Unclassified DSTI/ICCP/TISP(2002)5/FINAL

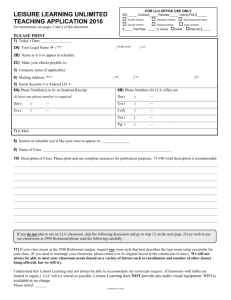

advertisement