Journal of Statistical and Econometric Methods, vol.1, no.3, 2012, 63-78

advertisement

Journal of Statistical and Econometric Methods, vol.1, no.3, 2012, 63-78

ISSN: 1792-6602 (print), 1792-6939 (online)

Scienpress Ltd, 2012

Autoregressive Process Parameters Estimation

under Non-Classical Error Model

S. Ramzani1 , M. Babanezhad∗2 and M.A. Mohseni3

Abstract

Error in measuring time varying data setting is one important source

of bias in estimating of time series modeling parameters. When the

measurement error model is non-classic, this raises the question whether

the different measurement error model strategy might differently affect

the estimation of the time series modeling parameters. In this article,

we investigate this in Autoregressive (AR) model parameters estimation

under the non-classical measurement error model. We compare the

parameters estimation of the AR model under the classical and nonclassical error models. We perform analytically this on the AR model of

order p. Further, we confirm this through simulation study specifically

on the AR model of order 1.

Mathematics Subject Classification: 62M10

Keywords: Non-classical measurement error model, Autoregressive process,

Parameter estimation

1

2

3

Department of Statistics, Faculty of Sciences, Golestan University, Gorgan, Golestan,

Iran, e-mail: sakineh.ramzani@gmail.com

Department of Statistics, Faculty of Sciences, Golestan University, Gorgan, Golestan,

Iran, ∗ Corresponding author, e-mail: m.babanezhad@gu.ac.ir

Department of Statistics, Faculty of Sciences, Golestan University, Gorgan, Golestan,

Iran, e-mail: azim mohseni@yahoo.com

Article Info: Received : July 18, 2012. Revised : August 27, 2012

Published online : November 30, 2012

64

Autoregressive process parameters estimation under non-classical error model

1

Introduction

Similar to other types of data, time series data can be prone to measurement error (e.g., measuring of population abundances or density, air pollution

or temperatures levels, disease rates, medical indices) [1, 2]. That is a variable of interest is observed with some measurement error and modeled as an

unobserved component. Since various error models are already known to be

classical measurement error model [3, 4], (a measurement error is classical if it

is independent of unobserved variable), while in many situation measurement

error might follows the model as follows,

y t = γ 0 + γ 1 x t + ut

t = 1, ..., T

(1)

where the observed error prone variable yt is assumed to be related to the true

unobserved xt through the above model [2, 3]. This error model is referred

to as the non-classical measurement error model or error calibration model [3,

4]. Model (1) is the classical measurement error model when γ0 = 0, γ1 = 1.

This implies that E(Yt |Xt = xt ) = γ0 + γ1 xt , unlike the classical error model,

suggesting that Yt is a possibly biased measure of Xt . Here, it is assumed that

Xt and Ut are independent in each time t [3, 4]. For example [5] examined

the time series studies of air pollution (effect of P M10 ) and mortality, if Xt

and Yt are respectively the average personal exposure to P M10 and measured

ambient P M10 concentration on day t, then the slope γ1 measures the change

in personal exposure per unit change in a measured ambient concentration and

the intercept γ0 represents personal exposure to particles that does not drive

from external sources, but arises from particle clouds generated by personal

activities or unmeasured micro-environments.

Since Autoregressive process has a clear structure in presence measurement

errors, therefore it is a popular choice for modeling of time series in many fields.

This is especially true in population dynamics where AR(1), AR(2) models are

often employed (see e.g., [6, 7]). [4] develops tests to identification of measurement error in long and short memory series. [8] studies the parameters

estimation of Autoregressive models using naive, ARMA and corrected naive

methods under the classical error model and heteroskedastic measurement errors. [9] studies the asymptotic properties of estimators based on Yule-Walker

equations in autoregressive models with measurement error.

65

S. Ramzani, M. Babanezhad and M.A. Mohseni

The goal of this paper is to estimate the parameters of AR(p) process under

the non-classical error model (1), and compare the bias and corresponding

standard errors of the estimators with the classical error model.

In model (1), {xt } the true time series agent which is unobserved, instead

we observed {yt }, and {ut } is measurement error with heteroskedastic variance

i.e. σu2t .

