The Extent and Impact of Food Non-Tariff Barriers in Rich Countries

advertisement

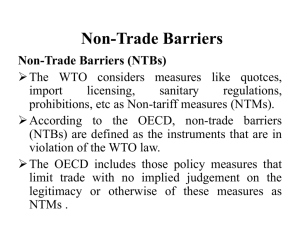

The Extent and Impact of Food Non-Tariff Barriers in Rich Countries by Scott Bradford Paper presented at the International Agricultural Trade Research Consortium Annual Meeting Theme Day December 4-6, 2005 San Diego, California THE EXTENT AND IMPACT OF FOOD NON-TARIFF BARRIERS IN RICH COUNTRIES Scott Bradford Brigham Young University January 2006 International trade negotiations have significantly reduced food tariffs in rich countries, increasing the relative importance of non-tariff barriers (NTBs). Since reducing them often requires deeper integration, the resulting negotiations have been more fractious and difficult than earlier efforts. The Uruguay Round took almost eight years, by far the longest round on record. The Doha Round has faced trouble in Seattle, Cancun, and Hong Kong. Given these considerations, we need to weigh the benefits of reducing NTBs. If these benefits are small, then perhaps the time has come to place a lower priority on achieving deeper economic integration. On the other hand, if the barriers remain substantial, it could be worthwhile to invest considerable political capital in their elimination. This paper presents a new method for estimating tariff equivalents of NTBs for final food goods in OECD countries. The analysis exploits detailed, comprehensive, and careful price comparisons: matched retail prices that the OECD collects on a regular basis in order to calculate purchasing power parity (PPP) estimates. Since this method does not identify policies, I strive to supplement the numbers by presenting preliminary information on possible sources of the barriers. I then use an applied general equilibrium model to provide a broad-brushed assessment of the impact of these NTBs. The results imply that NTBs significantly restrict trade in OECD nations and that removing them would bring large gains to them and to developing countries. Thus, this research implies that continued efforts to negotiate the reduction of NTBs will indeed exceed the costs. This work draws on joint work with Robert Lawrence, to whom I am greatly indebted. I thank David Blandford, Michael Ferrantino, Tim Josling, Suchada Langley, Christine McDaniel, William Meyers, Pat Westhoff, and Linda Young for their help. I also thank participants in the BYU Economics Department Raw Research Seminar, the APEC Non-tariff Measure Workshop (Bangkok, October 2003), the Empirical Trade Analysis Conference (Washington, DC, January 2004), the 2004 AAEA annual meeting in Denver, and the 2005 IATRC annual meeting in San Diego. I take full responsibility for any errors in this paper. Page 1 of 39 1 INTRODUCTION International trade negotiations over the past few decades have greatly reduced food 1 tariffs in rich nations, leading to a commensurate increase in the relative importance of food non-tariff barriers (NTBs). This has presented two challenges for trade analysts and negotiators alike. First, since NTBs cannot be measured as easily as tariffs, we have become less sure about how much food protection rich nations have. Second, since NTBs lack tariffs’ transparency and are often embedded within complex domestic regulatory regimes, reducing these NTBs generally requires more work than reducing tariffs does. This extra work stems not just from more difficult and technical subject matter but also from more intense political opposition to deeper integration. The Uruguay Round took almost eight years, the longest round on record, in part because it reduced NTBs more than any other previous round. The Doha Round, which seeks major opening in food sectors, suffered setbacks in Seattle and Cancun and had to settle for disappointing results in Hong Kong mainly because of a stalemate on agriculture. Food producer interests remain politically strong in rich nations, even to the point of possibly preventing a global trade deal that would bring great benefits to the world. Despite this opposition, the desire for more integration still drives policy, and support for significant liberalization in agriculture and food products is widespread. Many nations continue to negotiate bilateral and regional agreements, which almost always call for substantial barrier reductions in food. The United States has moved 1 By “food” I mean agricultural products; fishery products; and processed food, drink, and tobacco products. Page 2 of 39 beyond free trade agreements (FTAs) with Canada (CUSFTA) and Mexico (NAFTA) and concluded FTAs with at least 10 other nations. Several other deals are in the works. Even Japan has gotten into the FTA act lately, and there are signs there that it may soon begin to open agriculture as part of multilateral and bilateral deals. Given strong support for, and opposition to, reducing food NTBs, we need to weigh the benefits of doing so. If they are small, then perhaps we should place a lower priority on achieving deeper economic integration. On the other hand, large potential gains could make it worthwhile to invest considerable political capital in the reduction of food NTBs. Assessing the worth of food NTB reduction involves two tasks: 1) Reliably measuring the height of the NTBs, and 2) Using an economic model to infer the potential economic gains from their removal. Accordingly, I first present a new method for estimating tariff equivalents of NTBs for food final goods in OECD economies. The analysis exploits detailed, comprehensive, and careful price comparisons. I also present some preliminary information on the policies behind the estimates. Then, I use an applied general equilibrium (AGE) model to provide a broad-brushed assessment of the impact of these NTBs. 2 The results imply that food final goods NTBs greatly restrict trade in many OECD nations, especially in Japan, and that removing them would bring large gains to the world economy, for rich and poor countries alike. Thus, this research 2 This analysis gives an overview of the size and shape of the protection “forest”, without detailed descriptions of individual “trees”. Assessing the effects of particular policies, however, is important future work since it would probably facilitate the negotiations that this paper implies are worthwhile. Page 3 of 39 implies that continued efforts to negotiate the reduction of food NTBs will indeed exceed the costs. 2 MEASURING NTBs Nations can protect their markets in many different ways, making it hard to determine just how much protection different industries enjoy. As trade agreements have brought tariff reductions, governments have relied on a variety of more opaque but effective tools for insulating domestic food markets from foreign competition. For the purposes of this paper, I will define NTBs as follows: “A government policy or practice, other than a tariff, that raises the domestic price of a good above its import price”. Note that this definition does not include subsidies, since they do not drive wedges between domestic and import prices, even though such subsidies could restrict imports. This definition encompasses barriers that drive wedges between prices. Such NTBs include quotas and the procedures used to administer them; regulations that limit or completely exclude imports, such as sanitary and phytosanitary restrictions, testing and certification standards, labeling and packaging requirements, and food additive rules; inadequate protection for trademarks and geographical indications; restrictive distribution systems; burdensome customs procedures; safeguards, including anti-dumping duties; biased government procurement; rules of origin; sanctions; and threats of protection. Even when not created with protectionist intent, these policies can inhibit international arbitrage, shield producers, and shrink the world economy. Page 4 of 39 2.1 Other Approaches to Measuring NTBs This section discusses three prominent NTB measurement approaches that have been applied to food: 1) Counting NTBs and computing coverage ratios, 2) Inferring protection from trade flows, and 3) Inferring protection from price gaps. Then, this paper’s method is discussed. 