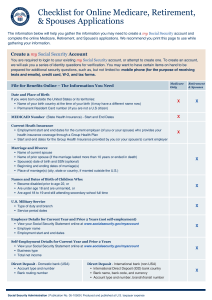

2014 Monthly Contributions for the University Benefits Programs State Health Plan

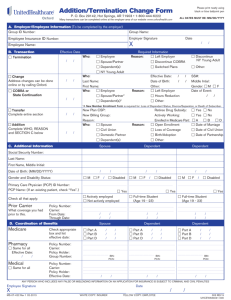

advertisement

2014 Monthly Contributions for the University Benefits Programs State Health Plan Employee Only Plan Traditional 70/30 Plan Employee + Children Employee + Spouse Employee + Family Critical Illness Insurance (MetLife) Age Employee Spouse $0 $205.12 $528.52 $562.94 Enhanced 80/20 Plan $63.56 $336.36 $692.10 $729.94 25-29 $1.64 $1.64 Consumer-Directed Health Plan $40.00 $224.60 $515.68 $546.64 30-34 $2.78 $2.78 35-39 $4.56 $4.56 If you are enrolled in the Enhanced 80/20 Plan or the Consumer-Directed Health Plan, you will have the opportunity to earn wellness premium credits each year, which will reduce your monthly premiums. 40-44 $7.70 $7.70 45-49 $13.00 $13.00 50-54 $20.04 $20.04 55-59 $30.34 $30.34 60-64 $45.46 $45.46 65-59 $68.28 $68.28 70-74 $99.64 $99.64 Less than 25 NCFlex Benefit Plans Plan Employee Only Employee + Spouse Employee + One Child Employee + Two or More Children Family Dental (United Concordia) High Option $37.40 $75.00 $71.96 $90.96 $132.42 Low Option $21.34 $43.04 $41.30 $52.62 $73.68 $0 N/A N/A N/A N/A Basic Plan (Exams and Materials) $5.76 N/A N/A N/A $15.98 Enhanced Plan (Enhanced Exams and Materials) $8.88 N/A N/A N/A $23.62 Vision (Superior Vision Plan) Core Wellness Plan $1.42 75-79 $157.68 $157.68 80-84 $197.64 $197.64 85 and older $213.62 $213.62 Employees may also cover eligible dependent children. Employee will pay one flat rate ($0.90) no matter how many children. Supplemental Retirement Plans Plan Contribution Limit Catch-Up Contribution* UNC 403(b) $17,500 $5,500 State 401(k) $17,500 $5,500 NC Deferred Comp $17,500 $5,500 * Catch-up contributions are available to participants who are age 50 by the end of the Plan Year. Cancer Insurance (American Heritage Life) Plan $1.42 Employee Only Employee + Family Low Option $6.78 $11.26 High Option $15.68 $26.06 Premium Option $21.64 $35.96 Income Protection Plans Mandatory Retirement Plan Contribution Rates Voluntary Group Term Life Insurance (ING) Teachers’ and State Employees’ Retirement System (TSERS) You can elect the following options: 1. Employee Only or Employee & Spouse*: Increments of $10,000. A minimum of $20,000 of coverage is available up to a maximum of $500,000 of coverage (spouse coverage cannot exceed 100% of employee’s elected amount). 2.Child(ren)*: $5,000 or $10,000. The following chart outlines the cost of coverage per $1,000 increments based on age. Your Age Under 24 25-29 30-34 35-39 40-44 45-49 50-54 55-59 60-64 65-59 70-74 75 and above Dependent Child(ren) Monthly Rates/$1,000 Coverage $0.048 $0.058 $0.078 $0.088 $0.12 $0.18 $0.28 $0.512 $0.764 $1.56 $2.28 $2.28 Per Dependent Unit $5,000 $0.68 $10,000 $1.36 9.14% Death Benefit Trust Fund 0.16% Retiree Health Plan Reserves 5.49% Disability Income Plan 0.41% Qualified Excess Benefit Arrangement 0.01% Total Employer Contribution Rate 15.21% Employee Contribution 6.00% TSERS – Law Enforcement Officers Pension Accumulation Fund 9.14% Death Benefit Trust Fund 0.16% Retiree Health Plan Reserves 5.49% Disability Income Plan 0.41% Qualified Excess Benefit Arrangement 0.01% State 401(k) Plan 5.00% Total Employer Contribution Rate Accidental Death & Dismemberment Insurance (AC Newman and Company) The amount of insurance you purchase is called the principal sum. Example benefit amounts include: $50,000 $75,000 $100,000 $125,000 $150,000 $175,000 $200,000 $250,000 $300,000 $350,000 $400,000 $500,000 Pension Accumulation Fund Employer Contribution (consists of the following): * Employee must be enrolled to cover spouse/child(ren) Principal Employer Contribution (consists of the following): Cost for Employee Only $0.96 $1.42 $1.90 $2.38 $2.86 $3.32 $3.80 $4.76 $5.70 $6.64 $7.60 $9.50 Cost for Employee/Family $1.50 $2.26 $3.00 $3.74 $4.50 $5.26 $6.00 $7.50 $9.00 $10.50 $12.00 $15.00 Employee Contribution 20.21% 6.00% UNC Optional Retirement Program (ORP) Employer Contribution (consists of the following): ORP Contribution Rate 6.84% Retiree Health Plan Reserves 5.49% Disability Income Plan 0.41% Total Employer Contribution Rate 12.74% Employee Contribution 6.00% The information contained in this document is not a contract and is subject to change by the proper authorities. It should be understood that explanations in this summary cannot alter, modify or otherwise change the controlling legal document or general statutes in any way, nor can any right accrue by reason of any inclusion or omission of any statement in this document. 7/2014