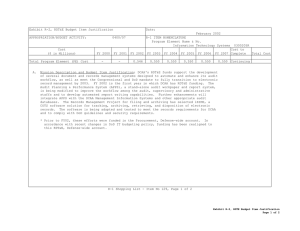

COST PRICING &

advertisement

American Conference Institute’s 4th Advanced Forum on GOVERNMENT CONTRACT COST & PRICING Strengthening Pre- and Post-Award Compliance Practices to Minimize the Risks of Disallowed Costs, Withholdings and False Claims April 17–18, 2013 | Hilton Crystal City, Arlington, VA GOVERNMENT KEYNOTE SPEAKERS The Latest on Policy Plans & Priorities: First-Hand Insights on the Incurred Cost Audit Backlog, and the DCAA-DCMA Relationship: Shay Assad Director, Defense Pricing Defense Procurement and Acquisition Policy U.S. Department of Defense Hear DCAA's Perspective on Executive Compensation: Patrick J. Higgins Supervisory Auditor Mid-Atlantic Region – Compensation Team (RST-6) Defense Contract Audit Agency John J. Bentz, Jr. Program Manager Policy Programs Division DCAA Policy and Plans Benchmark and Network with Senior Industry Experts: BAE URS Oshkosh Serco Alion Science & Technology United Launch Alliance Orbital Northrop Grumman Rolls Royce North America Balfour Beatty Construction John Shire Deputy Assistant Director DCAA Policy & Plans Directorate Ronald J. Youngs Director, Cost and Pricing Center, Defense Contract Management Agency DCMA Speaks on Forward Pricing Rate Proposal Expectations: Steve Trautwein Deputy Director, Cost and Pricing Center, Defense Contract Management Agency A stellar faculty of government and industry decision-makers will discuss how to resolve the most pressing, complex cost or pricing compliance challenges threatening your bottom line, including: • How to prepare for executive compensation reviews in the wake of the J.F. Taylor and Metron decisions: DCAA’s current statistical methodology • Defining “Materiality” and “Significant Deficiency”: Key qualitative and quantitative factors • Recordkeeping and Imaging: Revisiting your policies and procedures in response to the DCAA backlog • How to refine your incurred cost audit and rate negotiation strategy: Meeting increased sampling, submission and supporting documentation requirements • Assessing subcontractor compliance at the pre- and post-award stages: The scope of prime and sub responsibilities for ensuring adequacy and price reasonableness NEW FOR 2013! ENHANCED FOCUS ON STATUTE OF LIMITATIONS, INTERNAL AUDIT REPORTS AND FALSE CLAIMS: • Statute of limitations under the Contract Disputes Act: When the clock starts and stops running for DCAA audits and disallowed costs KBR • The latest on DCAA access rights to your internal audit reports and workpapers: Status of contractors’ rights and obligations ManTech International • When your estimates and contract bids can become “false claims”: Minimizing new prosecution, penalty, suspension and debarment risks Register Now • 888-224-2480 • AmericanConference.com/costpricing Earn CLE/CPE Credits BENEFIT FROM BEST PRACTICES FOR REDUCING THE RISKS OF DISALLOWED COSTS, WITHHOLDINGS AND FALSE CLAIMS. ATTEND WHAT IS REGARDED AS THE PREMIERE COST & PRICING COMPLIANCE AND BENCHMARKING FORUM OF THE YEAR. F ollowing extensive research with industry stakeholders and outside advisors, American Conference Institute has, once again, assembled a sophisticated program and multi-dimensional speaker faculty, who will discuss the most complex, pressing cost or pricing compliance issues affecting your business. Each year, industry and private practice professionals attend this event to hear the latest, cutting edge strategies for meeting heightened DCAA and DCMA compliance expectations. Past attendees have found this event to be highly practical and worthwhile. Here is what attendees from the April 2012 event had to say: “Great conference! Topics were all applicable to current issues we’re experiencing in our company right now.” – L-3 Communications “Very good topics/presentation and even some laughs.” – Pratt & Whitney “Overall experience was positive. Good to hear from people engaged in the same activities as myself.” – Harris Corporation In addition to CLE and CPE, the 2012 program will feature a new government, industry and private practice speaker faculty, as well as enhanced networking and Q & A sessions. 