Losses from Hurricane Irene: Are You Covered?

advertisement

August 30, 2011 Practice Group: Losses from Hurricane Irene: Are You Covered? Insurance Coverage Hurricane Irene slammed into North Carolina early Saturday morning, August 27th, after already causing extensive damage across the Caribbean, and then proceeded up the Atlantic seaboard, knocking out power and leaving widespread destruction of property and at least 24 fatalities in its wake. Days before Irene made landfall in the continental United States, the hurricane caused major disruptions as a result of unprecedented preparedness actions taken across the East Coast. In addition to declaring states of emergency, authorities ordered the mandatory evacuation of approximately 2.5 million people. Mass transit systems in the storm’s projected path suspended operations, including the New York Metropolitan Transit Authority, the nation's largest mass transit system, which shut down its entire system, including all subways, buses, and commuter rails, for the first time in history. Major airports, ports, bridges, tunnels and highways were closed. Airlines cancelled more than 10,000 flights. Non-emergency travel was banned. Businesses and entertainment venues closed. Numerous events were postponed or cancelled, including professional sporting events, headliner concerts and all of the weekend's Broadway shows. Although the full extent of damage and disruption of business has yet to be assessed in concrete dollar terms, early estimates in the U.S. alone are about $7 billion. 1 Insurance policies can play an important role in helping businesses and individuals recover from the hurricane, as much of the property damage and business interruption loss suffered in the wake of Irene is insured. Indeed, early estimates are that as much as $3 billion of losses in the U.S. may be covered by insurance. 2 Businesses often have insurance not only for property damage losses, but also for economic losses arising from business interruption, including interruption incurred as a result of actions of civil authorities (such as the evacuations, mass transit suspensions and airport closures) and for extra expenses incurred to minimize or avoid business interruption. Even if the hurricane did not damage their own property, many businesses will have sustained losses because of damage to the property of business partners (such as customers or suppliers), damage to infrastructure, actions of authorities, transit interruption, power outages, and/or disruption of various other forms of production and support systems. Businesses that have suffered losses related to the hurricane are advised to carefully assess and document those losses and to review all potentially applicable insurance policies to determine if such policies may afford coverage. A careful review of its insurance policies will be an important component of a company’s efforts to recover from Hurricane Irene. In addition, early identification, characterization and presentation of loss information in light of potentially applicable insurance coverage law can help maximize coverage and make a substantial difference in a policyholder’s ultimate recovery. 1 See Derek Hawkins, Insurers Brace for Claims 2 See id. Post-Irene, Law360, New York (Aug. 28, 2011). Losses from Hurricane Irene: Are You Covered? Identifying Possible Coverage Most businesses have property insurance policies that cover damage to the policyholder’s property and also provide so called “time element” coverages—including “business interruption” and “extra expense” coverages—that insure against loss resulting from the inability to conduct business normally. Although the terms and conditions of property policies vary significantly, these policies frequently provide coverage for expense incurred in minimizing or preventing an insured loss and may even cover the policyholder for costs associated in establishing the extent of a loss. Some of the types of coverage afforded under property insurance policies include the following: Property Damage Coverages Covered Property The peril of “windstorm”—which encompasses hurricanes such as Irene—is typically a covered peril under property insurance policies, which generally cover “physical loss of or damage to” insured property. Insured property is often broadly defined by the policy or applicable law. By way of illustration, the standard-form Insurance Services Organization (ISO) “Standard Property Policy” form includes, among other property, the policyholder’s scheduled “building or structure,” “business personal property” such as “furniture and fixtures,” “machinery and equipment,” “stock” and leased property. 3 Policies also frequently provide coverage for unscheduled "newly acquired or constructed” property and the property of third parties that is in the policyholder’s “care, custody or control.” Preventing or Mitigating Insured Loss Most property policies contain a separate provision that reimburses a policyholder’s costs and expenses incurred in taking preventative measures to reduce or avoid an insured loss. Businesses may be able to recover under this separate grant of coverage for preventative expenses incurred such as the cost to board up windows, move equipment or otherwise secure property in advance of Irene. Debris Removal Most property policies cover expenses that the policyholder incurs to remove debris on the policyholder’s property following an insured event. By way of illustration, the ISO standard form states that the insurer “will pay [the policyholder’s] expense to remove debris of Covered Property caused by or resulting from a Covered Cause of Loss that occurs during the policy period.” 