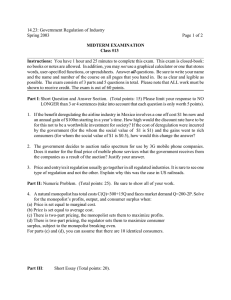

Session 12: Conducting a market review toolkit Conditions: Impact on ICT Regulation

advertisement

Session 12: Conducting a market review toolkit Training on Competition and Changing Market Conditions: Impact on ICT Regulation Addis Ababa, 6th – 9th November, 2007 By Dr Chris Doyle chris.doyle@cdoyle.com www.cdoyle.com Warwick Business School & Consultant World Bank 1 Assessing relevant markets Step 1 Identify functional characteristics of products and services offered in the communications sector Step 2 Describe the functions provided by the service (e.g. local voice telephony to and from a fixed location) 2 Assessing relevant markets Step 2 Identify retail and wholesale products Retail products are sold to end users directly by service providers Step 3 Wholesale products are sold by network and service operators to other network and service operators 3 Assessing relevant markets Step 3 For each identified product apply the hypothetical monopolist test (HMT) The HMT supposes that a monopoly provides the product in question Step 3 continued For each identified product apply the HMT in a geographic region where conditions are similar Conditions are similar where price offers are broadly the same Can this hypothetical monopolist profitably increase price by 5-10%? 4 Assessing relevant markets Step 4 5 Assessing relevant markets Step 4 To perform the HMT evidence on the market will be helpful Step 5 Collect data about the market – demand and supply-side conditions should be assessed 6 Assessing relevant markets Step 5 Applying the HMT (i) Step 5 continued Applying the HMT (ii) Start by looking at the demand-side of the market Use competitive prices in HMT Would an hypothetical monopolist be constrained by providers of similar products? If prices are regulated, assume that they are equivalent to competitive prices 7 Assessing relevant markets Step 5 continued Applying the HMT (iii) Apply a 10% price increase Using information and data assembled on demand determine to what extent demand would fall following such a price increase Step 5 continued Applying the HMT (iv) If demand falls significantly (elasticity is high), the firm would not be able to make profitable increase in price Demand falls significantly where there are products offering very similar functional characteristics and their prices are similar 8 Example of Step 5 We commence with a product defined as domestic voice telephony services provided to and from a fixed location to residential users If this product is offered by a monopolist (in reality it is offered by competing fixed and wireless local loop operators), could it profitably increase price 5-10%? A close substitute is mobile voice telephony services provided to residential users Test whether mobile services would constrain the hypothetical monopolist – this depends on how willing end users are to substitute fixed with mobile 9 Assessing relevant markets Step 6 If the HMT shows that the monopolist cannot succeed in sustaining higher profits from a price change, widen the market to include the products which constrain the firm Step 7 Example, fixed services may be constrained by mobile – market may need to include both 10 Assessing relevant markets Step 7 When the hypothetical monopolist can succeed in sustaining higher profits from a price increase, this will determine the candidate relevant market Step 8 It is a candidate relevant market because we have not finished applying the test, go to step 8 11 Assessing relevant markets Step 8 For a candidate relevant market assess whether a firm supplying similar products may easily switch production and compete with the monopolist Step 9 If supply-side substitution is possible, this negates the power of the monopolist 12 Assessing relevant markets Step 9 At the point where both demand and supplysubstitution does not constrain the hypothetical monopolist this defines the market boundaries Step 10 End HMT, relevant market identified 13 The relevant market and ex ante regulation Step 10 In the relevant market assess: (i) Entry barriers Step 11 If legal and/or structural barriers to entry exist, move to next step If legal and/or structural barriers to entry do not exist – market does not require ex ante regulation 14 The relevant market and ex ante regulation Step 11 In the relevant market assess: (ii) Dynamic effects Step 12 If innovation is limited, move to next step If innovation is likely to present opportunities for new entry – market does not require ex ante regulation 15 The relevant market and ex ante regulation Step 12 In the relevant market assess: (iii) whether competition law would be sufficient to deal with market failings Step 13 If there is no competition law OR if the law is regarded as an inadequate instrument to protect end users, the relevant market should be subject to ex ante regulation 16 Relevant market, ex ante regulation and market analysis Step 13 Start analysis of relevant market: Examine structural characteristics of market Step 14 Examine recent conduct of firms in market Requires empirical analysis and application of economic reasoning 17 Relevant market, ex ante regulation and market analysis Step 14 Determine on the basis of the evidence appraised whether there is effective competition in the market Step 15 If the market is effectively competitive, no need for the regulatory intervention If the market is not effectively competitive, determine source of market failure (those operators who are dominant) 18 Relevant market, ex ante regulation and market analysis Step 15 For those operators designated as dominant, determine the least burdensome set of remedies that would solve the identified problem(s) Step 15 continued Typical list of remedies Transparency Non-discrimination Accounting separation Access to facilities Price controls and cost accounting obligations Functional separation Structural separation 19 End Session 12 20