Architectures for Agents in TAC SCM

John Collins

Wolfgang Ketter

Maria Gini∗

Dept of CSE

University of Minnesota

Minneapolis, MN

Dept of DIS

Erasmus University

Rotterdam, NL

Dept of CSE

University of Minnesota

Minneapolis, MN

Abstract

An autonomous trading agent is a complex piece of software

that must operate in a competitive economic environment.

We report results of an informal survey of agent design approaches among the competitors in the Trading Agent Competition for Supply Chain Management (TAC SCM).

Introduction

Organized competitions can be an effective way to drive research and understanding in complex domains, free of the

complexities and risk of operating in open, real-world economic environments. Artificial economic environments typically abstract certain interesting features of the real world,

such as markets and competitors, demand-based prices and

cost of capital, and omit others, such as personalities, taxes,

and seasonal demand.

Our primary interest in this paper is to provide an

overview of the design choices made by the designers of

agents for the Trading Agent Competition for Supply-Chain

Management (Collins et al. 2005) (TAC SCM), and to describe the design of the MinneTAC trading agent, which has

competed effectively in TAC SCM for several years.

Overview of the TAC SCM game

In a TAC SCM game, each of the competing agents plays

the part of a manufacturer of personal computers. Agents

compete with each other in a procurement market for computer components, and in a sales market for customers. A

game runs for 220 simulated days over about an hour of real

time. Each agent starts with no inventory and an empty bank

account. The agent with the largest bank account at the end

of the game is the winner.

Customers express demand each day by issuing a set of

RFQs for finished computers. Each RFQ specifies the type

of computer, a quantity, a due date, a reserve price, and a

penalty for late delivery. Each agent may choose to bid on

some or all of the day’s RFQs. For each RFQ, the bid with

the lowest price will be accepted, as long as that price is at or

below the customer’s reserve price. Once a bid is accepted,

∗

Supported in part by the National Science Foundation under

award NSF/IIS-0414466.

c 2008, American Association for Artificial IntelliCopyright gence (www.aaai.org). All rights reserved.

the agent is obligated to ship the requested products by the

due date, or it must pay the stated penalty for each day the

shipment is late. Agents do not see the bids of other agents,

but aggregate market statistics are supplied to the agents periodically. Customer demand varies through the course of

the game by a random walk.

Agents assemble computers from parts, which must be

purchased from suppliers. When agents wish to procure

parts, they issue RFQs to individual suppliers, and suppliers

respond with bids that specify price and availability. If the

agent decides to accept a supplier’s offer, then the supplier

will ship the ordered parts on or after the due date (supplier

capacity is variable). Supplier prices are based on current

uncommitted capacity.

Once an agent has the necessary parts to assemble computers, it must schedule production in its finite-capacity production facility. Each computer model requires a specified number of assembly cycles. Assembled computers are

added to the agent’s finished-goods inventory, and may be

shipped to customers to satisfy outstanding orders.

An agent for the TAC SCM scenario must make the following four basic decisions during each simulated “day” in

a competition:

1. decide what parts to purchase, from whom, and when to

have them delivered (Procurement).

2. schedule its manufacturing facility (Production).

3. decide which customer RFQs to respond to, and set bid

prices (Sales).

4. ship completed orders to customers (Shipping).

These decisions are supported by models of the sales and

procurement markets, and by models of the agent’s own production facility and inventory situation. The details of these

models and decision processes are the primary subjects of

research for participants in TAC SCM. Many factors, such

as current capacity, outstanding commitments of suppliers,

sales volumes and price distribution in the customer market,

are not visible to the agents.

