Brazilian experience on cost modeling project

advertisement

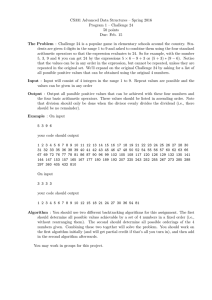

Brazilian experience on cost modeling project ITU/BDT Regional Seminar Mexico D.F. 19-22 March 2013 March 20th, 2013 Copyright 2012, Todos os direitos reservados. Nenhuma parte deste documento pode ser reproduzida, independente do meio, sem permissão escrita dos detentores de seus direitos autorais. 0 AGENDA 1 Introduction 2 Cost modeling project – top down models 3 Cost modeling project – bottom up model 4 Main lessons learned 1 MAIN MOTIVATIONS FOR THE COST MODELING PROJECT What is a cost model? What is the use of it? What are the impacts of the cost model in the telecom sector? Source: Advisia • Economic regulation • Competition • Settlement of disputes • Frequencies’ bids • Continuity • Universalization • Regulatory framework review 2 BACKGROUND AND MAIN MILESTONES 1990 Source: Advisia 2000 2010 1995: Constitutional amendment 2003: New PGMU 1997: LGT - Lei Geral de Telecomunicações 2003: Telecom Public Policy (Regulation 4733/2003) 1998: Privatization 2005: RSAC (Accounting Separation) 1998: PGMU – Universal Services 2008: PGR – Plano Geral de Atualização da Regulamentação 2011: Cost modeling project 3 DEVELOPMENT OF TELECOMUNICATIONS IN BRAZIL Fixed lines Mobile lines (Million) (Million) 203 245 40 42 43 31 10 86 13 23 0 1990 1995 1990 1995 2000 2005 2010 2012 Penetration (# fixed lines/ 100 households) 29 34 68 75 73 74 1 Penetration (# mobile lines/ 100 inhabitants) 0 01 2000 2005 14 47 2010 2012 106 125 Brazilian telecom regulation fomented a strong increase in number of lines and penetration – cost modeling should improve market conditions and enhance competition Source: Advisia, Anatel, Teleco 4 CONCEPTUAL COST MODELING METHODOLOGIES Bottom-up Top-down Methodology Methodology Accounting data Unit costs Allocation Operating costs / Capex Network elements Allocation Unit costs Efficient operator modeling Main types of models Main types of models • FAC(1) HCA(2) • FAC CCA(3) • LRIC(4) • LRIC(4) • FAC(1) (1) Fully allocated cost (2) Historical cost accounting (3) Current cost accounting (4) Long run incremental cost Source: Advisia 5 PROJECT SCOPE – PHASES Elements Contracting structure • All work fronts: ‒ Top-Down FAC-HCA ‒ Top-Down FAC-CCA ‒ Top-Down LRIC ‒ Bottom-Up ‒ Methodology Granted: ‒ STFC (fixed) operators ‒ SMP (mobile) operators ‒ Operators with Significant ‒ Market Power in Leased Lines Planning Phase II Operators´ data Phase III FAC-HCA Top-down • Preparation Phase I Phase IV FAC-CCA IT solution – Activity based costing management Phase V LRIC Phase VI • Activity-based-costing system ( MyABCM). Bottom-up Phase VII Tariffs 6 PROJECT SCOPE – ECONOMIC GROUPS WITH SIGNIFICANT MARKET POWER GROUPS COMPOSITION (Resolução nº 101) 1 Telefônica (STFC); Vivo (SMP); Emergia (SCM), DTHi (DTH) … 2 Telemar Norte Leste (STFC); TNL PCS (SMP); Brasil Telecom (STFC); 14 BrT Celular (SMP); BrT Com Multimídia (SCM), Vant (SCM)... 3 Embratel (STFC); Claro (SMP); Vésper (STFC); 4 CTBC Telecom (STFC); CTBC Multimídia (SCM); Engeredes… 5 Sercomtel (STFC); Sercomtel Celular (SMP) ... 6 TIM Nordeste (SMP); TIM Celular (SMP), TIM (STFC)… 7 AGENDA 1 Introduction 2 Cost modeling project – top down models 3 Cost modeling project – bottom up model 4 Main lessons learned 8 INTERNATIONAL CONSORTIUM PROFILE Consortium Management consulting Contracting partners • Advisia is a strategy consulting firm focused on supporting leading companies in identifying opportunities and solving complex problems • 500 professionals in 14 offices with the OC&C partnership Source: Advisia International specialists • Analysys Mason is a consulting firm specialized in telecom, technology and media • With nearly 250 professionals in 11 offices, has supported several clients including national regulatory agencies in 100+ countries for 25 years Independent accountants IT specialists • Grant Thornton offers an extensive range of services including audit, tax, labor and corporate consulting, corporate finance and outsourcing to private and public companies headquartered in Brazil and worldwide • ETEG develops customer demanded systems in several sectors • Throughout 11 years of operation, has become a reference in software development, and is one of the fastest growing SMEs according to Exame 9 PROJECT PHASES AND MAIN PRODUCTS Main products II Operators´data