to business and Government and engaging service providers. Action 2.1: The Space Growth Partnership Implementation Team will co-ordinate work to ensure that the specific activities to deliver priority markets are fed through to decision makers in the Satellite Applications Catapult, UK Space Agency, Technology Strategy Board, industry, Ofcom and UKTI. Agree Disagree Not Applicable Action 2.2: The Technology Strategy Board should launch R&D calls that are designed in scope to support cross-sector research that uses space data to create applications in broader economic sectors and create opportunities for the space and recipient sector to generate new applications. Agree Disagree Not Applicable Action 2.3: ESA IAP should launch R&D calls that develop cross-sector applications that directly facilitate new applications using space data in other sectors, where these align with IGS and ESA IAP priorities. Agree Disagree Not Applicable Action 2.4: Satellite Applications Catapult should champion opportunities for the space sector with other Catapults in relevant downstream markets. Agree Disagree Not Applicable Action 2.5: The Space Growth Partnership Implementation Team to undertake a review of the priority market trends and opportunities at least annually to validate the roadmap for delivery and identify changes in priorities. Agree Disagree Not Applicable Action 2.6: The UK Space Agency and industry, as part of a National Space Programme, should encourage the development of technology and novel services that will enable the UK to launch commercial low cost remote sensing services. Agree Disagree Not Applicable 5 Action 2.7: The Space Growth Partnership Implementation Team to design and run an integrated marketing campaign for space-enabled services and applications. Agree Disagree Not Applicable Action 2.8: The UK Space Agency should review the scale of its planned National Space Applications Programme and ensure it can capitalise on the skills and expertise in UK Industry and academia to substantially increase the awareness and take up of space services in Government. Agree Disagree Not Applicable Action 2.9: Industry to reply to more non-space, non-BIS consultations, targeting at least three major non-space consultations or inquiries per year, to help raise the profile of space as a solutions sector in key public user communities. Agree Disagree Not Applicable Action 2.10: Satellite Applications Catapult should create a new EO data access framework for application developers, identifying ease of access, service continuity and data quality as key attributes, with appropriate interfaces for integration of terrestrial data and services. Agree Disagree Not Applicable Please use the area below to add any additional feedback regarding this set of actions. Action 2.1: BT agrees in principle, but with respect to Ofcom: 1. Ofcom will need to remain technology neutral in terms of its remit within the UK; 2. BT fully supports the proposal that Ofcom should be proactive in the international arena in terms of access to and management of orbital slot resources for UK industry, so long as it does not conflict with 1 above. Action 2.2: The source of the budget used for cross-sector R&D calls should be transparent so that any implications for other TSB funding lines are fully visible. Action 2.3: no additional comments. Action 2.4: this should be done within a wider agreement on ‘ways of working’ between all Catapults, rather than a special procedure for space applications. 6 Action 2.5: Assigning this action to the SGPIT suggests that the SGPIT will exist in perpetuity. As previously stated, BT believes that the SGPIT should be a temporary body that seeks to embed good ‘delivery practice’ across the rest of the UK space sector landscape rather than have an open-ended role. In the long term, it would be better if this Action was owned by the UK Space Agency or the Catapult with appropriate support from industry. This support could include seconding resource from industry that has expertise in market analysis in specific areas of interest appropriate to each annual validation cycle. Action 2.6: Bringing a commercial mind-set to the EO sector will help accelerate the integration of space derived data into wider downstream commercial market. Action 2.7: This Action should be integrated into Action 2.8 and/or 3.1. There is no evidence that the SGPIT itself will have the right skills to undertake this task and it makes more sense to align the creation and execution of marketing activities with the drive for growing exports. The underlying marketing messages around the benefits derived from space will be the same and it will be important to maintain consistency when messaging inside and outside the UK. It might even be more appropriate for the space trade associations to own the marketing messages on behalf of industry (as a business-as-usual activity), but development of the messages should be done in cooperation with entities that have experience in the field, e.g. UKTI. Action 2.8: BT supports the proposed review in principle, but suggests that appropriate metrics need to be defined and published. Output