Myrtle Ellis Fund Donation Form

advertisement

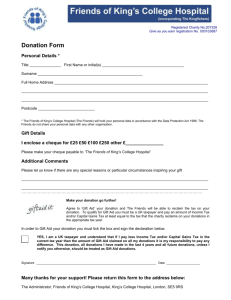

Donation Form Myrtle Ellis Fund Using Gift Aid means that for every £1 you give, the charity will receive an extra 25 pence from the Inland Revenue, helping your donation go further. This means that £10 can be turned into £12.50 just so long as donations are made through Gift Aid. Imagine what a difference that could make, and it doesn’t cost you a thing. Simply complete this form and send it along with your donation to The National Brain Appeal declaring that we can claim the tax back on your donation. Donor’s details Title First name Surname Home address Postcode Email Phone Please tick either or both boxes as appropriate I would like to make a donation to The National Brain Appeal - Myrtle Ellis Fund I would like to Gift Aid my donation, all donations I have made to The National Brain Appeal for the four years prior to this year and all donations in the future until I notify you otherwise. To qualify for Gift Aid, you must pay an amount of Income Tax and/or Capital Gains Tax for each tax year (6 April one year to 5 April the next) that is at least equal to the amount of tax that the charity will reclaim on your donations for that tax year. Signed Dated Please complete the form and return with your donation to: Please make cheques payable to: The National Brain Appeal The National Brain Appeal, Box 123, Queen Square London WC1N 3BG T 020 3448 4724 F 020 3448 3698 info@nationalbrainappeal.org www.nationalbrainappeal.org The National Brain Appeal is the working name of The National Hospital Development Foundation. Registered Charity Number 290173 Gift Aid You must pay an amount of Income Tax and/or Capital Gains Tax for each tax year (6 April one year to 5 April the next) that is at least equal to the amount of tax that the charity will reclaim from HM Revenue & Customs on your Gift Aid donations for that tax year. For every £1 given, the charity will currently reclaim 25p of tax. Tax claimed by the charity The charity will reclaim 25p of tax on every £1 you give on or after 6 April 2008. Please notify the charity if you: 1. Want to cancel this declaration. 2. Change your name or home address. 3. No longer pay sufficient tax on your income and/or capital gains. If you pay income tax at the higher rate, you must include all your Gift Aid donations on your Self Assessment tax return if you want to receive the additional tax relief due to you. The National Brain Appeal Box 123, Queen Square London WC1N 3BG T 020 3448 4724 F 020 3448 3698 info@nationalbrainappeal.org www.nationalbrainappeal.org The National Brain Appeal is the working name of The National Hospital Development Foundation. Registered Charity Number 290173 For donations received up to 5 April 2008, where Gift Aid applied, the charity will reclaim 28p of tax on every £1 you gave. Our website: www.nationalbrainappeal.org also has details regarding Gift Aid.