Econ 387: Assignment 2 David Andolfatto January 2006

advertisement

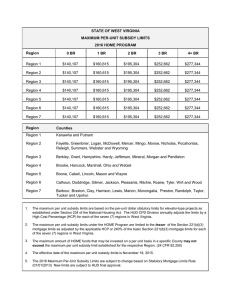

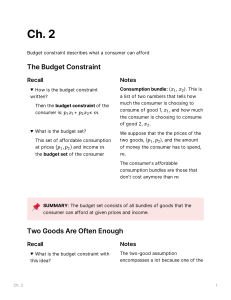

Econ 387: Assignment 2 David Andolfatto January 2006 This question constitutes an application of the heterogeneous agents model (available on the course web page). Consider an economy consisting of people with preferences for consumption and leisure (c, l) given by: u(c + vl), where u is an increasing and concave function. Here, I would like you to interpret l as time spent at home raising children. Time is indivisible so that l = 0 or l = 1. If we let n denote time spent in the labor market, then the time constraint for each person is given by n + l = 1. People value staying at home differently. We can capture these different preferences by assuming that v is distributed in some way across the population; e.g., let F (x) = Pr[v ≤ x]. As you must know by now, the Conservatives just won the Canadian federal election (Jan. 23, 2006). One of their election promises was to provide a subsidy s for people staying at home raising children. Presumably, this subsidy will have to be paid for by people who work; let τ denote the tax rate on earnings. In this case, each person faces the budget constraint: c = (1 − τ )zn + (1 − n)(v + s). [1] Given some (z, τ , s), show that the aggregate supply of labor is given by: N s (z, τ , s) = F ((1 − τ )z − s). [2] How does the aggregate supply of labor depend on the parameters (z, τ , s)? Explain (provide economic intuition). Note that the model developed so far is ‘partial equilibrium’ in nature because we have ignored the link that exists between τ and s. We can take either one of these variables as an exogenous policy parameter, say s. In this case, we can use the government’s budget constraint (together with the labor supply function) to calculate the tax rate τ ∗ necessary to finance the subsidy s. In particular: τ ∗ zF ((1 − τ ∗ )z − s) = [1 − F ((1 − τ ∗ )z − s)] s. Note that s = 0 implies that τ ∗ = 0. 1 [3] Provide an interpretation of the equation above (tell me what each side of the equation represents). [4] We can think of an increase in s as an increase in the generosity of the childcare subsidy program. What do you think will happen as we increase s from zero? Is there an upper limit to how generous the government can make this program? Explain (in words is fine—you don’t have to do the math—but good for you if you can!). 2