from this activity should also feed into Action 3.1 on growing exports. Action 2.9: BT agrees in principle in order to raise the profile of space capabilities. However, such a campaign would need to carefully orchestrated and managed to maintain consistency and stay focused on the main issues. It should be owned by an entity that can speak for the wider industry and which can identify the appropriate consultations to respond to, e.g. Intellect. Intellect already responds to government and EU/EC consultations on a wide range of topics, has a wide space industry related membership and would be well placed to deliver this Action. Action 2.10: BT agrees in principle to the creation of an EO data access framework, but would like to see such a framework support ‘appropriate interfaces’ for the export of satellite data into other systems for downstream exploitation (potentially in real time). The Satellite Catapult should not be positioned as the only satellite and terrestrial data integration facility. 7 Headline 3: Raise Space exports by taking a strategic approach to exports and investing in international marketing. Action 3.1: UK Trade and Investment, UKspace, UK Space Agency, Satellite Applications Catapult, UK Export Finance and the Export Control Organisation should jointly develop and implement a comprehensive UK Space sector export strategy, reporting to the Space Leadership Council, defining roles and responsibilities of each organisation in planning and delivering the required export growth. Agree Disagree Not Applicable Action 3.2: The Department for Business Innovation and Skills should work with the Department for International Development to identify opportunities where overseas development objectives can be delivered by, or would benefit from, space products and services provided by the UK. Agree Disagree Not Applicable Action 3.3: UK Trade & Investment and UKspace, with UK Space Agency and UK Export Finance, should run four space export symposia per year in different regions of the UK with the aim of encouraging companies to export and setting out the range of support available, from “Are you Export Ready?” to advise on new market opportunities. Agree Disagree Not Applicable Action 3.4: The Technology Strategy Board and UK Trade & Investment should secure 20 new multinational export partnerships in the next five years that have the potential to generate more than £1bn in export value by running export missions for groups of UK space companies to fastgrowing hot spots in overseas markets. Agree Disagree Not Applicable Action 3.5: UK Trade & Investment and the Technology Strategy Board, through the Space KTN, should introduce a new ‘one stop shop’ service that provides information and links to new business opportunities for SMEs in overseas markets. Agree Disagree Not Applicable 8 Action 3.6: The UK Space Agency and Technology Strategy Board to determine whether domestic procurement or SBRI grants can help stimulate the capabilities of UK companies to deliver domestic and export solutions when considering procuring UK services and applications that can use space data or infrastructure. Agree Disagree Not Applicable Action 3.7: UK Trade & Investment and UK Space Agency should identify ‘gaps’ in the UK’s technology supply chain that can be used to encourage inward investors. UKTI Inward Investment to launch a pilot project to systematically target companies to fill technology gaps in the UK. Agree Disagree Not Applicable Action 3.8: UK Trade & Investment and the UK Space Agency should develop and execute a plan to encourage world-leading companies to establish space applications and services operations in the UK. Agree Disagree Not Applicable Please use the area below to add any additional feedback regarding this set of actions. Action 3.1: BT agrees in principle that an export strategy would be helpful, but would suggest that a single owner be identified for this Action to ensure accountability. Industry needs to be involved in this Action because it can bring the benefit of experience in terms of the current barriers and issues around selling into the different industry sub-sectors, geographic regions and individual countries. Action 3.2: no additional comments. Action 3.3: BT agrees in principle with this Action, but would suggest that we are not prescriptive about the number or format of such events. It would be useful to tailor events to recognised needs and audience type. Action 3.4: Export promotion is not currently part of TSB’s remit; it is not clear that TSB has either the expertise or resources to engage in this Action with impacting on its primary role. In addition, Export Missions require a lot of resource and planning by participating companies. It might be better to develop a toolkit of options for export development that are tailored to specific opportunities, sectors and geographies. Finally, the target figure of 20 partnerships sounds like an arbitrary measure. More thought is needed on how to achieve the increase in export value across the manufacturing and service sectors. 