Without loss of generality, suppose that unobserved time series {xt } is

mean zero Autoregressive process model of order p, AR(p),

Xt = φ1 Xt−1 + ... + φp Xt−p + et

t = p + 1, ..., T

(2)

where et is white noise (Random variables e1 , e2 , ..., en are independent and

identically distributed with a mean of zero. This implies that the variables all

have the same variance σe2 and Cor(ei , ej ) = 0 for all i 6= j. If, in addition,

the variables also follow a normal distribution (i.e., et ∼ N (0, σe2 )) the series

is called Gaussian white noise). This paper is summarized as follows. In the

next Section, the homoskedastic and heteroskedastic measurement errors are

described. In Section 3, we obtain the AR estimators and theirs variances

using different method under the non-classical error model. We compare the

extracted estimators with that [8] examined under the classical error model.

Section 4 provides the result of simulation studies. It should be noted that

method based on the ARMA result among the existing (naive and corrected

naive methods) is free from the estimation of σ̂u2t .

2

Hemosckedastic and Heteroskedastic Measurement Errors

Hemosckedastic measurement error refers to case that the variance of measurement error is constant. While historically constant measurement error

variances have been used, there are many situations that changing variances

be allowed, i.e., with respect to definition of the Heteroskedastic measurement error, we are allowed for the fact that measurement error variances could

change across observation. The variances of the Heteroskedastic measurement

errors introduce as a function of sampling effort and unobserved variable, i.e.

66

Autoregressive process parameters estimation under non-classical error model

σu2t (xt ) which may depend on xt through a function h(xt ) and may depend on

the sampling effort at time t. For asymptotic purpose it is assumed when the

measurement error is Heteroskedastic, σu2 is defined as the limit average of σu2t

as follows [8],

PT

2

t=1 σut

= σu2

(3)

limT →∞

T

3

Estimators under the Non-Classical Error

Model

In this section, we obtain the parameter estimation of AR process using

different methods. To make clear our example, we focus on the AR(p) and

provide our simulation on AR (1). We first assume Hemosckedastic measurement errors, we obtain four estimators so called the propose ARMA, naive

estimators, and corrected estimators.

3.1

Gold Estimator (GE)

Suppose {Xt }, is an AR(p) process as model (2) with the unknown parameter φu = [φ1 , , φp ]0 and σe2 . Parameter φbGold , without presence the measurement

error and using Yule- walker estimation method (YW), derived from the following equations,

b Gold = 0,

[b

γ(1) , , γ

b(p) ]0 − Γφ

−1 φ0u Ĝφu

=0

+

σe

σe3

b p × p sample covariance

whereb

γ(k) , is lag k of sample Autocovariance from Γ,

b are defined as follows,

matrix and G

γ

b(0) −b

γ(1) −b

γ(2) · · · −b

γ(p)

γ

b(0) · · · γ

b(p−1)

−b

γ

γ

b

γ

b

·

·

·

γ

b

(1)

(0)

(1)

(p−1)

.

.

...

b = ..

b= .

.

.. , G

Γ

.

.

.

.

.

.

.

.

.

.

.

γ

b(p−1) · · · γ

b(0)

−b

γ(p) γ

b(p−1) γ

b(p−2) · · · γ

b(0)

67

S. Ramzani, M. Babanezhad and M.A. Mohseni

3.2

Naive Estimator (NE)

Using some regularity conditions, the convergence of sample Autocovariances can be determined as follows [10]

p

γ

by,|t−s| → γ12 γ|t−s|

and

p

γ

by,(0) → γ12 γ(0) + σu2

p

∀t 6= s

∀t = s

where → stands for convergence in probability. As T → ∞, the parameters

estimating equation for φ is following;

2

γ1 γ

b(0) + σu2 · · ·

γ12 γ

b(1)

..

..

...

. −

.

γ12 γ

b(p−1)

γ12 γ

b(p)

···

γ12 γ

b(p−1)

..

.

γ12 γ

b(0) + σu2

φ1

..

. = 0.

φp

2

Hence, the naive estimators (φbnaive , σ

be,naive

) under the error model (1) and

using YW methods will converge in probability to the following equations;

and

p

φbnaive → (γ12 Γ + σu2 I)−1 γ12 γ T = (γ12 Γ + σu2 I)−1 γ12 ΓφGold ,

p

2

σe,naive

→ γ12 γ(0) + σu2 − γ12 γ T (γ12 Γ + σu2 I)−1 γ12 γ.

2

Also the asymptotic bias of σe,naive

will converge in probability to;

p

2

2

σ

be,naive

−σ

be,Gold

→ ((γ12 − 1)γ(0) ) + σu2 − γ12 γ T (γ12 Γ + σu2 I)−1 γ12 γ + γ T (Γ)−1 γ.