2.1.1 Compute NTB “Coverage Ratios” The United Nations has developed “NTB coverage ratios” by computing what percentage of products within a sector has an NTB. Unfortunately, this measure does not take account of how restrictive each barrier is. One sector may have many products that are subject to minor NTBs. Another sector may have just a few products with very restrictive NTBs. The first sector would have a much higher NTB coverage ratio, while we would expect the second sector to actually have more restrictive trade barriers. Also, the UN’s accounting probably does not cover all NTBs. For instance, these coverage ratios do not include inefficient customs procedures, even though they probably significantly restrict a wide variety of imports. 2.1.2 Infer Protection from Trade Flows This approach seeks to measure the effects of NTBs by estimating their impact on the volume of trade in different industries. Researchers use models to predict trade patterns absent any barriers (on the basis of factors such as country size, distance from other economies, and factor endowments) and then use the gap between actual and Page 5 of 39 predicted trade flows to infer protection. This method has the advantage of being able to capture the aggregate impact of all barriers combined, even ones not considered by NTB list-makers. 3 This approach, however, depends on having a trade model that can accurately account for all determinants of trade, besides barriers, which is an ambitious requirement. One wonders how much of the gap between predicted and actual flows results from barriers and how much results from model misspecification or data mismeasurement or both. The fact that one has to specify demand elasticities in order to convert the quantity shortfalls into tariff-equivalents introduces another source of uncertainty. 2.1.3 Price Gaps Like the second approach, this method has the virtue of capturing the full impact of all NTBs. It has the additional virtues of not relying on any single model and providing tariff-equivalent measures directly. Although it has pitfalls, I believe that the price gap approach has the most promise for measuring NTBs. With many possible barriers to trade, I believe that one can best account for all of them by using the information that prices concisely convey. The basic philosophy behind this approach is that barriers to arbitrage across national borders should be considered barriers to trade. 4 If international markets are integrated, sellers cannot raise domestic prices above prices that would attract 3 One popular version of this approach is to use so-called gravity equations. For an excellent review of this methodology, see Frankel 1997. 4 This does not depend on individual consumers engaging in arbitrage. Organized and well-informed trading companies and other international wholesalers can easily seize arbitrage opportunities. Page 6 of 39 arbitrage from abroad. One needs to carefully account for unavoidable costs associated with shipping goods between economies. Once one has done this, however, if a price gap exists for equivalent goods in two different nations, then one can conclude that the higher-priced market is protected. Moreover, one can use the price gap as a measure of the extent of protection. Thus, a single number can give the total effect of all trade barriers. These gaps may be caused in part by policies that are not explicitly designed to impede trade, such as overly harsh sanitary standards. No matter what the intent, however, which can be difficult to judge anyway, I presume that policies that segment national markets are trade barriers. 5 The key to using this approach is obtaining appropriate price measures. Such efforts confront three challenges. The first is comparing prices of equivalent goods. Even if they have the same name, goods may have very different levels of quality. Thus, surveyors need to work hard to ensure comparability. Many researchers have used unit values as price proxies because they are widely available. These can provide reasonable estimates of price gaps at very detailed classification levels (eg, Harmonized System 10-digit), but, at higher levels of aggregation, unit values tend to be notoriously inexact measures of prices because of large quality differences in products. A second challenge is using producer, rather than consumer, prices. Most price surveys are undertaken with a view to comparing costs to the consumer. In order to accurately gauge protection for producers, though, one should compare producer 5 This notion corresponds to that of Knetter and Goldberg 1996, which argues that “A market is segmented if the location [sic] of the buyers and the sellers influences the terms of the transaction in a substantial way (i.e. by more than the marginal cost of physically moving the good from one location to another).” (pp 3-4.) Page 7 of 39 prices. Data gathered at the retail level include non-traded value added, such as distribution margins and transportation costs. These prices may therefore provide an inaccurate picture of protection since they include elements that cannot be eliminated through arbitrage. The price of a pound of coffee purchased in a supermarket in Tokyo may be higher than a pound of the same brand of coffee purchased in New York, either because trade barriers raise the wholesale price of coffee or because the costs of distributing coffee in Tokyo are higher, or both. One who seeks to isolate the role of trade barriers needs to compare producer, rather than consumer, prices. A third challenge relates to the comprehensiveness of coverage. Samples of a few products gathered at selective retail outlets may not be representative of the full array of goods sold. Also, many international surveys are undertaken to establish differences in the cost of living experienced by business executives and their families. These naturally focus on a set of products that are not representative of all purchases. 2.2 This Paper’s Method 6 Other studies have used price differentials as evidence of protection and to estimate the benefits of integration. 7 This section discusses how I have tried to overcome the challenges mentioned above, in order to produce improved estimates of NTB food final goods protection and its effects. I use data in which every effort has been made to ensure comprehensive coverage and comparability. In addition, I have 6 See Bradford and Lawrence 2004 and Bradford 2003 for more discussion of the methodology and data presented in this paper and for welfare analyses of total protection. 