9 Action 3.5: This Action would duplicate existing facilities. This kind of service is already available through UKTI, e.g. the OMIS service. There may be changes that can be made to the existing capability to make it more visible and effective, but duplication would be wasteful of resources. Action 3.6: BT supports the use of SBRI to encourage innovation among the SME community and it would be useful to determine the value of its impact in order to inform future funding programmes. However, BT does not support any action that potentially encourages protectionist behaviour in “domestic procurement” because, ultimately, this is likely to discourage innovation / risk taking and would lead to UK industry becoming less competitive over time (particularly where the UK has a single source of any given capability). Action 3.7: The primary focus should be on creating national capability where there are currently gaps. Bringing in capability from outside the UK would be a short-term solution, but such capability might be ‘repatriated’ by the parent company through corporate reorganisations or facility rationalisation in future years. Action 3.8: Primary focus should be on the creation of new UK capabilities/companies and facilitating the growth of existing UK players in global markets. This is the way to achieve sustainable growth. Creating a vibrant space industry in the UK coupled with an attractive business environment (not just for space companies) is the best way of attracting international investment in the UK space sector. 10 Headline 4: Stimulate a vibrant national Space SME sector by improving the supply of finance, business support, information, skills and industry support. Action 4.1: The Satellite Applications Catapult and the Satellite Finance Network should develop a coordinated package of support for SMEs and Start-up services and applications companies to increase the access to early-stage funding. Agree Disagree Not Applicable Action 4.2: The Satellite Finance Network, with UKspace, the UK Space Agency, the Satellite Applications Catapult and UK Export Finance, to run regional road shows that provide start-ups and SMEs with information about business financing and support products and services available in the UK and provide the opportunity to directly engage with these providers. Agree Disagree Not Applicable Action 4.3: The Space KTN, with the Satellite Applications Catapult and UK Space Agency, should produce a road-map of mentoring support schemes for SMEs specific to the Space sector and provide linkages to the standard set of tools promoted through regional clusters. Agree Disagree Not Applicable Action 4.4: The UK Space Agency should establish a national space skills point of contact to support the growth of regional space sector SMEs in both technical and business skills, by facilitating a network of contacts and using web-based tools. Agree Disagree Not Applicable Action 4.5: Financial Support should be provided by the UK Space Agency and appropriate Research Councils for a cross disciplinary Space Doctoral Training Centre. This would support PhD Studentships that are cross disciplinary, include business skills, and are targeted at the up- and down-stream space sector. Agree Disagree Not Applicable Action 4.6: The Space KTN, Harwell Oxford hub and Regions, with the UK Space Agency, Satellite Applications Catapult, Technology Strategy Board and UK Export Finance, to produce and host an ‘easy access’ road-map of government support schemes to drive growth for SMEs, including links to 11 relevant partner websites. This road-map to include non-government sources of funding and tax incentives schemes. Agree Disagree Not Applicable Action 4.7: The UK Space Agency should work with local and national partners to develop Harwell Oxford as a focal point for the UK Space sector that acts as a gateway to regional capabilities and supports the development and delivery of regional growth plans. Agree Disagree Not Applicable Action 4.8: The UK Space Agency and Satellite Applications Catapult will work with Invest Northern Ireland, Scottish Enterprise, Welsh Government, BIS Local, the English Local Enterprise Partnerships and companies in regions to develop regional space growth plans and appoint a champion(s) for space in each regional cluster. Agree Disagree Not Applicable Action 4.9: The UK Space Agency and the Satellite Applications Catapult, with industry, will develop a nationwide plan to co-ordinate investment in ground segment infrastructure and technology centres of excellence needed to grow space services and value-added applications. Agree Disagree Not Applicable Action 4.10: The UK Space Agency, Satellite Applications Catapult, regional clusters and UK Trade & Investment will work together to promote regional capabilities and the attractiveness of regional locations for inward investment, start-ups and growth. Agree Disagree Not Applicable Please use the area below to add any additional feedback regarding this set of actions. Action 4.1: this should include the facility to introduce start-ups and SMEs to potential partners and customers in the wider space industry. Action 4.2: this Action needs a clear owner to be identified. There is also potential for this Action to be combined with Action 4.3 and Action 6.6 (with a single owner) to provide a ‘one stop shop’ for start-up and SME support services. 