O&D Control: What Have We Learned?

advertisement

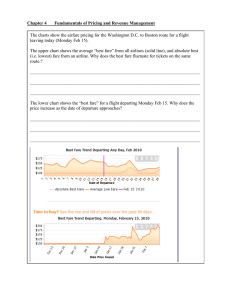

O&D Control: What Have We Learned? Dr. Peter P. Belobaba MIT International Center for Air Transportation Presentation to the IATA Revenue Management & Pricing Conference Toronto, October 2002 1 O-D Control: What Have We Learned? Summary of results from over a decade of research 4 Supported by PODS Consortium simulations at MIT 4 Theoretical models and practical constraints on O-D control O-D control can increase network revenues, but impact depends on many factors 4 Optimization, forecasting and effective control mechanism 4 Your airline’s network and RM capabilities of competitors 4 Operational realities such as airline alliances, low-fare competitors, and distribution system constraints 2 What is Origin-Destination Control? The capability to respond to different O-D requests with different seat availability on a given itinerary 4 Based on network revenue value of each request 4 Irrespective of yield or fare restrictions Can be implemented in a variety of ways 4 EMSR heuristic bid price (HBP) 4 Displacement adjusted virtual nesting (DAVN) 4 Network probabilistic bid price control (PROBP) Control by network revenue value is key concept 3 RM System Alternatives RM System Data and Forecasts FCYM Base Leg/class Heuristic Leg/bucket Bid Price Disp. Adjust. ODIF Virt. Nesting Prob. Netwk. ODIF Bid Price Optimization Model Leg EMSR Control Mechanism Leg/class Limits Leg EMSR Bid Price for Connex only Network LP + Leg/bucket Leg EMSR Limits Prob. Netwk. O-D Bid Convergence Prices 4 PODS RM Research at MIT Passenger Origin Destination Simulator simulates impacts of RM in competitive airline networks 4 Airlines must forecast demand and optimize RM controls 4 Assumes passengers choose among fare types and airlines, based on schedules, prices and seat availability Recognized as “state of the art” in RM simulation 4 Realistic environment for testing RM methodologies, impacts on traffic and revenues in competitive markets 4 Research funded by consortium of seven large airlines 4 Findings used to help guide RM system development 5 Network Revenue Gains of O-D Control Airlines are moving toward O-D control after having mastered basic leg/class RM fundamentals 4 Effective leg-based fare class control and overbooking alone can increase total system revenues by 4 to 6% Effective O-D control can further increase total network revenues by 1 to 2% 4 Range of incremental revenue gains simulated in PODS 4 Depends on network structure and connecting flows 4 O-D control gains increase with average load factor 4 But implementation is more difficult than leg-based RM 6 O-D Revenue Gain Comparison Airline A, O-D Control vs. Leg/Class RM 2.50% 2.00% HBP DAVN PROBP 1.50% 1.00% 0.50% 0.00% 70% 78% 83% Network Load Factor 7 87% Value Bucket vs. Bid Price Control Network Bid Price Control: 4 Simpler implementation of control mechanism 4 Performance depends on frequent re-optimization Value buckets (“virtual nesting”) 4 Substantially more complicated (and costly) changes to inventory required 4 Requires off-line re-mapping of ODFs to buckets Most PODS (and other) simulations show little significant difference in network revenue gains 8 Network Optimization Methods Several network optimization methods to consider: 4 Deterministic Linear Programming (LP) 4 Dynamic Programming (DP) 4 Nested Probabilistic Network Convergence (MIT) How important is optimization method? 4 DAVN uses deterministic LP network optimization, while PROBP uses a probabilistic network model 4 How do these methods compare under the DAVN and Bid Price control schemes? 9 DAVN Revenue Gains Deterministic LP vs. PROBP Displacement Costs 2.00% 1.75% 1.50% 1.25% 1.00% 0.75% 0.50% 0.25% 0.00% Determ. LP PROBP 70% 78% 83% Network Load Factor 10 87% Network Bid Price Control Deterministic LP vs. PROBP Bid Prices 2.00% 1.75% 1.50% 1.25% 1.00% 0.75% 0.50% 0.25% 0.00% -0.25% Determ. LP PROBP 70% 78% 83% Network Load Factor 11 87% Sensitivity to Optimization Methods Shift from deterministic LP to probabilistic displacement costs in DAVN has little impact: 4 Probabilistic estimates better by 0.05% or less 4 DAVN control structure is quite robust to choice of network optimization method On the other hand, pure Bid Price control is quite sensitive to choice of network optimizer: 4 Deterministic LP bid prices substantially more volatile, and have a direct impact on accept/reject decisions 12 Impacts of Forecasting Models Baseline PODS results assume relatively simple ODF forecasting and detruncation methods: 4 “Booking curve” detruncation of closed flights 4 “Pick-up” forecasts of bookings still to come PODS simulations have shown large impacts of forecasting and detruncation models: 4 “Projection” detruncation based on iterative algorithm (Hopperstad) 4 Regression forecasting of bookings to come based on bookings on hand 13 Impacts of Forecasting/Detruncation vs. FCYM with Same Forecaster, ALF=78% 1.75% 1.50% 1.25% 1.00% BC/PU PD/RG 0.75% 0.50% 0.25% 0.00% HBP DAVN 14 PROBP Sensitivity to Forecasting Models O-D methods benefit from more “advanced” detruncation and forecasting models 4 Revenue gains almost double vs. FCYM base case 4 Forecasting model