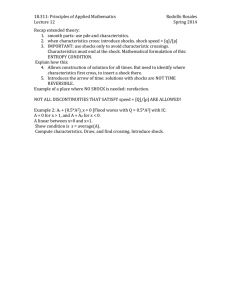

A Critique of Structural VARs Using Business Cycle Theory

advertisement