WILLINGNESS TO PARTICIPATE IN AN INSURANCE SCHEME BY ARTISANAL FISHERS IN GHANA BY

advertisement

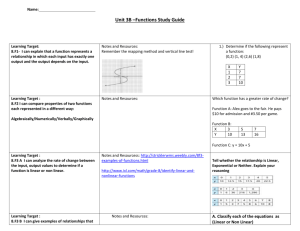

WILLINGNESS TO PARTICIPATE IN AN INSURANCE SCHEME BY ARTISANAL FISHERS IN GHANA BY Hayford G. Agbekpornu Doris A. Yeboah Samuel N.K. Quaatey Rosina Williams Richard Yeboah Fuseina Issah FISHERIES COMMISSION/MINISTRY OF FISHERIES AND AQUACULTURE DEVELOPMENT-GHANA IIFET CONFERENCE, 7-11 JULY, 2014 VENUE: BRISBANE-AUSTRALIA (QUT) 1/15/2015 1 Outline Introduction Methodology Results Conclusions Policy recommendations Introduction • Fisheries in Ghana contributes 1.4% of the GDP and 6.4% to Agric. GDP as at 2013 (GSS, 2014). • The Fisheries sector provides employment for 10% of the population through fishing enterprises, processing and ancillary businesses such as boat building, input trade etc. • Artisanal fisheries contributes 64% of the total catch valued at GH474,819,650.45 (2013) • 13,000 artisanal marine canoes (140,000 fishermen) and about 27,000 canoes (71,000 fishermen) for the Inland VESSELS IN THE CAPTURE FISHERIES Inland canoes Introduction cont’d • Capture fisheries in marine and inland areas involve risks. • These include : asset risks (loss or damage to fishing vessels, equipment, gears) and Human risk. • Insurance is an important tool in risk managing and fisheries management • Globally, fisheries insurance is available for Marine capture but not for Inland capture fisheries (FAO, 2009). • It is generally more difficult to obtain insurance for small scale vessels than larger ones (FAO, 2009). 1/15/2015 5 Introduction cont’d • Disasters hit the fisheries sector (e.g. tsunami in 2004 and 2006, annual hurricanes in the Caribbean, typhoons in Viet Nam and China in 2006), • Coverage of insurance is very low in Africa, South America, America and Asia (FAO, 2009) • Fatality rates- USA: 25-30 times the national average, Italy, 21 times, Australia, 143/100,000 compared with 8.1/100,000(FAO, 2000) • The number of global fatalities was estimated by the International Labour Organization in 1999 to be 24, 000 deaths worldwide/year (ILO, 2000) and heavily on dependents. • Ghana has had its fair share of the disaster (June, 2014-35 fishermen died) • How are these accidents handled? 1/15/2015 6 Methodology 1/15/2015 7 • Questionnaire: semi-structures questionnaires for canoe owners and crew (Slim Zekri et al., 2008) & focus group discussions, • Regional Directors of Fisheries helped in identifying the study areas, • Officers in the selected areas were trained to enumerate the questionnaires, • Questionnaires were pretested and reviewed, • 80% of the data collection was at the major landing sites/beaches, • Purposive (Chief fishermen), stratified (zones), random sampling, Willingness to participate. 1/15/2015 9 Sampled questionnaires Region Canoe Owners Crew Expected Actual Expected Actual Greater Accra 90 90 (100%) 30 30 (100%) Central 90 60 (67%) 30 30 (100%) Western 90 61 (68%) 30 30 (100%) Volta 90 89 (99%) 30 30 (100%) Lake 90 86 (96%) 60 50 (83%) Total 450 386 (86%) 180 170 (94%) 1/15/2015 10 Model specification Results 1/15/2015 12 Demographics Educational level Gender Freq % None 135 36.3 Freq % Primary 106 28.5 Male 364 94.3 JHS/Middle 100 26.9 Female 22 5.7 SHS 26 7.0 Total 386 100.0 Tertiary 5 1.3 Total 372 100.0 Residential status Freq % Indigene 285 73.8 Migrant 101 26.2 Total 386 100.0 1/15/2015 Marital status Freq % Married 362 95.5 Single 17 4.5 Total 379 100.0 13 Demographics Cont’d Other sources of income for fishermen (<31.0%) Sources of income of