Designs of agents for TAC SCM

We report findings from an informal survey which we sent

to the TAC SCM community via the TAC SCM discussion

email list in May 2007. The questionnaire was closed by

September 2007 and was completed by the best teams in

Team

Botticelli (B)

University

Brown University (USA)

CMieux (CM)

Carnegie Mellon University (USA)

CrocodileAgent (CA)

University of Zagreb (Croatia)

DeepMaize (DM)

University of Michigan (USA)

Foreseer (F)

MinneTAC (MT)

Cork Constraint Computation

Centre (Ireland)

Aristotle University of

Thessaloniki (Greece)

University of Minnesota (USA)

Southampton (S)

University of Southampton (UK)

TacTex (TT)

University of Texas (USA)

Tiancalli (T)

Benemerita Universidad

Autonoma de Puebla (Mexico)

Mertacor (M)

Team contact and role

Victor Naroditskiy

(team member for 4 years)

Michael Benisch

(team leader 2005/2006)

Vedran Podobnik

(team leader)

Chris Kiekintveld

(team member for 5 years)

David Burke

(main developer)

Andreas Symeonidis

(team member 2006)

John Collins

(team leader and designer)

Minghua He

(designer and programmer)

David Pardoe

(main developer for 5 years)

Daniel Macas Galindo

(team leader)

Table 1: Participating teams in the TAC SCM architecture questionnaire.

previous tournaments. In Table 1 we list the teams who responded to the questionnaire. We categorize the results according to our understanding of the research agendas of the

teams, and by the specific architectural emphases the teams

identified in their agent designs (see Table 2).

Constraint optimization. A supply-chain trading agent

must make its decisions subject to a number of internal and

external constraints. These constraints apply to parts of the

supply-chain, such as procurement (availability of supplies,

reputation), production (limited production capacity), sales

(limited demand, variable pricing), and fulfillment (shipments limited by finished goods inventory). Nearly all the

teams who answered our questionnaire used some form of

constraint optimization, so we list here the ones who highlighted it. The teams who focus on realtime optimization,

Botticelli (Benisch et al. 2004), DeepMaize (Kiekintveld et

al. 2006), Foreseer (Burke et al. 2006), MinneTAC (Ketter et al. 2007) use mainly third party optimization packages, including CPLEX1 , and lp solve2 . An exception is

CMieux (Benisch et al. 2006) which uses an internallydeveloped algorithm to solve a continuous knapsack problem for pricing customer offers.

Machine learning. Many agents use machine learning algorithms to learn from historical market data and have some

ability to learn during operation to adapt to changing situations. CMieux (Benisch et al. 2006), MinneTAC (Ketter

et al. 2007), and TacTex (Pardoe & Stone 2006) identified

the need to support learning and adaptation as primary concerns in the design of their agents. Both CMieux (Benisch et

al. 2006) and TacTex (Pardoe & Stone 2006) use the Weka3

machine learning tool set. MinneTAC is using Matlab4 in

combination with the Netlab5 neural network toolbox to develop and train market models, and to bootstrap the agent

with the resulting models. At runtime, MinneTAC updates

and adjusts those models using feedback and machine learning algorithms embedded in Evaluators.

Management of dynamic supply chains. The TAC SCM

simulation is an abstract model of a highly dynamic direct sales environment. Many teams have a strong research

focus on dynamic supply-chain behavior. These include

CMieux (Benisch et al. 2006), Foreseer (Burke et al. 2006),

Mertacor (Kontogounnis et al. 2006), MinneTAC (Ketter et

al. 2007), and Tiancalli (Galindo, Ayala, & Lopez 2006). As

a consequence teams strive for high flexibility in their agent

design, so that they can easily accommodate changes.

Telecommunication. The CrocodileAgent (Podobnik, Petric, & Jezic 2006) group is part of a larger group that focuses on autonomous agents for management of large-scale

telecommunication networks. They view TAC SCM as a

challenge in building an agent that can operate in a dynamic

environment, but they are also concerned with scalability

and other issues that go far beyond TAC SCM. They base

their design on the JADE6 framework, which is well-proven

for large-scale multi-agent systems.

