The Employment of Nations

advertisement

The Employment of Nations

Introduction

• Material living standards depend on the availability of goods and services

• Availability depends on production; production depends on employment

(more precisely: the aggregate labor input)

• What determines how much time (a scarce resource) is allocated to production in an economy?

• In short: what determines the employment of nations?

The Aggregate Labor Input

• Extensive Margin: Number of people employed (employment)

• Intensive Margin: Hours worked per employed person

• A commonly-used measure of the aggregate labor input:

Employment

Hours Worked per Employed Person

Hours per capita = Adult

×

Population

Available Time per Employed Person

Table 2.1

Aggregate Employment Rates

Selected OECD Countries

Canada

United States

Japan

Australia

Denmark

France

Germany

Ireland

Italy

Netherlands

Spain

Sweden

United Kingdom

1965 1970 1975 1980 1985 1990 1995

60.9 61.3 63.4 65.5 66.1 68.9 67.3

62.9 64.5 64.4 66.8 68.5 72.4 73.4

71.5 71.1 69.7 70.3 70.6 72.5 74.4

66.6 68.8 67.5 65.5 64.7 67.6 67.4

72.2 74.3 73.3 73.1 75.3 76.8 74.1

66.4 65.8 65.4 63.5 59.4 60.1 58.9

69.6 68.6 65.7 63.6 62.5 65.8 65.2

64.4 62.0 58.0 57.0 51.7 52.7 55.2

58.8 56.3 55.6 55.7 54.0 55.0 52.5

59.9 57.3 54.5 53.6 53.3 61.5 65.3

59.8 60.1 58.1 50.2 45.4 48.9 46.4

71.9 72.7 76.3 78.7 79.3 79.8 70.4

71.4 70.4 70.8 68.7 65.7 70.7 68.6

Mean

Standard Deviation

65.7

5.71

65.7

5.91

65.4

6.38

64.8

7.67

63.8

9.45

66.7

9.30

65.9

8.82

Table 2.2

Annual Hours Worked per Employed Person

Selected OECD Countries

Canada

United States

Japan

France

Germany

Italy

Norway

Spain

Sweden

1970

1890

1889

2201

1962

1949

1969

1766

n.a.

1641

1975

1837

1832

2112

1865

1801

1841

1653

n.a.

1516

1979

1832

1845

2126

1806

1696

1722

1514

2022

1516

1983

1780

1808

2095

1712

1657

1699

1485

1912

1518

1990

1788

1819

2031

1657

1598

1674

1432

1824

1546

1996

1784

1839

1892

1608

1511

1636

1407

1810

1623

Mean

1908 1807 1757 1719 1693 1663

Standard Deviation 163.1 172.2 197.8 189.9 185.0 165.6

Figure 2.1

Hours Worked as Fraction of Total Time

Selected OECD Countries

0.25

0.2

0.15

0.1

0.05

0

1965

1970

1975

1980

1985

1990

1995

2000

Approach

• Observation: large and persistent differences in employment patterns across

nations

• Question: what accounts for these differences?

• Aggregate behavior is simply the sum of individual behaviors

• Implication: to understand aggregate behavior, we need to understand

what motivates the individual behavior that generates it

• We need a theory of individual decision-making, applicable to the question

at hand

• Let us begin with two self-evident facts:

1. People are endowed with a limited amount of time;

2. People generally have competing uses for this time.

• Implication: people must decide how to allocate scarce time across competing uses (this is called a time-allocation problem)

• Approach: build a model economy, populated by model people, similar

(but by no means identical) to real people along a few selected dimensions

• We need to address a few questions:

1. What motivates our model people? (Specify an objective)

2. What actions are under their control? (Endogenous variables)

3. What objects are beyond their control? (Exogenous variables)

4. How do objectives interact with constraints to determine behavior?

(Prediction)

A Basic Model Economy

• There are two commodities: consumer goods () and home goods ()

