AN ECONOMIC EVALUATION OF CONFINEMENT SHEEP PRODUCTION

AN ECONOMIC EVALUATION OF CONFINEMENT SHEEP PRODUCTION

IN THE NORTHERN ROCKY MOUNTAINS AND

THE NORTHWESTERN GREAT PLAINS by

Henry Arlen Smith

A thesis submitted in partial fulfillment of the requirements for the degree of

Master of Science in

Applied Economics

MONTANA STATE UNIVERSITY

Bozeman, Montana

August 1984

ii

APPROVAL of a thesis submitted by

Henry Arlen Smith

This thesis has been read by each member of the thesis committee and has been found to be satisfactory regarding content, English usage, format, citation, bibliographic style, and consistency, and is ready for submission to the College of Graduate Studies.

Date

Date

Date

Chairperson, Graduate Committee

Approved for the Major Department

Head, Major Department

Approved for the College of Graduate Studies

Graduate Dean

tii

STATEMENT OF PERMISSION TO USE

In presenting this thesis in partial fulfillment of the requirements for a master's degree at Montana State University, I agree that the Library shall make it available to borrowers under rules of the Library. Brief quotations from this thesis are allowable without special permission, provided that accurate acknowledgment of source is made.

Permission for extensive quotation from or reproduction of this thesis may be granted by my major professor, or in his absence, by the Dean of Libraries when, in the opinion of either, the proposed use of the material is for scholarly purposes. Any copying or use of the material in this thesis for financial gain shall not be allowed without my permission.

S i g n a t u r e - - - - - - - - - - - - - - - - -

Date ______________________________ ___

iv

TABLE OF CONTENTS

Page

APPROVAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . n

STATEMENT OF PERMISSION TO USE.................................. iii

TABLE OF CONTENTS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . iv

LIST OFT ABLES. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . vi

LIST OF FIGURES. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . viii

ABSTRACT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ix

Chapter

INTRODUCTION ............................................. .

Statement of the Problem .................................... .

Objectives of the Project ..................................... .

Procedure ................................................ . 3

2 LITERATURE REVIEW......................................... 4

3 REGIONAL REVIEW. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

4 MAJOR ELEMENTS ........................................... ·. 7

Sheep . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Confinement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Slotted Floors or Bedded Barns. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Lambing Cycles... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Estrus Synchronization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . I I

Teaser Rams . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Early Weaned Lambs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . I 1

Limit Feeding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Medicated Water. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

5 DELINEATING A SET OF STUDY SYSTEMS . . . . . . . . . . . . . . . . . . . . . . . 13

6 THE SIMULATION PROGRAM................................... 23

7 SIMULATION RESULTS........................................ 29

v

TABLE OF CONTENTS-Continued

Page

8 CONCLUSION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56

9 EVALUATION OF THE STUDY.................................. 58

BIBLIOGRAPHY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

APPENDICES. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64

Appendix A. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

Appendix B. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

Appendix C. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

vi

LIST OF TABLES

Tables Page

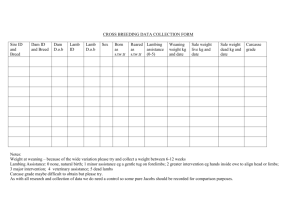

I. Estimated Lamb Production by System for a 500 Ewe Flock. . . . . . . . . . . . . 15

2. Estimated Total Production by System for a 500 Ewe Flock . . . . . . . . . . . . . 15

3. Estimated Per Head Feed Requirements and Cost per Head . . . . . . . . . . . . . . 16

4. Estimated Total Feed for 500 Ewes by System. . . . . . . . . . . . . . . . . . . . . . . . 18

5. Estimated Variable Expense Summary by System for a 500

Ewe Flock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 9

6. Estimated Fixed Asset Investment by System for a 500 Ewe Flock . . . . . . . . 21

7. Estimated Annual Charges for Fixed Assets for a 500 Ewe Flock. . . . . . . . . . 22

8. Recent Annual Weighted Average Lamb Prices Received by Farmers, Inflated Into 1982 Dollars per Cwt.. . . . . . . . . . . . . . . . . . . . . . . 2 7

9. System Benchmark Prices by Scenario . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

I 0. Base Scenario . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

11. Scenario with $15,000 of Income From Other Sources. . . . . . . . . . . . . . . . . . 33

12. Scenario with $30,000 of Income From Other Sources ................. : 35

13. Scenario with $100,000 oflncome From Other Sources. . . . . . . . . . . . . . . . . 36

13. System Benchmark Prices by Scenario . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

14. Scenario with Lower Initial Investment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

15. Scenario with Lower Initial Investment and $30,000 Income

From Other Sources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

16. Scenario with Higher Initial Investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

17. Scenario with Higher Initial Investment and $30,000 Income

From Other Sources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

18. Scenario with Ewe Fecundity Reduced 20% ............. , . . . . . . . . . . . . 41

yjj

Tables Page

19. Scenario with Ewe Fecundity Increased 20% . . . . . . . . . . . . . . . . . . . . . . . . . 42

20. Scenario with Variable Cost Reduced 20% . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

21. Scenario with Fixed Assets Reduced to $5,000........................ 45

22. Scenario with Reduced Fixed Asset Costs and $30,000 Income

From Other Sources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

23. Scenario with Four Simultaneous Favorable Variations to

Budget Items. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

24. Scenario with Low Interest and Inflation Rates . . . . . . . . . . . . . . . . . . . . . . . 49

25. Scenario with High Interest and Inflation Rates . . . . . . . . . . . . . . . . . . . . . . . 50

26. Scenario with Low Interest and Inflation Rates and $30,000 Income

From Other Sources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

27. Scenario with High Interest and Inflation Rates and $30,000 Income

From Other Sources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

28. Scenario with Smaller Reductions in Initial Production . . . . . . . . . . . . . . . . . 53

29. Scenario with Larger Reductions in Initial Production . . . . . . . . . . . . . . . . . . 54

viii

LIST

OF FIGURES

Figure Page

I . Flowchart of simulation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

ix

ABSTRACT

Confinement sheep production is currently the subject of considerable research effort and commercial investment. This study evaluates the economic potential of confinement sheep production for the region of the Northern Rocky Mountains and the Northwestern

Great Plains.