Architecture. CrocodileAgent (Podobnik, Petric, & Jezic

2006) and Southampton SCM (He et al. 2006) have structured their agent decision processes around the the IKB (In3

http://www.cs.waikato.ac.nz/ml/weka/

http://www.mathworks.com/

5

http://www.ncrg.aston.ac.uk/netlab/

6

http://jade.tilab.com/

4

1

2

http://www.ilog.com/products/cplex/

http://sourceforge.net/projects/lpsolve

Research Agenda

Constraint optimization

Machine learning

Dynamic supply-chain

Telecommunication

Architecture

Empirical game theory

Decision coordination

Dealing with uncertainty

Team

B, CM, DM, F, MT

CM, MT, TT

CM, F, M, MT, T

CA

CA

MT

DM

CM, DM, M, MT, S

B, S

Architectural Emphasis

3rd party packages

External analysis framework, 3rd party packages

Flexibility

Scalability

IKB model for physical distribution

Blackboard architecture with evaluator chain

External analysis framework

Modularity

Modularity

Table 2: Research agendas of teams and their architectural emphasis.

formation, Knowledge, and Behavior) model (Vytelingum

et al. 2005), a three layered agent-based framework. The

first layer contains data gathered from the environment, the

second knowledge extracted from the data, and the third encapsulates the reasoning and decision-making components

that drive agent behavior. CrocodileAgent (Podobnik, Petric, & Jezic 2006) has also adopted the IKB approach. An

advantage of using JADE is that the separation of I, K &

B layers enables physical distribution of layers on multiple computers. Information layer agents parse out information from the TAC SCM server messages, while information and knowledge flows are implemented as JADE agent

communication-based messages.

MinneTAC uses a component based framework. All data

to be shared among components are kept in the Repository,

which acts as a blackboard (Buschmann et al. 1996). MinneTAC is the only team that emphasized a design that attempts to minimize the learning curve for a researcher who

wishes to work on a specific subproblem.

Empirical game theory. The DeepMaize team pursues

empirical game-theoretic analysis as one of their major research cornerstones. They employ an experimental methodology for explicit game-theoretic treatment of multi-agent

systems simulation studies. For example, they have developed a bootstrap method to determine the best configuration of the agent behavior in the presence of adversary

agents (Jordan, Kiekintveld, & Wellman 2007). They also

use game-theoretic analysis to assess the robustness of tournament rankings to strategic interactions. Many of their experiments require hundreds to thousands of simulations with

a variety of competing agents. To support their work they

have developed an extensive framework for setting up and

running experiments, and for gathering and analyzing the

resulting data.

Decision coordination. The supply-chain scenario places

a premium on effective coordination of decisions affecting

multiple markets and internal resources. Decision coordination is an explicit emphasis for the DeepMaize (Kiekintveld

et al. 2006), MinneTAC (Ketter et al. 2007), and Southampton (He et al. 2006) teams. This problem is commonly

viewed as one of enabling independent decision processes to

coordinate their actions while minimizing the need to share

representation and implementation details.

MinneTAC uses a blackboard approach to allow decision

processes to coordinate their actions through a common state

representation. Southampton uses the hierarchical IKB approach, in which the Knowledge layer can be viewed as a

type of blackboard. DeepMaize (Kiekintveld et al. 2006)

treats the combined decisions as a large optimization problem, decomposed into subproblems using a “value-based”

approach. The result is that much of the coordination among

decision processes is effectively managed by assigning values to finished goods, factory capacity, and individual components over an extended time horizon.

Dealing with uncertainty. TAC SCM is designed to

force agents to deal with uncertainty in many dimensions.

Sodomka et al. (Sodomka, Collins, & Gini 2007) provide a

good overview of the sources of uncertainty in the context

of an empirical study of agent performance. The Botticelli

group clearly identifies the problem of dealing with uncertainty as one of their main research goals in (Benisch et al.

2004). SouthamptonSCM (He et al. 2006) employs a bidding strategy that uses fuzzy logic to adapt prices according

to the uncertain market situation.

The design of MinneTAC

In designing MinneTAC we follow a component-oriented

approach. The idea is to provide an infrastructure that

manages data and interactions with the game server, and

cleanly separates behavioral components from each other.

This allows individual researchers to encapsulate agent decision problems within the bounds of individual components

that have minimal dependencies among themselves. Two

pieces of software form the foundation of MinneTAC: the

Apache Excalibur component framework7 and the “agentware” package distributed by the TAC SCM organizers. Excalibur provides the standards and tools to build components

and configure working agents from collections of individual

components, and the agentware package handles interaction

with the game server.