• The pair ( ) ∈ R2+ is called a commodity bundle (where R2+ constitutes

the commodity space)

• What motivates a model person? Assume that they derive pleasure from

consuming ( )

• Moreover, assume that they can attach a number ( ) to each ( ) ∈

R2+ that ranks each commodity bundle in the commodity space

• Assume that ( ) is strictly increasing in and ; and strictly concave

in and

0 and

0

2

2

0 and

0

2

2

• Common example: ( ) = ln() + ln(); ≥ 0

• An indifference set is defined to be all combinations of ( ) that are

equally ranked; i.e., that satisfy

( ) = 0

for some 0 ∈ R (note: 0 could be negative)

• Note: given the assumptions made on this indifference set will be an

“indifference curve” that slopes downward in a convex manner from left

to right in the commodity space

• The marginal rate of substitution or MRS is (the absolute value of) the

slope of the indifference curve

• Denote by ( ); measures the relative valuation attached to and

by an individual at the point ( )

• Also: measures an individual’s willingness to substitute across different

commodities

• Additional assumption: homotheticity

Example

( ) = ln() + ln()

• Now set ( ) = 0 so that

ln() + ln() = 0

• This implies an indifference curve

= 0 −

• Slope is

• So MRS is given by

µ ¶

= −0 −−1 = −

µ ¶

( ) ≡

• Note: these preferences are homothetic

Constraints

• Let denote time endowment

• Let denote skill level in producing consumer goods

• Let denote time devoted to producing consumer goods (employment)

• Let denote time devoted to producing home goods (leisure)

• Assume that = (can only consume home goods produced by self)

• Then constraints are given by

+ =

=

• Or, combining...

= −

• Think of this as a budget constraint; where denotes the price of

measured in units of (the real wage)

• Alternatively + = ; where denotes the value of your time

endowment measured in units of

Summing Up

• A person has preferences defined over ( ) ranked by a function ( )

• Assume that ( ) are choice variables

• Therefore, choose the ( ) that delivers the highest rank ( )

• But without violating the budget constraint ≤ −

• In short, the choice problem can be stated as

( ) ≡ max { ( ) : ≤ − }

( ) ≡ max { ( ) : ≤ − }

• The choice variables ( ) are endogenous variables (objects that the theory is designed to predict/explain)

• The parameters ( ) are exogenous variables (objects that are not explained, but which potentially influence behavior)

• The solution to the choice problem is an optimal ( ); this solution will

be a function of parameters ( )

• ( ) is a maximum value function; or indirect utility function (think

of it as a welfare function)

Review

• Model economy consists of people with preferences defined over commodity

bundles ( )

• Preferences are represented by a ranking (or utility) function ( ); e.g.,

( ) = ln() + ln()

• ( ) measures a person’s willingess to substitute across and

• Model people endowed with time and skill

• There are two uses of time: + = (time constraint)

• Assume that = ; so that ≤

• Constraint boils down to ≤ −

• measures a person’s ability to substitute across and (interpret as

real wage; it is the price of leisure measured in units of consumption)

• Now, assume that people try to do the best they can, subject to their

constraints

• In this model, choose ( ) to maximize ( ) subject to ≤ −

• Solution is a pair of functions ∗( ) and ∗( ); which implies

∗( ) = − ∗( )

• Note: solution is a conditional forecast

• That is, this theory has the structure

( ) ⇒ (∗ ∗ ∗)

• We can use the theory to predict and interpret how any exogenous change

in ( ) will affect individual behavior

• We can also use theory to evaluate welfare consequences; ( ) ≡

(∗ ∗)

• Mathematically, solution is characterized by

(∗ ∗) =

∗ = − ∗

• Example 1: ( ) = ln() + ln() implies ( ) = (); so

solution is

µ

¶

1

∗ =

1 + ¶

µ

∗ =

1 + ¶

µ

1

∗

=

1+

• Note: ∗ is increasing in ; while time allocation is invariant to (interpretation: SE and WE stemming from a change in exactly cancel)

• Example 2: ( ) = 212 + 212 implies ( ) = ()12;

so solution is

∗ =

Ã

2

!