The extent and composition of confinement sheep production within the region is surveyed. The main elements available to alternative sheep production systems are cataloged, and the ramifications of each element for different systems are estimated.

Four sheep production systems representative of the range of alternatives are defined and budgeted. These four systems are economically evaluated by means of multi-period simulation. Sensitivity analysis is used both to replicate variations in the four systems and to measure the importance of variations in the budget estimates.

It is concluded that a major transition to confinement production is unlikely under current conditions. However, confinement production can be a viable alternative under certain circumstances. It is also demonstrated that marginal tax rates are important factors in determining net profitability and should be included in economic evaluations of production alternatives.

CHAPTER 1

INTRODUCTION

Statement of the Problem

Both researchers and commercial producers have been developing and implementing methods for intensification of sheep production. In a 1979 paper, Drs. Hinds and Lewis stated that, " ... the sheep industry is at the brink of launching into confinement production much as the swine industry was 20 years ago." This study evaluates the economic potential of confinement sheep production for a region encompassing the Northern Rocky

Mountains and the Northwestern Great Plains. This project should serve both researchers and producers by identifying, for further research or implementation into production systems, those techniques with the strongest economic potential.

Large discrepancies exist between the positive profits being reported by commercial confinement operators and the negative profits which were predicted by previous economic analyses. Previous analyses in the USA have found confinement production economically infeasible. Yet, commercial confinement operations are reportedly thriving. For intermediate level confinement systems, some previous analyses have estimated breakeven prices for lamb which were as high as double the prevailing market price of lamb. Yet, most of the successful commercial confinement operations in this region are of this intermediate type. This project will reconcile some of the discrepancies between economic predictions and actual results by applying a more dynamic and detailed analytical method than those which were used in previous analyses. It will, for example, include the impact of the tax system in detennining net profitability, which has been previously omitted.

2

Objectives of the Project

Confusion exists about the relationship between confinement and intensification. In this study, and some previous studies, confinement is defined as the restriction of the sheep to a small area and feeding them with harvested feeds. Thus, both the dry lot and the climate controlled barn are confinement facilities.

This project is limited to evaluating the economic potential of confinement within a roughly homogeneous geographic region because many circumstances which determine the costs and benefits of various techniques vary with geography. For example, in Indiana bedding straw is not only more expensive than it is in the Great Plains, but more bedding is required in Indiana due to wetter conditions. On the other hand, the cost of slotted floors is about the same in either Indiana or the Great Plains. Thus, the cost ratio of slotted floored barns versus bedded barns is region specific.

There are many elements or techniques which are available for implementation into a sheep production operation. One objective of this study is to define, as well as possible, the main elements available, and to estimate the ramifications of each element for various possible systems. A second objective is to delineate a representative set of systems for this region. Data gathered from producers and experiment stations within the region is used in delineating this set of systems.

It will not be possible to resolve every point of confusion surrounding the relationship of various techniques to alternative production systems. For example, while the researchers at the Dubois Experiment Station in Idaho are attempting to develop the sheep and the techniques for accelerated lambing on the range, most published work mentions accelerated lam bing only in conjunction with highly confined systems. Although data from

Dubois aided in the establishing the production estimates for conventional systems, sufficient data could not be found to allow the estimation of a suitably accurate budget for a conventional, accelerated system.

3

The final objective of the project is to economically evaluate the systems by an appropriate analytical method. It is a premise of this study that inappropriate analytical methods have been the principal cause of the previously mentioned discrepancies between economic predictions and commercial experience. While there are some questionable estimates in the budgets used in earlier studies, the discrepancies may be primarily attributed to the inability of static methods to deal with dynamic, multi-period interactions of the tax system and irregular cash flows. This study employs a method which can more accurately reflect the interactions of various economic elements within the operating environment.

Procedure

The analytical method used in this study is a multi-period simulation. Simulation allows net profitability to be determined by revenues, expenses, and the tax system in a jointly dependent, multi-period framework. The simulation results in a net future value from operations. Theoretically, net future value and net present value are transformations of the same value. Net future value is used for ease of computation. Computing the net present value is complicated since the tax rate, and therefore the after tax discount rate, is not known a priori. On the other hand, net future values are obtained by a sumljlation of the final period account balances which are the result of the revenues, expenses, inflation. and taxes occurring within each period of the simulation.

The net future value, which results from the multi-period simulation of a sheep production system, is compared to another net future value. This other net future value is the value of invested funds compounded from the time of investment at the rate for interest income. Within this simulation model, interest income is estimated to be 80% of the prespecified rate for interest expense. This net future value of invested funds is called the benchmark. The benchmark is used for comparative purposes, to judge the feasibility of the sheep production systems.

4

CHAPTER 2

LITERATURE REVIEW

In a study which was based on the confinement research operation at Wooster, Ohio,

Miller derives cost estimates for a 450-500 ewe, slotted floor, confinement operation.

From these cost estimates, he calculates the breakeven lamb prices at four lambing rates.

These breakeven prices range from $102/cwt. for the lowest lambing rate to $72/cwt. for the highest. Miller concluded from these breakeven prices that confinement production was not economically feasible under current conditions. In this study, Miller failed to consider any alternative confinement systems, evaluating only one system, employing an extreme degree of confinement. Also, some items in the budget, which is based on conditions in Ohio, are not applicable to the region considered in this study. The major deficiencies of the study, however, may be attributed to the analytical method. Miller uses high, nominal interest rates in the budget, while ignoring the other aspects of inflation. He equates economic depreciation with depreciation for tax purposes, while ignoring the tax benefits of depreciation and the possibility of any residual value in the fixed assets after the depreciation term.

