Finance Alert Eurosail: UK Securitisations and Balance Sheet Solvency

advertisement

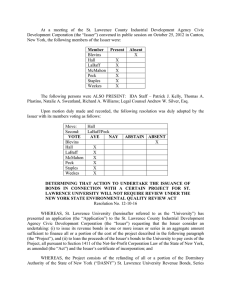

Finance Alert 10 August 2010 Authors: Stephen Moller stephen.moller@klgates.com +44.(0)20.7360.8212 Edward Smith edward.smith@klgates.com +44.(0)20.7360.8189 K&L Gates includes lawyers practicing out of 36 offices located in North America, Europe, Asia and the Middle East, and represents numerous GLOBAL 500, FORTUNE 100, and FTSE 100 corporations, in addition to growth and middle market companies, entrepreneurs, capital market participants and public sector entities. For more information, visit www.klgates.com. Eurosail: UK Securitisations and Balance Sheet Solvency In the recent case of BNY Corporate Trustee Services Limited v Eurosail-UK 2007-3BL PLC [2010] EWHC 2005 (Ch) ("Eurosail"), investors sought to take advantage of a structural feature present in many securitisations of UK assets to argue that the trustee should call an event of default and accelerate the notes. Eurosail included a post enforcement call option ("PECO") which was designed to make the special purpose vehicle issuing the notes (the "Issuer") insolvency remote while avoiding the need to limit the Issuer’s liability to its creditors to the value of its assets. The Issuer was an English incorporated limited company. While on the facts of the case the Issuer was found to be solvent, it was decided that the existence of the PECO had no bearing on whether the Issuer was technically solvent for the purposes of Section 123(2) of the Insolvency Act 1986 ("Section 123(2)"). The case therefore opens the door for investors in other UK securitisation transactions to argue that the issuer of their notes is technically insolvent and therefore that an event of default has occurred. The case is also of wider interest to creditors of English companies in that it clarifies how balance sheet solvency should be determined for the purpose of Section 123(2). Eurosail suggests that it may be harder than previously thought for lenders to assess whether an event of default based on the test contained in Section 123(2) has been triggered. Background: Eurosail 2007-3 Eurosail 2007-3 was a securitisation of UK non-conforming residential mortgages issued in 2007 with a face value of £650 million. The notes were issued in five tranches, ranking from A to E in order of seniority with each tranche being divided into sub-tranches which were denominated in different currencies. The currency mismatch between the Issuer’s sterling denominated assets and those of its notes which were denominated in US dollars or euros was dealt with by currency swaps between the Issuer and Lehman Brothers Special Financing Inc ("LBSF"). LBSF's obligations were guaranteed by Lehman Brothers Holdings Inc ("LBHI"). LBSF failed to make a payment due under the swap transactions on 15 September 2008 and LBHI failed to comply with its guarantee obligations. The swaps were subsequently terminated. The termination of the swaps was not itself an event of default under the notes, but it clearly raised the possibility that the Issuer would not have enough money to meet its obligations. The termination resulted in break costs in excess of $221 million payable by LBSF which LBSF (currently subject to insolvency proceedings in the United States) has not paid. The Issuer has not been able to enter into replacement swap transactions and is therefore currently unhedged. Finance Group Alert The conditions of the notes contained an event of default which read: "the Issuer… being unable to pay its debts as they fall due or, within the meaning of Section 123(1) or (2) (as if the words "it is proved to the satisfaction of the court" did not appear in Section 123(2)) of the Insolvency Act 1986 (as that section may be amended from time to time), being unable to pay its debts"; … provided that the Trustee shall have certified to the Issuer that such event is, in its sole opinion, materially prejudicial to the interests of the Noteholders. Section 123(2) is otherwise known as the "balance sheet" test. As amended by the wording of the event of default, Section 123(2) reads as follows: "A company is also deemed unable to pay its debts if … the value of the company’s assets is less than the amount of its liabilities, taking into account its contingent and prospective liabilities".[1] The holders of the A3 notes argued that the termination of the swap transactions had resulted in the Issuer becoming insolvent and that an event of default had occurred as a result. The Issuer and the holders of the A2 notes argued the opposite. the affiliate would release the Issuer from any further liability under the notes. The PECO was therefore thought to be an adequate substitute for the standard limited recourse wording used in non-UK securitisations. The Judgment: analysis of Section 123(2) of the Insolvency Act 1986 and the effect of the PECO Interpretation of Section 123(2) of the Insolvency Act 1986 A large part of the judgment was concerned with the requirement of Section 123(2) that "contingent and prospective liabilities" should be taken into account in assessing a company’s technical solvency. There is a limited amount of judicial guidance