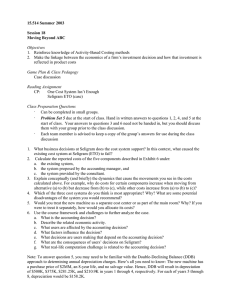

– Plant Assets and Depreciation Lesson Plan 7.5 Course Title Session Title

advertisement

Lesson Plan 7.5 – Plant Assets and Depreciation Course Title – Accounting I Session Title – Plant Assets and Depreciation Lesson Purpose – Demonstrate skill in calculating depreciation on plant assets and analyzing and journalizing transactions related to plant assets. Behavioral Objectives Define terms related to plant assets and depreciation. Calculate depreciation expense using straight-line method. Calculate depreciation expense using the declining-balance method. Calculate the book value of a plant asset. Record plant asset information in a plant asset record. Analyze and journalize transactions related to plant assets and depreciation. Preparation OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 4.a. calculate and record depreciation of plant assets; 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled. 7.c. make decisions using appropriate accounting concepts; 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 10.c. – prepare depreciation schedules TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Lesson 7.5 – Plant Assets and Depreciation Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Materials, Equipment and Resources: Textbook Accounting Software Journal Input Forms Spreadsheet Software Internet Teaching Strategies: Observation Verbal Drills Demonstration Lesson Content: Students are instructed on and practice calculating depreciation using the straight-line method and calculating the depreciation expense for partial years. They record depreciation information on plant asset records and analyze and journalize transactions like buying a plant asset, depreciating a plant asset and disposing of a plant asset. Assessment: Observation Graded Assignments Lesson 7.5 – Plant Assets and Depreciation Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Additional Resources: Textbooks: Guerrieri, Donald J., Haber, Hoyt, Turner. Glencoe Accounting RealWorld Applications and Connections. Glencoe McGraw-Hill, 2000. ISBN/ISSN 0-02-815004-X. Ross, Kenton, Gilbertson, Lehman, and Hanson. Century 21 Accounting Multicolumn Journal Anniversary Edition, 1st Year Course. SouthWestern Educational and Professional Publishing, 2003. ISBN/ISSN: 0-538-43524-0 Ross, Kenton, Gilbertson, Lehman, and Hanson. Century 21 General Journal Accounting Anniversary Edition, 7th Edition. SouthWestern Educational and Professional Publishing, 2003. ISBN/ISSN: 0-538-43529-1. Websites: Depreciation and Amortization on the Income Statement. About, Inc. 2009. http://beginnersinvest.about.com/library/lessons/bldepreciationexpense.htm. CCH Business Owner’s Toolkit. CCH Incorporated, 2003. http://www.toolkit.cch.com/text/P06_1548.asp. Dictionary of Small Business—Depreciation Expense. Carl O. Trautmann, 1994-2009. http://www.small-businessdictionary.org/default.asp?term=DEPRECIATION+EXPENSE. Business Partners: Loan officers from a bank Collection Agency officer Lesson 7.5 – Plant Assets and Depreciation Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 7.5.1 – Identifying Terms Course Title – Accounting I Session Title –Plant Assets and Depreciation Activity Purpose – Identify terms related to plant assets and depreciation expense. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 7.g. – process uncollectible accounts TAKS Correlation: WRITING Objective 5: The student will produce a piece of writing that demonstrates a command of the conventions of spelling, capitalization, punctuation, grammar, usage, and sentence structure. Objective 6: The student will demonstrate the ability to revise and proofread to improve the clarity and effectiveness of a piece of writing. MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Internet Teaching Strategies: Observation Graded Assignment Activity 7.5.1 – Identifying Terms Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity Outline: 1. Have students define these terms: current assets estimated salvage value accumulated depreciation loss on plant assets personal property disposal value plant assets straight-line method book value of a plant asset declining-balance method assessed value depreciation expense plant asset record gain on plant assets real property depreciation 2. Ask your students to create a crossword puzzle using at least ten of the terms above. They can use these sites to create crossword puzzles: http://puzzlemaker.school.discovery.com/ http://www.searchamateur.com/corkboard/Crossword-puzzle.html http://www.puzzlemesilly.com/ Ask students to trade puzzles to work and turn in. 3. Have your students answer these questions to check for their