Document 13609375

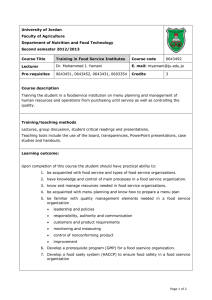

advertisement