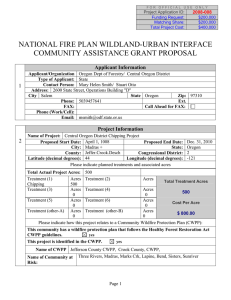

This letter serves to announce our new State-Wide Community Wildfire... for Texas A&M Forest Service (TFS). The purpose of...

advertisement