on how this test should be applied. The courts are usually concerned with the more common "cash flow" insolvency test (in Section 123(1)) as this usually forms the basis of creditor-led winding ups and administrations. Drawing upon Briggs J’s judgment in Re Cheyne Finance plc [2008] 2 AER 987, the judge concluded that "taking into account prospective and contingent liabilities" meant that: • Only present assets (i.e. not future and contingent assets) could be taken into account; • Future and contingent liabilities should not necessarily be attributed their face value; • A pure "accounting" treatment may not be appropriate if other factors were indicated. The test should take into account all the facts. The PECO Normal practice in securitisation transactions is to limit the liability of the issuer of the notes to the proceeds of the realisation of its assets. That was not done in the Eurosail transaction out of a concern that limiting recourse under the notes in that way would have resulted in interest payments on the notes being treated as distributions for UK tax purposes with the consequent denial of tax deductions for the Issuer[2]. Turning to the specific facts of the case: • Although LBSF's liability to the Issuer in connection with the termination of the swaps was not recognised in the Issuer’s accounts (because it was subject to ongoing litigation and might not be recovered), the liability of LBSF to make the termination payment should nevertheless be recognised as an asset of the Issuer for the purposes of Section 123(2) (albeit one which should be discounted to its face value to reflect secondary market valuations of Lehman debt); • The loss shown in the Issuer’s balance sheet which arose from the conversion of euro and US dollar liabilities to sterling at the prevailing spot rate could be ignored for the purposes of Section 123(2): the final Instead, the transaction addressed the rating agencies’ requirements in relation to insolvency remoteness by including a PECO. The PECO is a common device seen in many securitisations with a UK incorporated issuer. The terms of the PECO provided that, if there was an insufficient amount of money to pay all principal and interest due on any of the notes on enforcement, the holders of those notes could be required to sell their notes to an affiliate of the Issuer for a nominal consideration. In that eventuality, the commercial expectation was that 10 August 2010 2 Finance Group Alert • • redemption date in relation to these liabilities is 2045 and there is no way of knowing what the exchange rate will be at that time – the potential loss was therefore found to be too uncertain to be taken into account; a PECO mechanism - one which, depending on the factual circumstances surrounding the valuation of an issuer’s assets and liabilities, may be used by noteholders to allege that an event of default has occurred. The judge stated that the Issuer’s liability to noteholders was "fully funded" in the sense that any loss on the mortgage assets would reduce the liability of the Issuer to the noteholders through the operation of the principal deficiency ledgers (with respect, this was not an entirely accurate description in that the principal deficiency ledgers operate to divert income to pay down the notes – they do not automatically result in the writing down of the notes on the occurrence of a loss in the way which would be typical for a credit linked note); It is very clear from the judgment that the determination of whether an issuer is balance sheet insolvent for the purposes of Section 123(2) is not dictated by generally accepted accounting principles. For example, the liability of Lehman to pay the swap termination payment was taken into account and the unrealised loss resulting from the conversion of the Issuer’s now unhedged euro and US dollar liabilities into sterling was excluded – contrary to the treatment adopted in the Issuer’s accounts. There was no balance outstanding on the principal deficiency ledgers, which suggested that the Issuer was solvent. The judge’s conclusion was that the value of the Issuer’s assets was greater than the amount of its present liabilities taking into account its future and contingent liabilities. Therefore no event of default had occurred. The PECO It was found that the existence of the PECO made no difference to the analysis under Section 123(2). Even after the operation of the PECO, the Issuer's liabilities would remain, and the fact that they would be owed to an affiliate was irrelevant. The commercial expectation that the affiliate would write off the liabilities and not enforce against the Issuer did not reduce the amount of the liabilities - the affiliate was under no obligation to effect the write off. The judge did, however, express the view that the PECO was effective to make the Issuer insolvency remote in the sense that it provided a mechanism to divest the noteholders of their notes in circumstances in which they might otherwise seek to wind up the Issuer. Conclusion Whether, following the judgment, one views the Issuer as being insolvency remote is a matter of definition. The fact remains that the PECO did not protect the Issuer from becoming insolvent for