Practitioner’s Perspective Electronic Signatures — Increasing Use Means Increasing Questions

advertisement

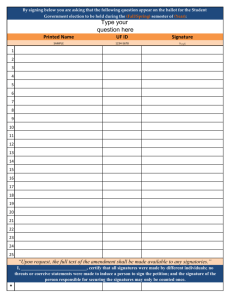

Guide to Computer Law—Number 283 Practitioner’s Perspective by Holly K. Towle, J.D. Electronic Signatures — Increasing Use Means Increasing Questions These are the kinds of questions we have begun to get from an increasing array of clients: Holly K. Towle is a partner with Kirpatrick & Lockhart Preston Gates Ellis LLP (K&L Gates), an international law firm, and chair of the firm’s E-merging Commerce group. Holly is located in the firm’s Seattle office and is the coauthor of The Law of Electronic Commercial Transactions (2003, A.S. Pratt & Sons). Holly.Towle@KLgates.com, 206-623-7580. ■ We are now receiving reports from [X] businesses signed with electronic signatures. They no longer wish to send us original signed copies by mail. Do we have to accept that? ■ We recently did an e-mailing of the paperwork for our [X] program, which is wonderful given the reduced mailing costs. Several customers responded by sending the forms with their names simply typed in on the signature line. Is that enough? At the most basic level, the answer to the first question is “No” and the answer to the second is “Yes.” But the real answer is more complex, fact-dependent and impacted by new laws. This article discusses the basic question of “what is an electronic signature” and related issues regarding their use. To put this into context, recall that not all contracts or documents require a “signature.” Many times a shake of the hand, a nod of the head or another “manifestation of assent” such as clicking an “I Agree” button is all that is required to form a contract. Here we are talking about situations in which something must be “signed” or bear a “signature.” When faced with such a requirement, or when signatures are simply preferred, what is an “electronic signature”? What is an electronic signature? The federal Electronic Signatures in Global and National Commerce Act (“E-Sign”) provides this definition: The term “electronic signature” means an electronic sound, symbol, or process, attached to or logically associated with a contract or other record and executed or adopted by a person with the intent to sign the record. Practitioner’s Perspective appears periodically in the monthly Report Letter of the CCH Guide to Computer Law. Various practitioners provideindepth analyses of significant issues and trends. A “record” means “ information that is inscribed on a tangible medium or that is stored in an electronic or other medium and is retrievable in perceivable form.” That’s gobbledygook for almost any medium except an oral conversation, i.e., a paper is a record; an email is a record; and a taped conversation is a record because each can be retrieved in a perceivable form for at least some instant in time. There is a reason spies take walks out of the range of tape recorders to convey information: oral conversations aren’t records because they can’t be retrieved even momentarily. CCH GUIDE TO COMPUTER LAW So which of these is an electronic signature if it appears in an email: 1. “Holly Towle” showing in the Sender line; 2. “Holly” typed in at the bottom of the email after the text; 3. “Holly Towle“ inserted as an image at the bottom (assume I signed in ink, scanned the signed paper into my computer, and then cropped it to create an image file that I use whenever I want to “sign” something); 4. “H” appearing at the bottom or “:)” (smiley face) which is my favorite way to sign (don’t worry, I’m making this up); 5. My use of a PKI encryption process that attaches my private key to the document (“digital signature”); NUMBER 283 Is that all there is to it? It never is. Proving the existence of a sound, symbol or process provided with the right intent is only one piece of a larger puzzle. Here are samples of additional questions that anyone relying on an electronic signature would want to ask: 1. How will I know who typed in “Holly”? This is the “attribution” question which plagues e-commerce (see my previous article “Getting to Yes in an Electronic Age” CCH Guide to Computer Law Report Letter No. 279, January 21, 2005, and Chapter 6 of my book The Law of Electronic Commercial Transactions). It is also the reason for Nos. 5 and 6 — digital signatures using public/ private key encryption and biometric identifiers — are used by some to provide more reliability regarding who actually signed. They are not generally required by law; to the contrary, U.S. law forbids states from preferring one technology over another (although some countries do prefer some technologies). 6. Insertion or use of a biometric identifier; 7. Attachment of a little sound recording saying “All my best, Holly;” or 8. Attachment of a scanned copy of a contract that I initially signed by hand. No. 8 is not an electronic signature: I delivered electronically a copy of a handwritten signature, but did not sign electronically in the first place. Each of Nos. 1-7 could be an electronic signature because each meets the first condition of being a sound, symbol or process: Nos. 1-4 and 6 could be symbols; No. 5 (or 6) could be a process, and No. 7 is a sound. But none will be a signature (electronically or otherwise) unless I add it with the intent to sign the record. There’s a New York case illustrating the point. A company faxed an unsigned guaranty to a person who refused to start work without one. When it came time to enforce the guaranty, the company said it never signed; the recipient said that the company’s name appearing at the top of the fax was a sufficient