2013 keynote speakers: - John Shire, Director, DCAA Policy & Plans Directorate - Ronald J. Youngs, Director, Cost and Pricing Center, DCMA - Shay Assad, Director, Defense Pricing, Defense Procurement and Acquisition Policy - Steve Trautwein, Deputy Director, Cost and Pricing Center, DCMA - Patrick J. Higgins, Supervisory Auditor, Mid-Atlantic Region – Compensation Team (RST-6), DCAA - John J. Bentz, Jr., Program Manager, Policy Programs Division (PPD), DCAA Policy and Plans Fully Updated 2013 Industry Speaker Line-up-Benchmark and Network with: - Kelly G. Peters, Director, Government and Corporate Compliance, BAE Systems Land and Armaments, GTS - Richard Martinez, Vice President, Government Compliance, Serco - Christine Flanagan, Director, URS Corporation - Carol Kastrinos, Senior Director, Financial Compliance and Pricing, Oshkosh - Amy Hernandez, Government Compliance Director, Balfour Beatty Construction - David J. Roll, Vice President – Industry Compliance, ManTech International - John Russell, Assistant General Counsel, Northrop Grumman - Scott Parr, Vice President, Director of Government Accounting, Alion Science & Technology - Kent Sharp, Purchasing Compliance Officer, Rolls-Royce North America - Neil Gardner, Vice President, Ethics & Compliance, Orbital Sciences Corporation - Charlie Kerr, Senior Manager, Government Compliance, KBR, North American Government & Logistics - John Brannock, Director of Government Finance and Risk Management, United Launch Alliance Seats at this highly anticipated event always fill up. Register now by calling 1-888-224-2480, by faxing your registration form to 1-877-927-1563, or by registering online at www.AmericanConference.com/costpricing. CONTINUING LEGAL EDUCATION CREDITS Accreditation will be sought in those jurisdictions requested by CLE the registrants which have continuing education requirements. Credits This course is identified as nontransitional for the purposes of CLE accreditation. American Conference Institute(ACI) will apply for Continuing Professional Education credits for all conference attendees who request credit. There are no pre-requisites and advance preparation is not required to attend this conference. ACI certifies that the activity has been approved for CLE credit by the New York State Continuing Legal Education Board in the amount of 14.5 hours. An additional 4.0 credit hours will apply to Workshop A/B participation. Course objective: Update on Government Contract Cost & Pricing compliance and audit best practices. Recommended CPE Credit: 14.5 hours, an additional 4.0 hours for Workshop A/B participation. ACI certifies that this activity has been approved for CLE credit by the State Bar of California in the amount of 12.0 hours. An additional 3.5 credit hours will apply to Workshop A/B participation. You are required to bring your state bar number to complete the appropriate state forms during the conference. CLE credits are processed in 4-8 weeks after a conference is held. ACI has a dedicated team which processes requests for state approval. Please note that event accreditation varies by state and ACI will make every effort to process your request. ACI is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth Avenue North, Suite 700, Nashville, TN, 37219-2417 or by visiting the web site: www.nasba.org To request credit, please check the appropriate box on the Registration form. Questions about CLE credits for your state? Visit our online CLE Help Center at www.americanconference.com/CLE Register now: 888-224-2480 • Fax: 877-927-1563 • AmericanConference.com/costpricing “Valuable experience, especially the first-hand experience related from industry leadership” – iRobot Corporation PRE-CONFERENCE BENCHMARKING GROUPS – TUESDAY, APRIL 16, 2013 9:00 a.m. – 12:30 p.m. A 1:30 p.m. – 5:00 p.m. A Complete Guide to Preparing Adequate Incurred Cost Submissions: How to Meet DCAA and DCMA Standards for Reasonableness, Allowability, and Allocability Scott Parr Vice President, Director of Government Accounting Alion Science & Technology (McLean, VA) Former Branch Manager/Regional Audit Manager, DCAA Sajeev Malaveetil Director, Government Contracts Practice Berkeley Research Group LLC (Washington, DC) This comprehensive working group will take you through the ins and outs of meeting DCAA requirements for incurred cost submissions. Through a careful review of sample submissions, the expert speakers will take a deep dive into the do’s and don’ts, and lessons learned from past mistakes. Don’t miss a worthwhile opportunity to hear directly from key experts on the standards for reasonableness, allowability, and allocability, and how to apply them to your work. In addition to enhanced networking, benefit from intensive learning and benchmarking with speakers and participants, and take away best practices that will add value to your organization. The expert