spouse (91.5%) Other sources (fishermen) Income source (Spouse) Animal rearing/fish farming Trading Fishing smoking Business Herbalist/Traditional healing Beautician Crop Farming Civil servants (Government worker) Artisans Hair dressing Trading Fish processing, mongering Driving/transport owner Farming Business Herbalist/ Traditional healing Attitude/Safety @ Sea Do canoes go in groups when fishing (Owners) Freq % Yes 74 20.0 No 296 80.0 Do crew inform their families before going fishing 1/15/2015 Freq % Yes 377 97.9 No 8 2.1 15 Attitude/Safety @ Sea Do you/crew listen to weather forecast before going fishing Freq % Yes 307 79.7 No 78 20.3 Do your crew wear lifejacket/lifebelt when fishing 1/15/2015 Freq % Yes 26 6.8 No 357 93.2 16 Attitude/Safety @ Sea cont’d Does your canoe carry a communication gadget (e.g. Mobile phone) to sea Freq % Yes 369 96.3 No 14 3.7 Does your canoe carry compass to sea when fishing 1/15/2015 Freq % Yes 26 6.8 No 357 93.2 17 Types of Asset Asset Freq % Car 6 1.6 House 225 58.3 Both 27 7.0 1/15/2015 18 Insurance If yes, which one (Multiple responses) Are you involved in an insurance scheme Existing Insurance Freq % National Health Insurance Scheme 32 8.3 Motor vehicle 29 7.6 Freq % Life insurance 8 2.1 Yes 70 18.7 Property 1 0.3 No 304 81.3 Net - - Total 374 100.00 Canoe 1 0.3 Outboard - - Others 3 0.8 1/15/2015 19 Willingness to participate in an insurance scheme 1/15/2015 20 Are you interested in taking up a Life/Accident Insurance Scheme for crew (group) Canoe Owners Freq % Yes 259 69.4 No 114 30.6 Total 373 100.0 Whether Crew were interested 1/15/2015 Freq % Yes 149 89.8 No 17 10.2 Total 166 100.0 21 Not interested in taking up a Life/Accident Insurance Scheme for crew (group) • Insurance companies are not reliable when it comes to payment of claims (delay in or no payment of sum assured) • Crew do not stay long with canoes or nets • Limited funds to insure 1/15/2015 22 Are you interested in taking up a personal Life Insurance Scheme Canoe Owners’ responses Freq % Yes 358 94.5 No 19 5.5 Total 377 100.0 Crew responses 1/15/2015 Freq % Yes 152 95.0 No 8 5.0 23 Not interested in taking up a personal Life/Accident Insurance Scheme • It is difficult to get claims from the insurers • They would not benefit if nothing happens to them • Limited funds to insure 1/15/2015 24 Are you interested in taking up a Life Insurance Scheme for your family (wife and children) Canoe owners Freq % Yes 276 76.7 No 84 23.3 Total 360 100.0 Crew response 1/15/2015 Freq % Yes 111 77.6 No 32 22.4 Total 143 100.0 25 Not interested in taking up family Insurance • Delay in payment of insurance claims • Have more than a wife and many children • Insure children and not wife • My family do not go fishing • My children are young • My children are old 1/15/2015 26 Responses of canoe owners Are you interested in taking up an insurance for your outboard motor Freq % Yes 283 79.1 No 75 Total 358 Are you interested in taking up an insurance for your fishing net Freq % Yes 302 82.3 20.9 No 65 17.7 100.0 Total 367 100.0 Are you interested in taking up an insurance for your canoe Canoe Owners Freq % Yes 325 88.8 No 41 11.2 Total 366 100.0 1/15/2015 28 Not interested in taking up insurance policy for fishing gears • Delay in claims • Accidents rarely occur • It is additional cost • Nets do not last long to be insured • Not interested • Canoes can be repaired 1/15/2015 29 Are you interested in taking up a pension scheme for yourself Canoe Owners Freq % Yes 314 84.0 No 60 16.0 Total 386 100.0 Crew 1/15/2015 Freq % Yes 