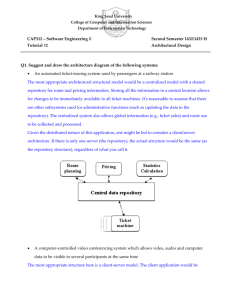

A MinneTAC agent is a set of components layered on

the Excalibur container, as shown in Figure 1. In the standard arrangement, four of these components are responsible for the major decision processes: Sales, Procurement,

Production, and Shipping. All data that must be shared

among components is kept in the Repository, which acts as

7

http://excalibur.apache.org/

a blackboard (Buschmann et al. 1996). The Oracle hosts

a large number of smaller components that maintain market

and inventory models, and do analysis and prediction. The

Communications component handles all interaction with the

game server. By minimizing couplings between the components, this architecture completely separates the major decision processes, thus allowing researchers to work independently. Ideally, each component depends only on Excalibur

and the Repository.

Excalibur Container

Procurement

Communications

Repository

Shipping

Production

Oracle

Sales

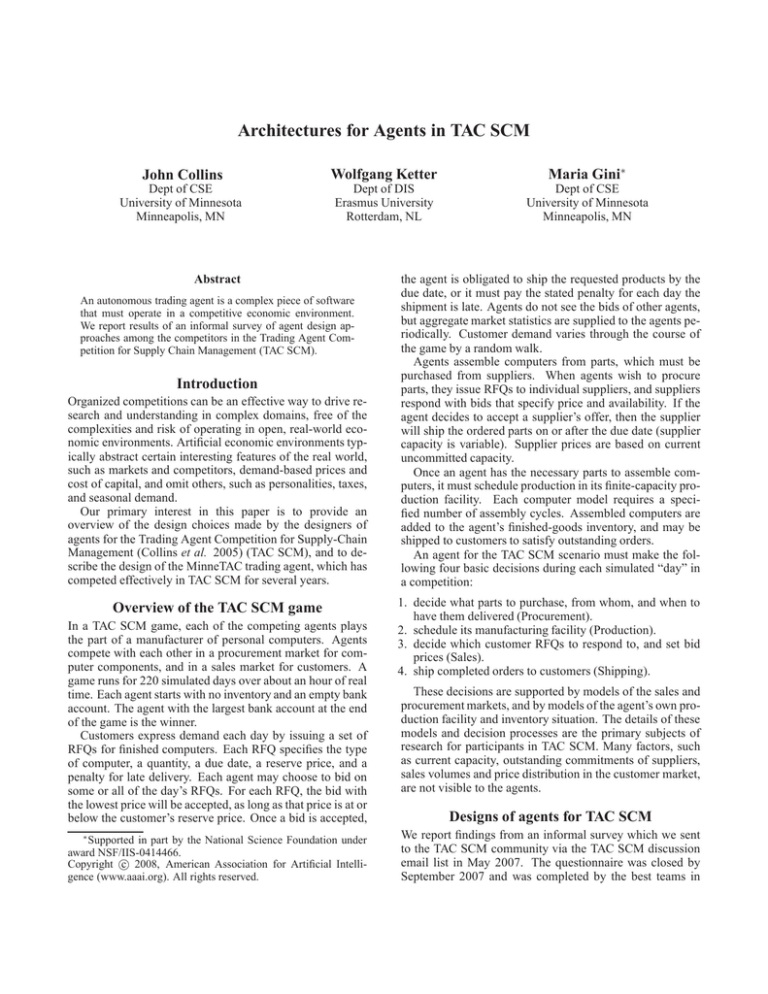

Events are generated in response to state transitions, as

visualized in Figure 2. Each simulated day begins in the

start of day state, during which the agent waits for the first

message from the server. In the receiving state, MinneTAC

handles all incoming data messages by storing them in the

Repository. Completion of the daily batch is signified by receipt of a “sim-status” message. The Repository responds

with a transition to the evaluating state and generation of

the data-available event. When a component receives dataavailable it is able to inspect the incoming data for the day’s

transactions and perform whatever analysis is needed to update its models. When this is complete, the Repository

generates the decision event, and transitions to the deciding state. When a component receives the decision event, it

is expected to finalize its decisions and record its outgoing

messages back in the Repository. At the conclusion of decision processing, the accumulated messages are returned to

the game server, and the Repository returns to the start of

day state.

init

start

message/

start of

game

game config

message/

incoming

message/

final config message/

start−of−game event

Figure 1: MinneTAC Architecture. Arrows indicate dependencies.

