Document 13862176

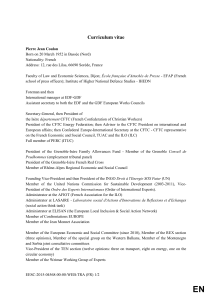

advertisement