4 A business may have coverage under this separate coverage for expenses incurred to clean up its property after the hurricane. 3 4 CP 00 99 06 07 (2007). Id. 2 Losses from Hurricane Irene: Are You Covered? “Time Element” Coverages, Including Business Interruption Business Interruption “Business Interruption” coverage generally reimburses the policyholder for its loss of earnings or revenue resulting from covered property damage. By way of example, the ISO “Business Income (and Extra Expense) Coverage Form” 5 covers the loss of net profit and operating expenses that the policyholder “sustain[s] due to the necessary ‘suspension’ of [the policyholder’s] ‘operations’ during the ‘period of restoration.’” 6 Importantly in a hurricane context, where impact is likely to be felt throughout the country, business interruption insurance may cover loss of business income at premises that are physically remote from the damaged property if such premises are operated in connection with the damaged property. Extra Expense “Extra Expense” coverage generally covers the policyholder for certain extra expenses incurred to minimize or avoid business interruption and in order to resume normal operations. For example, the ISO standard form covers, among other things, “Extra Expense” to “[a]void or minimize the ‘suspension’ of business and to continue operations at the described premises or at replacement premises or temporary locations ….” 7 The form defines “Extra Expense” as “necessary expenses” that the policyholder “would not have incurred if there had been no direct physical loss or damage to property caused by or resulting from a Covered Cause of Loss.” 8 Contingent Business Interruption “Contingent Business Interruption” generally covers the policyholder with respect to losses, including lost earnings or revenue, as a result of damage, not to the policyholder’s own property, but to the property of a policyholder’s supplier, customer or some other business partner or entity, which damage renders that entity unable to conduct normal business operations. Again, this coverage is important in a hurricane context. A business may have coverage, for example, if it suffers lost profits because of lost production and sales due to the fact that a supplier’s manufacturing facility was damaged by Hurricane Irene. Actions of Civil Authority “Civil Authority” coverage may apply when a business suffers a loss of income and/or extra expenses arising from an “action” or “order” of a civil authority that prevents or impairs access to the premises of the business. Importantly, this type of coverage typically applies even in the absence of property damage to the policyholder’s property, although it may require damage to the property of others depending on the specific policy language. 5 6 CP 00 30 06 07 (2007). Id. 7 Id. 8 Id. 3 Losses from Hurricane Irene: Are You Covered? Businesses may be able to recover under this separate grant of coverage in light of, for example, the mandatory evacuations, mass transit suspensions and airport closures resulting from Hurricane Irene. Lack of Access to Insured Premises “Ingress And Egress” coverage is similar to “Civil Authority” coverage and may provide coverage for business losses sustained when access to the policyholder’s premises is prevented by an insured peril. Typical wording provides that the “policy covers loss sustained during the period of time when, as a direct result of a peril not excluded, ingress to or egress from real and personal property not excluded hereunder, is thereby denied.” A business may have coverage hereunder if the hurricane prevented access to its premises. Property damage typically is not a requirement for this coverage to apply. Service Interruption “Service Interruption” coverage provides insurance when services to an insured property are interrupted. These services can include electricity, gas, water, phone and sewer services. By way of illustration, a standard ISO endorsement provides coverage for “loss of Business Income or Extra Expense at the described premises caused by the interruption of service….” 9 The interruption of service includes “water supply services,” “communication supply services,” and “power supply services.” 