processing and validation III FAC-HCA Top-down modeling P-II.1 P-II.2 P-II.3 P-II.4 P-III.1 P-III.2 P-III.3 IV FAC-CCA Top-down modeling I Planning P-IV.1 P-IV.2 P-IV.3 V LRIC Top-down modeling P-I.1 VII P-V.1 P-V.2 P-V.3 Tariffs VI Bottom up modeling P-VI.1 Source: Advisia P-VI.2 P-VI.3 P-VI.4 P-VII.1 P-VII.2 P-VI.5 P-VI.6 P-VI.7 P-VI.8 10 CONCEPTUAL COMPARATIVE VIEW AMONG FAC-HCA, FAC-CCA AND LRIC Characteristics FAC-HCA FAC-CCA LRIC Fully Allocated Costs Historical Cost Accounting Fully Allocated Costs Current Cost Accounting Long Run Incremental Costs • Accounting costs allocated to products • Based on historical costs • Transforms historical • Considers long run costs into current costs incremental costs allocated to products • May consider eliminating inefficiencies and replacing obsolete technologies • Tries to reflect economies of scale and scope - array of costvolume relationship Time horizon Past (backward looking) Present Future (forward looking) Assets evaluation Historical book value Current value Current / future replacement value Network equip. / Topology Existing Existing and modern equivalent New and modern equivalent Efficiency adjustments Not Possible Yes Source: RTR, ITU, Advisia The 3 models are hierarchical, complementary and evolutionary 11 TOTAL COST CALCULATION INCORPORATES OPERATIONAL EXPENSES AND COST OF CAPITAL Market weighted average Operational expenses 68% Cost of capital + Capital employed 91% 96% Operational cost 20% Cost of capital 17% 32% x WACC Total cost 80% 9% 4% Min 13% Max Mobile operators Min Max Fixed operators FAC-HCA total cost calculation considers, in addition to operational costs, also the capital employed for the telecommunication business Source: Advisia 12 ILUSTRATIVE OVERVIEW OF ABC-COSTING METHODOLOGY Activities – Cost centers Resources (Anatel standard) Drivers Income Cost objects Drivers Primary plant (groups of elements) Costs Support plant Assets Support functions Network elements Products Liabilities Source: Advisia Common costs 13 TOP-DOWN FAC-HCA MAIN ALLOCATION STEPS Operational income Operational costs Employed capital Step 1 Primary Plant Support Plant Support Functions Step 2 Primary Plant Support Plant Common Costs Step 3 Primary Plant Step 4 Network elements Step 5 Network elements Step 6 Products Step 7 Source: Resolution 396, Advisia 14 MAIN RSAC TABLES COVER ALL SEVEN COST ALLOCATION STEPS A Operational income Operational costs Initial resources table Employed capital B Step 1 C Cost centers tables Primary Plant Drivers table Support Plant Support Functions Step 2 Primary Plant Support Plant Common Costs Step 3 Primary Plant Step 4 Network elements Network elements table D Step 5 Network elements Step 6 Products list Products E Source: Resolution 396/2005 Anatel, Advisia Step 7 15 THE FIVE MAIN TABLES FROM RSAC INCORPORATES OVER A THOUSAND ITENS Descrição Number of items Variation among operators • Standard chart of accounts for assets, liabilities, income and expenses, to be used as a starting point for allocations • Aprox. 1000 • Low • Table with drivers recommended to be used at each stage of allocation • Aprox. 100 • High • Structure of the items that compounds the intermediate allocations cost centers: Primary plant, support plant and support functions • Aprox. 100 • Medium Network elements • Table with the main elements that compounds the network (fixed or mobile), from which the costs are allocated to products in stage 6 • Aprox. 100 • Low • Aprox. 300 • High Products • List of products, divided by business area, for which costs are calculated A PGSAC B Table of drivers C Cost centers D E Source: Advisia 16 MAIN IMPLEMENTATION CHALLENGES: FAC-HCA Outcome Approach Main Challenges Assessment of models from previous years Variation in the levels of detail between operators • Separation of analysis in comparable modules and groups between operators • Ex: Network elem. – Switching, Transmition and Access • Profound analysis, with identification of attention points by module / group Source: Advisia Review of the methodology and main RSAC tables Development of standard models Standardization of RSAC tables Complementary data gathering from operators • Search for alignment with guiding principles from RSAC and regulatory demands from agency • Collaborative approach, open for contributions about the process and proposed revisions • Achievement of tables attending