– Preparing Payroll – Part 4.1 Lesson Plan Course Title Session Title

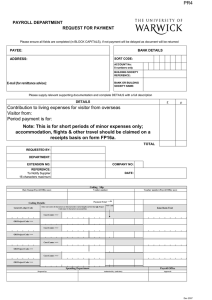

advertisement

Lesson Plan – Preparing Payroll – Part 4.1 Course Title – Accounting I Session Title – Preparing Payroll Lesson Purpose – Learn payroll procedures from the point of entry with a time card through calculating payroll, preparing payroll records and special controls on payroll bank accounts. Behavioral Objectives Calculate hours worked using a time card. Calculate employee payroll and payroll taxes. Calculate total deductions. Calculate gross and net pay. Prepare a payroll register. Discuss controls used in payroll checking accounts. Preparation OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 3.a. compute gross pay; 3.b. compute net pay; 3.c. compute employee-paid withholdings; 3.e. compute salary expense; 3.f. post general journal entries; 3.g. prepare a Trial Balance; This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 9.c – calculate employee-paid earnings such as gross earnings and net pay; 9.d. – calculate employee-paid withholdings; 3.g. – post journal entries to general ledger accounts; 3.h. - prepare trial balances; TAKS Correlation: READING Objective 1: The student will demonstrate a basic understanding of culturally diverse written texts. MATH Objective 10: The student will demonstrate an understanding of the Lesson 4.1 – Preparing Payroll Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Spreadsheet software Teaching Strategies: Observation Graded Assignments Learner Preparation: Have each student gather information from a business on how the business’s employees report their time. Have them include why they chose this particular type of input for reporting work hours as well as other types of reporting they have used. Include in the report the length of pay period they use in the business. Your students can get their information from a Manager or Assistant Manager by telephone interview, personal interview, or e-mail contact. Ask your students to report their findings to the class in a short presentation. Lesson Content: Introduction to payroll procedures with a beginning emphasis on terminology related to payroll. Students learn how to calculate hours worked using a time card and use that calculation to calculate gross pay. The lesson also covers calculating payroll taxes and adding in other types of deductions. Students complete payroll registers using all the above skills as well as learn control systems used in payroll payment. Assessment: Observation Graded Assignments Additional Resources: Textbooks: Guerrieri, Donald J., Haber, Hoyt, Turner. Glencoe Accounting RealWorld Applications and Connections. Glencoe McGraw-Hill 2000. ISBN/ISSN 0-02-815004-X. Ross, Kenton, Gilbertson, Lehman, and Hanson. Century 21 Accounting Multicolumn Journal Anniversary Edition, 1st Year Course. SouthWestern Educational and Professional Publishing, 2003. Lesson 4.1 – Preparing Payroll Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 ISBN/ISSN: 0-538-43524-0 Ross, Kenton, Gilbertson, Lehman, and Hanson. Century 21 General Journal Accounting Anniversary Edition, 7th Edition. SouthWestern Educational and Professional Publishing, 2003. ISBN/ISSN: 0-538-43529-1 Websites: Lycos Help and How To. Lycos Inc., 2009. http://howto.lycos.com/lycos/series/1,,10+54+89+23494,00.html. Compiling Time Sheets. Lycos, Inc., 2009. http://howto.lycos.com/lycos/step/1,,6+35+26165+26381+22993,00 .html#top. Out of date - replace Mt. Nebo Accounting Simulation. Carl Lyman, 2009. http://www.lymansite.net/Acct/MtNeboPumpkins/mtnebo.htm. Business Partners: Accountant Payroll Clerk Lesson 4.1 – Preparing Payroll Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 4.1.1 –Terms Related to Payroll Course Title – Accounting I Session Title – Preparing Payroll Activity Purpose – Identify terms that are related to payroll and state their definitions. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 1.b. - apply information from source documents 7.a. - follow oral and written instructions; 7.b. - develop time management skills by setting priorities for completing work as scheduled. This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C N/A TAKS Correlation: WRITING Objective 5: The student will produce a piece of writing that demonstrates a command of the conventions of spelling, capitalization, punctuation, grammar, usage, and sentence structure. Objective 6: The student will demonstrate the ability to revise and proofread to improve the clarity and effectiveness of a piece of writing. Materials, Equipment and Resources: Textbook Internet Index Cards Ring to hold index cards Teaching Strategies: Observation Activity 4.1.1 – Terms Related to Payroll Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity Outline: On an index card, write each of these terms on one side and its definition on the other side. Use the Internet to assist in defining