1 + 2

Ã

!

1

∗

=

2

1 +

Ã

!

2

∗ =

2

1 +

• Note: ∗ is increasing in ; and now ∗ is increasing in (so that ∗ is

decreasing in )

• For these preferences, SE dominates WE

From Individual to Aggregate Behavior

• Let Π(X

) denote fraction of population with characteristics ( );

Π( ) = 1

so that

• Special Case [Representative Agent Model] is when Π( ) = 1 for

some ( )

• Aggregate labor input is given by

∗ =

X

∗( )Π( )

• For representative agent model, aggregate labor input is simply ∗( )

Interpreting Cross-Country Differences in Employment

• Fact: over long periods of time, aggregate labor input (per capita) is

approximately constant (in relatively advanced economies)

• One interpretation: for permanent wage changes, SE and WE roughly

cancel

• This suggests that cross-country wage/productivity differentials is not likely

the primary source of observed differences in employment patterns

• Another possibility is cross-country differences in ; but not generally considered a plausible explanation

Redistributive Policies

• Ed Prescott argues that cross-country differences in tax/transfer policies

may be important

• In fact, there appear to be large and persistent differences in tax rates

across countries

Figure 2.11

Average Tax Rate on Labor Income

Selected OECD Countries

0.5

0.45

0.4

0.35

0.3

0.25

0.2

0.15

0.1

0.05

0

1965

1970

1975

1980

1985

1990

1995

2000

• Simple explanation is that higher labor income tax reduces the return to

working; leading to a substitution away from work into leisure

• In fact, the argument is a little more subtle than this

• In particular, a higher labor income tax is like a reduction in the real wage

• But if SE and WE roughly cancel, not likely to have a big impact on time

allocation choices

• Key lies here: what does the government do with tax revenue?

• Assume that they redistribute it in lump-sum manner (not a bad approximation)

Modeling a Redistribution Policy

• Let 0 ≤ ≤ 1 denote labor income tax rate; and let ≥ 0 denote

lump-sum transfer

• Then an individual’s budget constraint is

≤ (1 − )( − ) +

• The slope of the budget line is now −(1 − )

• That is, an increase in makes the budget line “flatter” (distorts the

relative price of consumption and leisure)

• So an increase in increases the price of consumption relative to leisure

(leisure is now relatively cheaper)

• On the other hand, an increase in is like an increase in wealth

• Choice problem is

max { ( ) : ≤ (1 − )( − ) + }

• Solution is characterized by

(̂ ̂) = (1 − )

̂ = (1 − )( − ̂) +

• Assume that people only differ in ; then solution is a pair of functions

̂( ) and ̂( )

• Example: ( ) = ()

µ

¶

µ

¶µ

¶

1

̂ =

−

+

1+

1 + Ã 1 − !

µ

¶

µ

¶

+

̂ =

1+

1+

(1 − )

Ã

!

µ

¶

µ

¶

1

̂ =

−

1+

1+

(1 − )

• Notice: reduces to what we had before if = = 0

• Theory predicts that increase in generally

— decreases increases decreases

• and that increase in generally

— increases increases decreases

• So an increase in both ( ) appears to have ambiguous impact on ; but

clearly leads to a decrease in

• Think about it this way:

— increase in implies ↓ (SE) and ↑ (negative WE)

— increase in implies ↑ (positive WE)

• Negative and positive WE basically cancel; leaving the SE

• But why should policy increase both and ? Why not just set tax rate

to zero and give everyone a transfer?