12 Action 4.3: this Action needs a clear owner to be identified. There is also potential for this Action to be combined with Action 4.2 and Action 6.6 (with a single owner) to provide a ‘one stop shop’ for start-up and SME support services. Action 4.4: no additional comments. Action 4.5: consideration should be given to enabling students to locate at regional technical clusters where appropriate to their studies and / or research. Action 4.6: agree in principle, but note significant overlap with Action 4.2 such these two Actions should be rationalised with a single owner identified for accountability. Action 4.7: agree in principle, but care will need to be taken to ensure that in acting as a gateway Harwell does not also become a bottleneck that inhibits access to regional capabilities. In addition, the Satellite Applications Catapult should engage with the other Catapult Centres to determine where there are opportunities to work with, or co-locate with, their own regional clusters as appropriate. Action 4.8: no additional comments. Action 4.9: this Action appears to be vaguely worded and may be unintentionally confusing several issues. An inventory of UK facilities would help the Catapult to identify the location of existing capability and regional ‘centres of gravity’ that could seed technology clusters. However, there is no evidence to suggest that there is a need to coordinate investment in traditional ground segment in the UK: there is healthy competition in the gateway (teleport) sector and no indication of market failure. Technology clusters, data management and research facilities are evolving naturally, usually coalescing around a concentration of customers, a major facility or educational establishment and it is not clear that there are any gaps or shortfalls in either a technical or geographic sense. Ensuring that such facilities are exploited to the best advantage for the space sector should be a function and consequence of the evolution of the Satellite Applications Catapult (and the other Catapults) and the regional technology clusters. Action 4.10: BT supports this Action in principle, but care must be taken to ensure that inward investment is not secured at the cost of stifling local business creation and growth. 13 Headline 5: Increase the UK’s returns from international space projects and new space markets by securing greater influence in large scale European-funded programmes and by improved collaboration with space nations. Action 5.1: The UK Space Agency, with UKspace, should create a European Space engagement plan with the intent of better influencing the EU to select space programmes that are important for growing the UK economy and to maximise the UK’s share of EU space programmes, available R&D and innovation support and space-enabled applications in other sectors. Agree Disagree Not Applicable Action 5.2: UKspace to constitute a European Affairs Group to handle co-ordination of industry’s policy interests and to promote engagement with EU and wider European initiatives. Agree Disagree Not Applicable Action 5.3: UKspace to work with the UK Space Agency to identify secondment opportunities for UK industry personnel to represent Government in EU programme committees and identify opportunities for placing UK nationals in relevant European bodies. Agree Disagree Not Applicable Action 5.4: The UK Space Agency should launch three bi-lateral science projects with nations that offer new opportunities for growth in the space sector. These missions should be designed and managed as affordable science missions, with the intent of reducing the time and cost to fly new technology, commensurate with meeting the core science objectives. Agree Disagree Not Applicable Action 5.5: The UK Space Agency to promote the use of ESA PPPs to drive ESA-led technology into new services that UK companies can exploit. Agree Disagree Not Applicable Please use the area below to add any additional feedback regarding this set of actions. Action 5.1: this Action already appears to be business-as-usual for the UKSA and therefore any new Action is redundant: the UK Civil Space Strategy 2012-2016 states that the UKSA “has established a new EU focused team working to ensure that development in European space policy and the EU 14 space programmes have real synergy with UK national interests”. It is not clear why a ‘new’ action plan is needed. If such a plan exists, or needs to be developed, it needs to be aligned with / driven by the proposed National Space Policy (NSP). Action 5.2: any such industry group should be a joint UKspace and Intellect grouping in order to ensure that downstream industry, particularly consumers of space derived services that are not considered to be ‘space companies’, are fully engaged in the process. The inclusion of ‘non-space’ companies will be crucial to understanding potential policy impact on the growth of the downstream business that the IGS is seeking to achieve. In addition, inclusion