10 Given the widespread power outages caused by Hurricane Irene, this grant of coverage may also come into play. Claim Preparation “Claim Preparation” coverage generally covers the policyholder for the costs associated with compiling and certifying a claim. Such coverage would apply, for example, to the expenses incurred by the policyholder in retaining consultants or claims accountants to assist in quantifying and preparing the claim submission to the insurer. As the aftermath of Hurricane Irene unfolds, it will be important for impacted businesses to ensure that all potentially responsive insurance policies, including excess policies, are considered and evaluated as a potential source of recovery. When attempting to identify potentially relevant types of coverage, it is important to remember that the insurance instruments containing these coverages may take a variety of different forms and may be differently termed. Where a company has a global insurance program, moreover, it is important to check the company’s “master” policy which can include difference-in-conditions and difference-in-limits clauses to plug any gaps in the coverage provided by the relevant “local” policy. Finally, it is important to note that many types of insurance coverage other than property/business interruption coverage may possibly be available to cover hurricane-related losses. 9 BP 04 57 01 06 (2004). 10 Id. 4 Losses from Hurricane Irene: Are You Covered? Identifying Potential Coverage Issues The availability of coverage may turn on a number of policy provisions or insurer defenses, including the following issues: What caused the loss? In the case of Hurricane Irene and other hurricanes, there may be multiple causes of loss. These may include the windstorm itself, high winds, tidal surges, floods, actions of civil authority and damage to the policyholder’s property or to other property. Determining the cause of loss is important because policies may exclude or limit coverage (including through application of sublimits and deductibles) for certain causes of loss, but not others. By way of example, property policies often exclude “flood” or contain sublimits applicable to “flood” that are substantially lower than the otherwise applicable policy limits. Likewise, “named” windstorms such as Hurricane Irene may be subject to higher self-insurance features. Courts have taken different approaches in determining the cause or causes of loss or damage. For example, many courts have adopted the “efficient proximate cause” doctrine, which supports a policyholder’s argument that a covered peril (such as a hurricane) cannot be excluded or forced into a sublimit simply because the chain of loss-producing events essentially ended in a "flood." Another approach is the “concurrent causation” doctrine, which supports a policyholder’s argument that coverage should be permitted when two or more causes appreciably contribute to a loss and at least one of those causes is a risk that is covered under the policy. Although some policies contain “anti-concurrent” causation language, which purports to exclude or sublimit a loss if any part of the causal chain involves the excluded or limited peril, such provisions may be held invalid. Does an exclusion apply? Insurers often respond to a claim by asserting that various exclusions in the policy apply to bar or curtail coverage. Some of the exclusions that insurers may assert in response to a Hurricane Irene claim may include the following: Flood Exclusion. Although property policies typically cover a variety of naturally occurring weather conditions, certain property policies may exclude flood and water damage. By way of illustration, a standard ISO form excludes loss or damage caused by “[f]lood, surface water, waves, tides, tidal waves, overflow of any body of water, or their spray ….” 11 As noted, however, such damage may be expressly covered by a separately purchased endorsement to the policy or by a separate insurance policy. Service Interruption Exclusion. Property insurance policies may exclude coverage for damage caused by interruption of services, such as electricity or natural gas. By way of illustration, a standard ISO form excludes loss or damage caused by “[t]he failure of power, communication, water or other utility service supplied to the de-scribed premises ….” 12 However, many policies expressly cover “service interruption” coverage as noted above. 11 12 CP 00 99 06 07 (2007). Id. 5 Losses from Hurricane Irene: Are You Covered? Pollution Exclusion. Property policies may contain pollution exclusions, which insures may argue bar losses resulting from, for example, water contamination arising from a hurricane. Again, not all policies exclude pollution-related loss, and pollution-related coverage may be expressly afforded in the policy, by endorsement, by separate policy or through a global “master” policy or umbrella coverage. Whether an exclusion may apply will depend upon the specific exclusionary language in the policy and whether the insurer can meet its burden to demonstrate that the exclusion unambiguously applies to the loss in question under applicable law. Ambiguities in policy language typically will be construed in favor of the policyholder under established principles of insurance contract interpretation. In addition, whether an exclusion applies may depend in large measure what is determined to be the cause of the loss, along with the applicable law on causation, as discussed above. What exactly is a “business interruption”? Insurers sometimes take a narrow view of what exactly comprises a suspension or interruption of business operations and argue that the phrase “necessary suspension of your operations” requires a complete cessation of all of the policyholder’s operations. On this basis, an insurer may refuse to pay for otherwise covered business income loss because the policyholder’s operations did not completely cease during the period of restoration. This should not be an issue under many policy forms, however. For example, an ISO standard form expressly defines “suspension” to include “[t]he slowdown or cessation of your business activities….” 