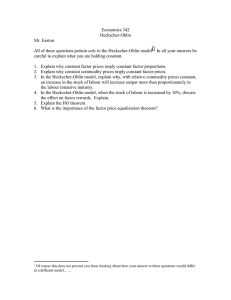

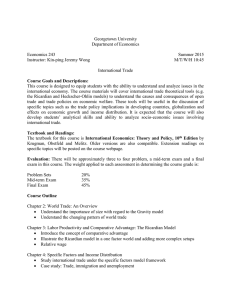

Lecture 4: The first wave of globalization, 1800 to 1914 AD 1

advertisement

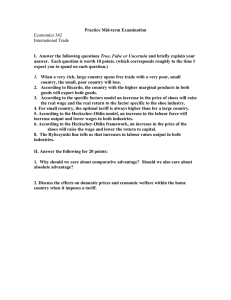

Lecture 4: The first wave of globalization, 1800 to 1914 AD 1 Emerging from shambles, European nations renew contacts with one another and the rest of the world from 1820. Thus, begins the “first wave of globalization”. What we will explore in this lecture is its course, causes, and consequences. But first, need to chart two developments which straddle the turn of the 19th century. Introduction 2 1.) The “French Wars” from 1793 to 1815: First truly global conflict. Powerful effects on the volume of trade, especially outside of Britain and after 1806. French exports & imports decline 45 & 60%; US exports & imports decline 90 & 95%; Background developments 3 Apart from these immediate effects, also need to think of long-run effects. Wars caused with collapse of the New World empires and, thus, colonial preferences. Second, wars proved the undoing of many of the chartered trading companies (VOC in 1806, likewise EIC in 1813). Background developments 4 Third, Napoleon made a number of internal reforms to the economies of his empire. Most importantly, prohibitions on the craft guilds and the dismantling of internal customs barriers. Thus, trade within Europe was promoted. Cumulatively, centuries-long restrictions on Background developments 5 Finally, the defeat of the French forces at Waterloo in 1815 ushered in a new era. The struggle for supremacy in Europe which had been waged for 500 years was over. British naval power gave rise to the Pax Britannica from 1815 to 1914. Background developments 6 2.) Also need to make note of simultaneous developments within Britain itself. Period from 1770 to 1820 gave rise to the British Industrial Revolution. Causes still debated, but a clear role for the “global economy” (slaves, cotton, and textiles). Background developments 7 First, there is the application of IR technology to other fields: above all, RRs (1820), telegraph (1834), and steamships (1838). Diffusion only from 1850, but final results clear. Maritime freight rates reduced by 50% (steam and Suez), overland rates reduced by 90%. Background developments 8 Circa 1900 Background developments 9 Second, perhaps even more important were the effects of the IR on prices and incomes. Technological improvement and implications for product prices…even without improvements in transport, this will affect relative prices of goods. Turning to demand, an (at least) unitary elasticity between income and imports. Background developments 10 Background developments 11 Background developments 12 So what else explains the rise in trade volumes from 1820? For most nations in 1820, commercial policy still set in mercantilist terms. Slowly changed with the substitution of (ad valorem) tariffs for import prohibitions. Causes of the global trade boom 13 Britain as an exception: after the French Wars, Britain reintroduced its Corn Laws. These were a set of sliding-scale, specific tariffs on wheat, rye, barley, and oats (i.e. Corn). But with the rise of industry in Britain, the Corn Laws came under attack. Causes of the global trade boom 14 1849, a radical change in commercial policy— unilateral and unreciprocated. Britain unilaterally liberalizes throughout the 1850s and encourages others to do so. Most significant development: signing of the Cobden Chevalier trade treaty of 1860. Causes of the global trade boom 15 Basic elements of modern day trade policy: reciprocity and most-favored-nation status. Reciprocity: concessions granted to countries are roughly equivalent in terms of trade flows or market access; but then, what’s the use? Most-favored-nation status: binds countries to automatically extend trading concessions Causes of the global trade boom 16 Institutionally, we see the rise of the Classical Gold Standard. In this system, countries fixed the gold content of their currencies→fixed exchange rates among countries on the gold standard. E.g. 0.14 Great British pounds/gram and 1.65 Dutch guilders/gram→11.79 NGL/GBP. Causes of the global trade boom 17 We also see the introduction of new commercial organizations and techniques: formal commodity & forex markets. Standardization of commodities/contracts dramatically reduced transaction costs. Finally, period saw the spread of European empires (formal and informal); China in 1839, Japan in 1853, India in 1858, Africa in 1890s. Causes of the global trade boom 18 Causes of the global trade boom 19 This expansion was accomplished with: 1.) application of IR technology to other spheres; 2.) improvements in medical “technology”; 3.) a European demographic surge. Bottomline: Europeans used new-found power to Causes of the global trade boom 20 What about other flows? From 1800 to 1850, negligible amounts of financial capital crossing national borders, but British take the lead starting in 1850. 