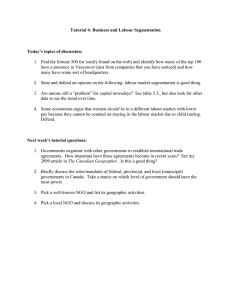

Human Resources and Skills Development Canada Report on Plans and Priorities 2010 – 2011 Estimates

advertisement