Repository.

The Repository is the one component that is visible to

other components. Its primary functions are storage and

management of agent state, event distribution, and support

of the Evaluation mechanism discussed below. At the beginning of each day of a game, new incoming messages are

received from the game server and deposited into the Repository. Once the full set of incoming messages has been received, events are generated to notify other components to

perform their analyses and decisions. In response to these

events, the decision components retrieve data and evaluations from the Repository, and record their decisions back

into it. Finally, the resulting decisions are retrieved from the

Repository by the Communications component and returned

to the server.

From an architectural standpoint, the Repository plays

the part of the Blackboard in the Blackboard pattern (Buschmann et al. 1996), and the remainder of the components, other than the Communications component, act as

Knowledge Sources. The Control element of the Blackboard

pattern is replaced by the Event and the Evaluable/Evaluator

mechanisms, which we now describe.

Events. A TAC Agent is basically a “reactive system” in

the sense that it responds to events coming from the game

server. These events are in the form of messages that inform

the agent of changes to the state of the world: Customer

RFQs and orders, supplier offers and shipments, etc. The

game is designed so that each simulated day involves a single exchange of messages; a set of messages sent from the

game server to the agent, and a set returned by the agent

back to the server.

start

of day

Once per day

last

day/

end of

game

incoming

message/

receiving

sim−status message/

data−available event

evaluating

/send messages

/decision event

deciding

Figure 2: States and transitions in the Repository component. Arcs are labeled with event/action pairs.

In processing the data-available and decision events, the

Repository acts as Subject and the other components as Observers in the Observer pattern (Gamma et al. 1995). This

approach has the advantage of eliminating dependency of

the Repository on the specific components. However, an

important limitation of the Observer pattern is that the sequence of notifications is not controlled, although in most

(single-threaded) implementations it is repeatable. But the

order of event processing is important for the MinneTAC decision processes. For example, it greatly simplifies the Sales

decision process to know that the current day’s Shipping decisions have already been made. To allow event sequencing

without introducing new dependencies, two events are generated by the Repository for each day of a game. The dataavailable event is a signal to read the incoming messages

and do basic data analysis. The subsequent decision event

is a signal to make the daily decisions and post the outgoing

messages back in the Repository. The decision event itself

provides an additional level of sequence control by allowing

components to “refuse” the event until one or more other

components (identified by role names) have made their decisions. Components that have refused the event will receive

it again once all other components have had an opportunity

to process it. To ensure that Sales decisions are made after

Shipping decisions, Sales must refuse to accept the decision

event until after it sees “shipping” among the roles that have

already processed it. No additional dependencies are introduced by this mechanism, since the role names are simply

added to the event object itself, and the names come from a

configuration file, not the code.

Oracle. The Oracle component is essentially a metacomponent, since its only purpose is to provide a framework

for a set of small configurable components, instances of the

type ConfiguredObject or its subtypes. These are used to

implement market models and to perform analysis and prediction tasks. The principal subtype is Evaluator, but a few

other types are supported as well. The Oracle itself reads its

configuration data when the agent starts, and uses it to create and configure the specified objects. ConfiguredObject is

an abstract class that has a name and an ability to configure

itself, given an XML clause. The Oracle creates ConfiguredObject instances and keeps track of them by mapping their

names to the created instances.

Another interesting subtype of ConfiguredObject is the

Selector. A Selector is a switch that can be used to select

different models or evaluators in different game situations.