understanding of the terms. Explain the difference between a current asset and a plant asset. When should you record depreciation expense in a journal? How is estimated salvage value determined? What does straight-line depreciation method mean? Why is it important to keep a plant asset record up to date or to keep it at all? What is the formula to calculate book value of a plant asset? How do you calculate accumulated depreciation? How do you know when you have a gain on a plant asset? How do you know when you have a loss on a plant asset? What is the difference between real and personal property? Assessment: Observation Verbal Drill Assignment Quality Feature Crossword puzzle prepared accurately with at least ten terms Correct answers in worked crossword puzzle Answers to verbal questions correct Completes in a timely manner Activity 7.5.1 – Identifying Terms Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 7.5.2 – Calculating Depreciation Expense Course Title – Accounting I Session Title –Plant Assets and Depreciation Activity Purpose - Demonstrate skill in calculating depreciation expense for a plant asset using the straight-line method of depreciation. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 4.a. calculate and record depreciation of plant assets; 4.b. prepare depreciation schedules; 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; 7.c. make decisions using appropriate accounting concepts; 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 7.g. – process uncollectible accounts TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Spreadsheet software Teaching Strategies: Observation Demonstration Activity 7.5.2 – Calculating Depreciation Expense Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity Outline: 1. Discuss depreciation and its affect on plant assets. Review definitions of plant assets and explain straight-line method. 2. Discuss useful life and salvage value of a plant asset. Write the formula for calculating depreciation expense on the board. Original Cost – Estimated Salvage Value = Estimated Total Depreciation Expense 3. Have your students calculate the estimated total depreciation expense for the following plant assets. Demonstrate a couple for them, and then check their answers. Date Purchased Item 1. Computer 2. Laptop 3. Copier 4. Digital Camera 5. Color Laser Printer Jan. 1, 2001 July 1, 2001 Oct. 1, 2002 April 1, 2003 Feb. 1, 2001 Original Cost Estimated Salvage Value $2,300 $3,100 $10,500 $700 $2,200 $500 $500 $1,200 $50 $600 Estimated Total Depreciation Expense 4. Have your students calculate the annual depreciation for each plant asset. Demonstrate the formula for calculating annual depreciation. Estimated Total Depreciation Expense / Useful Life = Annual Depreciation Item Estimated Total Depreciation Expense 1. Computer 2. Laptop 3. Copier 4. Digital Camera 5. Color Laser Printer Annual Depreciation Useful Life 4 years 3 years 8 years 3 years 6 years 5. Have your students calculate Accumulated Depreciation as of December 31, 2004 and the annual depreciation for 2004. You might want to create calendars to give students to use during this exercise. The calendar needs to show all 4 years: 2001-2004. Formula for Accumulated Depreciation = Annual Depreciation X Number of Years Owned Item 1. 2. 3. 4. 5. Annual Deprecia tion Computer Laptop Copier Digital Camera Color Laser Printer Activity 7.5.2 – Calculating Depreciation Expense Date Purchased No. of Years Owned as of December 31, 2009 (include fractions) Accumulat ed Depreciati on Depreciation for 2004 Jan. 1, 2001 July 1, 2001 Oct. 1, 2002 Apr. 1, 2003 Feb. 1, 2001 Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 6. Have your students divide into teams of 3 or 4. Each team draws for a type of business. (Farm or Ranch, Swimming Pool Maintenance Business, Charter Bus Business, Limousine Business, Construction Business, or School) You can use other businesses from your area. Have each team decide on 5 plant assets to purchase for their particular business. Using the Internet or local businesses, locate cost, approximate salvage value and estimated useful life. Create a table calculating the total depreciation, annual depreciation, accumulated depreciation and depreciation for the current year. Assessment: Observation Graded Assignment Quality Feature Student participates in verbal drill and accurately calculates the depreciation for each question. Student participates as a part of the team effort. Depreciation calculated accurately for all five items. Team makes every effort to use logical plant assets for their particular business as well as providing sources from which they determined the cost of the plant asset, salvage value and useful life. Completes in a timely manner. Activity 7.5.2 – Calculating Depreciation Expense Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 7.5.3 – Preparing Plant Asset Records Course Title – Accounting I Session Title –Plant Assets and Depreciation Activity Purpose - Demonstrate skill in preparing plant asset records. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 4.b. prepare depreciation schedules; 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; 7.c. make decisions using appropriate accounting concepts; 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C N/A TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Spreadsheet Software Teaching Strategies: Observation Activity Outline: Have your students create and use a Plant Asset Record spreadsheet to record the five plant assets from their previous team assignment. Activity 7.5.3 – Preparing Plant Asset Records Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Assessment: Observation Graded Assignment Quality Feature No details omitted. Amounts accurate. Completes in a timely manner. Activity 7.5.3 – Preparing Plant Asset Records Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 7.5.4 – Analyzing and Journalizing Depreciation Expense Course Title – Accounting I Session Title –Plant Assets and Depreciation Activity Purpose - Demonstrate skill in analyzing and journalizing depreciation expense for adjusting entries. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 4.a. calculate and record depreciation of plant assets; 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; 7.c. make decisions using appropriate accounting concepts; 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 3.e. – use T accounts; TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Accounting Software Input Forms Teaching Strategies: Observation Activity Outline: 1. Using “T” accounts, review the transaction for purchasing plant assets. Use as an example: Purchased a fishing boat for a new business in offering guided fishing tours. The boat Activity 7.5.4 – Analyzing and Journalizing Depreciation Expenses Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 cost $22,250.00 and has an estimated salvage value of $3,250.00 and an estimated life of 15 years. 2. Using “T” accounts, demonstrate Depreciation Expense and Accumulated Depreciation. Discuss their balance side, increase and decrease side and why Accumulated Depreciation is a contra account to the plant asset. 3. Calculate the annual depreciation for the boat. As a review, demonstrate the formula on the board. Assume the boat was purchased at the beginning of the current year and the journal entry is for the end of the fiscal year. Therefore, the annual depreciation is the depreciation expense for the fiscal year. Discuss when the annual depreciation is not the depreciation expense for the fiscal year. 4. Have your students use an input form to journalize the depreciation expense for the boat for the current year. Assessment: Observation Graded Assignment Quality Feature Score Participates in class discussion Journal entry for depreciation expense accurate Completes in a timely manner Activity 7.5.4 – Analyzing and Journalizing Depreciation Expenses Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 7.5.5 – Disposing of a Plant Asset Course Title – Accounting I Session Title –Plant Assets and Depreciation Activity Purpose - Demonstrate skill in analyzing and journalizing a transaction relating to disposing of a plant asset. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 5.a. compare the various forms of business organizations; 5.b. list advantages and disadvantages of each form of business organization; 5.c. identify the various accounting functions involved with each form of business organization; 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C N/A TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Input Forms Teaching Strategies: Observation Demonstration Activity 7.5.5 – Disposing of a Plant Asset Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity Outline: 1. Discuss the need to journalize the disposal of a plant asset. Removes the plant asset cost from the assets since it is no longer owned. Also removes the contra account accumulated depreciation. Cash received is recorded. Records any loss or gain on the plant asset. 2. Discuss the effects on assets if a business does not record any entries when disposing of a plant asset. 3. Discuss reasons why a business might dispose of a plant asset rather than continue using the plant asset. Why might a business dispose of a plant asset before its useful life was over? 4. Demonstrate a transaction in which the sale of the plant asset was for book value. Have your students put the transaction in an input form. Received cash from the sale of a fax machine for $50.00, original cost $695.00, accumulated depreciation $645.00. Receipt No. 111. 