For example when p = 1, i.e. AR(1), it is implied that,

γ2γ

p

φbnaive →

γ12 γ(1)

= λφGOld ,

γ12 γ(0) + σu2

where λ = γ 2 γ1 (0)

2.

1 (0) +σu

Using the results of [8], the naive estimator of φ under the classical error model

(γ0 = 0, γ1 = 1),

γ(1)

p

= λφGOld ,

φbnaive →

γ(0) + σu2

where λ =

γ(0)

2.

γ(0) +σu

68

Autoregressive process parameters estimation under non-classical error model

3.3

ARMA Estimator

ARMA method is based on the fact that if Xt is an AR(p) process with

parameters φ and ut is i.i.d with mean zero and constant variance σu2 , then

([11, 12]),

φ(B)(yt − γ0 ) = γ1 et + φ(B)ut = θ(B)bt ,

follows ARM A(p, p), where parameters in the ARMA model are the same as

in the original Autoregressive model. Also bt is white noise with mean zero

and variance σb2 , φ(z) = 1−φ1 z −...−φp z p , θ(z) = 1−θ1 z − −θp z p and B is the

backward shift operator with B j Wt = W(t−j) . A simple approach to estimate

φARM A , is to fit an ARM A(p, p) model to the observed {Yt − γ 0 } series. The

asymptotic properties of φbARM A , can be computed. For example, when p=1

([10], chapter 8),

!−1

!

!

−1

2 −1

b

(1 − φ )

(1 + φθ)

φARM A

φ

∼

.

, T −1

=N

−1

−1

b

(1 + φθ)

(1 − θ2 )

θARM A

θ

It can be conclude φbARM A ∼

= AN

φ,

(1+φθ)2 (1−φ2 )

T (φ+θ)2

, where AN is denoted ap-

proximately normal. There are two solutions for θ1 , but only one leads to a

stationary process. Defining,

γ12 σe2 + σu2 (1 + φ21 )

,

k=

φ1 σu2

then,

θ1 =

−k +

and

θ1 =

−k −

√

√

k2 − 4

,

2

if 0 < φ1 < 1

k2 − 4

, when − 1 < φ1 < 0.

2

Therefore for classical error model, one can obtain the similar result as

non-classical one just by substituting σe2 instead of γ12 σe2 , because γ1 et is white

noise with mean zero and variance γ12 σe2 .

3.4

Corrected Naive Estimator (CNE)

The problem with the naive estimator arises from the bias in the estimator

69

S. Ramzani, M. Babanezhad and M.A. Mohseni

of γy,(0) . For the eliminate bias, we obtain the following corrected estimator;

PT

−1

T

bY − σ

φbCN E = Γ

bu2 Ip

γ

bY,(1) , ..., γ

bY,(p)

2

σ

but

. Like moment estimator in linear regression, φbCN E can

where

= t=1

T

have problems for small samples. One reason is the distribution of the corrected estimator of γy,(0) , γ

by,(0) − σ

bu2 can have positive probability around zero,

so the estimate of γy,(0) may be negative (Bounaccorsi, 2010). To gard this

bY − σ

problem,we propose a modified version of this estimator; if Γ

bu2 Ip is non

positive definite, then φbCN E := φbnaive . In line with the proposition of [8], the

estimator φbCN E is consistent if,

PT

σ

b2 p

2

(4)

limT →∞ σ

bu = t=1 ut → σu2

T

σ

bu2

Theorem 1 Consider model AR(1), assuming independence Ut and σU2 t of

Xt , and using the following equations,

PT

2

γ(0)

γ12 γ(0)

t=1 σut

2

σu = limT →∞

, λ́ =

,

,λ = 2

2

T

γ1 γ(0) + σu

γ(0) + σu2

and

σσ2u2

= limT →∞ var

σ

bu2

, σu4

= limT →∞

P

σu4t

, E(u4 ) = limT →∞

T

t

P

t

E(u4t )

,

T

then the asymptotic variance of φbCN E under non-classical error model is as

follows,

"

#

2

2

2

4

4)

2

−

λ

φ

φ

1

(1

−

φ

)

σ

E(u

u

γ14 1 − φ2

+

+ 2 σσ2u2 .

avar(φbCN E ) =

+

2

2

T

λ

γ(0)

γ(0)

γ(0)

By assuming variance σu2 to be constant and E(u4 ) = δσu4 ,

"

#

2 2

2

2

−

λ

(1

−

λ́)

[φ

(δ

−

1)

+

1]

φ

1

γ14 1 − φ2

+ 2 σσ2u2 +

avar(φbCN E ) =

,

T

λ

γ(0)

λ́2

and under normality measurement error, i.e δ = 3;

1

avar(φbCN E ) =

T

"

γ14

#

2

2

2

φ

2

−

λ

(1

−

λ́)

[2φ

+

1]

.