either the reality of the operators and the necessities of the agency • Good quality level in the delivery of information and essential contributions for the revision of RSAC 17 STANDARD CCA MODEL LEVERAGES THE SAME DEFINITIONS OF THE STANDARD HCA MODEL PGSAC HCA Output of CCA model PGSAC CCA Assets Liabilities Updated assets Assets CCA Model HCA standard model Costs Gross value + accumulated depretiation Updated costs Operators´data Updated costs Source: Advisia CCA results per product Income CCA value of permanent assets Costs Liabilities Income 18 MAIN CCA CHANGES REFER TO ASSETS AND COSTS BASE • HCA Permanent Assets Base HCA Cost Base Price updates • Idleness exclusion • Operational costs impacts • Annual depreciation adjustments CCA Permanent Assets Base CCA Cost Base HCA changes to CCA base is basically updating the historical values for current prices, in order to get closer to the actual cost of an entrant, keeping the existing structure Source: Advisia 19 MAIN IMPLEMENTATION CHALLENGES: FAC-CCA Development of standard models Standardization of files and detailing of the assumptions Adaptation to the changes in regard to the FAC-HCA Utilization of different technical criteria for asset classification and valuation • Discussion with technical specialists and identification of common classification practices and trends in other countries • Translation of the RSAC into applicable equations in an integrated model • Constant alignment between the project phases and communication to operators • Classification standards identification and trend forecasts for discussion • Proposition of a detailed and standardized delivery model, reducing the complexity for the next years • Possibility of utilization of the same structure of the HCA models, with little adjustments Outcome Main Challenges Review of the RSAC methodology and main elements Approach Comparable models analysis The FAC-CCA challenges are mainly due to criteria standardization, definitions and formats Source: Advisia 20 LRIC FIRST STEP IS COST AND ASSETS GROUPS DEFINITION ACCORDING TO COMMON DRIVERS CCA assets and costs bases Group 1 Driver a Group 2 Driver b Group 3 Driver c (...) (...) Group n Driver x Cost-Volume curves (CVRs) Cost and assets grouping with the same allocation cost drivers (lower complexity compared to FAC) LRIC cost allocation methodology is distinct from HCA and CCA FAC, using own drivers and specific relationships of cost-volume Source: Advisia 21 THE SECOND STEP IS THE BUILD UP OF CRV (COST-VOLUME RELATIONSHIPS) CURVES CVRs examples Cost-volume relationship Cost/asset groups Asset cost (CVR – Cost Volume Relationship) Marginal increment Product increment Drivers Equipment installation in clients X Number of installation services Commutation X Number of terminals Public phone X Inhabitants Support structures X Number of antennas DSLAM X Number of access Driver volume CVRs are built up using statistical methods, field research or simulations, and identify the cost specific impact of a product increment increase Source: Advisia 22 DIFFERENCES IN GRANULARITY AND CRV AMONG OPERATORS PRESENT AN ADDITIONAL CHALLENGE FOR THE STANDARD MODEL DEFINITION Number of CVRs per operator Number of CVRs hierarchy • Great variability in the implementation of the LRIC models among operators 94 7 • Number of CVRs and hierarchy levels indicate granularity dispersion among models • This great variability difficults direct comparison among LRIC results – need of standardization 1 9 Min Source: Advisia Max Min Max 23 MAIN IMPLEMENTATION CHALLENGES: LRIC Proposed approach Main Challenges Comparable models analysis Review of the RSAC methodology and main elements Development of standard models • Comparison of results of curves and increments • Need of additional information to the RSAC • Clear definition of product increment • Analysis of comparable CVRs • Alignment with CCA standard model • Proposition of future evolutionary standardization • Grouping of similar curves and products among operators • Request in advance of data request for the operators • Arrangement of discussions and meetings with operators to discuss best practices • Understanding of CVR curves development criteria • Continuity of discussions with operators with regard to CCA standard model • Discussions with operators for criteria and definitions alignment The challenges expected for LRIC implementation