7 See in particular Hufbauer et al 2002. Page 8 of 39 endeavored to compare producer prices by eliminating the effects of distribution margins. The data is also analyzed at a fairly disaggregated level, to mitigate weighting problems. I start with carefully matched retail prices that the OECD collects on a regular basis in order to calculate purchasing power parity (PPP) estimates. With the cooperation of member governments, OECD researchers build on the resources, expertise, and data possessed by various national consumer price index (CPI) agencies and sample prices of over 3000 final goods, about half of which are in food. They make every effort to compare equivalent products across countries. For the most part, they rely on identical brand names or exact descriptions of the items to be priced. When they cannot find appropriate matches based on descriptions, researchers from the nations involved travel abroad to determine which items would be most appropriate matches for the items in their country. This has occurred with grain, some vegetables, and tobacco. The researchers also call upon the expertise of producers, trade associations, and buyers for large stores in order to determine matches. Prices are collected from many markets and outlets at different times during the year in order to obtain a single annual, national average (World Bank 1993, p10). Also, prices of the average-sized purchase for that country are compared. After collecting the data, apparent mismatches in quality are dealt with either by refining the specifications or discarding the data (OECD 1995, p5). This method does not produce perfect data, but the scale of resources expended on accurate matching indicates that these are excellent measures of price differences for equivalent products. Page 9 of 39 The researchers aggregate the most detailed price data into categories called “basic headings”. These are defined as “groups of similar well-defined commodities for which a sample of products can be selected that are both representative of their type and of the purchases made in participating countries” (OECD 1995, p5). Thus, a basic heading should not be too broad or too narrow. It should not be so broad that very different products are compared; it should not be so narrow that few economies in the sample sell it. For instance, seaweed is too narrow, and food is too broad. In multilateral comparisons, one usually cannot find products that are representative of the category and typical of what is bought in every country, since consumers in different nations buy different mixes of products. Thus, while most items are priced in most or all of the nations, not every product in the sample is priced in each country. To be included in the sample, a product needs to be a “representative product” in at least one country and it must be sold in large enough quantities in at least one other country so as to be price-able. A “representative product” is one that accounts for a large share of that country’s expenditure on that basic heading. For instance, cheddar is a representative product for the cheese basic heading in France but not for Italy. Cheddar cheese, however, is price-able in Italy. As long as nations price their own major products and a share of all other products, relative prices for each product and country can be calculated indirectly as well as directly. For details on how the prices are combined into one average price for each country see EurostatOECD PPP Programme 1996. There are about 200 basic headings in the whole sample. I obtained unpublished basic heading price data for 1999 and trimmed the sample to Page 10 of 39 about 50 traded food goods. All prices were converted to US dollars using the 1999 exchange rates. See Table 1 for the list of categories. The consumer price measures were converted to producer prices using data on margins—wholesale trade, retail trade, transportation, and taxes—which come from national input-output tables. 8 I did so for nine countries: Australia, Belgium, Canada, Germany, Italy, Japan, the Netherlands, the United Kingdom (UK), and the United States (US). Although I wanted to include more nations, such as France, the availability of detailed margins data determined which ones became part of the sample. I matched these margins with the OECD retail price data and derived estimates of producer prices by peeling off the relevant margins. Thus, [1] p ijc , p = 1 + m ij p ij pijp: pijc: mij: the producer price of good i in country j, the consumer price of good i in country j, as taken from the OECD data, the margin for good i in country j, as taken from the national IO table. Unfortunately, margins data only become available with a considerable time lag.9 The producer price estimates were therefore obtained by assuming that distribution margins were the same percentage of overall value-added as they were in the most recent year for which data were available. 8 Roningen and Yeats 1976 also use retail prices and adjust for taxes and transport costs, but they do not adjust for wholesale and retail trade margins, which significantly outweigh taxes and transportation. 9 The margins data come from the following years: Australia, 1995; Belgium, 1990; Canada, 1990; Germany, 1993; Italy, 1992; Japan, 1995; Netherlands, 1990; UK, 1990; and US,1992. Page 11 of 39 Producer prices allow us to get a sense of which industries in which nations have the lowest prices, but inferring the extent of insulation from foreign competition requires one more step: taking account of transport costs from one nation’s market to another. A foreign good must travel from the foreign factory to the foreign border and then to the domestic border in order to compete with a domestic good. 10 Thus, one cannot infer protection simply by comparing producer prices. The domestic producer price must be compared to the import price of the foreign good. Such import price data that matches the producer prices in this data does not exist independently and needs to be inferred. This is done by combining data on export margins, also available from national input-output tables, with international transport costs. 11 I could only get detailed data on international transport costs for Australia and the US. Each reports import values for detailed commodities on both a basis that includes insurance and freight (cif) and one that does not—so-called free on board (fob). The cif/fob ratio is a good measure of all the costs of shipping goods from abroad to these economies. The ratios for both nations are small, so that the gap between the two is also small: the average for all products for the US is 1.05, while the overall average for Australia it is 1.09. Thus, for each detailed sector, the average of the two cif/fob ratios is used as an estimate for the international transport cost for that product for all the countries. 10 For a discussion of the importance of export margins, see Rousslang and To 1993. I have export margins for all countries except the UK, for which I used the Netherlands export margins. Export margins tend not to vary much by country, so I feel confident that using the Netherlands margins does not compromise the results. 11 Page 12 of 39 These data on export margins and international transport costs are used to compute import prices for each product and country, as follows. Adding the export margins to the producer prices enables one to calculate the export price for each product in each country. The lowest export price plus the common international transport cost is the import price. Thus, the export price is given by: [2] p ije = p ijp (1 + em ij ) , pije: the export price of good i for country j, emij: the export margin of good i for country j. The import price is then given by: [3] p iI = p iMe (1 + tri ) , piI : tri: p iMe the import price of good i (the same for each nation), the international transport margin for good i, = min( p ie1 , p ie2 ,K , p ie9 ) : the minimum of the 9 export prices. The ratio of each country’s producer price to the import price gives us an initial measure of protection, pr ijIN : [4] prijIN = p ijp . p iI Page 13 of 39 For a given good, these measures will differ from true protection if all of the countries in the sample have barriers to imports for that good. For such goods, the calculated import price will exceed the true import price to the extent that the low cost producer has barriers against imports. This will bias the protection estimates downward. By the same token, if just one of the nine has no barriers to imports in that good, then prijIN will approximate true protection, because, in this case, the price in the free trading country will approximate the import price. Since the sample includes Australia, Canada, and the US, which are