Dr. Petritz made a more comprehensive economic evaluation of confinement production, which included the full spectrum of confinement configurations. TI1e conceptual structuring of hypothetical systems by Petritz, served as the starting point for delineating the systems and estimating the budgets in this study. However, the analytical method used by Petritz to evaluate the systems is similar to that used by Miller, with the same shortcomings. For a partial confinement system with annual lambing, Petritz estimates the break even price of lamb to be $133/cwt. Yet, a commercial system, which closely

5 resembles the partial confinement system in Petritz's analysis, is reportedly being operated profitability near Fairview, Montana.

The Animal Research Centre, Ottawa, in conjunction with the University of Saskatchewan, economically evaluated a totally confined system with accelerated lam bing in comparison to a conventional system with animal lambing. The Canadian approach involved regressing net farm income on four independent variables, which are ewe fecundity, lamb survival rate, slaughter lamb price, and the price of barley. The net farm income generated by the confined system is shown to be more sensitive than the net farm income of the conventional system to the four variables. The confined system is more profitable than the conventional system at favorable levels of these variables, and less profitable at unfavorable levels. Although some cursory budgeting is done for intermediate systems, no evaluation is done. Some recommendations are given for implementing confinement, and the overall tone is optimistic for the prospects of confinement production.

Besides the difficulty of translating the Canadian study across national boundaries and into a different currency, there are other drawbacks. The design of the confinement system in the study is almost identical to the research design at the Animal Research

Centre. The lambs are removed from the ewes after taking colostrum, and are raised on milk replacer. This is expensive, labor intensive, and seems to contribute to inordinately high neo-natal death losses. Furthermore, even with the early removal of the lambs from the ewes and extensive hormone therapy on the ewes, ewe fecundity remains well below the better examples reported from elsewhere.

Thompson and Ross analyzed three years of data on four different lambing cycles in Missouri. It is impossible to tell from the report what level of confinement, if any, was involved. Also, ewe fecundity is diminished by hot climates, and the lam bing rates from

Missouri are so low that there is little applicability to the Northern Rocky Mountains and the Northwestern Great Plains.

6

CHAPTER 3

REGIONAL REVIEW

Two quite different research programs pertaining to confinement are operating within the region. Hettinger Experiment Station in North Dakota has 450-500 ewes in a totally confined, bedded barn, with annual lambing. The research at Dubois, Idaho, on the other hand, is intent on developing sheep and techniques for accelerated lambing in range flocks.

It is noteworthy, however, that the Polypay, a range breed developed at Dubois, has become popular for confinement operations in this region.

Several commercial confinement operations exist within the region. See Appendix 2 for a list of those which were contacted in the preparation for this project. Petritz defines both partial-confinement and total confinement as separate systems, with the distinction that partial confinement systems use about 30 days of pasture per year. Under such a definition, no totally confined systems were found within the region. However, examples of both partial confinement with annual lambing and partial confinement with acc~lerated lambing are operating in the region. Both types of systems report satisfactory financial results, even though Petritz predicted that the production costs for both systems would be impossibly high.

It has often been assumed that the cost for bedding and manure handling in confined systems would be very high, and that slotted floors would be essential. Only one operator within the region reports using slotted floors, and the rest report minimal cleaning and bedding costs.

7

CHAPTER 4

MAJOR ELEMENTS

Sheep

The breed or type of sheep which is selected for a production system is a very important consideration. Ewe fecundity is an attribute which exhibits substantial variation among breeds of sheep. It is also an attribute which has been the subject of substantial research and development in recent years. The average lamb crop for this region is less than 100%.

Yet, there are operators who consistently exceed 300% annual lamb crops raised to weaning weight, .and who imminently anticipate attaining 400%. Reports of very prolific and heavy milking breeds, which are not yet available in this country, suggest the full potential for increased lamb crops has not been reached. The gains in fecundity from breeding and selection are expected to continue.

Polypay breeders are reporting the highest lamb production, without sacrifice of quality in carcass or wool. These production standards are used in estimating the Jamb crops for the system budgets in this study.

Confinement

Advances in ewe fecundity are, to some extent, applicable to every type of production system. However, there seem to be functional barriers in conventional systems to Jamb crops above 200%. On the other hand, confinement systems facilitate many things which can sustain higher Jamb crops. Methods for enhancing ewe fecundity are easier to implement, mothering is improved, hazards to the lambs are reduced, and supplemental feeding

8 and care are facilitated. Approximately an additional 150% lamb crop is currently attainable with confinement.

Other aspects of confinement are more difficult to evaluate than the possibility for increased lamb crops. For example, some diseases and internal parasites are easier to control in confinement systems, while other diseases and external parasites can become more problematic. There is insufficient data to determine if the net change in flock health from confinement is, on average, positive or negative. A similar ambiguity surrounds the feed efficiencies from confinement, which is discussed later under the topic of limit feeding.

Shelter is a possible adjunct to confinement. Warm barns aid the survival of newborn lambs, especially for those of low birth weight. However, all sheep are very cold tolerant, once they are a week or two old. If older lambs and mature sheep are kept dry and sheltered from the wind, the incremental gains from increasing shelter are very ·small. It has been stated that warm barn housing, except during lambing, is for the comfort and convenience of the operator, which may be a worthwhile consideration.

Slotted Floors or Bedded Barns

Some authors have assumed that the cost of bedding and manure handling in cpnfined systems would be very high, and that slotted floors would be the only viable approach. The cost of operating a bedded system is a regional variable. In a region which has a humid climate and where predominantly ensiled feeds are used, the moisture content of the manure is very high and slow to dissipate. This is not true in a dry climate where hay is the primary feed. Local experience indicates that a clean, dry environment can be maintained with an annual barn cleaning and infrequent, light applications of additional bedding material. Hettinger Experiment Station reports the straw required for a ewe and her lambs has averaged 5.1 bales per ewe per year. They also report the labor required for bedding and barn cleaning has averaged about 0.4 hours per ewe per year. These figures are for an

9 annual lam bing system, and would be expected to increase for an accelerated system. They should not, however, become so high as to render slotted floors the only viable alternative.

