Complexity DTC Mini-Project Proposal (Period 1):

Complexity DTC Mini-Project Proposal (Period 1):

Financial Time Series Analysis & Multi-fractal Replication

Prof. Robin Ball - University of Warwick, Physics Department

Prof. Anthony Neuberger – Warwick Business School, Finance Department

Background

The 2008 financial crisis has highlighted the fundamental importance of the financial markets to all our lives. After nearly three decades of unprecedented expansion, the credit crisis knocked nearly $16trn off of the value of global financial assets and plunged much of the world into a deep recession 8 .

Given the importance of the financial system, it is vitally important that we develop a greater understanding of market structure and dynamics. This research should provide important insights for improvingrisk management and asset analysis techniques. Continued innovation and greater investor confidence should also enable economic and market growth.

Project

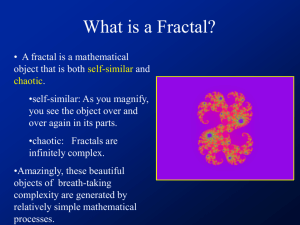

This project aims to investigate the statistical properties of financial market time series and identify theirstylised properties; these are properties that are common across assets and time periods. Building upon the research of

Mandelbrot et al the student will identify and calculate the fractal dimensions of financial asset returns and analyse how they change through time and across assets. It will then be necessary to investigate the concept of fractal time and attempt to develop a multi-fractal framework.

The results obtained in the first part of the project will then be used to attempt to build a multi-fractal market model that replicates the actual markets stylised properties; this may be done using an appropriate optimisation method such as genetic algorithms.

The multi-fractal market model is an important development for several reasons. Firstly, it may be used to generate an infinite size training set for developing trading models and in conjunction with statistical volatility models used to simulate derivative portfolios for risk management purposes. Secondly, it may be used to develop a Monte Carlo based option pricing model.

Extensions

Depending on the progress of the project the student may aim to develop the aforementioned Monte Carlo based option pricer and compare the results to the traditional Black-Scholes valuation framework. It may also be possible to analyse the distribution of returns in more depth and attempted to develop an analytical solution.

References

[1] R. Mantegna & E. Stanley, An Introduction to Econophysics , 2000, Cambridge University Press

[2] D. Sornette, Why Stock Markets Crash , 2004, Princeton University Press

[3] B. Mandelbrot, The (Mis)behaviour of Markets , 2004, Profile Books

[4] B. Mandelbrot, Fractals and Scaling in Finance: Discontinuity, Concentration, Risk , 1997, Springer

[5] P. Bak, M. Paczuski& M. Shubik, Price Variation in a Stock Market with Many Agents , 1996, Cowles Foundation Discussion Paper

[6] J.P. Bouchard, Power-laws in economy and finance: some ideas from physics , 2000, Service de Physique de l’Etat Condense

[7] R. Cont, Empirical Properties of Asset Returns: Stylized Facts & Statistical Issues , 2001, Institute of Physics Publishing

[8] McKinsey & Co, Global Capital Markets: Entering a New Era