+ 2 σσ2u2 +

1 − φ2

λ

γ(0)

λ́2

70

Autoregressive process parameters estimation under non-classical error model

( For more details of proof see Appendix).

Finally using the proposition (3) of [8], it can be concluded that the asymptotic variance of φbCEE has approximately normal distribution. Under the classical error model, similar results can be observed by substituting γ0 = 0, γ1 = 1.

4

Simulation study

In this section, simulation studies are carried out for AR(1) process. In

order to investigate the bias of the estimators and theirs standard errors, a

simulation study is done for the case where {xt } is AR(1) process. The simulation is done in three steps:

• At first step, T segment was simulated from AR(1) for {xt }

• At second step, by assuming normality of the measurement error ut , yt

was simulated from model (1) for all the different values of γ1 between

(0.5, 2).

• At third step, the biases and standard errors of estimators are evaluated,

with 500 replication for steps (1) and (2), given different values of β =

0.1, 0.3, 0.5, 0.7, 0.9 and T = 100, 200, 500, λ = 0.5, 0.75, 0.9 under the

non-classical error model.

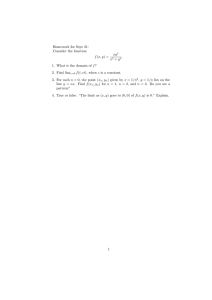

Figure 1, represents the simulation result under the non-classical measurement error model. The left and right panels are respectively bias and standard

error of the estimators. It is clear that biases are decreased when the values

of T are increased, but bias behavior of the estimators is uniform by changing

values of the γ1 , that is it shows the low influence of the γ1 . Also it can be

observed that the bias of the naive estimator is more than the other estimators.

Similarly, We observe that the influence of γ1 and T respectively in the naive

and ARMA estimators standard error.

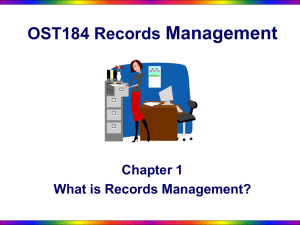

Figure 2 shows the second scenarios of the obtained estimator through the

considered values of φ. It can be seen that, for the small values of φ, the bias of

the ARMA estimator is more than the other estimators, because identification

from of the ARMA model be harder.

71

S. Ramzani, M. Babanezhad and M.A. Mohseni

0.5

1.0

1.5

Average S.E by T=200

1.0

1.5

S.E

Average bias by T=200

0.0 0.4 0.8

gamma1

−0.06

gamma1

2.0

0.5

1.0

1.5

gamma1

2.0

2.0

cee

ARMA

naive

Gold

0.05

−0.12

1.5

0.15

Average S.E by T=500

S.E

Average bias by T=500

−0.04

gamma1

1.0

2.0

cee

ARMA

naive

Gold

gamma1

cee

ARMA

naive

Gold

0.5

1.5

2.0

cee

ARMA

naive

Gold

0.5

S.E

3.0

1.5

cee

ARMA

naive

Gold

0.0

−0.06

1.0

−0.14

bias

0.5

bias

Average s.E by T=100

cee

ARMA

naive

Gold

−0.14

bias

Average bias by T=100

0.5

1.0

1.5

2.0

gamma1

Figure 1: bias of the estimators of the Autoregressive process of order one for

γ1 = (0.5, 2) and T = 100, 200, 500 and φ = 0.5, λ = 0.75.

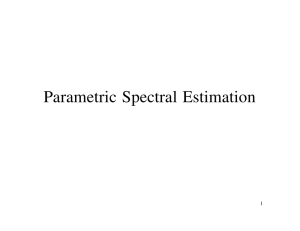

Figure 3 represents the simulation result of the corresponding estimator’s

standard error. It clearly can be seen that by changing the considered values of

φ, the naive and ARMA estimators considerably vary. This might be because

of the impact of increasing of the standard error of γˆ1 .

