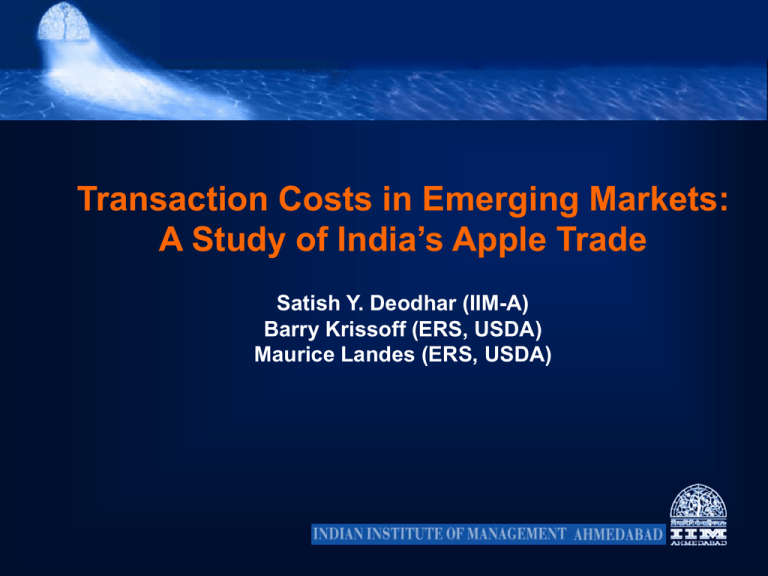

Transaction Costs in Emerging Markets: A Study of India’s Apple Trade

advertisement

Transaction Costs in Emerging Markets: A Study of India’s Apple Trade Satish Y. Deodhar (IIM-A) Barry Krissoff (ERS, USDA) Maurice Landes (ERS, USDA) What we want to tell? • Of course, imports grow due to rise in incomes and fall in tariff rates • However, reduction in transaction costs matter a lot And, to show this .. • We take a preview of India’s apple imports, domestic supply, marketing cost and margins, and price integration • And, hint at FDI in retail and wholesale markets India: An Emerging Market • Sustained high GDP growth rates – 9 percent in recent past (2006-2007) • Rising middle-class segment – 250-400 million apple consumers – 50 to 100 million imported-apple consumers • Rapid growth in food demand expected – Particularly in high value horticultural products such as apple Change in Import Regime • In 1999 significant liberalization in agricultural trade regime • Policy now guided by WTO precepts • QRs converted to tariffs • Generally high WTO bound rates • Applied rates are lower • However, high rates on apples – Bound rate = applied rate = 50% Tariff Rates on Select Fresh Fruit, India Percent India: Applied Tariffs 55 50 45 40 35 30 25 20 15 10 5 0 Imports Scenario • Imports account for less than 1.5% of domestic supply (about 25,000 tons) • Imports mainly from USA, Australia, China, and New Zealand in that order 3,000 2,500 Tons 2,000 1,500 1,000 500 0 Sept02 Oct Nov Dec Jan-03 Feb Mar Apr May Jun Months Australia China New Zealand USA Jul Aug03 Domestic Supply Production is about 1.5 million tons – US = 4 million; China = 20 million • Low yield at about 6 tons/ha – US = 26 tons/ha; China = 10 tons/ha • Low production growth: about 1% – US = -3%; China = 5% • Impediments – Old root stock (red delicious), erratic monsoon rainfall, mountainous terrain – Producers bear all price risk – No cold chain, lack of grading, poor road transport Anti-Hail Nets Mountainous Terrain Ready to Upset the Apple Cart! Domestic Fruit Prices Apples are generally the most expensive fruit in the market… Wholesale Price Comparison for Major Indian Fruits, 2003 season, Rs/kg. January April October Apples Bananas Grapes Mangoes Oranges Bangalore 31.73 5.22 22.54 -- 20.92 Calcutta 25.66 3.57 25.59 -- 13.94 Chennai 59.49 4.65 18.92 -- 18.71 Delhi 27.83 5.14 27.99 -- 21.13 Mumbai 35.87 5.87 21.43 -- 25.06 Bangalore 39.26 5.26 23.55 -- 20.77 Calcutta 36.84 3.80 24.04 10.52 13.67 Chennai 64.75 4.73 21.57 23.44 16.64 Delhi 28.42 8.53 24.21 19.34 20.88 Mumbai -- 5.50 27.53 16.41 27.16 Bangalore 34.78 5.28 -- -- -- Calcutta 23.81 3.26 -- -- -- Chennai 36.40 4.74 -- -- 11.25 Delhi 25.68 4.10 -- -- 15.02 Mumbai 32.15 5.87 -- -- 18.11 Domestic Market Not Well Integrated • Regional markets are not well integrated – Confirmed by error correction model • Full transmission of price changes occurs in about 2 weeks in some cities • Other markets are poorly integrated • Lack of efficient transport & direct procurement from growers limits price arbitrage between Delhi & other markets • Cascading trader margins Domestic Marketing Cost and Margins November 2003, Rs per box of 20 kgs Net price received by grower Expenses incurred by growers on: Picking, grading, packing, & handling Packing materials Freight up to market Commission of commission agent Realisation at wholesale market, Delhi Expenses of wholesale trader Wholesale trader’s margin Sub-wholesaler