fairly free traders, the low price in the sample approximates the import price the great majority of the time. Nevertheless, data on trade taxes are used to correct, at least partially, for the possible downward bias. These tariff data come from the OECD tariff database, which gives most favored nation tariff rates for member countries at the Harmonized 6-digit level. The final measure of total protection, prijTOT , is given by: [5] prijTOT = max( pr ijIN ,1 + tar ij ) , tarij: the tariff rate for good i in country j. I simply use the fact that tariffs provide a lower bound on protection. If the initial measures do not exceed the overall tariff rate, then that tariff rate is used as the measure of protection. This happened about one-third of the time. After this correction, the only time that these protection measures will be biased downward is when all nations in the sample have NTBs against the rest of the world. Page 14 of 39 These measures provide estimates of the protective effect of all kinds of barriers—tariffs and NTBs alike. For our purposes, we want to focus on the impact of NTBs alone, so I perform one final, simple modification. Tariffs are subtracted from these total protection numbers. Mathematically, NTB protection is given by [6] pr ijNTB = pr ijTOT - tar ij = max( pr ijIN - tar ij ,1) . Note that, since we measure protection as a ratio of the world price, a value of 1 indicates no protection. Thus, I conclude that there is no NTB protection whenever pr ijIN - tar ij < 1 ⇒ pr ijIN < 1 + tar ij , that is, whenever the percentage by which the producer price exceeds the import price does not exceed the tariff rate. Figure 1 shows a schematic example that illustrates this methodology. Suppose that there are three countries, with consumer prices as shown: Country A with the lowest and Country C with the highest. C’s consumer price is nearly 2.5 times that of A, but such a facile comparison can mislead. After peeling off domestic distribution costs for this good, the ratio of C’s producer price to A’s is lower, though still large. As is often the case in reality, in this example, the country with the high consumer price also has the highest percentage domestic distribution margin. Converting to producer prices gets us closer to our goal, since these provide a clearer indication of how efficient producers in different nations are. Still, as discussed above, a straight comparison of producer prices would overstate protection, since doing so would not take account of the costs required to sell in foreign markets. So, to each of the Page 15 of 39 producer prices, we add the unavoidable export margins and the international transport costs. Note that, because of its relatively small export margin, Country B ends up with the lower border price, even though its consumer and producer prices are higher than A’s. In the end, the NTB protection level for C that we calculate is (25% - the tariff rate) (if the tariff rate is lower than that), a much smaller gap than that between the underlying consumer and producer prices. 3 SUMMARY AND ASSESSMENT 3.1 Four Key Characteristics I believe that measures using this method, while not perfect, will shed useful new light on NTB protection because they possess, to a large degree, four key characteristics: completeness, comprehensiveness, accuracy, and international comparability. 3.1.1 Completeness Using price gaps enables one, in principle, to capture the combined effects of all NTBs, which can include any number of regulations and bureaucratic procedures. For example, a UN study analyzed how excess paperwork and cumbersome customs procedures impede the international flow of goods. The study points out that, in addition to direct costs, these regulations impose indirect costs, such as losses due to “deterioration or pilferage” while cargo is waiting to be cleared, or the “strong disincentive for potential exporters” imposed by complicated procedures. (See United Page 16 of 39 Nations Conference on Trade and Development (1992).) The study estimated that these barriers imposed costs that averaged 10 to 15%, on top of any other trade barriers. Protection measures that rely on lists of individual barriers, such as the UN’s own NTB measures, will tend to overlook subtle but real barriers such as these. This paper’s method, however, will capture the protective impact of such barriers if they raise domestic prices above the import price implied by the sample. 3.1.2 Comprehensiveness These measures cover all traded final goods, instead of a small subset thereof. Some other studies (such as Hufbauer and Elliott 1994) have limited their coverage to sectors in which protection had been previously thought to exist, without testing whether other sectors might enjoy well-disguised insulation from foreign competition. The approach in this paper allows one to construct a more comprehensive picture of final goods NTB protection in these nations. By the same token, this method does exclude non-final goods, which account for most output and trade. 3.1.3 Accuracy Accuracy stems from comparing actual prices of identical or equivalent goods. Differences in quality have bedeviled attempts to use prices, except for certain homogeneous goods. The data here, on the other hand, have resulted from intensive multilateral efforts to correct for quality differences. Page 17 of 39 3.1.4 International Comparability Many other estimates have only been derived for a single country at a time, making it difficult to rank economies in terms of openness. These measures use the same data and apply the same method to each country in the sample, thus allowing one to make such rankings, for individual products, for aggregated categories, and for each country as a whole. 3.2 Possible Concerns 3.2.1 Imperfect Competition Is it possible that market power could lead to estimates that do not really reflect NTBs? I argue that this is not so. If the domestic producer price exceeds the prevailing import price by more than the tariff rate, an NTB must support that gap, no matter how those prices came to be. Market power does not change this fact. With market power, a trade barrier may endogenously change prices, but the fact remains: an un-arbitraged gap between the domestic price and the tariff-inclusive import price cannot persist without NTBs that segment the domestic and world markets, and the gap measures the amount of NTB protection. 3.2.2 Terms of Trade Effects A related concern is the impact of terms of trade effects, for which this method makes no adjustment. If an NTB drives down the import price, should one measure Page 18 of 39 NTB protection with respect to the NTB-ridden import price or the free trade import price? For instance, suppose that the latter is 1.00 and that a country imposes an NTB of 0.2 that drives the domestic price to 1.10 and the import price to 0.90. Is the amount of NTB protection 22% ( 1.1 1.1 − 1 ) or 10% ( − 1 )? One could make an 0.9 1 argument for either, but this paper’s method presumes that the amount of NTB protection is 22%, because that is the size of the wedge. With the barrier in place, domestic consumers have to pay 22% more than people who can buy the good at world prices. Consider a more extreme case. Suppose in the above example that the domestic price remains at 1.00, while the import price gets driven to 0.80. It seems that one should not conclude that NTB protection is zero simply because the domestic price did not move; after all, the domestic price is 25% higher than the world price. In practice, the terms of trade rarely, if ever, move as much as in the above examples and will usually not matter. Even if one does want to correct for terms of trade effects, one does not observe the free trade import price, so speculation would drive the correction, and it would introduce a fair amount of uncertainty into the measures. Thus, for theoretical and practical reasons, there is no correction for terms of trade effects. 