can have as great an impact as choice of optimization model Possible explanations for improved gains 4 ODF Forecasts are not more “accurate”-- inability to accurately measure actual demand 4 Overall forecasts are now larger due to more aggressive detruncation, leading to more seat protection for higher revenue passengers 15 Competitive Impacts of O-D Methods Implementation of O-D control can have negative revenue impacts on competitor: 4 Continued use of basic FCYM by Airline B against O-D methods used by Airline A results in revenue losses for B 4 Not strictly a zero-sum game, as revenue gains of Airline A exceed revenue losses of Airline B 4 Other PODS simulation results show both airlines can benefit from using more sophisticated O-D control Failure to implement network RM (O-D control) can actually lead to revenue losses against competitor! 16 Competitive Impacts of O-D Control Network ALF=83%, Airline B with Basic YM 1.50% 1.25% 1.00% 0.75% 0.50% 0.25% 0.00% -0.25% -0.50% -0.75% -1.00% Airline A Airline B HBP DAVN 17 PROBP Response to Low-Fare Competition Under basic leg/fare class RM, no control over value of different passengers booking in each class 4 With low-fare competitor, matching fares requires assignment to specific fare class 4 Fare class shared by all O-D itineraries using same flight leg and supply of seats With O-D control, bookings are limited by network revenue value, not fare type or restrictions 4 Low matching fares will still be available on empty flights 4 But will not displace higher revenue network passengers 18 Matching Low-Fare Pricing Structures Low-fare airlines offer “simplified” fare structures 4 Elimination or reduction of advance purchase requirements 4 Removal of “Saturday night minimum stay” restrictions Matching will reduce revenue for traditional airlines 4 By as much as 8-9% with removal of advance purchase 4 By 13% or more with no Sat. night stay requirements Revenue loss is mitigated by O&D control methods 4 Compared to less sophisticated FCYM practices 4 But, no evidence that O&D control will eliminate revenue loss – fare restrictions are critical to revenue performance 19 Revenue Losses – Removal of Restrictions on Lower Fares 0% -2% FCYM DAVN PROBP -4% -6% Adv Purchase Sat Night Stay -8% -10% -12% -14% -16% 20 Alliance Network O-D Control Alliance code-sharing affect revenue gains of O-D control 4 Ability to distinguish between ODIF requests with different network revenue values can give O-D control airline a revenue advantage 4 With separate and uncoordinated RM, one partner can benefit more than the other, even causing other partner’s revenues to decrease Information sharing improves network revenue gains, even if partners use different O-D methods: 4 Exchanges of network displacement costs or bid prices 4 Currently limited by technical and possibly legal constraints. 21 Alliance Information Sharing Booking Request Airline B: Bid Price Computation Bid Prices At the end of each time frame Separate Optimization Airline C: Bid Price Computation Seat Inventory Control Decision Booking Request Bid Price Sharing Bid Prices 22 Seat Inventory Control Decision Displacement Cost Sharing: DAVN/DAVN 2.50 % GAIN vs. BASE 2.00 1.50 B C B+C 1.00 0.50 0.00 -0.50 No Sharing (Local Fares) No Sharing (Total Fares) 23 DC Sharing (Total Fares) Bid Price Sharing: ProBP/ProBP 2.50 % GAIN vs. BASE 2.00 1.50 B C B+C 1.00 0.50 0.00 -0.50 No Sharing (Local Fares) No Sharing (Total Fares) 24 BP Sharing (Total Fares) “Abuse” of O-D Controls GDS and website technology has evolved to provide “improved” fare searches: 4 Objective is to consistently deliver lowest possible fare to passengers and/or travel agents in a complicated and competitive pricing environment Example: Booking two local legs when connecting itinerary not available, then pricing at the through O-D fare in the same booking class. 4 Appears to be occurring more frequently, as web site and GDS pricing search engines look for lowest fare itineraries 25 Revenue Impacts of O-D Abuse How big is the revenue impact on O-D methods? 4 No revenue impact on FCYM control, since no distinction between local and connecting requests Impact depends proportion of eligible booking requests that actually commit abuse 4 Even at 25% probability of abuse, revenue gains of DAVN are reduced by up to 1/3 4 Means actual revenue gain of DAVN is closer to 1.0% than estimates of 1.4% under perfect O-D control conditions 26 O-D Revenue Gains with Varying Probability of Abuse (Base Case: Eb vs. Eb, DF=1.0, LF=83%) O -D R e v e n u e G a in 2.00% 1.80% 1.60% 1.40% 1.20% 1.00% DAVN 0.80% 0.60% 0.40% 0.20% 0.00% 0.00% 25.00% Probability of Abuse 27 50.00% O-D Control: What Have We Learned? Revenue gains of O-D control affected by: 4 Network characteristics, demand levels and variability 4 Combined implementation of optimization, forecasting and control mechanisms 4 Airline alliances, fare structures and distribution constraints A strategic and competitive necessity for airlines: 4 Typical network revenue gains of 1-2% over basic FCYM 4 Protect against revenue loss to competitors with O-D control 4 Improved control of valuable inventory in the face of pricing pressures, distribution channels, and strategic alliances 28