– Payroll Records Unit 4 - Lesson Plan Course Title Behavioral Objectives

advertisement

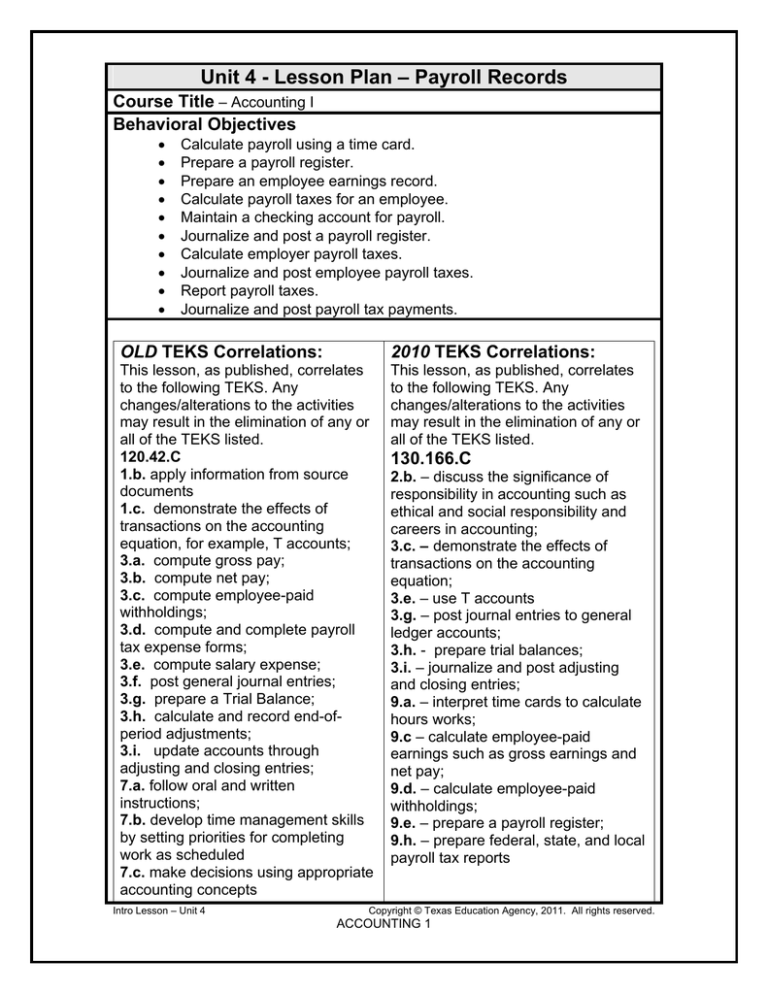

Unit 4 - Lesson Plan – Payroll Records Course Title – Accounting I Behavioral Objectives Calculate payroll using a time card. Prepare a payroll register. Prepare an employee earnings record. Calculate payroll taxes for an employee. Maintain a checking account for payroll. Journalize and post a payroll register. Calculate employer payroll taxes. Journalize and post employee payroll taxes. Report payroll taxes. Journalize and post payroll tax payments. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 1.b. apply information from source documents 1.c. demonstrate the effects of transactions on the accounting equation, for example, T accounts; 3.a. compute gross pay; 3.b. compute net pay; 3.c. compute employee-paid withholdings; 3.d. compute and complete payroll tax expense forms; 3.e. compute salary expense; 3.f. post general journal entries; 3.g. prepare a Trial Balance; 3.h. calculate and record end-ofperiod adjustments; 3.i. update accounts through adjusting and closing entries; 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled 7.c. make decisions using appropriate accounting concepts This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. Intro Lesson – Unit 4 130.166.C 2.b. – discuss the significance of responsibility in accounting such as ethical and social responsibility and careers in accounting; 3.c. – demonstrate the effects of transactions on the accounting equation; 3.e. – use T accounts 3.g. – post journal entries to general ledger accounts; 3.h. - prepare trial balances; 3.i. – journalize and post adjusting and closing entries; 9.a. – interpret time cards to calculate hours works; 9.c – calculate employee-paid earnings such as gross earnings and net pay; 9.d. – calculate employee-paid withholdings; 9.e. – prepare a payroll register; 9.h. – prepare federal, state, and local payroll tax reports Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 7.d. explain the concepts of integrity and confidentiality as related to the accounting profession; 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch. Intro Lesson – Unit 4 Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 TAKS Correlation: READING Objective 1: The student will demonstrate a basic understanding of culturally diverse written texts. WRITING Objective 5: The student will produce a piece of writing that demonstrates a command of the conventions of spelling, capitalization, punctuation, grammar, usage, and sentence structure. Objective 6: The student will demonstrate the ability to revise and proofread to improve the clarity and effectiveness of a piece of writing. MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Unit Overview: Introduce students to payroll procedures for a business including calculating payroll, keeping payroll records, journalizing and posting payroll. The unit covers the calculation, journalizing, posting and payment of employers’ taxes as well as reporting taxes. Students have the opportunity to explore importance of confidentiality as it relates to payroll. Learner Preparation: Read the article at http://www.accountingcoach.com/online-accountingcourse/13Xpg01.html on reconciling bank statements and keeping track of a check register. Prepare a presentation that summarizes the article you read from the Web site, with a minimum of 6 slides. Lesson Content: The lesson covers instruction in opening and maintaining checking accounts, reconciling bank statements and preparing journal entries resulting from banking transactions. Intro Lesson – Unit 4 Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Assessment: Observation Graded Assignments Intro Lesson – Unit 4 Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Additional Resources: Textbooks: Guerrieri, Donald J., Haber, Hoyt, Turner. Glencoe Accounting RealWorld Applications and Connections. Glencoe McGraw-Hill, 2000. ISBN/ISSN 0-02-815004-X. Ross, Kenton, Gilbertson, Lehman, and Hanson. Century 21 Accounting Multicolumn Journal Anniversary Edition, 1st Year Course. SouthWestern Educational and Professional Publishing, 2003. ISBN/ISSN: 0-538-43524-0 Ross, Kenton, Gilbertson, Lehman, and Hanson. Century 21 General Journal Accounting Anniversary Edition, 7th Edition. SouthWestern Educational and Professional Publishing, 2003. ISBN/ISSN: 0-538-43529-1. Websites: Reconciling your Bank Account. Swinburn University of Technology – Computing and Information Technology http://cit.wta.swin.edu.au/cit/subjects/VBH055/Topics/Topic08BankReconciliation.pdf Bank Statement Reconciliation. Rutgers Accounting Research Center, 2009. http://accounting.rutgers.edu/raw/courses/ex05~1.htm. replace link Checking Account. Investopedia.com, 2009. http://www.investopedia.com/terms/c/checkingaccount.asp. Business Partners: Banker Teller Customer Service Representative in a Bank Intro Lesson – Unit 4 Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1