speakers will also provide helpful reference materials that you can use for your daily work after the event. Topics will include: • Requirements for filing an incurred cost submission • DCAA and DCMA audit priorities under Chapter 6 of the DCAM • Classifying your incurred cost proposals as High or Low Risk • What is Incurred Cost Electronically (ICE) model, and how are contractors complying with its strict requirements • Preparing Schedule H, I, J, K • Ensuring adequate documentation to support your costs • Concentrating on DPAP/DCAA identified high risk incurred cost proposals for major contractors, including overseas contingency operations • Scope of documentation required to support incurred costs • Determining allocability • Preparing a cumulative allowable cost spreadsheet • What systems you need to have in place • The required level of sampling to render an opinion, and the most effective sampling techniques • Practical impact of the FAR contract closeout rule on annual incurred cost proposals WHO ATTENDS EACH YEAR Vice Presidents, Managers and Directors of: - Government Accounting - Finance - Contracts & Pricing - Government Contracts - Federal Government Procurement - Government Compliance/Relations - Acquisition Policy - Industrial Compliance Corporate Legal Professionals - VPs, Legal Affairs/Operations - Government Contracts Counsel - Litigation and Compliance Counsel Attorneys and Consultants specializing in: - Government Contracting Compliance and Litigation - Cost Accounting and Cost Allowability - False Claims Act and Procurement Fraud - GSA Contracts - Suspension and Debarment - Bid Protests B CASE STUDY – An Inside Look at a Business Systems Audit: How Audits Have Changed Under the New Rule, How to Prepare and Manage the Process from Start to Finish Robin Schulze Director Baker Tilly Virchow Krause LLP Baker Tilly Beers & Cutler, PLLC (Tysons Corner, VA) Former Director, Contracts Policy Division, DCMA John Kreideweis Partner KL Contract Consulting (Plano, TX) Richard Fields Vice President, Government Compliance Accenture Federal Services (Haymarket, VA) This unique, interactive working group will take you through the ins and outs of what to expect from a business systems audit under the new rule amid evolving DCAA compliance expectations. Through an in-depth case study, you will learn what to expect, and how to prepare for many expected and unexpected scenarios that can arise at various points throughout the process. Take away valuable tools for how to respond to audit requests, and handle multiple, complex situations on your feet. Through a number of concrete examples, the speakers will also focus on what NOT to do, and take you through a variety of mock situations that can trigger auditor suspicion, more delays, and referrals to other government agencies and the DoJ. Unlike other sessions on business systems audits, you will also benefit from hands-on exercises that will help you to hone your audit management skills, and bolster your organization’s efforts to yield favorable DCAA audit findings. • How system audits are being structured • How DCAA audits all components of a system • How much to prepare for the audit under the new rule - what changes to make internally due to the new rule: what additional detail and supporting documentation must be prepared - assigning subject-matter experts to each system: key considerations • Do’s and don’ts for preparing a systems demonstration: Key considerations for each business system • Explaining to DCAA how your internal controls work • Educating DCAA on what you are relying on for your systems • Developing a corrective action plan in advance for your known deficiencies • What leads to payment withholdings and other remedies: Key system inadequacies and deficiencies to look for before it’s too late • What can lead to additional costs of non-compliance, including lost business and other forms of financial liability • What level of documentation is required for a compliant system, and when you need to have written policies and procedures Register now: 888-224-2480 • Fax: 877-927-1563 • AmericanConference.com/costpricing “At least one nugget of gold from each presentation that I will take home/share” – Harris Corporation DAY 1 – WEDNESDAY, APRIL 17, 2013 7:30 Registration Opens & Continental Breakfast 8:30 Co-Chairs’ Opening Remarks • Which aspects of the DCAA Contract Audit Manual on compensation are still in effect • How to respond to DCAA audits with these recent decisions in mind • What is “reasonable”, and how to prove it vs. what is “unreasonable” • Using survey data to support compensation • Challenging DCAA methodologies: Examples of successful and unsuccessful rebuttals during compensation reviews • Status of Congressional Bills to limit executive compensation: Post-election update and anticipated initiatives going forward Nicole J. Owren-Wiest Partner Wiley Rein LLP (Washington, DC) Neil Gardner Vice President, Ethics & Compliance Orbital Sciences Corporation (Washington, DC) 8:45 KEYNOTE ADDRESS: DCAA Speaks on the Incurred Cost Audit Backlog and Expectations for “Adequate” Submissions 10:45 Networking Coffee Break 11:00 Defining “Materiality” and “Significant Deficiency”: Key Qualitative and Quantitative Factors Carol Kastrinos Senior Director, Financial Compliance and Pricing Oshkosh Corporation – Defense (Oshkosh, WI) Former Director, Contracts Policy Division, DCMA John Brannock Director of Government Finance and Risk Management United Launch Alliance (Centennial, CO) Bradley Waters Partner KPMG LLP (Tysons Corner, VA) John Shire Deputy Assistant Director DCAA Policy & Plans Directorate (Washington, DC) Benefit from a worthwhile opportunity to hear first-hand insights and ask your questions to a senior DCAA decisionmaker. Gain updates on the latest incurred cost audit policies and learn about DCAA's compliance expectations. Attendees will have ample opportunity for Q & A, so come prepared! 9:30 Preparing for Executive Compensation Reviews in the Wake of the J.F. Taylor and Metron Decisions: What Recent Experiences Reveal about DCAA’s Current Statistical Methodology • Defining a “significant deficiency” • Degree of materiality for identifying a significant deficiency: Quantitative and qualitative factors guiding DCAA’s risk assessment • Meeting standards for materiality • When deficient subcontractor data can lead to an “inadequacy” finding • How DCAA verifies the adequacy of estimating and other systems • Key weaknesses to avoid in contractor business systems • Applying FAR’s guiding principles under Part 1 • What leads to payment withholdings and other remedies: Key system inadequacies and deficiencies • Recent examples of what is “material” • What can lead to additional costs of non-compliance, including lost business and other forms of financial liability • What level of documentation is required for compliant business systems Patrick J. Higgins Supervisory Auditor Mid-Atlantic Region – Compensation Team (RST-6) Defense Contract Audit Agency (Southern New Jersey Office) John J. Bentz, Jr. Program Manager, Policy Programs Division (PPD) DCAA Policy and Plans (Southern New Jersey Office) Christine Flanagan Director, Federal Regulatory Compliance URS Corporation, Corporate Headquarters (San Francisco, CA) Jimmy J. Jackson President, JJ Jackson Consulting, Inc. (Arlington, VA) Developer of methodology accepted by the ASBCA in decision #56105 (J. F. Taylor, Inc.) Sole J.F. Taylor Expert Witness in the J.F. Taylor case Nicole J. Owren-Wiest Partner Wiley Rein LLP (Washington, DC) • Practical impact of ASBCA decisions #56105 (J. F. Taylor, Inc.) and #56624 (Metron, Inc.): What the decisions say about statistical methodology of DCAA reviews • Status report on DCAA’s statistical methodology and audit approach post-J.F. Taylor and Metron decisions: How DCAA is now using compensation surveys and defining what is “reasonable” 12:00 Recordkeeping and Imaging in an Era of DCAA Backlog: Revisiting How Long to Retain Records, and Whether or Not to Change Your Timeline, Policies and Procedures Amy Hernandez Government Compliance Director Balfour Beatty Construction (Fairfax, VA) Former Financial Liaison Auditor & Investigative Support Auditor, DCAA David J. Roll Vice President-Industry Compliance ManTech International Corporation (Fairfax, VA) Former Chief, Technical Audit Services Division, DCAA Register now: 888-224-2480 • Fax: 877-927-1563 • AmericanConference.com/costpricing Paul Pompeo Partner Arnold & Porter LLP (Washington, DC) Represented Raytheon Company in statute of limitations case, Raytheon Company v. US, 104 Fed. Cl. 327 (2012) Stu Nibley Partner K&L Gates LLP (Washington, DC) • The latest DCAA record retention guidance: DCAA expectations for your retention practices • How long to retain supporting records: Pros and cons of using the FAR vs. a longer timeframe • Determining how far beyond the FAR requirements to keep records due to DCAA backlog • When to change retention practices and shorten your retention