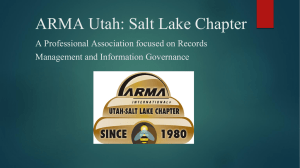

Figure 4 shows the presentation of the estimators behavior and corresponding standard errors by different values of the λ, where λ is function of γ1 and

γ2γ

σu2 , i.e., λ = γ 2 γ1 (0)

2 . As is shown, when λ values is increased, bias is de1 (0) +σu

creased. Because it might be the les impact of σu2 . The standard error of the

naive estimator is more than the ARMA estimator when the values of γ1 and

λ is simultaneously increased.

72

Autoregressive process parameters estimation under non-classical error model

1.5

−0.02

bias

2.0

0.5

1.0

1.5

Average bias by p=.5

Average bias by p=.7

−0.12

1.0

1.5

2.0

gamma

bias

gamma

−0.15 −0.05

gamma

cee

ARMA

naive

Gold

0.5

cee

ARMA

naive

Gold

−0.08

−0.04

1.0

−0.04

0.5

bias

Average bias by p=.3

cee

ARMA

naive

Gold

−0.12

bias

Average bias by p=.1

2.0

cee

ARMA

naive

Gold

0.5

1.0

1.5

2.0

gamma

−0.10

cee

ARMA

naive

Gold

−0.25

bias

Average bias by p=.9

0.5

1.0

1.5

2.0

gamma

Figure 2: bias of the estimators of the Autoregressive process of order one for

γ1 = (0.5, 2) and φ = 0.1, 0.3, 0.5, 0.7, 0.9 and T = 300, λ = 0.75.

73

S. Ramzani, M. Babanezhad and M.A. Mohseni

Average S.E by p=.3

1.0

1.5

S.E

0.5

1.0

1.5

1.0

1.5

2.0

gamma

0.20

Average S.E by p=.7

2.0

cee

ARMA

naive

Gold

0.05

S.E

Average S.E by p=.5

0.20

gamma

cee

ARMA

naive

Gold

0.5

1.0

2.0

gamma

0.05

S.E

0.5

cee

ARMA

naive

Gold

0.0

4

cee

ARMA

naive

Gold

0

S.E

8

2.0

Average S.E by p=.1

0.5

1.0

1.5

2.0

gamma

0.20

cee

ARMA

naive

Gold

0.05

S.E

Average S.E by p=.9

0.5

1.0

1.5

2.0

gamma

Figure 3: standard error of the estimators of the Autoregressive process of

order one for γ1 = (0.5, 2) and φ = 0.1, 0.3, 0.5, 0.7, 0.9 and T = 300, λ = 0.75.

74

Autoregressive process parameters estimation under non-classical error model

Average s.E by lamda=.5

1.0

1.5

S.E

0.4

1.0

1.5

2.0

1.5

cee

ARMA

naive

Gold

0.1

−0.06

1.0

0.3

Average S.E by lamda=.75

S.E

Average bias by lamda=.75

2.0

0.5

1.0

1.5

2.0

Average S.E by lamda=.9

−0.06

1.0

1.5

gamma1

2.0

S.E

Average bias by lamda=.9

0.05 0.15

gamma1

−0.02

gamma1

cee

ARMA

naive

Gold

0.5

0.5

gamma1

cee

ARMA

naive

Gold

0.5

bias

2.0

gamma1

−0.14

bias

0.5

cee

ARMA

naive

Gold

0.1

cee

ARMA

naive

Gold

−0.25 −0.10

bias

0.7

Average bias by lamda=.5

cee

ARMA

naive

Gold

0.5

1.0

1.5

2.0

gamma1

Figure 4: bias of the estimators of the Autoregressive process of order one for

γ1 = (0.5, 2) and λ = 0.5, 0.75, 0.9 and T = 300, φ = 0.5.

75

S. Ramzani, M. Babanezhad and M.A. Mohseni

5

Conclusion

This study concerns the estimation of parameter for AR(1) process in the

presence of non-classical error model. From theoretical point of view and also

simulation study, it is concluded that Corrected naive and Gold estimators

have similar behaviors from biases and the standard errors in the presence of

the non-classical measurement error model. Moreover, when the parameters

of the model are like that the model is markedly far from to be a white noise,

i.e., φ and γ1 are increased simultaneously, it can be seen that the bias and

standard error of the ARMA estimator closed to CNE and GE. Further the

naive estimator has not good performance, because with increasing γ1 parameter, the corresponding standard error is increased. A comparison between the

estimators, it can be obtained that Corrected naive estimator is more efficient

than the other estimators. These results show the trace of non-classical measurement error model and measurement error, and considering that tends to

be more valuable and informative.