148 93.7 No 10 6.3 Total 158 100.0 30 Not interested in taking up a pension scheme • Delay in claims • Fishermen do not retire • Children will take care of the aged • Not interested 1/15/2015 31 Risk and emergency managing strategy Freq. % Rank Boat mommies 93 24.7 1 Bank 82 21.8 2 Savings/self 82 21.8 3 Family 60 15.9 4 Money Lenders 46 12.2 5 Friends 39 10.3 6 Fish mongers/processors 22 5.8 7 Micro-fiance group 21 5.6 8 Credit union 6 1.3 9 1/15/2015 32 Disaster encountered during fishing for the last 5 years • Storm 129 • Excess rain 58 • Others – Collision – Damage of net – Damage of canoe – Loss of net – Loss of outboard motor – Loss of canoe – Burning of boat (electrical fault) 36 142 112 268 48 12 1 1/15/2015 33 Logistics result Socio-economic characteristics Canoe characteristics WTP Coef. Std. Err. Z P>z (Marg. Effect) Age Education family size Number of dependent Experience (Years of fishing) Residential status Involved in insurance 0.008 -0.336 -0.165 -0.116 -0.060 0.252 -1.783 0.022 0.420 0.063 0.041 0.022 0.422 0.575 0.35 -0.80 -2.60 -2.85 -2.70 0.60 -3.10 0.728 0.423 0.009*** 0.004*** 0.007*** 0.550 0.002*** 0.001 -0.065 -0.032 -0.023 -0.012 0.051 -0.400 0.90 0.33 -0.75 1.17 -1.57 0.02 -2.74 1.31 1.94 -1.53 0.58 0.367 0.741 0.453 0.453 0.116 0.984 0.006*** 0.191 0.053** 0.127 0.564 0.007 0.001 -0.001 0.008 -0.135 0.005 -0.230 0.178 0.215 -0.118 - Engine age Horse power Duration Number of crew Attitude Canoe group Inform family Weather Life jacket Assets Own a Car Own a House Constant Log likelihood = -101.56794 LR chi2(18) = 82.17 Pseudo R2 = 0.2880 0.037 0.041 0.006 0.019 -0.007 0.010 0.038 0.033 -0.642 0.409 0.026 1.273 -1.503 0.549 1.151 0.880 1.514 0.781 -0.629 0.412 0.869 1.507 Number of obs. = 222 Prob. > chi2 = 0.000 Conclusions • A few of the canoe owners are involved in various insurance schemes • Most of the canoe owners/crew are willing to participate in: – Group insurance of crew – Personal insurance – Family insurance – Gears insurance (Outboard motor, Net, Canoe) – Pension schemes • Most are willing to pay a premium 1/15/2015 35 Conclusions Cont’d • Most canoe owners depend on external sources as risk and emergency management strategy and are indebted to such sources. • Canoe owners have encountered some form of disaster on the water bodies (Sea & Lakes) since they started fishing. • Family size, number of dependents, fishing experience, involvement in insurance scheme, weather forecast, and ownership of car significantly influence Willingness-To-Pay. 1/15/2015 36 Policy Recommendations • There should be stakeholder consultation on the scheme. • There should be intensive awareness creation of life insurance schemes through the print, electronic media, workshops, conferences among others. • Insurance companies are to target the illiterate fishermen and their families in insurance awareness creation. • The telecommunication network should widen the coverage area of the use of their services on the sea. 1/15/2015 37 Policy Recommendations • There should be dialogue with the telecommunication industries to develop life/accident insurance package for the sector. • Insurance companies should undertake risk management. • Insurance scheme should be piloted before expanded to minimize errors in implementation, • Laws, policy and/or regulation should be put in place to protect the fishermen against unscrupulous insurance companies, • To protect the insurance industry, standards should be set for the insurance of the fishing gears, 1/15/2015 38 Thanks for your attention 1/15/2015 39