Tax Alert

September 2010

Authors:

J. Stephen Barge

steve.barge@klgates.com

+1.412.355.8330

K&L Gates includes lawyers practicing out

of 36 offices located in North America,

Europe, Asia and the Middle East, and

represents numerous GLOBAL 500,

FORTUNE 100, and FTSE 100

corporations, in addition to growth and

middle market companies, entrepreneurs,

capital market participants and public

sector entities. For more information,

visit www.klgates.com.

Increased Tax Penalties for Incorrect

Information Reports Faced by Financial

Service Companies

Business entities required to file common tax information returns and payee

statements, such as Forms W-2, Forms 1099 and 1098, face increased penalties as a

result of the Small Business Jobs Act of 2010 (the “Act”), which President Obama

signed on September 27, 2010.

Perhaps of greatest significance is the virtual elimination of the annual cap on

penalties for incorrect Forms 1098 and 1099. The Act replaces the current $250,000

and $100,000 annual caps for incorrect information returns and payee statements

with mirror $1,500,000 annual caps for each. These increased penalties turn up the

heat on any business in the financial services sector that files large amounts of Forms

1099 and 1098 such as mortgage loan servicers, regulated investment companies and

banks. These businesses now will face increased scrutiny by the Internal Revenue

Service of their internal procedures for preparing these information returns

(including particularly their procedures relating to soliciting, obtaining and reporting

the proper taxpayer identification number for each borrower, investor or account

holder) to determine whether their procedures satisfy the “reasonable cause” standard

for waiving penalties. These increased penalties will apply to information returns

filed after January 1, 2011 and thus time is running short for companies to ensure

that they have taken all necessary and reasonable steps to maximize the likelihood of

correct information reporting and successfully challenge these major penalties.

Highlights of the Act’s Penalty Provisions

•

Doubles the $50 per incorrect information return to $100

•

Replaces $250,000 annual cap on aggregate penalties with $1,500,000 cap

•

Doubles the $15 penalty for information returns corrected within 30 days to $30;

increases the $75,000 annual cap for such penalties to $250,000

•

Doubles the $30 penalty for information returns corrected before August 1 to

$60; increases the $150,000 annual cap for such penalties to $500,000

•

For taxpayers with gross receipts of $5 million or less, increases the caps on

aggregate penalties to $500,000 for incorrect information returns; $75,000 for

returns corrected within 30 days; $200,000 for returns corrected by August 1

•

Imposes similar tiers and caps for incorrect payee statements with the penalties

for incorrect information returns

Tax Alert

Waiver of Penalties

The Act does not modify Section 6724 of the Code,

which provides, among other things, that these

penalties must be waived if the information

reporting failure was due to reasonable cause and

not wilful neglect. The current treasury regulations

implementing Section 6724’s reasonable cause

waiver set forth general rules as to when reasonable

cause exists. It would not be wholly unexpected if

the IRS (particularly at the examination level) adopts

a stringent reading of these rules and holds taxpayers

to a higher standard than in the past. As a result,

taxpayers need to be prepared to explain to the IRS

in detail their internal procedures relating to Form

1099 and 1098 reporting (including particularly their

procedures related to incorrect or missing TINs) and

why those internal procedures satisfy the applicable

regulations. As part of that effort, the IRS can be

expected to question procedures that it believes can

be improved and to require taxpayers to modify

those procedures if those modifications would, in

the IRS’ view, maximize compliance with the

information reporting requirements.

*

*

*

As Congress continues its search for revenue in the

months ahead, it is possible that other, similar

measures aimed at increasing tax compliance and

reducing the tax gap will surface. Tightening

information reporting regimes and closing corporate

tax “loopholes” are on the menu of potential offsets

lawmakers will be considering in the near-term.

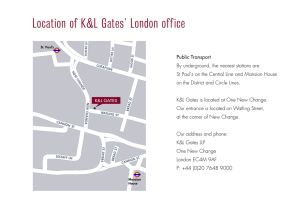

Anchorage Austin Beijing Berlin Boston Charlotte Chicago Dallas Dubai Fort Worth Frankfurt Harrisburg Hong Kong London

Los Angeles Miami Moscow Newark New York Orange County Palo Alto Paris Pittsburgh Portland Raleigh Research Triangle Park

San Diego San Francisco Seattle Shanghai Singapore Spokane/Coeur d’Alene Taipei Tokyo Warsaw

Washington, D.C.

K&L Gates includes lawyers practicing out of 36 offices located in North America, Europe, Asia and the Middle East, and represents numerous

GLOBAL 500, FORTUNE 100, and FTSE 100 corporations, in addition to growth and middle market companies, entrepreneurs, capital market

participants and public sector entities. For more information, visit www.klgates.com.

K&L Gates comprises multiple affiliated entities: a limited liability partnership with the full name K&L Gates LLP qualified in Delaware and

maintaining offices throughout the United States, in Berlin and Frankfurt, Germany, in Beijing (K&L Gates LLP Beijing Representative Office), in

Dubai, U.A.E., in Shanghai (K&L Gates LLP Shanghai Representative Office), in Tokyo, and in Singapore; a limited liability partnership (also named

K&L Gates LLP) incorporated in England and maintaining offices in London and Paris; a Taiwan general partnership (K&L Gates) maintaining an

office in Taipei; a Hong Kong general partnership (K&L Gates, Solicitors) maintaining an office in Hong Kong; a Polish limited partnership (K&L

Gates Jamka sp.k.) maintaining an office in Warsaw; and a Delaware limited liability company (K&L Gates Holdings, LLC) maintaining an office in

Moscow. K&L Gates maintains appropriate registrations in the jurisdictions in which its offices are located. A list of the partners or members in each

entity is available for inspection at any K&L Gates office.

This publication is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon

in regard to any particular facts or circumstances without first consulting a lawyer.

©2010 K&L Gates LLP. All Rights Reserved.

Circular 230 Notice

To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. federal tax advice contained in this

communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i)

avoiding penalties under the Internal Revenue Code of 1986, as amended or (ii) promoting, marketing or recommending to

another party any transaction or matter addressed within.

September 2010

2