are related to the comparability of results created by different CVRs Source: Advisia 24 AGENDA 1 Introduction 2 Cost modeling project – top down models 3 Cost modeling project – bottom up model 4 Main lessons learned 25 BOTTOM-UP MODEL FLOW Inputs Calculation Outputs 1 Demand forecast 2 Network design 3 Service costing Service list – market data Network assumptions Unit costs Depreciation methodology Routing factors and mark-up Final calculation Service demand Network assets dimensioning Network cost Annualized costs LRIC/LRIC+ per service Unit cost per service • Demand for each service, divided geographically (sector – Fixed; SMC – Mobile) • Traffic dimensioning per asset (per sector – Fixed; per SMC – Mobile) • Calculation of capital cost per asset per region • Annualized total capital cost per asset per region • LRIC per unit of traffic of each service, per region • Final unit cost of TU-RL, TURIU1, TU-RIU2, VU-M e EILD • Annualized total operating costs per asset per region • LRIC+ per unit of traffic of each service, per region • Final dimensioning of network assets Source: Advisia • Calculation of total operating costs per asset per region 26 STRUCTURE OF THE DEMAND FORECAST MODEL Module 1 Macro economic forecast • Total population forecast • • • • Module 2 Access forecast • Forecast of the number of access of several services: GDP forecast − Mobile access Number of − M2M households forecast − Active fixed access Number of companies − Broad band access forecast − Access of IPTV Population by income − EILD ranges forecast Module 3 Services forecast • Forecast of the total amount of services for the Brazilian market • List of services: − VC1 on-net/Off-net − Data traffic 2G − SMS on-net/off-net − Others Module 4 Calculation by SMC area/ by PGO sector • Calculation of demand forecast to input in the bottom-up model: − By SMC area − By PGO sector This structure to demand projection follows the international best practices and is adapted and adequate to the specific context of the Brazilian market Source: Advisia 27 EXAMPLE OF FORECAST TECHNIQUE – OVERVIEW OF THE DIFFUSION TECHNIQUE Adoption Variable Innovators • Adopt innovation because of the product’s intrinsic attractiveness Imitators Time • Adopt innovation because of social influence (communication, network effect, etc.) Diffusion model Accumulated Adoption Variable Diffusion Curves Examples of Models: Fisher-Pry: 𝑦 = 1 [1+𝑒 −𝑏 𝑡−𝑎 ] Gompertz: 𝑦 = 𝑒 −𝑒 Bass: 𝑦 = Time −𝑏 𝑡−𝑎 1 − 𝑒 − 𝑝+𝑞 𝑡 𝑞 1 + 𝑝 (𝑒 − 𝑝+𝑞 𝑡 ) Diffusion is the process of penetration of new products, that is determined by intrinsic factors and social influences – diffusion modeling is applied in several fields such as product development and epidemics propagation Source: Advisia 28 THE MODELING WAS DEVELOPED CONSIDERING THE COMPLEXITY OF THE BRAZILIAN MARKET... Mobile Demand of Mobile Services by SMC area Network design by SMC area Aggregation and design of the network at national level Differentiated expenditures by region Services costing at regional level Aggregation and design of the network at national level Differentiated expenditures by region Services costing at regional level Asset aggregation Differentiated expenditures by region Services costing at regional level Fixed Core Network design by PGO sector Demand of Fixed Services by PGO sector Fixed Access Network design by PGO sector Demand Forecasts Network Geographic Design Design of others aspects of network and expenditures at regional level Services costing at regional level 29 … RESULTING IN A DETAILED STRUCTURE Obligations for Operator 1 Obligations for Operator 2 Selected Operator Hypothetical entry data Obligations for Operator 3 Obligations for Operator 4 Selected Obligations Regulatory obligation of each operator All remaining inputs (hypothetical and specific of each operator) Selected entry data SMC 1 SMC 2 SMC 3 SMC4 SMC 5 SMC 6 SMC 7 SMC 8 SMC 9 SMC 10 Calculation of the Network design National Backbone Expenditures Calculation of costs Services Costing (Region I) Services Costing (Region II) Services Costing (Region III) 30 THE NETWORK ALGORITHMS ALLOW FOR THE CALCULATION OF ASSOCIATED COST OF THE MOBILE NETWORK PS Internet POI CK CK Servers, NMS, revenue TRX TRX TRX NodeB GGSN TSC/ MSC-s TRX TRX TRX Hub BTS MSC/ MGW SGSN TRX TRX TRX Hub BSC RNC Hub BTS CK CK CK CK TRX TRX TRX The number of assets implemented is determined