For example, the early part of a game is typically characterized by customer prices that start high and fall rapidly as

agents acquire parts and begin building up inventories. The

behavior of the market during this early period is fairly predictable. Later in the game, prices are less predictable and

more sophisticated models may be useful. A DateSelector

can be used to switch between pricing models at a particular

preset dates, or a more sophisticated Selector can be used to

switch models once the initial price decline bottoms out.

Evaluators. To minimize coupling between components

when a component needs to make a decision, it will inspect

its own internal data and data in the Repository and run some

function. Operations on Repository data can be encapsulated in the form of Evaluations, and made available to other

components.

All the major data elements in the Repository are Evaluable types. Each Evaluable can be associated with some

number of associated Evaluations and with an EvaluationFactory, which maintains a mapping of Evaluation names to

Evaluator instances, and is responsible for producing Evaluations when they are requested. It does this by inspecting the

class of the Evaluable and the name of the requested Evaluation, and invoking the appropriate evaluate method on an

associated Evaluator. Evaluators implement back-chaining

by requesting other Evaluations in the process of producing

their results. Evaluators are hosted by the Oracle component, which is responsible for loading and configuring Evaluators. Evaluators are registered with the Repository when

they are configured, thus making them known to the EvaluationFactory. Figure 3 shows an example of some Evaluable

instances and a set of Evaluations that might be associated

with them. The price evaluation might combine parts cost

information with an estimate of current market conditions.

The profit evaluation would need parts cost information and

price. The sort-by-profit evaluation would need the profit

evaluations on the individual RFQs.

Evaluable

getEvaluation()

CustomerRFQList

CustomerRFQ

model

quantity

dueDate

reservePrice

sort−by−profit

price

profit

order−probability

Figure 3: RFQ evaluation example.

Example of using Evaluators for Sales

To illustrate the power of Evaluators, we show in Figure 4

the evaluation chain that is used to produce sales quotas and

set prices in a relatively simple MinneTAC configuration.

Each of the cells in this diagram is an Evaluator. A version of the Sales component called PriceDrivenSalesManager is conceptually very simple – it places bids on each

customer RFQ for which the randomized-price evaluator returns a non-zero value. The core of this chain is the allocation evaluator, which composes and solves a linear program

each game day that represents a combined product-mix and

resource-allocation problem that maximizes expected profit.

The objective function is

Φ=

h X

X

Φd,g Ad,g

d=0 g∈G

where Φ is the total profit over some time horizon h, G is

the set of goods or products that can be produced by the

agent, Φd,g is the (projected) profit for good g on day d,

and Ad,g is the allocation or “sales quota” for good g on

day d. The constraints are given by evaluators availablefactory-capacity, the current day’s effective-demand, projected future-demand, and by Repository data, such as existing and projected inventories of parts and finished products, and outstanding customer and supplier orders. Predicted profit per unit for each product type is the difference

between Evaluations called median-price and cost-basis for

those products.

The Evaluation generated by the allocation evaluator

gives desired sales quotas for each product over a time horizon. Given a sales quota for a given product and an orderprobability function, the simple-price evaluator computes a

price that is expected to sell the desired quota, assuming that

price is offered on all the demand for that product. In other

words, if the quota is 25 units and the demand is for 100

units, simple-price computes a price that is expected to be

accepted by only 25% of the customers. Since there is some

uncertainty in the predictions of price and order probability, randomized-price adds a slight variability to offer prices.

price−follower

slope−estimate

price−error

median−price

order−probability

cost−basis

allocation

available−supply

simple−price

effective−demand

randomized−price

demand

future−demand

available−factory−capacity

Figure 4: Evaluator chain for sales quota and pricing.

This improves the information content and reduces variability of the returned orders.

Conclusions and Future Work

The survey outcome shows that there are common themes

emerging from the different research groups on how to design a successful agent architecture. in addition to problemspecific approaches. There are also some strong differences

such as how to organize the communication between the different modules and which modules should own the data for

specific tasks.

With the design of MinneTAC we show one way to construct such an agent, using a readily-available component

framework. The framework provides the ability to compose

agent systems from sets of individual components based on

simple configuration files. We also show that two basic

mechanisms, event distribution with the Observer pattern

and our pipe-and-filter style Evaluator-Evaluation scheme,

permit an appropriate level of component interaction without introducing unnecessary coupling among components.