1865−1913: British invest as much in Africa, Asia, and Latin America as in the UK itself. Trends in other flows 21 But what sets this period really apart from the present day is immigration. 1800−1913: >50 million people left Europe for the “European offshoots” In the same time, a vast number of people— perhaps 50 million—leave China and India. Trends in other flows 22 The end result was what some have called “The Great Specialization”. First truly global division of labor: periphery specializes in raw materials in exchange for manufactured products of the core. Trade increases not only in volume, but also in variety; implies big increase in welfare. Trends in other flows 23 What explains the form that the Great Specialization took? HO: differences in factor abundance across countries and differences in factor intensity across industries determine trade patterns. Also strong predictions for income distribution in presence of trade (but absence of other flows). The Heckscher-Ohlin model of trade 24 Key assumptions: 1.) Two countries (i=H,F), two homogenous tradeable consumption goods (j=1,2), and two homogenous non-tradeable factors of production (R,L) in fixed supply; (2x2x2). 2.) Endowments of factors of production are different in the two countries. The Heckscher-Ohlin model of trade 25 4.) CRS with diminishing marginal returns; Fj(2Rij,2Lij)=2Yij and d2F/dR2<0. 5.) Perfect competition. 6.) Factor intensity assumed to be different in two sectors. 7.) Identical tastes and preferences. The Heckscher-Ohlin model of trade 26 HO theorem states that each economy will export the good that uses relatively intensively its relatively abundant factor of production. Consider an example where agriculture is relatively land-intensive and the foreign country is relatively land-abundant. Thus, we expect the foreign country to export The Heckscher-Ohlin model of trade 27 Graphically… The Heckscher-Ohlin model of trade Graphically… The Heckscher-Ohlin model of trade Graphically… Agriculture With trade Manufactures The Heckscher-Ohlin model of trade 1.) Stolper-Samuelson Theorem: Increases in the relative price of a good will increase the real return to the factor used intensively in its production. At the same time, it will decrease the real return to the other factor of production. Implications of the Heckscher-Ohlin model 31 2.) Factor Price Equalization: Free trade will tend to equalize not only commodity prices but also the factor prices of L and R in both H and F. In the limit, all laborers will earn the same wage and all land-owners will earn the same rental Implications of the Heckscher-Ohlin model 32 Note that all these taken together imply very strong distributional effects for trade. Suppose Home from above opens up to trade; what are the predictions of the HO model? 1.) Home exports labor-intensive manufactures. 2.) Relative price of manufactures at Home will increase The Heckscher-Ohlin model of trade 33 A historical example: North America (NA) and the United Kingdom (UK) in 1870. Population in the UK: 31 million Population in NA: 44 million Land area of UK: 240,000 square km. Land area of NA: 18,200,000 square km. The Heckscher-Ohlin model of trade 34 HO: relative abundance matters instead. R/LUK=0.008 sq km per person R/LNA=0.414 sq km per person NA is relatively land abundant (by a factor of about 50!). The Heckscher-Ohlin model of trade 35 What about output? A very crude approximation: agriculture (relatively land-intensive) and (relatively labor-intensive) manufacturing. From 1870, radical improvements in institutions, policy, and technology … HO predicts the UK will export manufactured goods and NA will export agricultural goods. The Heckscher-Ohlin model of trade 36 And what about relative factor returns? In the UK, the formerly scarce factor (land) suffers while the formerly abundant factor (labor) benefits In NA, the formerly scarce factor (labor) suffers while the formerly abundant factor (land) benefits The Heckscher-Ohlin model of trade 37 Finally, what about inequality? In the UK, land holdings highly concentrated, implying inequality should have declined. In NA, the decline in w/r would seemingly increase inequality. The Heckscher-Ohlin model of trade 38 Period from 1820 to 1913 witnessed the birth of an uncontestable wave of globalization; culminated in the Great Specialization. But as much as these linkages deepened, the global economy was still susceptible to shocks. Anything which threatened domestic (political) or international (diplomatic) support could bring the whole thing to a grinding halt. Conclusions 39