those terms not in your textbook. salary pay period payroll total earnings payroll taxes withholding allowance Medicare FICA tax federal unemployment tax state unemployment tax payroll register tax base net pay automatic check deposit gross earnings wage employee earnings record time card overtime rate deduction allowance employee’s earnings record accumulated earnings payroll tax expense salaries FUTA expense federal tax Form 940 deposit coupon direct Form W-3 deposit SUTA Form 941 Form W-2 FIT tax commission direct deposit In a team, drill on the terms until everyone in the team knows the terms. Ask each student to create a test of 10 terms. The test can be fill-in-the-blank, true/false or multiple choice. Collect the tests and pass them around to the students. No one should know whose test he or she received. Go over those terms missed on the student-made test. Give a quiz on the terms. Assessment: Observation Quiz on Terms Related to Payroll Activity 4.1.1 – Terms Related to Payroll Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Quiz on Terms Related to Payroll 1. ____________ is an amount paid an employee based on a percent of the employee’s sales. 2. FICA stands for __________________________________________________. 3. A business form used to record payroll information is a ___________________. 4. The state tax used to pay benefits to unemployed workers is _______________. 5. Taxes based on the payroll of a business are ____________________________. 6. An Employee’s Withholding Allowance Certificate is ____________________. 7. Total pay due for a pay period before deductions is ______________________. 8. A deduction from total earnings for each person legally supported by a taxpayer is ______________________________________________________. 9. Used to accurately record work hours during a pay period. ________________. 10. Employee’s year-to-date earnings are called ____________________________. 11. Expense account used to record employee’s earnings is ___________________. 12. FUTA stands for _________________________________________________. 13. Used to report the employer’s unemployment (state and federal) taxes. ______________________________________________________. 14. The Transmittal of Wage and Tax Statements that are filed by the employer with the federal government is _______________________________________. Activity 4.1.1 – Quiz on Terms Related to Payroll Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Quiz on Terms Related to Payroll - KEY 1. Commission is an amount paid an employee based on a percent of the employee’s sales. 2. FICA stands for Federal Insurance Contributions Act. 3. A business form used to record payroll information is a payroll register. 4. The state tax used to pay benefits to unemployed workers is state unemployment tax. 5. Taxes based on the payroll of a business are payroll taxes. 6. An Employee’s Withholding Allowance Certificate is Form W-4. 7. Total pay due for a pay period before deductions is gross earnings. 8. A deduction from total earnings for each person legally supported by a taxpayer is withholding allowance. 9. Used to accurately record work hours during a pay period time card. 10. Employee’s year-to-date earnings are called accumulated earnings. 11. Expense account used to record employee’s earnings is salaries expense. 12. FUTA stands for Federal Unemployment Tax Act. 13. Used to report the employer’s unemployment (state and federal) taxes - Form 940. 14. The Transmittal of Wage and Tax Statements that are filed by the employer with the federal government is Form W-3. Activity 4.1.1 – Quiz on Terms Related to Payroll Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 4.1.2 – Calculating Time Course Title – Accounting I Session Title – Preparing Payroll Activity Purpose – Demonstrate skill in calculating total hours worked using time cards. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 1.b. - apply information from source documents 7.a. - follow oral and written instructions; 7.b. - develop time management skills by setting priorities for completing work as scheduled. 7.c. - make decisions using appropriate accounting concepts; 7.e. - perform accounting procedures using manual and automated methods’ 7.g. - demonstrate use of the numeric keypad by touch. This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 9.a. – interpret time cards to calculate hours worked TAKS Correlation: WRITING Objective 6: The student will demonstrate the ability to revise and proofread to improve the clarity and effectiveness of a piece of writing. MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Database software Activity 4.1.2 – Calculating Time Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Teaching Strategies: Observation Demonstration Activity Outline: During the payroll unit, have each student keep their time on their projects in a database. Ask them to use the Time and Billing template