Patented Medicine Prices Review Board 2007-2008 Departmental Performance Report

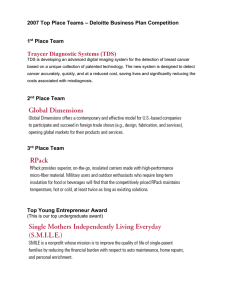

advertisement