The ability to compose complex evaluator chains out of relatively simple, straightforward elements has greatly simplified the design of the decision components themselves.

References

Benisch, M.; Greenwald, A.; Grypari, I.; Lederman, R.;

Naroditskiy, V.; and Tschantz, M. 2004. Botticelli: A supply chain management agent designed to optimize under

uncertainty. ACM Trans. on Comp. Logic 4(3):29–37.

Benisch, M.; Sardinha, A.; Andrews, J.; and Sadeh, N.

2006. CMieux: adaptive strategies for competitive supply chain trading. In Proc. of 8th Int’l Conf. on Electronic

Commerce, 47–58. ACM Press.

Burke, D.; Brown, K.; Tarim, S.; and Hnich, B. 2006.

Learning Market Prices for a Real-time Supply Chain Management Trading Agent. In AAMAS06: Workshop on Trading Agent Design and Analysis (TADA/AMEC).

Buschmann, F.; Meunier, R.; Rohnert, H.; Sommerlad, P.;

and Stal, M. 1996. Pattern-Oriented Software Architecture: a System of Patterns. Wiley.

Collins, J.; Arunachalam, R.; Sadeh, N.; Ericsson, J.;

Finne, N.; and Janson, S. 2005. The supply chain management game for the 2006 trading agent competition. Technical Report CMU-ISRI-05-132, Carnegie Mellon University, Pittsburgh, PA.

Galindo, D.; Ayala, D.; and Lopez, F. L. Y. 2006. Statistic

analysis for the Tiancalli agents on TAC SCM 2005 and

2006. In Proc. 15th Int’l Conf. on Computing, 161–166.

Gamma, E.; Helm, R.; Johnson, R.; and Vlissides, J. 1995.

Design Patterns: Elements of Reusable Object-Oriented

Software. Addison-Wesley.

He, M.; Rogers, A.; Luo, X.; and Jennings, N. R. 2006.

Designing a successful trading agent for supply chain management. In Proc. of the 5th Int’l Conf. on Autonomous

Agents and Multi-Agent Systems.

Jordan, P.; Kiekintveld, C.; and Wellman, M. 2007. Empirical game-theoretic analysis of the TAC supply chain game.

In Proc. of the 6th Int’l Conf. on Autonomous Agents and

Multi-Agent Systems.

Ketter, W.; Collins, J.; Gini, M.; Gupta, A.; and Schrater,

P. 2007. A predictive empirical model for pricing and resource allocation decisions. In Proc. of 9th Int’l Conf. on

Electronic Commerce, 449–458.

Kiekintveld, C.; Miller, J.; Jordan, P.; and Wellman, M. P.

2006. Controlling a supply chain agent using value-based

decomposition. In Proc. of 7th ACM Conf. on Electronic

Commerce, 208–217.

Kontogounnis, I.; Chatzidimitriou, K. C.; Symeonidis,

A. L.; and Mitkas, P. A. 2006. A Robust Agent Design

for Dynamic SCM environments. In 4th Hellenic Conference on Artificial Intelligence (SETN’06), 127–136.

Pardoe, D., and Stone, P. 2006. Tactex-05: A champion supply chain management agent. In Proc. of the

Twenty-First Nat’l Conf. on Artificial Intelligence, 1389–

1394. Boston, Mass.: AAAI.

Podobnik, V.; Petric, A.; and Jezic, G. 2006. The

CrocodileAgent: Research for Efficient Agent-Based

Cross-Enterprise Processes. Lecture Notes in Computer

Science 4277:752–762.

Sodomka, E.; Collins, J.; and Gini, M. 2007. Efficient statistical methods for evaluating trading agent performance.

In Proc. of the 22nd Nat’l Conf. on Artificial Intelligence,

770–775. Vancouver, BC: AAAI.

Vytelingum, P.; Dash, R.; He, M.; and Jennings, N. 2005.

A Framework for Designing Strategies for Trading Agents.

Proc. IJCAI Workshop on Trading Agent Design and Analysis 7–13.