with the Time Card hour form. They can use the switchboard to enter their own name and keep up with their time on each project. If you want, you can have them enter a billing rate based on their last report card. Students with an “A” would receive $7.00 an hour. Those with a “B” would receive $6.50 an hour. Those with a “C” would receive $6.00 an hour. Those below “C” would receive $5.50 an hour. Print a report for the Instructor when the payroll unit is finished. Save as: Time. Assessment: Observation Graded Assignment Quality Feature Uses correct template and form Time kept accurately each day during the unit Work saved in the database Report appropriate Activity 4.1.2 – Calculating Time Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 4.1.3 –Calculating Payroll Course Title – Accounting I Session Title – Preparing Payroll Activity Purpose – Demonstrate skill in calculating total hours worked using time cards. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 1.b. - apply information from source documents; 3.a. - compute gross pay; 3.b. - compute net pay; 3.c. - compute employee-paid withholdings; 3.e. - compute salary expense; 7.a. - follow oral and written instructions; 7.b. - develop time management skills by setting priorities for completing work as scheduled. 7.c. - make decisions using appropriate accounting concepts; 7.e. - perform accounting procedures using manual and automated methods’ 7.g. - demonstrate use of the numeric keypad by touch. This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 9.c – calculate employee-paid earnings such as gross earnings and net pay; 9.d. – calculate employee-paid withholdings; TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Spreadsheet software Activity 4.1.3 – Calculating Payroll Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Teaching Strategies: Observation Demonstration Quiz on Formulas for Payroll Activity Outline: Have students use spreadsheet software to create a spreadsheet to calculate payroll. Demonstrate the formulas. Emphasize learning the formulas in the comments in the spreadsheet. Assessment: Observation Quiz Graded Assignment Quality Feature Spreadsheet formulas accurate Net pay accurate on each line Completes in a timely manner Saves as instructed Activity 4.1.3 – Calculating Payroll Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Employee Name Mullins, Mary Maynard, Mark Jameson, James Mitchell, Mitch Driggers, Donals Broadway, Bridget Kelly, Karin Samuels, Sally Strickland, Shawn Hours Wage per Overtime worked hour Rate 42 6.95 10.43 35 12.50 18.75 45 9.00 13.50 25 5.60 8.40 40 7.70 11.55 42 6.20 9.30 50 13.50 20.25 36 10.00 15.00 Regular Overtime Regular Overtime Hours Hours Earnings Earnings 40.00 2.00 278.00 20.85 35.00 0.00 437.50 0.00 40.00 5.00 360.00 67.50 25.00 0.00 140.00 0.00 40.00 0.00 308.00 0.00 40.00 2.00 248.00 18.60 40.00 10.00 540.00 202.50 36.00 0.00 360.00 0.00 Gross Earnings 298.85 437.50 427.50 140.00 308.00 266.60 742.50 360.00 400.00 FICA FIT Tax Total Deductions Net Pay 298.85 39.38 39.00 26.00 227.60 Quiz on Formulas for Payroll 1. Mary Mullins works for $6.95 an hour. She worked for 42 hours last week. What is her gross pay? 2. Mark Maynard works for $12.50 an hour. He worked 35 hours last week. At 9% social security, how much is his FICA Tax deduction? 3. James Jameson works for $9.00 an hour. He worked 45 hours last week. What is his overtime rate? 4. Mitch Mitchell works for $5.60 an hour. He worked 25 hours last week. How much is his overtime pay? 5. Donald Driggers works for $7.70 an hour. He worked 40 hours last week. How much are his gross earnings? 6. Bridget Broadway works for $6.20 an hour. She worked 42 hours last week. Her total deductions are $ 39.00. How much is her net pay? 7. Karin Kelly works for $13.50 an hour. She worked 50 hours last week. How much is her overtime pay? 8. Sally Samuels works for $10.00 an hour. She worked 36 hours last week. How much are her gross earnings? 9. Shawn Strickland earned $400.00 total earnings last week. He is single with 1 allowance. What is his FIT Tax? Activity 4.1.3 – Quiz on Formulas for Payroll Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Quiz on Formulas for Payroll - KEY 10. Mary Mullins works for $6.95 an hour. She worked for 42 hours last week. What is her gross pay? $291.90 11. Mark Maynard works for $12.50 an hour. He worked 35 hours last week. At 9% social security, how much is his FICA Tax deduction? $39.38 12. James Jameson works for $9.00 an hour. He worked 45 hours last week. What is his overtime rate? $13,59 13. Mitch Mitchell works for $5.60 an hour. He worked 25 hours last week. How much is his overtime pay? $0 14. Donald Driggers works for $7.70 an hour. He worked 40 hours last week. How much are his gross earnings? $308.00 15. Bridget Broadway works for $6.20 an hour. She worked 42 hours last week. Her total deductions are $ 39.00. How much is her net pay? $227.60 16. Karin Kelly works for $13.50 an hour. She worked 50 hours last week. How much is her overtime pay? $202.50 17. Sally Samuels works for $10.00 an hour. She worked 36 hours last week. How much are her gross earnings? $360.00 18. Shawn Strickland earned $400.00 total earnings last week. He is single with 1 allowance. What is his FIT Tax? $26.00 (based on 2009 tax table: http://www.irs.gov/pub/irs-pdf/p15t.pdf Activity 4.1.3 – Quiz on Formulas for Payroll Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 4.1.4 –Computerized vs. Manual Payroll Registers Course Title – Accounting I Session Title – Preparing Payroll Activity Purpose – Make comparisons in computer-generated and manual payroll registers. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 9.e –prepare a payroll register 120.42.C 1.b. - apply information from source documents; 3.f. - prepare payroll registers 7.a. - follow oral and written instructions; 7.b. - develop time management skills by setting priorities for completing work as scheduled. 7.c. - make decisions using appropriate accounting concepts; 7.e. - perform accounting procedures using manual and automated methods TAKS Correlation: WRITING Objective 5: The student will produce a piece of writing that demonstrates a command of the conventions of spelling, capitalization, punctuation, grammar, usage, and sentence structure. Objective 6: The student will demonstrate the ability to revise and proofread to improve the clarity and effectiveness of a piece of writing. Materials, Equipment and Resources: Textbook Guest Speaker Activity 4.1.4 – Computerized vs. Manual Payroll Registers Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Word processing software Teaching Strategies: Observation Demonstration Activity Outline: Have your students prepare several payroll registers manually until most students in the class can complete a payroll register with 95% accuracy. Invite a guest speaker to demonstrate a computerized payroll system like Peachtree. Ask your students to write a summary of the differences in preparing the payroll register manually and by computer software. List the advantages and/or disadvantages of each. Compare the finished product—the report. How are they similar? How are they different? Assessment: Observation Graded Assignment Quality Feature Score Summary well-written Summary thorough with several good observations about both methods of doing payroll Summary error-free Summary in proper business report format Completes in a timely manner Participates appropriately with the guest speaker Activity 4.1.4 – Computerized vs. Manual Payroll Registers Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 4.1.5 –Control Systems in Payroll Bank Accounts Course Title – Accounting I Session Title – Preparing Payroll Activity Purpose – Demonstrate understanding of payroll bank accounts. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 1.b. - apply information from source documents; 3.i. - determine methods of dissemination of payroll funds, for example, direct deposit, and mail; 7.a. - follow oral and written instructions; 7.b. - develop time management skills by setting priorities for completing work as scheduled. 7.c. - make decisions using appropriate accounting concepts; 7.e. - perform accounting procedures using manual and automated methods; 7.g. - demonstrate the use of the numeric keypad by touch. This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C N/A TAKS Correlation N/A Materials, Equipment and Resources: Textbook Teaching Strategies: Discussion Observation Questioning Activity 4.1.5 Control Systems in Payroll Bank Accounts Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity Outline: Lead a class discussion about the use of a special account for payroll. Point out the advantages and need for having a payroll control system in place. Demonstrate writing the check for net pay from the general account. This amount is then deposited in the payroll account. Only that exact amount can be written from the account. This helps control unauthorized payments as well as keep it in balance. The payroll account preprinted checks are different from the general account checks. Demonstrate the difference in the checks using the projector or overhead. Discuss different methods of disseminating employee payroll checks, including direct deposit, electronic funds transfer and mail. Ask your students these questions: Why is there a need for a special account for payroll rather than just writing payroll checks directly from the general account? The check written from the general account is written for what amount? What is different in the preprinted checks from the general account and the payroll account? What is the most common method of disseminating payroll checks today? Why? Assessment: Observation Participation Activity 4.1.5 Control Systems in Payroll Bank Accounts Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1