period to FAR timeline • What happens when you can’t produce old records during an audit • Weighing the need for “adequate” support for costs vs. when to destroy supporting records • When to keep originals • If, when and how DCAA is auditing documents created outside the FAR timeframe • How DCAA audits document retention, scanned imaging and hard copy records • Record destruction requirements under the FAR 1:00 Networking Luncheon 2:15 Refining Your Incurred Cost Audit Management and Rate Negotiation Strategy: Operating Amid Increased Sampling, Submission and Supporting Documentation Requirements • When does a claim accrue under the Contract Disputes Act • Recent cases, and their practical impact • Application of the statute of limitations to contractors’ final indirect rates • How DCAA has interpreted the six-year limitation: How far back can DCAA claim costs based on incurred cost proposals more than six years ago? 4:45 VADM Lou Crenshaw USN (Ret.) CDFM Principal Grant Thornton LLP (Alexandria, VA) • Partial termination for convenience vs. deductive change: Differences in treatment of costs • Partial terminations: - contrasting partial termination principles vs. full terminations - when indirect costs become direct - treatment of severance costs by DCAA - adjusting accounting systems in response to a partial termination notice • Unique considerations for deductive changes • Which costs to include in a termination proposal, including: - indirect costs and re-classifying them as direct - dealing with cost overrun on contracts - constructive changes - tracking individual costs - building up costs (rate and burdens) and the necessary systems to have in place - determining overhead rates • Common areas of cost disagreements in the context of terminations • Negotiating a termination settlement: Successful strategies • Cost or pricing data required to support a termination proposal, and how to demonstrate reasonableness • How strictly you need to follow FAR cost principles in the context of a restructuring • What to do if your program is on the brink: How to work with the U.S. Government to “lean out” a program and manage the impact of cost overrun Kelly G. Peters Director, Government and Corporate Compliance BAE Systems Land and Armaments, GTS Richard Martinez Vice President, Government Compliance Serco (Reston, VA) James W. Thomas Partner PwC (McLean, VA) • How incurred cost audits have become more detailed and complex: How DCAA and DCMA assess reasonableness, allowability, and allocability • Incurred cost rate negotiations: Best practices for forecasting rates, closing out contracts and reducing delays • Identifying areas of increased risk through internal evaluations of previous audits • Recent examples of what can trigger disagreements with DCAA • When to re-submit rates, and avoiding disruptions to customers • What has triggered penalty, disqualification from direct billing, and civil/ criminal penalties for claiming unallowable costs • Working closely with the auditor and Contracting Officer to provide information in a timely, efficient manner 3:30 Networking Coffee Break 3:45 Statute of Limitations under the Contract Disputes Act: When the Clock Starts and Stops Running for DCAA Audits and Disallowed Costs James J. McCullough Partner Fried, Frank, Harris, Shriver & Jacobson LLP (Washington, DC) Partial Terminations, Deductive Changes and Contract Restructurings: Applying Varying Cost and Termination Principles for Assessing Allowability and Reasonableness 5:30 Conference Adjourns GLOBAL SPONSORSHIP OPPORTUNITIES With more than 500 conferences in the United States, Europe, Asia Pacific, and Latin America, American Conference Institute (ACI) provides a diverse portfolio devoted to providing business intelligence to senior decision makers who need to respond to challenges spanning various industries in the US and around the world. As a member of our sponsorship faculty, your organization will be deemed as a partner. We will work closely with your organization to create the perfect business development solution catered exclusively to the needs of your practice group, business line or corporation. For more information about this program or our global portfolio of events, please contact: Wendy Tyler Head of Sales, American Conference Institute Tel: 212-352-3220 x5242 | Fax: 212-220-4281 | w.tyler@AmericanConference.com Register now: 888-224-2480 • Fax: 877-927-1563 • AmericanConference.com/costpricing “Very well done, timely given new