the purpose of section 123(2) of the Insolvency Act 1986 in the way that standard limited recourse wording might be expected to. Arguably, therefore, there is a structural flaw in the great number of UK securitisations which use It is certainly possible to argue against the finding that the Issuer was solvent in this case. The margin between the Issuer’s assets and its liabilities was small - like other securitisation SPVs it had a nominal amount of capital and was not intended to accumulate significant amounts of profit. The termination of the swap transactions did not create a windfall for the Issuer - in broad terms, the termination payment was designed to enable the Issuer to replace its hedging protection. Therefore, had LBSF been able to pay the termination amount in full, it appears that the Issuer would have been back to the position it was on the issue date - fully hedged and solvent, but not by a very large margin. The judge’s own assessment of the value of LBSF's liability to pay the termination payment was about 35 per cent of its nominal amount - in other words about $143 million less than its nominal amount. Unless the excess spread in the transaction was very significant, it is hard to see why the $143 million shortfall did not result in the Issuer being insolvent or why in assessing the Issuer's solvency it was appropriate to rely upon the prevailing market value of Lehman debt, but not the prevailing market value of the US dollar and the euro against sterling. Moving away from the specifics of the case, the finding that accounting principles are not determinative for the purposes of Section 123(2) means that in practice it may be very difficult for lenders and noteholders to assess whether a borrower or issuer is insolvent on a balance sheet basis. It is possible that, in the future, more debt documents will include a basic balance sheet solvency test within financial covenants in addition to relying upon Section 123(2) to mitigate this issue. The uncertainly around the assessment of a company's solvency under 10 August 2010 3 Finance Group Alert Section 123(2) will also dissuade many creditors from relying upon an event of default based on Section 123(2) in the absence of other more clear cut events of default. Eurosail is a first instance decision. It remains to be seen whether the A3 Noteholders will seek to appeal. [1] Although not relevant to the outcome of the case , it is worth making two observations about the event of default: firstly, the reason that the wording “it is proved to the satisfaction of the court” is sometimes omitted from events of default which cross reference Section 123(2) is to avoid any argument that the event of default only bites after a court decides that the borrower/issuer in question is insolvent; secondly, it is unusual that this type of event of default is contingent upon the trustee forming a view that the insolvency is materially prejudicial to noteholders – that qualification normally only applies to events of default that relate to breaches of covenant. [2] It is worth noting that one of the benefits of the tax rules for securitisation companies introduced on 1 January 2007 is the exempting of issuers that meet the "securitisation company" test from the provisions that recharacterise interest as distributions. Anchorage Austin Beijing Berlin Boston Charlotte Chicago Dallas Dubai Fort Worth Frankfurt Harrisburg Hong Kong London Los Angeles Miami Moscow Newark New York Orange County Palo Alto Paris Pittsburgh Portland Raleigh Research Triangle Park San Diego San Francisco Seattle Shanghai Singapore Spokane/Coeur d’Alene Taipei Tokyo Warsaw Washington, D.C. K&L Gates includes lawyers practicing out of 36 offices located in North America, Europe, Asia and the Middle East, and represents numerous GLOBAL 500, FORTUNE 100, and FTSE 100 corporations, in addition to growth and middle market companies, entrepreneurs, capital market participants and public sector entities. For more information, visit www.klgates.com. K&L Gates is comprised of multiple affiliated entities: a limited liability partnership with the full name K&L Gates LLP qualified in Delaware and maintaining offices throughout the United States, in Berlin and Frankfurt, Germany, in Beijing (K&L Gates LLP Beijing Representative Office), in Dubai, U.A.E., in Shanghai (K&L Gates LLP Shanghai Representative Office), in Tokyo, and in Singapore; a limited liability partnership (also named K&L Gates LLP) incorporated in England and maintaining offices in London and Paris; a Taiwan general partnership (K&L Gates) maintaining an office in Taipei; a Hong Kong general partnership (K&L Gates, Solicitors) maintaining an office in Hong Kong; a Polish limited partnership (K&L Gates Jamka sp. k.) maintaining an office in Warsaw; and a Delaware limited liability company (K&L Gates Holdings, LLC) maintaining an office in Moscow. K&L Gates maintains appropriate registrations in the jurisdictions in which its offices are located. A list of the partners or members in each entity is available for inspection at any K&L Gates office. This publication is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. ©2010 K&L Gates LLP. All Rights Reserved. 10 August 2010 4