13 Does coverage for business interruption depend on physical loss or damage to insured property? Although the business interruption coverage set forth in some policies expressly requires loss or damage to the policyholder’s property, this may not always be the case. “Covered property” may broadly include other property in which the policyholder may be said to have an “insurable interest.” In addition, as noted above, many policies expressly provide coverage where a supplier or customer suffers damage that results in interruption of the policyholder’s business. This also may be a non-issue if the policyholder is seeking coverage because of, for example, business interruption due to circumstances created by an action of civil authority or inaccessible ports, roads and closed airports. How is business interruption loss measured? Insurance policies typically contain provisions stating how business interruption losses are to be measured. In most cases, prior experience and projected earnings and expenses will be highly relevant. Because insurers often request detailed proof of claimed losses, affected businesses should keep comprehensive records of lost sales and revenues, and extra expenses that have been incurred. Moreover, accounting procedures should be established to collect and maintain adequate supporting documentation for claimed losses. Retention of the 13 CP 00 30 06 07 (2007). 6 Losses from Hurricane Irene: Are You Covered? services of a forensic accountant, working with insurance coverage counsel, is often advisable in formulating a claim for business interruption coverage. What are the applicable deductibles/retentions or “waiting periods”? Some policies have language providing that time element coverages only allow coverage after a certain dollar threshold or a certain period of time has expired. The application of these policy features may have a significant impact on the amount of the policyholder’s potential recovery. Many of these issues are nuanced and their resolution may vary based on the applicable law. Presenting a Claim The manner in which a claim is presented may have a significant impact upon the policyholder’s ultimate recovery. As noted, policies may have various exclusions, sublimits or deductibles depending on the particular peril causing the loss. The manner in which the policyholder characterizes a loss and presents its claim may impact upon whether these limiting features of the policy are applied to its claim. In all cases, a policyholder should evaluate its loss information in light of the policy wording and applicable law, and present the claim to the insurer or insurers in a coverage-promoting manner. Important Policy Conditions and Timing Deadlines Most policies purport to identify specific procedures that should be followed in presenting and pursuing a claim (including notice of loss, proof of loss, and suit limitation provisions), and some of these procedures may have timing deadlines associated with them. Failure to comply with these timesensitive procedural requirements, insurers will argue, may invalidate an otherwise covered claim. Thus, careful advance attention to these potential requirements is recommended. In addition, virtually all policies contain general “cooperation” provisions obligating the policyholder to cooperate with the insurer in its investigation of the loss. Advance Payments Businesses often need insurance to resume normal business operations and thus cannot afford a protracted adjustment period. Indeed, an insurer’s delay in making appropriate and periodic payments may cause an increase in the covered timeframe for business interruption and extra expense purposes. Importantly, many policies expressly require that insurers pay losses as incurred while the full extent of the loss is being adjusted. Conclusion Insurance is a valuable asset. Businesses that have suffered losses because of Hurricane Irene may have substantial financial protection through their insurance policies. Businesses should consider the scope of coverage under those policies carefully and should act promptly to recover all insurance coverage that may be available. Experienced insurance coverage counsel may be able to assist a 7 Losses from Hurricane Irene: Are You Covered? policyholder in identifying coverage, assessing the viability and strength of its potential claim, communicating with the insurers’ representatives, and ultimately maximizing the potential insurance recovery. Authors: John M. Sylvester john.sylvester@klgates.com +1.412.355.8617 Roberta D. Anderson roberta.anderson@klgates.com +1.412.355.6222 8

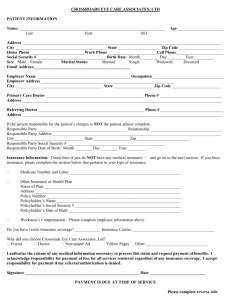

![[Date] [Policyholder Name] [Policyholder address] Re: [XYZ](http://s3.studylib.net/store/data/008312458_1-644e3a63f85b8da415bf082babcf4126-300x300.png)