of non-space companies will expose the space industry to wider relevant policy and market issues that might otherwise be missed. Action 5.3: in addition to elements identified, this Action should be expanded to create a rolling programme of industry secondment to the UKSA to help address long-term market and commercial issues in areas where UKSA may not have significant expertise and that would benefit from industry experience, e.g. market analysis. Action 5.4: no additional comments. Action 5.5: BT agrees in principle, but with the following observations and caveats: The PPP mechanism provides the opportunity to develop and bring new technology to market quickly, but the emphasis so far has been on in-orbit capability rather than the downstream market; The criteria for project initiation and progress management needs to place significant emphasis on “game changing” technology development and exploitation, i.e. those technologies that have a significant impact on capabilities and/or costs available to downstream application and service providers. Incremental developments only produce marginal gains that do little or nothing to change the market landscape for application and service providers and will not create the opportunities for the scale of downstream growth that the IGS is seeking to stimulate; The criteria and metrics used for project initiation decisions and progress management at both UK and ESA levels needs to be published. 15 Headline 6: Make the UK the best place to grow new and existing space businesses and attract inward investment by providing a regulatory environment that promotes enterprise and UK investment. Action 6.1: The UK Space Agency should review the UK's financial, legal, insurance and regulatory framework on a three year cycle to ensure the UK is the most competitive place to grow a space business. The first study should be completed by December 2014. Agree Disagree Not Applicable Action 6.2: The UK Space Agency, Ofcom, Department for Culture Media and Sport, Ministry of Defence and UKspace should create a space spectrum group reporting to the SLC and DCMS ministers. This group will seek to maximise UK long term access to Satellite spectrum and ensure UK representatives at international regulatory meetings, as far as is practicable, take full account of the UK growth agenda, and oversee reform of licensing procedures. Agree Disagree Not Applicable Action 6.3: UKspace, consulting with Ofcom and the UK Space Agency, to present to the spectrum group by March 2014 an analysis of the future spectrum and orbital needs of the UK space industry and the economic benefits and options for incentivising private and public operators to make full use of spectrum. Agree Disagree Not Applicable Action 6.4: UK Space Agency and Ofcom should revise due diligence requirements for Outer Space Licenses and ITU Satellite Filings respectively to reflect the ambition that companies securing these resources contribute to UK economic growth. Agree Disagree Not Applicable Action 6.5: The spectrum group should study and propose changes to simplify the licensing procedures for SME's at UK Space Agency bringing in fixed fees and unambiguous criteria that are SME friendly. Agree Disagree Not Applicable 16 Action 6.6: The spectrum group, led by UKspace and with the support of Satellite Finance Network and Satellite Applications Catapult, to organise a commercially focused facility to aid start-ups and SMEs with the licensing process. Agree Disagree Not Applicable Action 6.7: The UK Space Agency and BIS should reform the Outer Space Act to put UK-based companies on a level playing field with US companies. Specifically the reforms should introduce a permissive environment for commercial space plane manufacturing and operations, and the establishment of a UK Space Port by December 2015. Agree Disagree Not Applicable Please use the area below to add any additional feedback regarding this set of actions. Action 6.1: no additional comments. Action 6.2: the objectives to maximise UK long-term access to satellite spectrum and to support UK space industry needs in international forums are already part of Ofcom’s remit. In addition, Intellect has been asked by DCMS to facilitate and lead an industry-led Spectrum Forum to act as a ‘sounding board’ for Government and the regulator on future UK spectrum management and regulatory issues. It would therefore appear more appropriate for the space industry to engage directly with the Spectrum Forum to pursue satellite spectrum interests in the context of wider UK spectrum strategy. Ofcom can then report to / liaise with the SLC as appropriate. Action 6.3: the wider UK space industry, i.e. UKspace, Intellect and other relevant interested parties (e.g. the science community), should present the case for satellite spectrum requirements direct to the Spectrum Forum. Action 6.4: this Action appears to be poorly worded. BT interprets the intent of the Action to mean that licences should only awarded to players that can demonstrate that the award of licences will result in new business that will materially contribute to UK space industry growth. Assuming