3.2.3 Dumping Dumping can possibly bias the inferred import price downward, which would bias the protection measures upward. While protectionists make much of dumping, true cases of dumping in which firms sell goods overseas below cost are rare to nonexistent. Most economists would agree that, the vast majority of the time, Page 19 of 39 policymakers use anti-dumping duties as alternative ways to protect inefficient industries, not as justified defenses against artificially low prices and the predatory threats they pose. Even if such dumping occurs, and the resulting import price is lower than otherwise, that does not invalidate it as a proper benchmark. Again, gaps between domestic and import prices only result from barriers, even if the import prices are artificially low. 3.2.4 Demand Differences One may wonder whether these measures are valid if consumers in different economies have different demands. The question arises: If Country A’s citizens have a higher demand for good X than do Country B’s citizens, won’t that drive up the price of good X in Country A in the absence of trade barriers? Answer: Only if there is a barrier in Country A that allows such a gap to emerge. If Country A and Country B are truly integrated, then good X will have one single demand curve, and the price will be the same everywhere. Demand differences without barriers cannot sustain price gaps. 3.2.5 Price vs. Quantity Effects Finally, in deriving these estimates, I realize that there is no clear connection between tariff equivalents and the amount by which imports are reduced. Quantity changes depend on market structure and such key parameters as the elasticities of supply and of demand. Thus, a high NTB on a good with a low elasticity of demand may reduce imports by less than a small NTB on a good with a high elasticity of Page 20 of 39 demand. I do not purport, however, to analyze prices and quantities at the same time. In order to assess the impact of the barriers on quantities, and thus on welfare, one would need a model of the particular sector in question. I claim that the cleanest, most effective way to measure NTB protection is to derive tariff equivalents and leave quantity and welfare analysis for the next step. 4 THE EXTENT OF NTB PROTECTION Table 2 presents the NTB data for the nine nations. Again, these are reported as the ratio of the domestic producer price to the world price. Thus, a reading of 2.00 would be a protection rate of 100%. As mentioned above, the measures were constructed using 50 categories, but, to facilitate the presentation, I have aggregated up to 13 sectors, which correspond to the GTAP sectors that will be used in the AGE analysis below. The table also reports weighted geometric means for each country. I used the value of consumption as weights in constructing these means. Two factors motivated this choice: 1) Protection skews the value of consumption less than protection skews the value of production or of imports, and 2) The OECD reports the value of consumption along with its price data, so consumption data that exactly matches the protection aggregation was available. While these expenditure shares vary by country, the first column of the table presents median expenditure shares to indicate the importance of each sector. These results imply that Canada, Italy, the Netherlands, and the US have the lowest food NTB barriers, averaging less than 10%. Australia, Belgium, Germany, and Page 21 of 39 the UK rank in the middle, ranging from 11% to 22%. Japan is a huge outlier: its food NTBs average more than 90%, and Japan’s NTBs are the highest in each category listed except garden products (mostly houseplants and planting products) and eggs. Overall, this analysis suggests that there is nontrivial NTB food protection in industrial nations, but Japan’s barriers loom very large. Much work needs to be done to bring greater transparency and openness to Japan’s food markets. Looking at individual sectors, these results imply that, in addition to Japan, Germany, the UK, and the US have significant NTBs in fresh fruits and vegetables. As one would expect, the data show Australia, Canada, and the US with low barriers in the two meat sectors, while the Europeans and Japanese have extensive NTBs. In dairy products, in addition to Japan, Australia, Belgium, Canada, and the US seem to have nontrivial NTBs. Belgium and the UK have higher barriers than average in the large processed food sector, but, once again, Japan’s barriers loom much larger than anyone else’s. The beverages and tobacco sector probably has the most measurement error because of the difficulties involved in correcting for large taxes. With this caveat in mind, we have some evidence that Australia, Canada, and the UK join Japan with significant barriers. One may wonder about the sugar estimate for the US: 0% NTB protection. Three factors contribute to this result. First, Australia is the low-price producer sample, but its import price is probably higher than the true world price, biasing sugar protection estimates downward. Second, to make its sugar restrictions more WTOcompatible, the US has converted its quotas to tariff-rate quotas, which means that its Page 22 of 39 official tariff rate is high (about 75%; see Table 3 below). The tariff rate ends up exceeding the inferred NTB price gap, resulting in a finding of no NTB protection. Finally, the underlying price data only includes sugar sold to final demand, not sugar sold to food processing firms; the price gaps for final demand sugar are probably lower than the gaps for sugar sold to produers. For comparison purposes, Table 3 provides tariff data. Not surprisingly, tariffs are generally lower and more tightly distributed. The Europeans have the highest average tariffs in food. One can use the tariff and NTB numbers to calculate a measure of “protection transparency”, which is defined as the ratio of tariff protection to total protection (which is simply the sum of NTB and tariff protection). These data imply that Japan and Australia have the most opaque food protection regimes, while Italy and the Netherlands have the most transparent. Obstfeld and Rogoff 2000 concludes that “a recurring theme here is that the markets for most ‘traded’ goods are not fully integrated, and segmentation due to various trade costs can be quite pervasive. In fact, the spectrum of goods subject to low trade costs may be very narrow.” Our data provide support for this view in the realm of food. 5 POLICIES BEHIND THE PRICE GAPS These NTB estimates may help policy makers in one of two ways. First, for known NTBs, these measures provide estimates of the extent to which those NTBs actually restrict trade. Thus, these results may provide useful information to trade Page 23 of 39 negotiators as they decide how to efficiently focus their efforts on freeing up trade. Second, some sectors that have not reached the trade negotiation agenda may, in fact, enjoy significant disguised NTB protection that is worth negotiating down. This research can help to flag such sectors. To illustrate how these results can help in the first way mentioned, Table 4 shows possible barriers for some of the NTB gaps, though much more work along these lines needs to be done. I have drawn on the EU Market Access Database, the USTR’s 2000 Report on Foreign Trade Barriers, and 2000 WTO Trade Policy Review for the European Union, the US, and Japan. A more detailed analysis would reveal more policies behind the NTBs. Also, for any given price gap, the policies listed may not be major causes, but they are initial candidates. Looking back at Table 2, there are a number of NTBs for which there are no listed possible policies. In these cases, more detailed research may reveal particular sources of the gaps, which might then become subject to negotiation. Also, any of these gaps, as well the ones which have listed policies, could result from burdensome customs procedures and other administrative friction, as discussed above. Thus, efforts by trade negotiators to remove such widespread sand from the wheels of trade could potentially have large benefits across many sectors and economies. 