signature. The court said that because federal law requires every fax to show the name of the sender, the sole fact that the name appeared was not, alone, enough to show intent that the name count as a signature. That makes No. 1 the most suspect of the examples given that every email shows the sender’s name. But No. 1 could count in some circumstances (e.g., we’ve been exchanging emails for months and I send one saying “Okay, we have a deal” — my knowledge that the sender line includes insertion of my name may be enough — in the “paper world,” letterhead has been held to be enough). Parties adopt these or other technologies to make the attribution task easier. Each technology presents its own issues and may or may not be practical, acceptable to those involved, or actually allow attribution. For example, any identifier stored in an insecure computer can become problematical. If I store my little signature stamp (No. 3) in my computer and an unauthorized person gains access to it, then their insertion of it onto a document is not my signature. That’s a forgery and you will not be able to tell the difference (just like you cannot now tell the difference if someone talented forges my check). 2. What is my risk if I can’t prove who typed in “Holly”? The answer will vary with the transaction. Selection of an electronic signature method should be appropriate to the risks involved— if you are lending $50 million on the strength of an electronic signature, the risks are obvious. If you are a travel agent covered by the Bank Secrecy Act’s rules for opening new accounts, complying electronically may need to involve use of biometric identifiers or the like. One size does not fit all. 3. Am I looking at the right law? I quoted E-Sign and although it has a sweeping preemptive effect, it does not apply to intrastate transactions and contains other scope limitations or exceptions, such as for all articles of the Uniform Commercial Code except Articles 2 and 2A (sales and leases of goods) and for wills. Regulators have certain powers and the Securities and Exchange Commission is illustrative of a regulator with extensive “e-consent” rules. E-Sign also does not preempt the Uniform Electronic Transactions Act (UETA) if a state adopted the 1999 uniform version — about 46 states CCH GUIDE TO COMPUTER LAW have adopted UETA but not all adopted the uniform version. Other laws can also apply and sometimes parties will have signed master contracts governing what must, or must not, be done. The e-signature method chosen needs to work under the laws and contracts that apply to the particular transaction. 4. May I assume that electronic records are just like paper records? No. E-Sign and UETA have special rules regarding electronic records and so do some states and regulators (again, the SEC is illustrative). Electronic records are also more likely to be covered by new laws regarding information security. Some of them include, for example, an obligation to provide notice to customers and regulators upon breach of the security of the system. Again, applicable law can depend on what you are doing, who you are and where you are. 5. Is use of electronic signatures practical? This question is important but often ignored. Electronic signatures may be imperative for an online business that needs signatures on standard documents, but impractical in other settings. Consider the typical real estate or business closing involving unique documents with page substitutions during the closing, and parties such as title insurance companies that may or may not be willing to accept an electronic signature. That is not to say that electronic closings are not possible; they can be impractical, however. Must everyone deal electronically even if they don’t want to? Generally, no. E-SIGN says that it does not “require any person to agree to use or accept electronic records or electronic NUMBER 283 signatures, other than a governmental agency with respect to a record other than a contract to which it is a party.” That’s E-Sign. Parties are free to contract to use them as much, or as little, as they would like. However, UETA says that consent to deal electronically as to one transaction cannot be binding as to other transactions. This creates a need to define the “transaction” appropriately. If a consumer customer of yours is willing to deal electronically in areas where paper would otherwise be required, can you simply substitute electronics? No. If a law requires information to be provided to a consumer on paper, such as a Truth in Lending Act disclosure statement for a consumer credit transaction, the consumer cannot simply agree to accept an electronic substitute. Although consent to the substitute is required, it must be preceded by extensive disclosures regarding software and hardware and other matters. (See 15 USC § 7001(c) for more information and/or Chapter 11 of my book). Under that rule, consider the second question listed at the beginning of this alert regarding “program X:” if X involves consumer information required to be delivered on paper, the disclosing party is not free, unilaterally, to substitute electronic disclosures even if the consumer does not know or care about the federal rule (and/or additional UETA rules). Those rules exist and need to be considered. The above is not a complete list of issues that should be considered. There are more and they, along with many other issues relating to use of electronics in commerce, can be impacted by increasing legislation and other developments. It may be time to take a look at your practices vis-à-vis current law, if you have not already done so.