Modeling Objectives Goal Programming Several Objectives Minimum Regret Models

advertisement

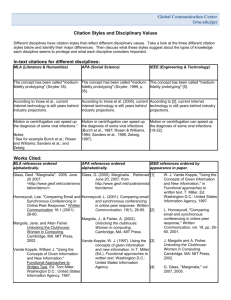

Modeling Objectives Goal Programming Several Objectives Minimum Regret Models 15.057 Spring 03 Vande Vate 1 Workforce Scheduling Some days we will have too many workers Excess Only concerned with the largest excess Minimize the largest Excess 15.057 Spring 03 Vande Vate 2 Challenge Formulate a Solver Model 15.057 Spring 03 Vande Vate 3 Formulating the LP Scheduling Postal Workers Shift Day Mon Tues Wed Thurs Fri Sat Sun Mon - Tues - Wed - Thurs - Fri - Sat - Sun Fri Sat Sun Mon Tues Wed Thurs 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 15.057 Spring 03 Vande Vate 1 Demand 17 13 15 19 14 16 11 4 Enhancement Given Goals: Have the right number of workers each day Cost for exceeding and falling short |Actual Workers – Desired Number| Challenge: Formulate a Linear Model 15.057 Spring 03 Vande Vate 5 Formulating the LP Scheduling Postal Workers Shift Day Mon Tues Wed Thurs Fri Sat Sun Mon - Tues - Wed - Thurs - Fri - Sat - Sun Fri Sat Sun Mon Tues Wed Thurs 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 15.057 Spring 03 Vande Vate 1 Demand 17 13 15 19 14 16 11 6 Policy vs Physical Consts Physical/Logical Constraints Flow Conservation Capacity ... Policy Constraints Meet service levels ... 15.057 Spring 03 Vande Vate 7 Small Violations Can violate policy constraints a little Sometimes can violate physical constraints Capacity Raw materials … Handle with “deviation from targets” 15.057 Spring 03 Vande Vate 8 Conflicting Objectives Cost vs Service Price vs Quality Revenue vs Market Share Reach vs Frequency Risk vs Return ... 15.057 Spring 03 Vande Vate 9 Other Examples 15.057 Spring 03 Vande Vate 10 Cost Undominated Optima Current Position Dominating Positions Service Level 15.057 Spring 03 Vande Vate 11 Getting to the Frontier Associate a value with Service ($/Time) Change this value of Time Systematic change using Sensitivity Analysis Remember the Retail Pricing Model 15.057 Spring 03 Vande Vate 12 Reach vs Frequency Invest in Marketing Radio Ads TV Ads Newspaper Ads Want Reach: Lots of people to see the ads Frequency: People to see the adds lots of times Generally conflicting 15.057 Spring 03 Vande Vate 13 Example Budget of $500 Media Radio Cost $15 Reach 100 Frequency 10 TV News $30 $10 500 10 2 100 What are the Frontier Solutions? 15.057 Spring 03 Vande Vate 14 The Frontier 6000 News 5000 Frequency 4000 Undominated Solutions 3000 2000 Solutions using the full budget 1000 TV Radio 0 0 1000 2000 3000 4000 5000 15.057 Spring 03 Vande Vate Reach 6000 7000 8000 9000 15 Dollarize Reaching one person worth $1 (normalize) Frequency worth $f per repetition Media Radio Cost $15 Reach 100 Frequency 10 Value $100 + 10f TV News $30 $10 500 10 2 100 $500 + 2f $10 + 100f What happens to the answer as f increases? 15.057 Spring 03 Vande Vate 16 The Frontier $120.00 Radio Value/$ $100.00 TV News $80.00 $60.00 $40.00 $20.00 $0.00 0 1 2 3 4 F 5 6 15.057 Spring 03 Vande Vate 7 8 9 10 The Frontier 6000 News 5000 Frequency 4000 Undominated Solutions 3000 2000 Solutions using the full budget 1000 TV Radio 0 0 1000 2000 3000 4000 5000 15.057 Spring 03 Vande Vate Reach 6000 7000 8000 9000 18 Multiple Scenarios Uncertain Future Make a decision today Live with it tomorrow Example Singapore Electric Production plan against FORECASTED orders Uncertain Economic climate HOT (130%) Temperate (100%) Cold (70%) 1/3 chance 1/3 chance 1/3 chance Allow back-ordering 15.057 Spring 03 Vande Vate 19 Singapore Electric Unit Costs Prod. $ Inventory $ Prod. Quant. Prod. Limits Init. Inv. Del. Reqmts Ending Inv. Prod. Cost $ Inv. Cost $ Total Cost $ Singapore Electric Generator Production Jan Feb Mar Apr. 28.00 $ 27.00 $ 27.80 $ 29.00 0.30 $ 0.30 $ 0.30 $ 0.30 0 60 15 58 (43) 0 62 -43 36 (79) $ (4.20) $ (4.20) $ $ (18.30) $ (18.30) $ 0 64 -79 34 (113) May 0 66 -113 59 Minimum (172) 7 $ (28.80) $ (42.75) Total (28.80) $ (42.75) $ (94.05) 15.057 Spring 03 Vande Vate 20 Allow Back-Ordering Defer demand at a cost of $3/unit/month Challenge: Formulate a linear model 15.057 Spring 03 Vande Vate 21 With Backordering Singapore Electric Generator Production Economic Climate 100% Unit Revenue $ 50 Unit Costs Jan Feb Mar Apr. Prod. $ 28.00 $ 27.00 $ 27.80 $ 29.00 Inventory $ 0.30 $ 0.30 $ 0.30 $ 0.30 BackOrder $3.00 $3.00 $3.00 $3.00 Prod. Quant. Inventory BackOrder Net Inv. Prod. Limits Init. Inv. Del. Reqmts Ending Inv. Prod. Cost $ Inv. Cost $ Total Cost $ 31 0 0 0 60 10 58 (17) 868 $ $ 868 $ 25 0 0 0 62 (17.00) 36 (28) 675 $ $ 675 $ 15.057 Spring 03 Vande Vate 24 0 0 0 64 (28.00) 34 (38) May 48 7 0 7 66 (38.00) 59 Minimum (49) 7 667 $ 1,392 $ 21 Total 667 $ 1,413 $ 3,623 Net Rev. 5,727 22 Revised Model No constraint on ending inventory Charge $50 for any back orders in May Maximize Net Revenue $50 for each item sold – Cost – Lost Sales ($50 for back orders in May) 15.057 Spring 03 Vande Vate 23 Robust Answers Minimum Regret: Max the Min Revenue Regardless of the outcome, we get at least this revenue Idea of the model One set of variables for production Inventory variables for each scenario Cost & Revenue calculations for each scenario New Variable for Minimum Revenue Maximize the Minimum Revenue S.t. Minimum Revenue ≤ Revenue in Each Scenario 15.057 Spring 03 Vande Vate 24 Best Answers Solution Hot Temper Cold Min Regret Net Rev $ 5,627 $ 4,442 $ 3,604 $ 2,221 Solution Hot Temper Cold Min Regret $ $ $ $ Jan Feb 60 51 36 60 Hot 5,627 1,452 (1,534) 2,221 Mar 62 62 62 62 Temper $ 2,802 $ 4,442 $ 1,568 $ 4,150 15.057 Spring 03 Vande Vate 64 64 41 64 $ $ $ $ Apr. 47 1 Cold 873 2,513 3,604 2,221 25 Model (Messy) Unit Costs Prod. $ Inventory $ BackOrder Unit Revenue $ 50 Jan Feb Mar Apr. 28.00 $ 27.00 $ 27.80 $ 29.00 0.30 $ 0.30 $ 0.30 $ 0.30 $3.00 $3.00 $3.00 $3.00 60 Prod. Quant. Scenario 1 Inventory BackOrder Net Inv. Prod. Limits Init. Inv. Del. Reqmts Ending Inv. Prod. Cost $ Inv. Cost $ Total Cost $ Scenario 2 Inventory BackOrder Net Inv. Prod. Limits Init. Inv. Del. Reqmts Ending Inv. Prod. Cost $ Inv. Cost $ Total Cost $ Scenario 3 Inventory BackOrder Net Inv. Prod. Limits Init. Inv. Del. Reqmts Ending Inv. Prod. Cost $ Inv. Cost $ Total Cost $ 62 Economic Climate 24 57 0 0 24 57 60 62 10 24.00 46 29 24 57 1,680 $ 7 $ 1,687 $ 1,674 $ 17 $ 1,691 $ Economic Climate 12 38 0 0 12 38 60 62 10 12.00 58 36 12 38 1,680 $ 4 $ 1,684 $ 1,674 $ 11 $ 1,685 $ Economic Climate 0 10 5 0 -5 10 60 62 10 (5.00) 75 47 (5) 10 1,680 $ 15 $ 1,695 $ 15.057 Spring 03 Vande Vate 1,674 $ 3 $ 1,677 $ 64 May Minimum Net 0.981607 2221.43892 80% 94 47.981607 0 0 94 47.981607 64 66 57.00 94.00 27 47 Lost Sales 94 48 $ 1,779 $ 28 28 $ 14 Total 1,807 $ 43 $ 5,229 Net Rev. 2,221 100% 68 0 68 64 38.00 34 68 9.981607 0 9.981607 66 68.00 59 Lost Sales 10 $ - 1,779 $ 28 20 $ 3 Total 1,800 $ 31 $ 5,200 Net Rev. 4,150 130% 30 0 0 46.018393 30 -46.01839 64 66 10.00 30.00 44 77 Lost Sales 30 (46) 4,601.84 1,779 $ 28 9 $ 138 Total 1,788 $ 167 $ 5,327 Net Rev. 2,221 26 Summary Modeling Goals Modeling Conflicting Objectives The Efficient Frontier Modeling Scenarios Complicated models Robust Solutions 15.057 Spring 03 Vande Vate 27