Comparing the construction costs for bedded barns and slotted floor barns of equal capacity is also inconclusive for selecting between these alternatives. The Sheep Housing and Equipment Handbook states that, "About twice the animals can be housed on slotted floors as an equivalent sized solid floor." The ratio, based on the ranges given for each in the Handbook, is slightly less than two to one, but the ratio of per square foot construction costs is also slightly less than two to one. Furthermore, any additional maintenance cost incurred with a solid barn floor must be offset by the cost of replacing the slotted flooring after its ten year life expectancy.

The literature contains some discussion of the potential value of bedding free sheep manure as a commodity saleable to home gardeners, etc. At this time there appears to be insufficient demand for this to be a factor in the decision of whether to invest in slotted floors.

Health problems are present with either alternative. There are foot and mastitis problems on slotted floors, and disease and parasite problems on bedded floors. The data is insufficient to quantify the relative seriousness of these considerations in either case.

Lambing Cycles

For the operator who chooses annual lambing, the primary consideration is when during the year to schedule the lambing. When the sheep enterprise is undertaken in conjunction with other enterprises, the demands of the other enterprises may dictate the lambing schedule. Another consideration is to schedule the lambing so as to take advantage of seasonal price variations.

10

Accelerated lambing introduces other considerations. Gestation in sheep is approximately five months and about 45 to 60 days are required for uterine involution and postpartum interval. Efforts to shorten the time between lambing and rebreeding, in order to achieve semi-annual lam bing, have not produced satisfactory results.

Some operators simply ignore cycles and rebreed as soon as possible. This can produce some excellent lambing rates, but it entails irregular demand for labor and a Joss of uniformity in the lamb crops.

Sufficient data is not available to determine how maximum potential production is effected by attempts to organize breeding into a cyclical pattern. There are several patterns. Researchers at Rowett, Scotland, wanted data on rebreeding during every month of of the year, and chose a seven month cycle, with excellent results. Others have chosen an eight month cycle, with some splitting their flocks into two groups and lambing alternate groups every four months. Scientists at Cornell have developed two patterns, CAMAL and

MAGEE. These are the Cornell Alternate Month Accelerated Lambing and a scheme developed by and named for their farm manager, Brian Magee. Magee noted an average 146 day gestation with their sheep, and split this into two 73 day periods. There are five of these 73 day periods in a year. Each period is partitioned into 30 days for lam bing and rebreeding, and 43 days for nursing the lambs and resting the ewes. All lambs are weaned at the end of the 43 days.

More data is needed before attempting any meaningful comparison of the effect on reproductive performance of the different cycles. The individual characteristics of the operation should determine the choice. Confinement operations entail so much daily labor and close supervision, that the marginal labor savings from cyclical lambing may be negligible.

11

Estrus Synchronization

Estrus synchronization is akin to lambing cycles. The biochemical techniques are effective. However, they are very expensive and currently only approved for experimental use. Two other methods of estrus synchronization are being tested and show some promise.

They are light controlled barns, and teaser rams.

Teaser Rams

Ewes, which are exposed to rams during the last few days of anestrus after having been isolated from rams, will come into heat more quickly and as a group. They will subsequently tend to ovulate more heavily in the second heat cycle.

Vasechtomized teaser rams are also useful with young replacement ewes. If the teaser ram is placed with the young ewes before they are of full breeding age, they are calmer and more readily bred when a potent ram is introduced.

Early Weaned Lambs

Weaning the lambs at about six weeks of age facilitates rebreeding of the ewes, and it allows increased feed efficiency in finishing the lambs. Lambs which are placed on a high energy, low roughage diet at an early age have the development of rumen arrested, and they can be fed out as quasi-monogastrates. By employing this feeding technique in conjunction with the use of breeding rams which have been selected for superior rates of gain. feed to gain ratios lower than 3 pounds of feed per pound of gain are being attained. However, at current price ratios, confinement feeding of lambs still results in higher feed costs than raising the lambs to market weight on pasture.

12

Limit Feeding

Confinement decreases the nutritional requirements of ewes during maintenance and early gestation. Studies have found the nutritional requirements of mature, confined sheep during these periods to be approximately 40% below NRC recommendations. With full feed during late gestation and lactation, the feed requirements for an accelerated program will be about 20% below NRC recommendations.

Limit feeding requires at least three times as much linear feed bunk space per ewe as is required for free choice feeding. This leads to design problems in the facility. It also entails either substantial additional labor costs or a large investment in automated feeding equipment.

An alternative approach to limiting the nutrient intake of confined ewes is being tested at Hettinger Station. Data is being collected on lam bing performance and body condition scores for four groups of ewes fed the following four rations on a free choice basis:

I 00% alfalfa, 80% alfalfa and 20% straw, 60% alfalfa and 40% straw, and 40% alfalfa and

60% straw. The results are not conclusive thus far, but the report points to some quality control problems experienced with the protein content of the rations.

Medicated Water

Pneumonia and some other diseases can spread quickly in confinement systems.

Although expensive to install, medicated water systems appear to be very advantageous.

Some concern has been expressed that the overuse of antibiotics will lead to resistant strains of the diseases. Studies of this possibility are not yet available.

13

CHAPTER 5

DELINEATING A SET OF STUDY SYSTEMS

The classifications of sheep production systems which have been previously developed are inappropriate for the Northern Rocky mountains and the Northwestern Great Plains.

Because of the climate winter shelter is advantageous for all systems, so classification which is based on the presence of winter shelter is inappropriate. This and other similar considerations render the classifications previously developed unsuitable for this study. Therefore, four systems are defined and evaluated in this study. The four systems are conventional with the lambs raised on pasture, conventional with early weaned lambs, confined with annual lambing, and confined with accelerated lambing. The sensitivity analysis is designed to include consideration of other applicable systems as variations in these four.

Two of the systems which were previously defined are conventional and semicont1ned. If winter shelter is added to the conventional, then the major, remaining distinction between conventional and semi-confined is whether or not the lambs are raised with the ewes on pasture. Therefore, these systems are classified as conventional, with a distinction for lambs raised on pasture or early weaned.

