LIST OF DOCUMENTS IN THIS FILE: 1. MEMO

advertisement

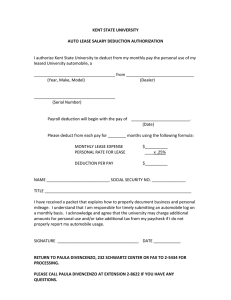

LIST OF DOCUMENTS IN THIS FILE: 1. MEMO 2. MATRIX 3. SUBSTANTIATION 4. AUTO LEASE SALARY DEDUCTION AUTHORIZATION 5. AUTOMOBILE MILEAGE LOG 6. INSTRUCTIONS TO COMPLETE AUTOMOBILE MILEAGE LOG INTERDEPARTMENTAL CORRESPONDENCE Kent State University Kent, Ohio Treasury & Tax Services TO: Kent State University Employees with University or Dealer-provided automobiles FROM: Paula DiVencenzo, Tax Manager SUBJECT: Recordkeeping for Your University or Dealer-Provided Automobile DATE: September 23, 2011 All employees who receive a KSU or dealer-provided automobile must keep a daily log by month of the business use of their vehicle. In addition, odometer readings must be recorded at the beginning and the end of each month to determine the business/personal use of the vehicle for the month. The log must be completed “at or near” the time of business usage of the vehicle for each month of the year. Completed logs for all employees other than those who work in intercollegiate athletics must be sent to Treasury & Tax Services, Room 232 Schwartz Center. Intercollegiate athletics employees will send completed logs to their business office who will then forward them on to Treasury & Tax Services. All completed monthly logs are due in the Treasury & Tax Services office by the 10th of the following month. Timely completion and submission of the log on a monthly basis is essential for substantiation of the business/personal use of your employer or dealer-provided automobile. Failure to maintain the log will result in the entire value of your monthly automobile lease being considered income taxable to you. In order to assist you in this matter, a copy of a log is attached for your use along with guidelines for using the form. Also, a business/personal automobile mileage decision matrix is attached for your use as well as a write-up which explains how KSU will calculate taxable income for personal use of your vehicle. Please note that business mileage is allowed only to the extent it exceeds your normal commute. Thank you for your cooperation with this IRS mandated requirement. If you have questions or need additional information concerning this matter immediately please call me at extension 28622. KENT STATE UNIVERSITY EXAMPLES OF BUSINESS/PERSONAL AUTOMOBILE MILEAGE AS OF JANUARY 1, 2011 DESCRIPTION OF TRAVEL TYPE OF TRAVEL BUSINESS (Note 1) PERSONAL HOME TO REGULAR JOB LOCATION Example: You travel from your home to your regular KSU job location. X HOME TO TEMPORARY WORK LOCATION X Example: You travel from your home to a short-term assignment at the Trumbull Campus when you have a regular Kent job location. Example: You travel from your home to Ohio State University. Example: You travel to a conference or workshop in Cleveland. HOME TO A SECOND JOB LOCATION Example: You have a regular office at Kent and a second job at Stark. You travel from your home to Stark. X REGULAR JOB LOCATION TO HOME Example: You travel from a regular KSU office to your home. X REGULAR JOB LOCATION TO SECOND JOB LOCATION Example: You travel from a regular KSU office to the Salem Campus. X REGULAR JOB LOCATION TO TEMPORARY WORK LOCATION Example: You travel from a regular KSU office to a short-term assignment at the Tuscarawas Campus. Example: You travel from a regular KSU office to a meeting at Youngstown State University. X TRAVEL AROUND CAMPUS Example: You travel from a regular KSU office in Kent to a business meeting across campus. X TRAVEL ON AN EXTRA DAY Example: You normally work Monday through Friday, however, due to a special event, your workload, or a request from your supervisor, you work on a Saturday. SECOND JOB LOCATION TO A TEMPORARY WORK LOCATION Example: You have a regular Kent office and a second job at Stark. You travel from Stark to a third short-term assignment at the Trumbull