by the coverage and by the traffic and number of subscribers TRX TRX TRX BTS TRX TRX TRX NodeB BTS 31 CONCEPTUAL PHASE VII DISCUSSES THE RECONCILIATION OF TOP-DOWN AND BOTTOM-UP MODELS Based on available accounting data Theoretical efficient enterprise Regulatory Challenge Bottomup Model Source: RTR, ITU, IRG 2005, Advisia Top-dow Model Possible adjustments: • Top-down: - Exclusion of irrelevant costs - Inclusion of efficiency adjustments • Bottom-up: - Opex adjustments based on accounting data - Inclusion of scorched node assumptions Range 32 SCHEDULE AND NEXT STEPS OVERVIEW x 100% II Now Operators´data processing and validation 100% I Planning x% % concluded 95% III FAC-HCA Nov/11 – Aug/12 • Validate and consolidate operators’ information (DSAC) − Mobile operators − Fixed operators • Integrate DSAC information on ABC/ABM aplication • Develop training Project phase Aug/12 – Mar/13 95% IV FAC-CCA Aug/12 – Msr13 5% V Sep/11 • Detail activities • Define responsible • Develop VI detailed schedule • • • • Source: Advisia LRIC 0% VII 90% Bottom up modeling Dez/11 – Abr/13 Forecast services demand and define technology for models Design and size models Define costs of efficient operators Train the team Feb/13 – Jun/13 Tariffs Jul-Set/13 • Develop methodology for tariffs’ definition 33 AGENDA 1 Introduction 2 Cost modeling project – top down models 3 Cost modeling project – bottom up model 4 Main lessons learned 34 SUMMARY– MAIN OPERATIONAL CHALLENGES OF THE PROJECT Main Challenges Profile differences among operators Data and Info gathering within required deadlines Telecom sector evolutionary dynamics Source: Advisia Detailing Project Approach • Distinct realities among operators – field , product portfolio scope, business strategy, etc. • Constant dialogue with operators – via public consultation of documents, conjoin and bilateral meetings • How to reflect these differences in a standard model? • Composition of a team with significant experience in the industry • Difficulty by operators to gather data within required deadlines • Constant dialogue with operators – Adjustments in the model or consideration of alternative parameters • How to consider parameters that some operators are not able to provide within the project’s deadline? • Sector characterized by rapid evolution in technology and development of new products • How the cost model will reflect this technological evolution / products? • Utilization of several sources of information: Operators data, Anatel data, international benchmarks, consortium experiences • Development of the project with a dedicated team from Anatel • Continuous formal training of Anatel throughout the project – training to conduct adjustments and evolution of the model, after the finalization of the project 35 IMPORTANCE OF INTERFACE WITH OPERATORS International Best Practices Brazilian market context Source: Advisia • Participation of telecom sector through: ‒ Obtainment of information and data ‒ Multilateral meetings ‒ Bilateral meeting to clarify ‒ Society Consultation ‒ Delphi questionnaire ‒ Conceptual Paper • Confidentiality assurance of data and process transparency (tradeoff); • Adequacy to operators’ reality 36 MAIN CHALLENGES OF THE PROJECT AND CONTINUITY Main challenges Management of several stakeholders Interaction with telecommunication sector and society Continuity and applicability Source: Advisia Project approach • • • • Structuring of a dedicated team at Anatel Support to other areas of Anatel Support to ITU Operating model with the consortium: In presence meetings, conference calls, video conference • Participation of agents from telecommunication sector • • • • Bilateral meetings: in presence, conference calls, video conference Multilateral meetings Consultation to operators: Data, information and clarifications Consultation to society: including Public Consultation and questionnaires to sector’s specialist (Agency, Operators, Governmental bodies, associations, suppliers, academic institutions, research centers). • • • • Training of Anatel team during project execution Continuous follow-up and meeting with the Consortium Anatel’s internal structuring for applicability of the cost models Review and update of the models after project finalization (Area/Structured team) 37 CONTACT DETAILS Thanks! Questions? Contacts: Daniel Wada Phone: daniel.wada@advisia.com +55-11-96843-1663 38