ACKNOWLEDGEMENTS. This study was granted by Golestan University, Gorgan, Golestan, Iran.

Appendix

In this Section we shad light on some formulas that we have pointed out

in the text.

!

√

0

γ

by − γy

.

is

obtained,

where

γ

=

γ

,

...,

γ

The asymptotic behavior of T

y

y,(0)

y,(p)

σ

bu2 − σu2

The variance of φbCEE is determined by using the delta method.

P

Z

If Zt0 = [Yt2 , Yt Y!t+1 , ..., Yt Yt+p ] and Z = Tt t , then the asymptotic behavior

√

√

γ

by − γy

T

T Z. By taking the limit exists, we can

is

equivalent

to

σ

bu2 − σu2

√

evaluate limT →∞ Cov( T Z) = Q, where

Q=

"

Qγ Qγ,σu2

Qσu2 ,γ Qσ2 2

σu

#

.

76

Autoregressive process parameters estimation under non-classical error model

For computation of the matrix Q, we should obtain elements of the matrix Q,

i.e., limT →∞ Cov(b

γy,(p) , γ

by,(r) ) and limT →∞ Cov(b

γy(r) , σ

bu2 ). To do so, we obtain

limT →∞ Cov(b

γy,(p) , γ

by,(r) )

X

1 X

(Ys − E(Ys ))(Ys+r − E(Ys+r )))

= limT →∞ E( (Yt − E(Yt ))(Yt+p − E(Yt+p ))

T

t

s

− limT →∞ T E(b

γy,(p) )E(b

γy,(r) )

1 XX

= limT →∞ (

E ((γ1 Xt + Ut )(γ1 Xt+p + Ut+p )(γ1 Xs + Us )(γ1 Xs+r + Us+r )))

T t s

− γy,(p) γy,(r) .

Now it follows from the latter that,

E(γ1 Xt + Ut )(γ1 Xt+p + Ut+p )(γ1 Xs + Us )(γ1 Xs+r + Us+r ).

Assuming independence of Xt and Ut , we have,

= I(r = 0)[γ12 E(Xt Xt+p )E(Us2 )] + I(p = 0)[γ12 E(Xs Xs+r )E(Ut2 )]

2

+ I(p = r = 0)[E(Ut2 Us2 )] + I(p = r 6= 0)[E(Ut2 Ut+p

)]

+ I(s = t + p − r)[γ12 E(Xt Xs )E(Ut+p Us+r )]

+ I(s = t + p)[γ12 E(Xt Xs+r )E(Ut+p Us )]

+ I(s = t − r)[γ12 E(Xt+p Xs )E(Ut Us+r )]

+ I(s = t)[γ12 E(Xt+p Xs+r )E(Ut Us )] + [γ14 E(Xt Xt+p Xs Xs+r )].

Replacing in the previous equation, it can be concluded,

limT →∞ Cov(b

γy,(p) , γ

by,(r) )

X

X

1

I(r = 0)[γ12 E(Xt Xt+p )E(Us2 )])

= limT →∞ (

T t s

1 XX

+ limT →∞ (

I(p = 0)[γ12 E(Xs Xs+r )E(Ut2 )])

T t s

1 XX

I(p = r = 0)[E(Ut2 Us2 )])

+ limT →∞ (

T t s

1 XX

2

+ limT →∞ (

I(p = r 6= 0)[E(Ut2 Ut+p

)])

T t s

1 XX

+ limT →∞ (

I(s = t + p − r)[γ12 E(Xt Xs )E(Ut+p Us+r )])

T t s

77

S. Ramzani, M. Babanezhad and M.A. Mohseni

1 XX

+ limT →∞ (

I(s = t + p)[γ12 E(Xt Xs+r )E(Ut+p Us )])

T t s

1 XX

I(s = t − r)[γ12 E(Xt+p Xs )E(Ut Us+r )])

+ limT →∞ (

T t s

1 XX

+ limT →∞ (

I(s = t)[γ12 E(Xt+p Xs+r )E(Ut Us )])

T t s

1 XX 4

[γ E(Xt Xt+p Xs Xs+r )]) − γy,(p) γy,(r) .