Campus. X X KENT STATE UNIVERSITY EXAMPLES OF BUSINESS/PERSONAL AUTOMOBILE MILEAGE AS OF JANUARY 1, 2011 (CONTINUED) DESCRIPTION OF TRAVEL TYPE OF TRAVEL BUSINESS (Note1) PERSONAL SECOND JOB LOCATION TO HOME Example: You have a regular Kent office and a second job at Stark. You travel from Stark to home. X SECOND JOB LOCATION TO REGULAR JOB LOCATION Example: You have a regular Kent office and a second job at Stark. You travel from Stark to your Kent office. X TEMPORARY WORK LOCATION TO HOME Example: You travel from a short-term assignment at East Liverpool to your home. Example: You travel from Indiana University to your home. Example: You travel from a conference or workshop to your home. X TEMPORARY WORK LOCATION TO REGULAR JOB LOCATION Example: You travel from a short-term assignment at the Ashtabula Campus to your regular Kent office. X TEMPORARY WORK LOCATION TO SECOND JOB LOCATION Example: You travel from a short-term assignment at the Stark Campus to another short-term assignment at the Geauga Campus when your regular office is in Kent. X VACATION TRAVEL WITH NO BUSINESS TRAVEL Example: You take your yearly family vacation to Cedar Point. SHOPPING TRIPS, ENTERTAINMENT TRAVEL, FAMILY USE OF VEHICLE AND/OR OTHER NON-BUSINESS USE Example: You take a trip to the mall and/or to the movie theater. Example: Your wife uses the vehicle. Example: Your son uses the vehicle. SECOND TRIP TO/FROM REGULAR JOB LOCATION TO/FROM HOME IN THE SAME DAY Example: You travel to/from home and to/from your regular KSU job location for the second time in one day. X X X NOTE 1: Business mileage is the total miles traveled less the total normal commuting miles. LEGEND: HOME: THE PLACE WHERE YOU RESIDE REGULAR JOB: YOUR PRINCIPAL PLACE OF EMPLOYMENT TEMPORARY WORK LOCATION: A PLACE WHERE YOUR WORK ASSIGNMENT IS IRREGULAR OR SHORT-TERM, GENERALLY A MATTER OF DAYS OR WEEKS. SECOND JOB: A REGULAR SECOND ASSIGNMENT ALONG WITH YOUR REGULAR JOB. KENT STATE UNIVERSITY SUBSTANTIATION OF BUSINESS MILEAGE AND CALCULATION OF TAXABLE INCOME FOR PERSONAL USE OF AN EMPLOYER OR DEALER- PROVIDED AUTOMOBILE Your automobile log is a record to substantiate business mileage and to calculate personal mileage for your employer-provided or dealer-provided automobile. The substantiated business mileage is excluded from taxation while the personal mileage must be treated as taxable income. The calculation to determine taxable income for a tax year is as follows: Assume your logs for the year display the following information: END OF YEAR ODOMETER READING START OF YEAR ODOMETER READING TOTAL MILES DRIVEN IN THE YEAR 10,500 7,500 3,000 TOTAL BUSINESS MILES FOR THE YEAR FROM THE MONTHLY LOGS 2,000 TOTAL PERSONAL MILES DRIVEN FOR THE YEAR = TOTAL MILES DRIVEN IN THE YEAR LESS TOTAL BUSINESS MILES DRIVEN IN THE YEAR 1,000 PERSONAL MILES PERCENTAGE 1,000 3,000 = 33 1/3% Using the percentage from above and an IRS provided automobile lease value of $6,350 the following yearly calculation will be made: TAXABLE INCOME FOR THE TAX YEAR FOR PERSONAL USE $6,350 X 33 1/3% = $2,116 The taxable income for December of the prior tax year and January through November of the current tax year will be compared to the monthly payroll withholdings related to the vehicle for the same period. If the taxable income is greater than the amount withheld from the pay of the employee for the tax year this excess amount will be added to W-2 taxable income for the current year with no withholding of taxes. For example: Assume the taxable income for the twelve months (December last year and January through November of the current year) was $2,116. Assume the monthly amount deducted from your pay each of these twelve months was $100. The amount of additional taxable income for the year would be: Taxable income for the twelve months Amount deducted from your pay for the twelve months Additional reported compensation ($2,116 – $1,200) $2,116 $1,200 $916 Timely completion and submission of the log on a monthly basis to the proper KSU office is essential for substantiation of the business/personal use of your employer or dealer-provided automobile. Failure to maintain the log will result in the entire value of your monthly automobile lease being considered income taxable to you. KENT STATE UNIVERSITY AUTO LEASE SALARY DEDUCTION AUTHORIZATION I authorize Kent State University to deduct from my monthly pay the personal use of my leased University automobile, a ____________________________________ from ______________________________ (Year, Make, Model) (Dealer) ____________________________________ (Serial Number) Payroll deduction will begin with the pay of __________________________. (Date) Please deduct from each pay for ________ months using the following formula: MONTHLY LEASE EXPENSE PERSONAL RATE FOR LEASE $__________ ____x .25% DEDUCTION PER PAY $__________ NAME ____________________________ SOCIAL SECURITY NO. _______________ TITLE _________________________________________________________________ I have received a packet that explains how to properly document business and personal mileage. I understand that I am responsible for timely submitting an automobile log on a monthly basis. I acknowledge and agree that the university may charge additional amounts for personal use and/or take additional tax from my paycheck if I do not properly report my automobile usage. SIGNATURE ____________________________________ DATE ____________ RETURN TO WILLIAM HENDRICKS, 234 SCHWARTZ CENTER, FOR PROCESSING OR FAX TO 2-5434. PLEASE CALL ME AT EXTENSION 2-8622 IF YOU HAVE ANY QUESTIONS. Actual mileage logs can be located at: http://www.kent.edu/bas/forms/automobilemileagelog.cfm KENT STATE UNIVERSITY DATE BUSINESS MILES AUTOMOBILE MILEAGE LOG FOR THE MONTH OF _______, YEAR ______ NAME: _____________ DESTINATION(S) BUSINESS PURPOSE(S) TYPE EXPENSES: AMOUNT EXAMPLE START OF MONTH ODOMETER READING _________________ END OF MONTH ODOMETER READING __________________ SIGNATURE: ______________________________ TOTAL MILES DRIVEN IN THE MONTH _________________ TOTAL BUSINESS MILES DRIVEN IN THE MONTH ________________ TOTAL PERSONAL MILES DRIVEN IN THE MONTH _______________ Please mail to Bill Hendricks, 234Schwartz Center by the 10th of each month. Ph: 2-8622 Fax: 2-5434 DATE: _______________ Automobile Mileage Log Instructions as of January 1, 2011 The log must be completed at the time of business usage of the vehicle for each month of the year. 1. Enter the month and year for which the log is being submitted. 2. Enter your name. 3. For each business use of your vehicle, enter: A. The date for the business use of your vehicle. B. The business miles driven for the day. C. The destination for the business use of your automobile for that day. D. The business reason for incurring business miles for that day. 4. Enter the odometer reading for the start of the month for this reporting period. 5. Enter the odometer reading for the end of the month for this reporting period. 6. Enter the total miles driven in the month - subtract beginning of month odometer reading from end of month odometer reading. This field will automatically calculate when completing this form on-line. 7. Enter the total of the business miles driven in the month. This field will automatically calculate when completing this form on-line. 8. Enter the total personal miles driven in the month - subtract the total business miles from the total miles driven. This field will automatically calculate when completing this form on-line. 9. Sign and date the form. Send the original form by the 10th of each month to: Treasury, Tax and Risk Management Services 232 Schwartz Center NOTE: Intercollegiate Athletics employees should send completed logs to their business office, which will then forward them on to Treasury & Tax Services.