regulation, DCMA-DCAA relationship” – Orbital Sciences Corporation DAY 2 – THURSDAY, APRIL 18, 2013 7:30 Continental Breakfast 8:30 Co-Chairs’ Opening Remarks 8:35 DCAA Access Rights to Your Internal Audit Reports and Workpapers: Status Report on Contractors’ Rights and Obligations Post-DCAA Guidance 11:00 Networking Coffee Break 11:15 When Your Estimates and Contract Bids Can Become “False Claims”: How to Strengthen Your Cost and Price Proposal Practices to Reduce New Prosecution, Penalty, Suspension and Debarment Risks Rodney W. Mateer Director, Government Contracting Services Deloitte Financial Advisory Services LLP (McLean, VA) John Russell Assistant General Counsel Northrop Grumman Corporation (Baltimore, MD) Joseph D. West Partner Gibson, Dunn & Crutcher LLP (Washington, DC) Deborah Nixon Partner – Government Contract Services Ernst & Young LLP (McLean, VA) • Practical impact of the recent 9th Circuit decision in United States ex rel. Hooper v. Lockheed Martin Corp., No. 11-55278: When contract bids or estimates can be “false claims” • Defining a “false estimate” in the context of a cost reimbursement contract • Adjusting your approach to cost and price proposals in the wake of the Hooper decision • When a contractor can be deemed to have acted with “reckless disregard” or “deliberate ignorance” • What is a deemed as an honest mistake vs. intentional error • Growing, creative government theories to assert false claims, and DOJ success levels for prosecutions and securing settlements for cost or pricing violations • Successful defenses • How DCAA assesses fraud during an audit and investigates mistakes • Presenting evidence of good faith to pre-empt a fraud referral • When fraud referrals from DCAA can result in DOJ prosecutions Donald J. Carney Partner Perkins Coie LLP (Washington, DC) • Status of Congressional action to overrule Newport News case and grant DCAA statutory authority • Recent DCAA guidance and changes to accounting manual • What triggers DCAA requests for the reports • When an executive summary report is a sufficient response to an access request • Recent examples of DCAA requests • Managing the legal aspects of granting/denying access requests, including privilege • Revisiting your policies regarding government requests for internal audit reports and workpapers • Working with your internal audit department on policies for reviewing reports and workpapers • Defining the reporting relationships between internal audit and other corporate departments • Fostering company-wide adherence to policies • Ensuring internal audit departments are clearly documenting objectives, procedures, findings and remediation steps • Reducing the risks associated with poorly documented internal audit reports and workpapers 9:45 Q & A with DPAP, DCAA and DCMA: The Latest on Auditor Training Initiatives, the DCAA-DCMA Relationship, Role of the Contracting Officer and Priorities Going Forward Shay Assad Director, Defense Pricing Defense Procurement and Acquisition Policy U.S. Department of Defense (Washington, DC) John Shire Deputy Assistant Director DCAA Policy & Plans Directorate (Washington, DC) Ronald J. Youngs Director, Cost and Pricing Center Defense Contract Management Agency (Washington, DC) 12:15 Networking Luncheon 1:30 Year-In-Review: Update on CAS and Board Interpretations Charlie Kerr Senior Manager, Government Compliance KBR, North American Government & Logistics (Houston, TX) Bill Walter Partner Dixon Hughes Goodman, LLP (Tysons Corner, VA) • CAS Activities: Review of CAS pronouncements, updates and decisions over the past year • Update on CAS Board agenda, and priorities • Impact of cost or pricing data requirements and CAS exemptions on prime contractors, and first and second tier subcontractors • Recent trends in B&P and IR&D: Practical impact of IR&D changes by Congress and the Department of Defense, and the impact of reduced Federal spending on B&P costs and the alignment with the Fundamental Requirements of CAS 420 Register now: 888-224-2480 • Fax: 877-927-1563 • AmericanConference.com/costpricing • Harmonization of CAS with the Pension Protection Act, and how existing pension standards and contract prices are impacted • Best practices to ensure that home office allocations comply with the Fundamental Requirements of CAS 403 • Strategies for small businesses to be proactive in addressing the increased burden associated with transitioning to performing on CAS covered awards 2:30 Nicole M. Mitchell Partner Aronson LLC (Rockville, MD) • New