• Answer: Because such a policy is not budget feasible for the government

The Government Budget Constraint (GBC)

• In this model economy, the GBC is given by

=

X

̂( )Π()

• So, for exogenous policy this can be solved for the budget-balancing

tax rate ̂

• Or, for exogenous policy this can be solved for the budget-balancing

lump-sum transfer ̂

A Representative Agent Economy

• For a given theory delivers the following restrictions

(̂ ̂) = (1 − )

̂ = (1 − )( − ̂) + ̂

̂ = ( − ̂)

(1)

(2)

(3)

• Hence, 3 equations in the 3 unknowns (̂ ̂ ̂ ) as a function of parameters

(in particular, )

• And, of course, once we know ̂ we can deduce ̂

• Condition (2) asserts that (̂ ̂) lies on the budget line ̂ = (1 − )( −

̂) + ̂

• If we combine (2) and (3), we get ̂ = ( − ̂)

— this implies that (̂ ̂) also lies on the feasible line

• Now, since (̂ ̂) = (1 − ) = (∗ ∗) it follows that

̂ ∗ and ̂ ∗ for any 0

• It follows that ̂ is decreasing in ; which is broadly consistent with the

data

• For a RA economy, economic welfare is also decreasing in

A Heterogeneous Agent Economy

• Assume that people differ according to only; distributed according to

Π()

• Now, for any given we can compute an equilibrium allocation ̂( ) ̂( )

for each

— we can also compute individual welfare ( ) ≡ (̂( ) ̂( ))

• Generally speaking, low types welfare is increasing in ; while high

types welfare is decreasing in (redistribution)

• The redistribution policy modeled here is called a negative income tax

(NIT)

• People pay tax and receive transfer ; so that their net tax obligation

is −

• For high types, − 0 (net contributors)

• For low types, − 0 (net recipients)

• Increasing (and hence ) has the effect of increasing inequality in gross

earnings

• Why?

• Because ↑ leads low-skill to reduce labor supply more than high-skill

• Why?

• Because high-skill are net contributors (negative wealth effect implies greater

willingness to work)

• Because low-skill are net recipients (positive wealth effect implies they can

afford more leisure)

• On the other hand, increasing (and hence ) has the effect of reducing

inequality in after-tax earnings (1 − ) +

Socially Optimal Tax Policy

• The answer to this question depends on what one assumes is a reasonable

measure of social welfare

• A case could be made for the Rawlsian veil of ignorance

W=

X

( )Π()

• If government objective is to maximize W then generally speaking, optimal

tax rate is positive

• Essentially, redistributive program insures risk-averse agents against the

“bad luck” of being born with low skill

Taking the Theory to the Data

• Assume ( ) = ln() + ln() and identical across people and

countries (representative agent model)

• This implies

∙

1−

̂( ) =

+1−

¸

• Calibrate this to the U.S. in 1985; where = 01414 and = 0209

• This implies

∙

1 − 0209

01414 =

+ 1 − 0209

¸

• Solve for = 4803

• Now, we can use our “estimated” model’s prediction

∙

1−

̂( ) =

4803 + 1 −

¸

• Data is for Canada, France, Germany, Italy, Japan, Spain and Sweden;

each in the years 1970 and 1995

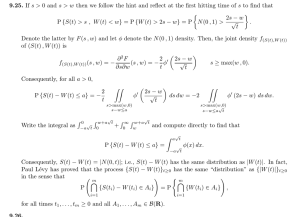

Figure 2.14

Actual and Predicted Hours Worked

Hours Worked / Total Time

0.2

0.18

0.16

0.14

0.12

Predicted

0.1

0.08

0.06

Actual

0.04

0.02

0

0

0.1

0.2

0.3

Tax Rate

0.4

0.5

Conclusions

• In the context of the theory developed here, cross-country differences in

employment not likely the consequence of cross-country differences in productivity

• Cross-country differences in the “generosity” of redistributive programs

may be quantitatively important (but clearly not the entire story)

• Higher labor-income tax rates may induce lower levels of employment and

per capita income (GDP), but this does not necessarily imply that lower

GDP is associated with lower “social” welfare

⇒ do not confuse GDP or employment with social welfare