Partial confinement and total confinement are two other systems which were previously distinguished from one another. Petritz defines partial confinement as a confined system with the ewes placed on pasture for about 30 days. The buildings and equipment will not differ substantially for systems which are equivalent except for thirty days of pasture. Lambing frequency is a much more important distinction. Therefore, these systems will be grouped into one class, confined, with alternatives for annual lambing and accelerated lambing.

14

Table I contains the detailed estimates of lamb production for 500 ewes in each of the four systems. The predicated lambing rates are well within the range of lam bing rates currently being reported for similar systems, and are probably underestimates of future potential. For the purposes of comparative economic evaluation, the relative spacing of production estimates is more important than the absolute levels of the estimates.

In Table 1 the death losses for lambs on pasture are higher than for early weaned and confinement fed lambs. Higher death loss of lambs on pasture is consistent with experience and reflects more hazards and less supervision. Alternatively, the replacement rate is higher for ewes in an accelerated lambing program. This higher replacement rate reflects the increased stress and greater probability of complications which accompany more frequent lambing.

Table 2 presents the estimated saleable production of lambs, culls, and wool for each of the four systems. Prices are included for the culls and wools because these were not found to warrant sensitivity analysis. Cull prices are traditionally very low and the contribution to total revenue is small. Wool prices are stabilized by the federal wool incentive program.

The estimated feed requirements for each type of animal within each system are presented in Table 3. The estimates for mature sheep in confined systems reflect a 20% reduction from NRC recommendations to allow for the reduced requirements of these animals during periods of maintenance and early gestation. The lamb rations in the three systems with early weaned lambs reflect the approximate three to one feed to gain ratios that are attainable. The lambs to be raised on pasture are assessed pasture fees, which is consistent with previous studies. However, it is unlikely in practice that lambs would be charged at the full rate for mature sheep. Nevertheless, pasture maintains an almost two to one cost advantage for feeding the lambs.

Table I. Estimated Lamb Production by System for a 500 Ewe Flock.

System

Conventional

Lambs raised on pasture

Lambs confined

Confined

Annual lamb crop

Accelerated lam bing

1 Lambs sold weighing II 0 lbs.

%Lamb

Crop

165

165

200

300

%Death

Loss

15

10

10

10

#Lambs %Ewe

Raised Replacement

700

740

900

1350

15

15

15

20

#Lambs

Kept

75

75

75

100

#Lambs Lbs of Lamb

Sold Sold'

625

665

825

1250

68,750

73, !50

90,750

137,500

Table 2. Estimated Total Production by System for a 500 Ewe Flock.

System

Conventional

Lambs raised on pasture

Lambs confined

Confinement

Annual lamb crop

Accelerated lambing

1 Assuming one-third death loss of cull ewes.

LbsofLamb

Sold

68,750

73,150

90,750

137,500

Culls, 140 Lbs

@

$.20/Lb

1

$1,400.00

$1,400.00

$1,400.00

$1,876.00

Wool, 8 Lbs/Mature

Ewe or Ram

@ $1.35/Lb

$5,616.00

$5,616.00

$5,616.00

$5,616.00

V>

Table 3. Estimated Feed Requirements and Cost per Head.

System

Concentrate

(Lb)

Hay

(Lb)

Salt/Mineral

(Lb)

Per Ewe

Milk Replacer

(Lb)

Pasture

(Days) Cost/Head

3

Conventional

Lambs with ewes

Lambs early weaned

Confined'

Annual lambing

Accelerated

Lambs with ewes

Lambs confined 2

175

150

150

250

45

275

650

650

950

1050

10

50

12

12

12

12

Per Lamb

1.5

1.5

Per Ram

7

1

1

185

185

-

-

120

-

$44.35

$42.60

$40.50

$50.50

$1 1.33

$21.43

Conventional

Confined

Annual breeding

Accelerated

30

30

90

720

1100

1200

7

7

185

-

-

$35.68

$35.98

$40.18

1 Based on 20% reduction below NRC recommendations for confined mature sheep.

2 Based on feed to gain ratios of approximately 3lb feed/! lb gain.

3 Costs as follows: concentrate@ $.07 /lb, hay@ $.03/lb, salt/mineral@ $.125/lb, milk replacer@ $.50/lb, pasture@ $.06/day. a-

17

Table 4 presents the total feed costs by system for 500 ewes, ::>0 rams, and the estimated lamb crop for each system. Some previous studies have allowed for fewer than ~0 rams with 500 ewes in an accelerated system, since breeding is more spread out. The 20 rams are constant in these estimates, allowing for fewer potent rams and some vasechtomizcd teaser rams in the accelerated system.

The total variable cost estimates for each system are detailed in Table 5. There arc several differences between how variable costs arc estimated in this study and how they are formulated in other studies. Labor is included in the variable cost estimates of this study. Shearing costs are included only for mature sheep. Bedded barns are assumed for every system, and the bedding is charged at a price more in line with local straw prices.

Finally, the quantity of labor required for all systems is substantially less than the amount included in some previous studies. Data from Hettinger Station indicates an average annual labor requirement for a ewe and her lambs of less than two hours per ewe. This. of course, applies only to one system as it is implemented at Hettinger Station, with free choice feeding, etc. However, information gathered from local operators supports the conclusion that labor estimates in some previous studies arc too high. For this study, a range of reasonable labor requirements was estimated based on the data from Hettinger Station, the Canadian study, the Montana Fanner Stockman Articles on the operations of the Huttcritcs and lvlr.

Norby_ and interviews with other producers. Then the hypothetical systems used in tl1is study were distributed evenly within this range, in order of ascending !a bor req uircments.

The final estimates are in two parts, labor per ewe and labor per lamb. The labor per ewe is as follows, one hour per ewe in both conventional systems, two and one half hours per ewe in the cont1ncd system with annual lambing, and three hours per ewe in the confined system with accelerated lambing. The labor per lamb is estimated to be one hour per lamb in the conventional system with the lambs on pasture, and one and one half hours per lamb in the three systems with cont1nement fed lambs.