criteria for forward pricing rate proposals - more required detail for forecasting - how to manage rates by pool • How audits of forward pricing rate proposals are conducted, including the use of proposal walk-throughs • Requisite level of detail in a forward pricing rate proposal, and how much is too much • What triggers findings of inadequacies: How auditors have determined if the data provided adequately supports the contractor’s proposed rates • Completing forward pricing rate negotiations in a timely manner • How auditors have determined if the data provided adequately supports the contractor’s proposed rates • Requirements for cost-plus, time & material and sub-tier proposals • Computing and applying indirect rates, including cost breakdowns • Supporting the reasonableness of the rates under FAR Part 15 • Completing forward pricing rate negotiations in a timely manner • Close-out proposal requirements • Coordinating and ensuring your proposals are consistent Verifying Subcontractor Cost or Pricing Compliance at the Pre- and Post-Award Stages: The Scope of Prime and Sub Responsibilities for Ensuring Adequate Data and Price Reasonableness Kent Sharp Purchasing Compliance Officer Quality Audit Manager Rolls-Royce North America (Indianapolis, IN) Liz Novak Director, Regulatory Compliance Booz Allen Hamilton, Inc. (Herndon, VA) • The scope of a prime contractor’s obligation to conduct cost or price analyses of subcontractor proposals, and key pitfalls to avoid • Subcontractor responsibilities to certify and submit cost or pricing data • Expected level of prime monitoring of subcontractor compliance at the pre- and post-award stages • To what extent a prime contractor can access a subcontractor’s records, including the status of their accounting systems, and when a subcontractor’s denial of access to records can be justified • When and how to request assistance from the contracting officer to ensure a subcontractor’s compliance with CAS and FAR • Applying global indemnity clauses and contractual audit rights: To what extent a prime needs to emulate DCAA audit processes, and how to meet DCAA expectations • Distinction between “price analysis” vs. “cost analysis”, and what is required for each • Ensuring that your purchasing system processes can identify responsible prospective subcontractors and vendors • Key pitfalls to avoid in evaluating “price reasonableness” of subcontractor cost or pricing data • Extent to which DCAA requests subcontractor cost or pricing data that is not required by regulation • Negotiating with a contracting officer regarding the scope of required cost or pricing data • Monitoring and tracking overhead, G & A and other charges over the life of a subcontract 3:30 Networking Coffee Break 3:45 Forward Pricing Rate Proposals: How to Comply with New Criteria for Forecasted Data, BOEs and Adequacy Steve Trautwein Deputy Director Cost and Pricing Center Defense Contract Management Agency (Washington, DC) 4:45 Evaluating Your Audit Readiness: Conducting an Internal Assessment to Correct Internal Control and Compliance Weaknesses before It’s Too Late Terry A. Carlson Managing Director Capital Edge Consulting, Inc. (Reston, VA) • Who should perform the assessment: Building the most effective assessment team • Selecting frequency and scope of internal reviews • Who should conduct the assessment: When to use in-house compliance and legal groups vs. outside counsel and forensic accountants • How to structure the internal assessment, including designating an internal auditor to each system • Documenting information and rationale for your risk assessment approach • How to work effectively with the internal audit department • Best practices for identifying weak internal controls • Protecting attorney-client privilege: When and how to assert privilege • Identifying and implementing corrective measures, including tightened systems and targeted training • Updating policies and procedures for CAS, FAR and DFARS compliance • Recordkeeping requirements • Sharing the findings: Determining whether or not to disclose to DCAA and DCMA, and how 5:30 Conference Concludes © American Conference Institute, 2013 Media and Association Partners: Register now: 888-224-2480 • Fax: 877-927-1563 • AmericanConference.com/costpricing NEW 2013 FACULTY American Conference Institute’s 4th Advanced Forum on United Launch Alliance DCAA GOVERNMENT CONTRACT DCMA COST & PRICING DPAP Northrop Grumman Alion Science & Technology Rolls Royce North America BAE