How Have Land-use Regulations Affected Property Values in Oregon? Special Report 1077

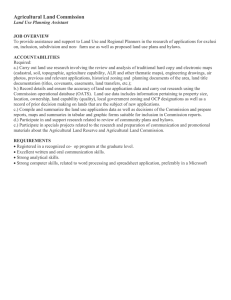

advertisement