5. The fax machine was purchased on January 1, 2000 and disposed of on December 31, 2009. Ask your students to create a Plant Asset Record spreadsheet for the fax machine, including the disposal information. 6. Demonstrate a transaction in which a gain was made on the sale of the plant asset. Explain the new account Gain on Sale and why it has a normal credit balance. A lawn care business purchased a lawn mower on January 1, 2001 for $1,900.00. They estimate its useful life at 5 years with a salvage value of $300.00. On July 1, 2004, the owner decides to sell it for $600.00. Answer these questions: What is the annual depreciation on this plant asset? How long did the business own the plant asset? How much is the accumulated depreciation for this plant asset? What is the book value of the plant asset? What was the gain on the sale of this plant asset? 7. Have your students journalize the transaction to record the part-of-a-year depreciation and the sale of the plant asset. 8. Demonstrate the sale of a plant asset for less than book value. Explain the new account Loss on Plant Asset and why it has a normal debit balance. Sold a computer that was purchased on July 1, 2001 for $2,500.00. Date of sale was July 1, 2004. Its estimated useful life is 4 years with a salvage value of $300.00. The computer was sold for $100.00. Answer these questions: What is the annual depreciation on this plant asset? How long did the business own the plant asset? Activity 7.5.5 – Disposing of a Plant Asset Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 How much is the accumulated depreciation for this plant asset? What is the book value of the plant asset? What was the loss on the sale of this plant asset? 9. Have your students journalize the transaction to record the part-of-a-year depreciation and the sale of the plant asset. Assessment: Observation Graded Assignment Quality Feature Amounts accurate in all three transactions with questions’ answers accurate Input forms accurate with debit and credit entries analyzed accurately Completes in a timely manner Activity 7.5.5 – Disposing of a Plant Asset Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 7.5.6 – Calculating Depreciation Using DecliningBalance Method Course Title – Accounting I Session Title –Plant Assets and Depreciation Activity Purpose - Demonstrate skill in using declining-balance method of calculating depreciation. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 4.a. calculate and record depreciation of plant assets; 4.b. prepare depreciation schedules; 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; 7.c. make decisions using appropriate accounting concepts; 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C N/A TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Spreadsheet Software Teaching Strategies: Observation Verbal Drill Activity 7.5.6 – Calculating Depreciation Using Declining-Balance Method Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity Outline: 1. Explain why a business might choose to use the declining-balance method of calculating depreciation over the straight-line method. 2. Demonstrate how to calculate the percent to use if the business chooses to use twice the rate of the straight-line method. Give the example of a plant asset that has a useful life of 10 years. The straight-line percent is 10%; therefore, the declining-balance method is twice that, 20%. Estimated Total Depreciation Expense 100% divided by Years of Estimated Useful Life 10 Straight-Line Rate = 10% 3. Fill in the chart for the Declining-Balance Method of calculating depreciation for a buggy used to give rides in Central Park. The buggy was purchased on January 1, 2001 for $8,200 and has a useful life of 5 years. What is the declining-balance percent for calculating depreciation? Date Jan. 1, 2001 Jan. 1, 2002 Jan. 1, 2003 Jan. 1, 2004 Beginning Book Value $8,200 Depreciation Date Dec. 31, 2001 Dec. 31, 2002 Dec. 31, 2003 Dec. 31, 2004 Annual Depreciatio n $3,280 Ending Book Value $4,920 4. Ask students to create the same chart using a spreadsheet. Assessment: Observation Graded Assignment Quality Feature Student participates in discussion Completes table accurately using the declining-balance method of depreciation Spreadsheet designed with correct formulas All lines on the spreadsheet labeled accurately Completes in a timely manner Activity 7.5.6 – Calculating Depreciation Using Declining-Balance Method Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1