Table 4. Estimated Total Feed for 500 Ewes by System.

Concentrate

(Lbs)

Hay

(Lbs) System

Conventional

Lambs on Pasture

500 ewes

20 rams

700 lambs

Total

Lambs Confined

500 ewes

20 rams

740 lambs

Total

Confined

Annual Lamb Crop

500 ewes

20 rams

400 lambs

Total

Accelerated Lambing

500 ewes

20 rams

1350 lambs

Total

87,500

600

31 ,500

119,600

75,000

600

203,500

279,100

75,000

600

247,500

323,100

125,000

I ,800

371,250

498,050

325,000

14,400

7,000

346,400

325,000

14,400

37,000

376,400

475,000

22,000

45,000

542,000

525,000

24,000

67,500

594,900

Salt/Mineral

(Lbs)

6,000

140

1,050

7,190

6,000

140

1 ,110

7,250

6,000

140

1,350

7,490

6,000

140

2,025

8,165

Milk Replacer

(Lbs)

Pasture

(Days)

-

-

- -

700

-

-

- -

740

Total

Cost

92,500

3,700

84,000

180,200

92,500

3,700

96,200

$30,824.75

$37,877.25

90

-

- -

900

- -

1350

-

-

$40,263.25

$54,406.13

Table 5. Estimated Variable Expense Summary by System for a 500 Ewe Flock.

System Feed

Vet. &

Med' Shearing 2

Conventional

Lambs on pasture $30,824.75 $1,700 $780

Lambs confinement fed $37,877.25 $1,740 $780

Marketing 3

$1,687.50

$1,787.50

Power &

Fuel Supplies Bedding• Labor' Total

$1,000

$1,500

$ 500

$ 500

$ 350

$ 700

$ 6,000 $42,842

$ 8,050 $52,934

Confinement

Annual lamb crop $40,263.25 $1,900 $780

Accelerated $54,406.13 $2,350 $780

$2,187.50 $4,000 $ 500 $2,100 $13,000 $64,730

$3,292.50 $5,000 $1,000 $2,625 $17,625 $87,078

5

1 $2.00/ewe and $1.00 lamb.

2 Mature sheep only, $ 1.50/hd.

3 $2.50/hd. sold.

4 10 ton, 20 ton, 60 ton, and 75 ton respectively@ $35.

1 hr/ewe and lamb, 1 hr/ewe and 1.5 hr/lamb, 2.5 hr/ewe and 1.5 hr/lamb, 3 hr/ewe and 1.5 hr/lamb, respectively,@ $5 hr.

-

'C!

20

The estimated investments in buildings and other fixed assets are detailed in Table 6.

These estimates are based on the space requirements given in the Sheep Housing and

Equipment Handbook. It is assumed that warm barn space is provided only for lambing in the confined systems.

Table 7 illustrates how the annual charges for maintenance, taxes, and insurance on fixed assets are calculated within the simulation. The charges vary with changes in the fixed assets, and this table is provided to illustrate how they are calculated within the program.

In addition to the factors estimated in the preceding tables, it is necessary to estimate interest and inflation rates. An interest rate of 12% with inflation of 7% is estimated to be typical of recent experience. This yields a before tax real rate of 5%. Finally, it is estimated that production in the first year of operation will be seventy percent of the average production estimated for each system. Production in the second and third years is estimated to be eighty and ninety percent of normal, respectively. Thus the startup coefficients will be .7, .8,and .9.

Table 6. Estimated Fixed Asset Investments by System for a 500 Ewe Flock.

System

Conventional

Lambs on pasture

Lambs early weaned

Warm Barn'

(sq.

-

ft)

Cost Cold Barn

@

-

-

$6 (sq. ft)

8,800

13,200

2 Cost Feed Storage 3

@

$5 ($)

$44,000

$66,000

$ 5,500

$ 7,500

Fencing

($)

3 Equipment 3 Total

$16,400 $10,000 $ 75,900

$13,120 $12,500 $ 99,120

Confinement

Annual lamb crop

Accelerated lambing

1,000

750

$6,000

$4,500

16,750

14,750

$83,750 $10,000

$73,750 $12,500

-

-

$15,000 $114,750

$15,000 $105,750

1 Provide warm environment for lambing jugs. Space for 10% of the ewes under annual lambing and for 8% under accelerated lambing. Includes 10% plus rounding for orphan lambs and work space.

2 Figured as follows: Conventional, lambs pastured with ewes, 16 sq. ft/ewe and lambs.

Conventional, lambs weaned early and confinement fed, 12 sq. ft/ewe and 8 sq. ft/feeder lamb.

Confinement annual lamb crop, 16 sq. ft/ewe and 8 sq. ft/feeder lamb.

Confinement accelerated, 16 sq. ft/ewe and 8 sq. ft/'h feeder lamb crop.

3

In all cases 10% plus rounding added for access aisles.

Estimates taken from Table 2, Petritz, either directly or on a proportionate basis. tv

Table 7. Estimated Annual Charges for Fixed Assets for a 500 Ewe Flock.'

Building

Maintenance

1.5%

Equipment

Maintenance

3.5% System

Conventional

Lambs raised with ewes

Lambs confinement fed

$ 988.50

$1,299.30

$350.00

$437.50

Confinement

Annua1lamb crop

Accelerated lambing

$1,496.25

$1,361.25

$525.00

$525.00

1 Estimated according to the percentage allowances in Petritz.

Taxes

.5%

$379.50

$495.60

$573.75

$528.75

Insurance

.3%

$227.70

$297.36

$344.25

$317.25

Total

$1,945.70

$2,529.76

N

N

$2,939.25

$2,732.25

23

CHAPTER 6

THE SIMULATION PROGRAM

A FORTRAN program was developed to simulate the multi-period results of a sheep production system which can be described by a set of budget estimates such as those in the preceding chapter. This program assumes a 500 ewe operation in all cases. A listing of the program is reproduced in Appendix C and a flowchart of the simulation method is contained in Figure I.