+ limT →∞ (

T t s 1

If Cov(b

γy,(p) , γ

by,(r) ) = qγrp , then using simple calculation for different form

of r, p = 0, 1, we will have;

qγ,00 = γ14 q00 + 4γ12 γ(0) σu2 + E(u4 ) − σu4

qγ,01 = γ14 q01 + 4γ12 γ(1) σu2

qγ,11 =

γ14 q11

+2

γ12 γ(0) σu2

+

γ12 γ(2) σu2

and also it implies Qγb,bσu2 = 0, because

+ limT →∞

PT

t=1

σu2t σu2t+1

T

1 XX

E(Yt Yt+p )b

σu2t ) − γy,(p) σu2 = 0.

limT →∞ Cov(b

γy,(p) , σ

bu2 ) = limT →∞ (

T t r

Now, is obtained the corrected naive estimator under AR(1) model, φbCN E =

using three variables of the Taylor expansion evaluated at (b

γy,(0) , γ

by,(1) , σ

bu2 ),

we have,

φ 2

1

(b

γy,(1) − φb

γy,(0) ) +

σ

b .

φbCN E = φGold +

γ(0)

γ(0) u

Then,

φ2 2

1 2

q

+

φ

q

−

2φq

+

var(φbCN E ) =

σσu2 .

γ11

γ00

γ01

2

2

T γ(0)

T γ(0)

γ

by,(0)

2,

γ

by,(0) −b

σu

Substituting var(φGold ) =

1

2

2 [q11 +φ q00 −2φq01 ]

T γ(0)

(where qrp is auto-covariance

between γ

bx,(p) and γ

bx,(r) ) in the above equation, it can be compute that,

"

P 2 2 #

2

1

−

φ

1

t σut σut+1

2 2

var(φbCN E ) = γ14

+

lim

+

2γ

σ

γ

+

γ

T

→∞

(0)

(2)

1 u

2

T

T γ(0)

T

h

i

1

1 2

2

2

2

2

4) − σ4 ) −

8φγ

γ

σ

φ

(4γ

γ

σ

+

+

E(u

(1)

(0)

1

u

1

u

u

2

2

T γ(0)

T γ(0)

+

φ2 2

σσu2 .

2

T γ(0)

Proof is proved with simplification.

78

Autoregressive process parameters estimation under non-classical error model

References

[1] A.J. Scott, T.M.F. Smit and R.G. Jones, The application of time series

methods to the analysis of repeated surveys, International Statistical Review, 45, (1977), 13-28.

[2] A.J. Scott and T.M.F. Smit, Analysis of repeated survays using time series

methods, Journal American Statistical Association, 69, (1974), 674-678.

[3] J.P. Bounaccorsi, Measurement error models, methods and applications,

New York, Chapman Hall/CRC, Taylor and Francis Group, 2010.

[4] K. Tanka, A unified approach to the measurement error problem in time

series Models, Econometric Theory, 18, (2002), 278-296.

[5] F. Dominici and S. Zeger, A measurement error model for time-series

studies of air pollution and mortality, Biostatistics, 1, (2000), 157-175.

[6] B. Dennis and M.L. Taper, Density dependence in time series observations

of natural populations: estimation and testing, Ecology, 64, (1994), 205224.

[7] D.W. Williams and A.M. Liebhold, Influence of weather on the synchrony

of gypsy moth (Lepidoptera: Lymantriidae) outbreaks in New England,

Envirnomental entomlogy, 24, (1995), 987-995.

[8] J. Staudenmayer and J.P. Bounaccorsi, Measurement error in linear

autoregressive models, Journal American Statistical Association, 471,

(2005), 841-852.

[9] K.C. Chanda, Asymptotic properties of estimators for autoregressive models with errors in variables, The Annals of Statistics, 24, (1996), 423-430.

[10] P.J. Brockwell and R.A. Davis , Time series: Theory and methods, Second

Edition, New York, Springer, 1991.

[11] G.E.P. Box, G.M. Jenkins and G. Reinsei Time Series Analysis: Forecasting and Control, 3rd ed., New York: Prentice-Hall, 1994.

[12] M. Pagano, Estimation of Models of Autoregressive Signal Plus White

Noise, The Annals of Statistics, 2, (1974), 99-108.