Evolution and Intelligent Design By Thomas J. Sargent*

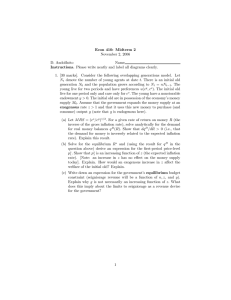

advertisement