6 THE WELFARE EFFECTS OF INTEGRATION To provide insights into the importance of NTBs, this section simulates their removal. For eight of the nine nations, the simulations compare real incomes in the Page 24 of 39 world as it is with one in which the NTBs are eliminated. (Unfortunately, data problems prevent Belgium from being included.) I use an AGE model based on one developed by Harrison, Rutherford, and Tarr (HRT). 12 The model has considerable country and sectoral detail: 16 regions and 33 sectors (See Table 5). 13 The model also allows for both increasing returns to scale and dynamic adjustment of the capital stock. The next two subsections describe the model and then report the simulation results. 6.1 Description of the Model 6.1.1 Production Structure Production involves the use of intermediate goods and five factors—capital, skilled labor, unskilled labor, land, and natural resources. Only capital can move across national boundaries; all factors can move freely across sectors. Value added in each sector has a CES (constant elasticity of substitution) production function. This formulation means that, within each sector, the elasticity of substitution between any two of the factors is the same. I use HRT’s values for these elasticities, which they estimated econometrically using US time series data from 1947 to 1982 and using the same functional form as is used in this AGE model. In their estimates, however, they used only three factors—capital, labor, and land—instead of five. See Table 6 for these 12 The model is based on the computer code provided by Glenn Harrison, Thomas F. Rutherford, and David Tarr. Their code is available for public access at http://theweb.badm.sc.edu/glenn/ur_pub.htm and was used in their 1995, 1996, and 1997 articles. 13 The underlying data come from Version 5 (1997) of the Global Trade Analysis Project (GTAP) database. Page 25 of 39 estimates and their standard errors. The production function for intermediates and the value-added composite is Leontief. 14 Some sectors are assumed to have constant returns to scale. Other sectors, though, are modeled with increasing returns to scale and imperfect competition. 15 In these sectors, there is firm-level product differentiation, with output being a composite of varieties. Firms have fixed costs and constant marginal costs, meaning that reducing the number of firms leads to rationalization gains. These firms compete using quantity conjectures, with entry and exit that drive profits to zero. Dynamics are incorporated by allowing the capital stock to vary in response to changes in the rate of return caused by liberalization. If the rate of return increases, investment increases the capital stock until its return is driven back down to the longrun equilibrium. The results, therefore, reflect the model’s predictions for what happens after the capital stock has changed enough to return the price of capital to its original level. The capital adjustment process is not modeled, and the time horizon implied by these results depends on how long one thinks it takes capital to respond to interest rate differentials. The model ignores the consumption foregone by the increased investment, which may overstate the estimated benefits. On the other hand, the model ignores any impact of growth on productivity and innovation, which leads to an underestimate of the gains. 6.1.2 Demand Structure 14 Relaxing this assumption does not significantly change the results. Page 26 of 39 On the demand side, each region has a representative consumer and a single government agent, each of whom has a nested CES utility function and practices multistage budgeting. At the top level, demand across the 33 sectors is Cobb-Douglas. Consumers first decide how much to spend on each of the 33 aggregate goods, given total income and aggregate prices. Each of these goods is a CES composite of domestic output and an import composite, which are imperfect substitutes. In this second level, consumers divide spending between the domestic and import good by maximizing a CES utility function subject to the total spending they have allocated to that sector and given the aggregate prices in that sector. At the third level, the model invokes the Armington assumption in that imports of the same good from different economies are assumed to be imperfect substitutes. Preferences across these different goods from different economies are given by a CES utility function. At this third level, consumers choose quantities of each import subject to the amount they have budgeted for aggregate imports at the second level and subject to the various prices. I follow HRT and set the elasticity of substitution across import varieties, σ MM , equal to eight and the elasticity of substitution between the import composite and the domestic good, σ DM , equal to four. These elasticities affect the magnitude of the results. Higher values of these parameters lead to greater substitution in response to price reductions and, in general, higher welfare gains from liberalization. Roughly speaking, cutting these elasticities in half reduces the gains by 10% to 50%, depending on the region and the simulation. Similarly, doubling these elasticities increases the estimated gains 15 See Table 6 for the sectors and the mark-ups used. This table also presents alternative mark-ups from Page 27 of 39 by about 20% to 100%. Even such wide changes in the calibration, however, do not change any of the main conclusions. In the sectors with increasing returns, yet another level of constrained choice is introduced. In this set-up, the domestic good and each import good produced in each region, instead of being homogeneous goods, are themselves composites of different varieties produced by the different firms. Consumers have CES preferences over these varieties and allocate spending across them subject to the amount they budgeted for each good at the third level. The elasticity of substitution across these varieties is set at 15. All results are robust to wide changes in this parameter. 6.1.3 Incorporating the New Data 6.1.3.1 Protection Data To simulate the impact of NTBs, the model was benchmarked with the total protection measures—NTBs plus tariffs—instead of the GTAP protection data, which consists almost entirely of tariffs. In the model, all policy distortions enter as ad valorem price wedges 16 , which, conveniently, is the form that this paper’s new protection data take. So, replacing the GTAP tariff equivalents with these data is fairly straightforward. I did not, however, simply use the new measures as is, since they apply only to final goods, while all of the sectors of the model contain a combination of final and intermediate goods. Instead, I used a weighted average of the new data and the original GTAP data. The weight on the former was the fraction of output in that the GTAP model. The results are robust to the set of mark-ups used. Page 28 of 39 sector sold to final demand; the GTAP measure got the complementary weight. Thus, letting B and GTAP be the two protection measures and α , the final demand fraction, the protection estimate used was αB + (1 − α )GTAP . Using this method ensures that model sectors with a high proportion of final goods use a protection estimate close to mine, while sectors with a low fraction of final goods use a protection estimate close to the GTAP measure. Put another way, the lower the final demand fraction, the less the data deviated from the standard GTAP data. See Table 7 for a comparison of these weighted data and the original GTAP data. This table shows the food estimates in bold; it also includes total protection estimates for non-food sectors in the model. Replacing the GTAP data with these does not significantly affect the food results. 