this interpretation is correct; BT supports this approach but suggests that the growth-related criteria for licence award should be published to enable transparency. Action 6.5: this Action is confused and/or badly worded. The need or otherwise for a ‘spectrum group’ notwithstanding (see above), making changes to the Outer Space Act licensing processes is not a spectrum issue. This Action needs to be re-assigned to an appropriate owner. Action 6.6: the need or otherwise for a ‘spectrum group’ notwithstanding (see above), this Action appears to address a sub-set of the support, mentoring and tools for start-ups and SMEs identified in Action 4.2 and Action 4.3. BT proposes combining this Action with Action 4.2 and Action 4.3 (with a single owner) to provide a ‘one stop shop’ for start-up and SME support services. Action 6.7: no additional comments. 17 Headline 7: Lead developments in game-changing technologies that will create new opportunities for space-enabled applications and enhance the UK’s competitive edge by making targeted and market-led industry and government investments. Action 7.1: The UK Space Agency, Technology Strategy Board and Industry should take full account of the NSTSG’s prioritised technology road maps in shaping the future technology development calls. Agree Disagree Not Applicable Action 7.2: The UK Space Agency should commission feasibility studies to establish the technology development and costs for potentially game-changing technologies that would enable the UK to be first to market in new space markets. Agree Disagree Not Applicable Action 7.3: UK Space Agency, Technology Strategy Board and Industry to work together to ensure an overall year-on-year increase in investment in Space R&D from a National Space Programme, ESA technology funding and EU Horizon 2020 programme. Agree Disagree Not Applicable Action 7.4: The Technology Strategy Board, Satellite Applications Catapult, UK Space Agency and industry should plan and launch a series of in-orbit technology demonstrator missions that can showcase new technologies and an end-to-end service delivery in new markets. Agree Disagree Not Applicable Please use the area below to add any additional feedback regarding this set of actions. Action 7.1: BT agrees that the NSTSG’s roadmaps are an important input to the shape of future technology development calls, but they are not the only input. UKSA and TSB should also stay abreast of policy, regulatory and market landscape changes that may suggest alternative choices. Action 7.2: the feasibility studies should address the full cost of moving from service concept to market, not just the cost of the technology development itself. There may be factors in the deployment of new services that make them commercially unviable in the long term, even if the short term technology development appears to be cost effective. The output of such feasibility studies should be used to validate and refine the NSTSG roadmaps. Action 7.3: BT supports this Action with the following caveat: any growth in space R&D spending should be justified by demonstrable and quantifiable market (customer) pull, not technology 18 (supplier) push. Growth in R&D spending that is not market led and subject to rigorous benefits analysis can result in the emergence of R&D dependant businesses and / or R&D ‘tourists’ and could impact the wider industry credibility. Action 7.4: BT supports the use of in-orbit technology demonstrator missions in principle, but with the following observations and caveats: Large scale demonstration missions are inherently expensive and public funding should only be available for the innovative technology components of any proposed mission, not elements such as launch services or previously flight qualified bus and payload elements; There must be sufficiently challenging acceptance criteria for any proposed mission to ensure that the mechanism is primarily used for “game changing” technology developments, i.e. those technologies that have a major impact on capabilities and/or costs available to application and service providers. Incremental developments only produces marginal gains that do little or nothing to change the downstream market landscape for application and service providers and will not create the opportunities for the scale of growth that the IGS is seeking to stimulate; The criteria and metrics used for project initiation decisions and progress management needs to be published; All funding options for demonstration missions should be considered depending on scale and scope, including co-funding, PPP etc.; The wording of the Action suggests that demonstration missions could be used to offer commercial services. In these circumstances, access to wholesale services should be provided on an open, non-discriminatory basis to all service providers in line with state aid requirements. Thank You You have now completed the survey. Thank you for taking the time to give us your feedback. Your time and input is much appreciated. Please hold the 14th November 2013 in your diary for the launch of the official Space IGS 2013 report. More details to be available soon. 19