The program runs in one of two output modes, determined by a single digit as the first record in the data file. All subsequent records in the data file specify one production system to be simulated under one set of circumstances. The data record specifying a sim ulation contains the following eighteen fields; number of periods in the simulation, interest rate, inflation rate, beginning equity, other income, fixed assets, equipment, value of the breeding flock, annual variable cost, quantity of lamb sold per period, culls sold per period, average pounds of wool per head per period, price of lamb, price of culls, price of wool, and three start up coefficients. These start up coefficients are used to establish the level of lamb production during the first three years of operations. They are numbers between zero and one, and are multiplied by the quantity of lamb sold, which provides for an initial three periods with reduced production.

In output mode one, the program prints all period by period balances. In mode two, the account balances are printed only for the final period of operations. In either mode, two summary net future values are printed. The first of these net future values is the benchmark. The benchmark is the after tax, compounded value of beginning equity and other income. These two flows are compounded at the rate of interest income. Other income is

START set output mode

Read new data record

Initialize internal variables

Increase Joan payment if necessary

Calculate revenue from operations

Calculate interest

Add ALL income to cash balance

Calculate cash outflow

If

Period

No. IS

Yes

Deduct cashout from cash (ma·y borrow)

Deduct repaid principal from debt

Prepay debt if there if extra cash

Figure 1. Flowchart of simulation.

24

40

Calculate tax and deduct tax credits

Deduct tax from cash

(may borrow)

Store period results from operation

Calculate after tax increment in benchmark value

If

Period equals limit

Increment period counter

Yes

Intlate prices and other income

Calculate final value from operations:

Cash-debt+ breeding flock

(inflated value)

Print simulation results

25 included in the benchmark because within each system simulation it is added annually to cash balances. Other income is intended to replicate those instances where the sheep operation is one of two or more enterprises of a multiple enterprise farm or ranch. This method of handling it allows the tax rate for each period to be determined by the net income from all operations. Other income must, therefore, be included in the benchmark, in order to ascertain when the sheep operation obtains returns equal to the opportunity cost of all funds. The second net future value is the result of simulating operation of the system according to the specifications in the data record. This net future value from operation consists of the final cash balance less outstanding debt and plus the inflation adjusted value of the breeding flock. All other assets are assumed to have been exhausted during the full term of operations. The equipment specified for a system is replaced with equipment of an equal, inflation adjusted value after fifteen periods of operation.

Federal income and social security taxes are calculated and paid annually. The income taxes are calculated by the 1984 Head of Household table, with allowance for three exemptions. Social security taxes are calculated at the 1984 effective rate of 11.3% on incomes up to $37,800. After the first year, both the income tax brackets and the social security ceiling on taxable income are indexed to inflation. This is in accord with. current law for the income taxes, and is an estimate of future increases in social security taxes.

The tax calculations include provisions for the current regulations concerning depreciation, investment credit, and loss carry forward. Current regulations allow five year ACRS depreciation on livestock and single purpose agricultural structures. The tax code also provides for the carrying forward of losses to offset income in subsequent years. They may be carried forward for up to fifteen years. The carry backward provision of the tax code was not included in these simulations because of the large depreciation, which places most of the losses in the early years, for those simulations which are eventually profitable.

26

The simulation program assumes that cashflows within a period are simultaneous, with one exception. The exception is that when surplus cash is applied to the repayment of debt, a cash balance equal to one half of variable cost is maintained. The model borrows money whenever it is needed, at the prespecified rate of interest. A payment amount is set based on twenty-five year amortization. Subsequent borrowing first extends the time for repayment. Then, if necessary in order to accomplish repayment within twenty-five years from the date of the new borrowing, the payment amount is increased. Payment amounts are never subsequently reduced until all debt is repaid.

First period prices and other income are inflated annually at the prespecified inflation rate. The assumption, that lamb prices follow inflation, was tested. The maintained hypothesis used was P=alb, where P is the price received by farmers, and I is the implicit price deflator for total personal consumption expenditures in the GNP. The function was double logged, and an ordinary least squares regression was run on data from 1950 through

1982. Since b would be expected to equal one, if prices have followed inflation, at-ratio was calculated at one instead of zero. The estimate of b was 1.1775 with a standard error of .10799, which results in at-ratio of 1.64. It was concluded, therefore, that b was not significantly different than one, and that lamb prices have approximately followed inflation. The R-squared was .8039.

The program assumes that the lambs are sold weighing 110 pounds, and that cull ewes and rams average 140 pounds. The wool sold is calculated on the basis of 500 head of mature ewes and 20 rams.

A single scenario in which the four systems are compared for a given set of conditions requires twenty simulations, that is four different systems at five lamb prices. The five

Jamb prices, used in all but one of the scenarios, range from $.50 per pound to $.90 per pound, in even increments of $.10. This price range is consistent with recent history. Table

8 contains the annual weighted average lamb price received by farmers for the years 1970

27 through 1982. The rightmost column contains the inflation adjusted value of these prices in 1982 dollars. The range is from $.53 to $.863.

Table 8. Annual Weighted Average Lamb Prices Received by Farmers, Inflated Into 1982

Dollars per Cwt.

Year

1970

1971

1972

1973

1974

1975

1976

1977

1978

1979

1980

1981

1982

Nominal

Weighted

Average

Price'

26.4

25.9

29.1

35.1

37.0

42.1

46.9

51.3

62.7

66.7

63.6

54.9

53.1

Inflation

Index 2

92.5

96.5

100.0

105.7

116.4

125.3

131.7

139.3

149.1

162.5

179.2

194.5

205.3

1 Source: U.S. Department of Agriculture, Economic Research Service, Livestock and Meat

Statistics: 1982, Statistical Bulletin Number 522 (Washington, D.C.: U.S. Government

Printing Office, 1982), p. 123. Table 158.

2 Source: Council of Economic Advisers, Economic Report of the President; February

1984 (Washington, D.C.: U.S. Government Printing Office, 1984), p. 224. Table B-3. Personal Consumption Expenditures, Total.