6.1.3.2 Distribution Margins Data The margins data used to derive the protection measures allow one to model distribution more accurately within the AGE framework. Most AGE trade models do not account for margins explicitly. All distribution services are lumped into the trade and transport sector and consumed as a separate good, instead of being linked to the goods that use those distribution services. Since margins vary across sectors, this obscures the role of distribution in the economy and can skew the results of AGE analyses. For instance, simulations of price reductions in other sectors may imply a large substitution out of trade and transport services, even though actual consumption of these will probably increase in order to facilitate commodity flows. Also, not 16 Government revenue is held constant throughout all simulations by assuming that lump-sum taxes are used to replace any lost tax revenue. Page 29 of 39 accounting for margins implies that consumers base choices on producer prices instead of the higher consumer prices that include margins. These problems are addressed by incorporating distribution explicitly into each final demand sector for which there is margins data. This is done by treating margins like taxes, since margins create a wedge between consumer and producer prices. For the eight nations involved, therefore, margin wedges were insertedinto each of the relevant sectors. 17 The value of the trade and transport sector was reduced by the total value of these margins. Finally, inputs into the trade and transport sector were reduced and re-distributed across the final goods sectors in accordance with the amount of distribution used in those sectors. 18 6.2 Welfare Analysis This section presents estimates of the potential gains from including food NTBs on the trade negotiation agenda. Since tariffs presumably require much less work to remove, it is not likely that negotiators will remove NTBs and not tariffs. So two sets of scenarios are simulated: one in which nations remove all food protection—NTBs and tariffs alike—and one in which nations only remove tariffs. For each of these two situations, I conduct two types of simulations: unilateral barrier removal in each of the eight nations and multilateral worldwide opening by all eight at once. I focus on 17 See Gohin 1998 and Komen and Peerlings 1996 for other examples of modeling margins in this way within AGE models. Bradford and Gohin 2006 explicitly model the distribution sector for the US within an AGE model. 18 These modifications only apply to final goods. Due to lack of data, I do not modify the model to account for intermediate distribution. It turns out that these intermediate margins are quite a bit smaller than the margins for final goods. Page 30 of 39 changes in equivalent variation (which, given the model structure, is the same as changes in real consumption) as a percentage of GDP. Tables 8 and 9 show the main results for total protection and just tariffs. These tables report the permanent, annual effect of trade opening on consumption, as a percentage of GDP, once the capital stock has changed to its new equilibrium. Alternatively, they report the welfare costs, born at home and abroad, of tariff and total protection in the eight nations separately and as a group. Table 10 shows the difference between the two scenarios and thus the predicted extra gains from removing food NTBs. (Alternatively, the results in Tables 8A and 8B are simply the sum of the results from Tables 9 and 10.) For each table, Panel A reports these gains as a percentage of GDP, while Panel B shows them in billions of 1997 US dollars. Tables 8A and 8B imply that, overall, food protection in these eight nations imposes significant costs on the world. If all food barriers in all eight were removed, world welfare would increase by 0.73% of GDP, or about $185 billion (in 1997 dollars). About $135 billion of that would accrue to rich countries, with less developed countries (LDCs) getting permanent annual gains of about $50 billion. All but Canada, Germany, and the US would reap significant gains from unilateral opening, and all but Germany would benefit greatly from opening in all eight. Germany suffers from adverse terms of trade effects when all eight open: the reallocation of resources causes demand for the goods that Germany tends to export to decline, relative to demand for the goods that Germany tends to import. Japan’s food barriers impose large costs on poor countries. Every poor region would benefit most from Japanese opening. (“Rest of Europe” is Page 31 of 39 mostly rich countries.) Interestingly, the US would get significant gains from Japanese food barrier removal but not from its own. Tables 9A and 9B reveal that poor countries would reap most of their gains from the removal of tariffs, not NTBs: about $33 billion from tariff removal, compared to $50 billion for all protection removal. Food tariffs in Japan, Germany, the UK, and the US impose the largest burdens on poor countries. Since tariffs are much easier to reduce than NTBs, it appears that poor countries will get more bang from their negotiating buck by focusing on food tariff removal in rich countries, rather than food NTBs. Focusing on Table 10, most of these nations do not get significant extra annual boosts to GDP from unilateral food NTB opening. Multilateral opening from all eight, however, would bring nontrivial annual gains of at least 0.1% of GDP for all except Canada and Germany. Global GDP would rise an additional 0.4%, or $90 billion, with NTB removal in just the food sectors. It appears that poor countries have little to gain from NTB reductions in Europe or the US. Japan, however, remains a large burden, and their food NTBs warrant close attention from poor and rich countries alike. In fact, Japanese opening of food NTBs accounts for almost as many gains as having all eight open. Three main forces drive the gains for any given country: the amount of protection removed, the share of trade in GDP for that country, and terms of trade effects. The US’s relatively low barriers and its low trade/GDP share lead to relatively low predicted gains for the US. Similarly, the Netherlands’ high trade share amplifies its percentage gains. On the other hand, Japan’s NTBs are so high that it reaps Page 32 of 39 substantial extra gains from NTB liberalization despite the fact that Japan has the lowest trade share in the sample: only about 10%. Terms of trade changes mute gains for Canada, Germany, and Italy. For all economies except Canada and Japan, the extra gains from multilateral food NTB opening are significantly more than the gains from unilateral opening. These six economies have incentives to engage in multilateral NTB reform, as opposed to going it alone. Overall, these results imply that the potential gains to be reaped from food protection are not trivial, whether one considers tariffs or NTBs. Of course, such extensive liberalization in these nations is not on the table right now. Complete opening may not be an option because of short run political stresses caused by contraction in protected sectors. Our analysis does not provide a recipe for reform, but it does show that the potential gains from future attempts to integrate markets remain quite large. These estimates of the benefits of integration do not take account of certain costs. In particular, differences in national languages, policies, and