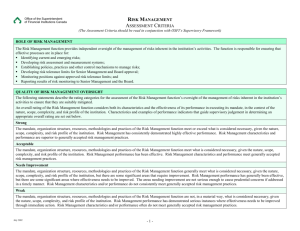

Office of the Superintendent of Financial Institutions Canada Departmental Performance Report

advertisement