margin Retailer’s expenses Retailer’s margin Consumer price, Delhi 295 118 20 45 20 33 Trader Margins account for 46% of the final consumer price 413 6 84 101 65 231 900 Import Marketing Cost and Margins May 2003, Rs per box of 20 kgs Import unit price, CIF Expenses incurred by importer on: Tariff Clearing Freight Commission of agent Importer’s margin Realisation at wholesale market, Delhi Expenses of wholesale trader Wholesale trader’s margin Sub-wholesaler margin Retailer’s expenses Retailer’s margin Consumer price, Delhi 510 434 255 20 70 89 165 1,109 23 198 199 5 466 2,000 Trader Margins account for 51% of the final consumer price Import Prospects • Drivers of import demand – GDP growth – Tariff (customs duty) reduction – Transaction cost (trader margins) reduction • Assumptions – Price elasticity of demand = -1.0 – Income elasticity of demand = 1.5 – GDP growth rate = 6% p.a. Likely Outcomes Scenario 1. Status Quo 2. Tariff Reduction 3. Margin Reduction 4. ( 2 & 3) Import Trader Imports by* Cumulative* Tariff Margins 10th Year Imports 50% 51% 52,082 364,327 25% 51% 55,130 385,651 50% 21% 66,417 464,600 25% 21% 69,465 485,925 * Base year 2003. Base year imports 22,000 ton To Conclude .. • Of course, income growth and tariff reduction will increase imports However • Reduction in transaction cost may be very critical in increasing imports. – FDI in retail and wholesale market may be the key to reducing transaction cost – Already happening to some extent with Walmart tying-up with Bharti group – Shop Rite (SA), selling imported apples only at Rs. 70 Model Equations and estimations ∆Yt = β1 + δYt-1 + αi Σ ∆Yt-1 + et Yt = a01 X t + a11 X t -1 + a12 Yt -1 + et . (a01 +a11 ) DYt = a01 DXt +(1 -a12 ) Xt -1 -Yt -1 + et . (1 -a12 ) k -1 k -1 i =0 i =1 DYt = a00 + ai1 DXt -i + ai 2 DYt -i + m0 [m1 Xt -k -Yt -k ]+ et , where m0 = (1 - k a i =1 i2 ) k and m1 = ai 1 i =0 m0 . Stationarity Test for Wholesale Apple Prices Prices Phillips-Perron Test* Bangalore Market I (0) -3.4098 I (1) -11.343 I (0) -2.1249 I (1) -8.8227 I (0) -1.7410 I (1) -10.204 I (0) -3.3919 I (1) -8.5721 Mumbai Market Kolkata Market Delhi Market * All I(0) statistics were insignificant and all I(1) price series were significant at 1%. We also used Augmented Dickey Fuller test. Results were similar if not identical . Pairwise Cointegration Test of Apple Prices Independent variable Phillips-Perron Test Dependent variable Bangalore Mumbai Kolkata Delhi Mumbai -5.0577* Kolkata -6.0628* Delhi -3.6218 Bangalore -3.7663 Kolkata -5.7100* Delhi -2.5926 Banaglore -4.5672* Mumbai -5.5744* Delhi -2.2124 Bangalore -3.5841 Mumbai -3.7807** Kolkata -3.7162 * Significant at 1 percent, ** barely significant at 5 percent. Error Correction Model for Bangalore-Mumbai Wholesale Prices Variable Estimated coefficient T-Ratio ∆ Mumbai 0.512553 4.942379 Lag ∆ Mumbai 0.491419 4.082613 2Lag ∆ Mumbai 0.014614 0.10793 Lag ∆ Bangalore -0.53769 -4.52354 2Lag ∆ Bangalore -0.28854 -2.13489 3Lag Mumbai (m1) 0.485094 4.184314 3Lag Bangalore (m0) 0.416772 3.261569 Constant 565.1429 3.205162 R-square = 00.45268 Adjusted R-square = 0.3972 Error Correction Model for Kolkata-Mumbai Wholesale Prices Variable Estimated coefficient T-Ratio ∆ Mumbai 0.526279 6.397178 Lag ∆ Mumbai 0.348977 3.149225 2Lag ∆ Mumbai 0.347016 2.716818 Lag ∆ Kolkata -0.51106 -4.08421 2Lag ∆ Kolkata -0.35146 -2.34657 3Lag Mumbai (m1) 0.715076 8.487148 3Lag Kolkata (m0) 0.443729 2.829072 Constant 193.0658 2.412387 R-square = 0.44052 Adjusted R-square = 0.3802