institutions may well create barriers to price arbitrage, but they may also provide benefits that would be lost if the world economy was to be deeply integrated in the sense we are exploring in this study. Also, I have not considered adjustments costs as workers and other factors move out of shrinking sectors into expanding sectors. On the other hand, these results may understate the costs of the barriers by treating them as if they were tariffs. There are at least two ways in which the costs of Page 33 of 39 NTBs may be higher. First, they do not generate revenue for the government as tariffs do, so this benefit is foregone. An NTB such as excessive fumigation raises costs to the foreign exporter without necessarily generating income for the importing country. The fumigators in that country may get paid more than otherwise, but this is a transfer from within the economy, not an extra source of revenues as with tariffs. Second, removing barriers may actually save resources and therefore yield even larger benefits than estimated here. As Anderson and van Wincoop 2002 emphasizes, tariffs generate deadweight losses, but NTBs may consume resources directly. Suppose, for example, that two nations each require meat to be certified as safe even though their criteria are very similar. Firms that wish to sell in both markets must expend real resources to meet foreign requirements. Meat approved in one economy cannot simply be sold abroad. Under these circumstances, in addition to the gains from removing the barriers, freeing the resources that are consumed by the (unnecessary) duplicative regulatory processes could produce additional gains. The estimates are also conservative because they ignore the potential benefits from opening nations outside the sample of eight used in the study. 7 CONCLUSION This paper has presented a method for estimating food NTB protection in rich countries. The estimates imply that rich nations harbor significant food NTB protection, in addition to food tariffs. Japan has unusually high food NTBs. AGE simulations imply that negotiating the removal of food NTBs, especially in Japan, would bring large Page 34 of 39 benefits to rich and poor nations alike, implying that the extra work required to open these markets would probably pay off. Of course, the trade opening devil lurks in the details, so trade analysts need to determine the actual policies that underlie the protection we have quantified in this paper. It is easy for governments to claim that certain policies in other economies act as trade barriers; the more difficult task is to provide evidence for these claims. We have taken an initial step toward this goal by matching up suspected policies with sectors for which we have evidence of NTB protection. As shown in Table 4, we find that, for agriculture and food products, overly restrictive phytosanitary and sanitary requirements, apparently unfounded import bans of certain products, and onerous labeling rules emerge as potentially damaging trade barriers and worthwhile targets of negotiations. Various experts for individual sectors are probably well aware of such barriers; this paper has provided potentially valuable information by putting numbers on the extent and effects of a wide range of barriers. This initial analysis could be improved in a number of ways. More recent price data are available, making it possible to derive updated protection data. Including more countries in the price comparisons would improve the accuracy of the barrier estimates and would provide a more complete picture of the potential gains from trade opening. The AGE analysis could be improved by accounting for technological change. Also, it would probably be worthwhile to add confidence intervals to the AGE estimates, something which is quite feasible. Page 35 of 39 I hope that this paper has provided useful initial insights on the extent of, the effects of, and the policies underlying food NTB protection in rich countries. I also hope that this paper will stimulate much-needed future research in this area. Page 36 of 39 REFERENCES J.E. Anderson and E. van Wincoop. 2002. “Borders, Trade and Welfare” in S.M. Collins and D. Rodrik, eds. Brookings Trade Forum 2001. Washington DC: Brookings Institution. S.C. Bradford. February 2003. "Paying the Price: Final Good Protection in OECD Countries." Review of Economics and Statistics. 85(1):24-37. S.C. Bradford and A. Gohin. 2006. “Modeling Distribution Services and Assessing Their Welfare Effects in a General Equilibrium Framework.” Review of Development Economics. 10(1):87-102. S.C. Bradford and R.Z. Lawrence. February 2004. Has Globalization Gone Far Enough? Washington, DC: Institute for International Economics. Eurostat-OECD PPP Programme. 1996. "The Calculation and Aggregation of Parities." Unpublished. J.A. Frankel. 1997. Regional Trading Blocs in the World Economic System. Washington DC, Institute for International Economics. A. Gohin. 1998. Modelisation du Complexe Agro-alimentaire Francais dans un Cadre D’equilibre General. PhD Dissertation, Universite de Paris I, Panthéon-Sorbonne. G.W. Harrison, T.F. Rutherford, and D. Tarr. December 1995. "Quantifying the Outcome of the Uruguay Round." Finance and Development. 32(4):38-41. G.W. Harrison, T.F. Rutherford, and D. Tarr. 1996. "Quantifying the Uruguay Round" in W. Martin and L.A. Winters, eds. The Uruguay Round and the Developing Countries. New York: Cambridge University Press. G.W. Harrison, T.F. Rutherford, and D. Tarr. September 1997. "Quantifying the Uruguay Round." Economic Journal. 107:1405-1430. G.C. Hufbauer et al. 2002. The Benefits of Price Convergence: Speculative Calculations. Washington, DC: Institute for International Economics. G.C. Hufbauer and K.A. Elliot. 1994. Measuring the Costs of Protection in the United States. Washington, DC: Institute for International Economics. M.M. Knetter and P.K. Goldberg. 1995. “Measuring the Intensity of Competition in Export Markets.” Cambridge, MA: National Bureau of Economic Research Working Paper. M.H.C. Komen and J.H.M. Peerlings. 1996. “WAGEM: an Applied General Equilibrium Model for Agricultural and Environmental Policy Analysis.” Wageningen Economic Papers: 1996-4, The Netherlands M. Obstfeld and K. Rogoff. 2000. “The Six Major Puzzles in International Macroeconomics: Is There A Common Cause?” NBER Macroeconomics Annual 2000. Cambridge, MA: NBER. Organization for Economic Cooperation and Development (OECD). 1995. Purchasing Power Parities and Real Expenditure. Paris: OECD. V. Roningen and A. Yeats. 1976. "Nontariff Distortions of International Trade: Some Preliminary Empirical Evidence." Weltwirtschaftliches Archiv. 112(4):613625. Page 37 of 39 D.J. Rousslang and T. To. 1993. "Domestic Trade and Transportation Costs as Barriers to International Trade." Canadian Journal of Economics. 26(1):208221. United Nations Conference on Trade and Development (UNCTAD). 1992. Analytical Report by the UNCTAD Secretariat to the Conference. New York: United Nations. World Bank. 1993. Purchasing Power of Currencies: Comparing National Incomes Using ICP Data. Washington, DC: World Bank. Page 38 of 39 FIGURE 1 NTB PROTECTION CALCULATION: SCHEMATIC EXAMPLE CONSUPRODMER Domestic UCER Export PRICE Margin PRICE Margin c p ( pij ) ( m ij ) ( pij ) ( em ij ) p = p ij COUNTRY A COUNTRY B $2.24 $2.70 60% 80% EXPORT PRICE ( pije ) pijc International LANDED Margin PRICE ( tm i ) ( p il ) pije = pijp (1 + emij ) 1 + mij 10% 50% $1.40 $1.50 $2.10 33% $2.31 10% $2.00 $2.20 e COUNTRY C Î $5.50 NTB Protection in C = 100% Minimum Export Price: piM e pil = piM (1 + tm i ) $2.75 p iCp 2.75 − tar ij = − tar ij = 1.25 − tar ij , ie, (25% - tariff rate), if the tariff rate is l 2.20 pi 25% or less. Otherwise, NTB protection is inferred to be zero. Note: i indexes products, and j indexes countries. Page 39 of 39