Balfour Beatty Construction URS Strengthening Pre- and Post-Award Compliance Practices to Minimize the Risks of Disallowed Costs, Withholdings and False Claims Oshkosh April 17–18, 2013 | Hilton Crystal City, Arlington, VA KBR ManTech International Serco R E G I S T R AT I O N F O R M Orbital Registration Fee The fee includes the conference‚ all program materials‚ continental breakfasts‚ lunches and refreshments. PRIORITY SERVICE CODE Payment Policy Payment must be received in full by the conference date. All discounts will be applied to the Conference Only fee (excluding add-ons), cannot be combined with any other offer, and must be paid in full at time of order. Group discounts available to individuals employed by the same organization. .S Cancellation and Refund Policy You must notify us by email at least 48 hrs in advance if you wish to send a substitute participant. Delegates may not “share” a pass between multiple attendees without prior authorization. If you are unable to find a substitute, please notify American Conference Institute (ACI) in writing up to 10 days prior to the conference date and a credit voucher valid for 1 year will be issued to you for the full amount paid, redeemable against any other ACI conference. If you prefer, you may request a refund of fees paid less a 25% service charge. No credits or refunds will be given for cancellations received after 10 days prior to the conference date. ACI reserves the right to cancel any conference it deems necessary and will not be responsible for airfare‚ hotel or other costs incurred by registrants. No liability is assumed by ACI for changes in program date‚ content‚ speakers‚ or venue. ATTENTION MAILROOM: If undeliverable to addressee, please forward to: Vice President-Contracts & Pricing, Government Finance/Accounting; Government Contracting Counsel Hotel Information CONFERENCE CODE: 768L13-WAS YES! Please register the following delegate for GOVERNMENT CONTRACT COST & PRICING American Conference Institute is pleased to offer our delegates a limited number of hotel rooms at a preferential rate. Please contact the hotel directly and mention the “ACI’s Government Contract Cost & Pricing” conference to receive this rate: Venue: Hilton Crystal City (at Washington Regan National Airport) Address: 2399 Jefferson Davis Hwy, Arlington, VA 22202 Reservations: 800-695-7551 CONTACT DETAILS NAME POSITION APPROVING MANAGER POSITION Incorrect Mailing Information If you would like us to change any of your details please fax the label on this brochure to our Database Administrator at 1-877-927-1563, or email data@AmericanConference.com. ORGANIZATION 5 ADDRESS CITY STATE TELEPHONE FAX EMAIL TYPE OF BUSINESS ZIP CODE MAIL FEE PER DELEGATE Register & Pay by Feb 8, 2013 Register & Pay by Mar 15, 2013 Register after Mar 15, 2013 Conference Only $1995 $2095 $2295 Conference & 1 Workshop A or B $2595 $2695 $2895 ELITEPASS*: Conference & Both Workshops $3195 $3295 $3495 I cannot attend but would like information on accessing the ACI publication library and archive *ELITEPASS is recommended for maximum learning and networking value. EXP. DATE CARDHOLDER I have enclosed my check for $_______ made payable to American Conference Institute (T.I.N.—98-0116207) Please quote the name of the attendee(s) and the event code 768L13 as a reference. For US registrants: Bank Name: HSBC USA Address: 800 6th Avenue, New York, NY 10001 Account Name: American Conference Institute UPIC Routing and Transit Number: 021-05205-3 UPIC Account Number: 74952405 ✃ NUMBER Non-US residents please contact Customer Service for Wire Payment information FAX 888-224-2480 877-927-1563 ONLINE AmericanConference.com/costpricing EMAIL CustomerService @AmericanConference.com CONFERENCE PUBLICATIONS ACH Payment ($USD) Please charge my VISA MasterCard AMEX Discover Card Please invoice me American Conference Institute 45 West 25th Street, 11th Floor New York, NY 10010 PHONE I would like to receive CLE accreditation for the following states: ___________________. See CLE details inside. PAYMENT Easy Ways to Register To reserve your copy or to receive a catalog of ACI titles go to www.aciresources.com or call 1-888-224-2480. SPECIAL DISCOUNT We offer special pricing for groups and government employees. Please email or call for details. Promotional discounts may not be combined. ACI offers financial scholarships for government employees, judges, law students, non-profit entities and others. For more information, please email or call customer service.