Price

Inflated into 1982

Dollars

58.6

55.1

59.7

68.2

65.3

69.0

73.1

75.6

86.3

84.3

72.9

57.9

53.1

In one scenario a different price range was used in order to span the lamb prices at which the returns from operation were equal to the benchmark value. This scenario consists of the simultaneous variation of four parameters in a direction conducive to lower costs. A price range of $.20 to $.60 per pound was used.

Much of the evaluation of the systems and the sensitivity analysis centers on the lamb prices at which operating returns are equal to benchmark returns. These points are called the benchmark prices. Other prices are also likely. The graphical presentation of the future values provides a way of visualizing how the systems compare as lamb prices diverge from i the benchmark price.

28

A fundamental concern in designing this study was to analyze how the systems compare from the point of view of a potential investor with a fixed starting position. Thus beginning equity and other income are held constant across systems. Factors such as the capital structure or the debt/asset ratio are not proportionate. When variations in beginning equity or other income are posited, their magnitude is constant across all systems. Possible insights from another approach are discussed in the final chapter.

29

CHAPTER 7

SIMULATION RESULTS

The results from operating one specific system at one set of prices are obtained in a complete simulation on one input data record. In the results presented here, one scenario consists of twenty separate simulations, that is four systems at five lamb prices.

The results of each scenario are presented in both tabular and graphical form. Each table of results is headed by a list of the system and price specifications which describe the scenario. Where a specification is constant for all systems, the specification is simply given.

However, where the specification varies by system, such as variable cost, the specification is described in terms of how it relates to the estimates in Chapter 5, Tables 1 through 7.

For example, under variable expense, the notation "x.8" indicates that the variable expense for each system is 80% of the amount described in Table 5.

Following the descriptive data, the benchmark value of invested funds is given. Since the benchmark is invariant by system or lamb price, it is constant for each scenario. Below this, a table of the net future values from operating each system at each lamb price is presented. Finally, the results and benchmark for each system are graphed on the right side of the page. For convenience when comparing across systems and scenarios, the interpolated benchmark prices for all systems and scenarios are summarized in Table 9.

The scenario presented in Table 10 consists of each of the systems as delineated in

Chapter 5. Subsequent scenarios consist of variations to one or more of the estimates which delineate the systems in Chapter 5.

The pattern of results in the base scenario presented in Table 10 is consistent with the results from previous studies. That is, the least intensified, conventional system is favorable

30

Table 9. Interpolated System Benchmark Prices by Scenario (prices in cents per pound).

Scenario Description

Conventional, Conventional, Confined, Confined,

Lambs on Lambs Early Annual Accelerated

Pasture Weaned Lambing Lambing

80 79.8 69 Systems as estimated, no variations

Systems as estimated, $15,000 other income

Systems as estimated, $30,000 other income

Systems as estimated, $100,000

67.4

59.5

57 .I other income

Systems as estimated, beginning equity reduced to $10,000

Interaction of $10,000 beginning

52.6

69.2 equity and $30,000 other income 57.7

Systems as estimated, beginning equity increased to $100,000

Interaction of $100,000 beginning estimated levels

Production increased to 120% of the

64.7 equity and $30,000 other income 56.7

Production reduced to 80% of the

84.2

56.7 estimated levels

Variable expense reduced to 80% of the estimated amount

Fixed asset cost of every system

54.9

58.7 reduced to $5,000

Interaction of reduced fixed asset cost and $30,000 other income

Higher production, lower variable expense, reduced fixed asset cost and $30,000 other income

Interest rate and inflation rate reduced to 5% and 0%

Interest rate and inflation rate

50.8

31.7

68.5 increased to 20% and 14%

Interaction of low interest and

67.9 inflation and $30,000 other income 61.8

Interaction of high interest and inflation and $30,000 other income 51.9

Initial three year start up coefficients increased to .9, .95, .99 66.1

Initial three year start up coefficients reduced to .5, .75, .875 68.3

72.9

70.2

65.4

83.4

70.9

78.1

69.5

99.6

67.6

66.2

69.6

62.4

39.6

81.9

81.5

75.4

65.2

78.5

82

74

71.3

67

82.6

72

78.3

70.7

99.4

67.5

66.2

69.9

64.1

41.1

81.3

81.2

75.8

67.2

78.3

81.6

65.1

63.1

60.1

69.8

63.5

68.2

62.6

87

58.2

56.9

64.5

58.6

38.1

69.6

69.3

66

60.1

67.9

69.8

Table 10. Base Scenario.

Interest rate

Inflation rate

Beginning equity

Other annual income

Fixed assets

Equipment

Variable expense

Lamb production

Start up coefficients

Benchmark

12%

7%

$50,000.00

$-O-

X I

X I

X I

X I

. 70, .80, .90

$487,949.37

Future Values From Operation

(millions of dollars)

Price of

Lamb*

$.50

. 60

.70

.80

.90

Conventional Conventional Confined

Lambs on

Pasture

Lambs Early

Weaned

Annual

Lambing

-4.333

-1.367

1.127

2.241

3.083

-8.889

-5.734

-2.578

.487

2.013

-11.054

-7.140

-3.225

.551

2.317

*Dollars per pound.

Confined

Accelerated

Lambing

-10.384

-4.453

1.046

3.140

4.630

...

. /

'·

... /

-8

-;; 0

0

"

'M

~

:;1 -1 e

~

~

~

_,

2

"' -2

"'

> iii

-3

-5

-7

-6, .

.

f ~/

.

. v.

.-'

Benchmark _____

~-·

£ __

/

/ .

. •

/

/

'

/

.

'

.-/

.-::-

·--1--

/ j

;/

.,;

•

I

. r.J/. .._./ .i-'·

1

I j I j; ;~·

I/

I

I .

. I .~.t·

!

•0

I li/

•j

•

.60

.50

. 70 .80

.90

LAMB PRICE ( S/lb.)

w

32 at low lamb prices, while the most intensified, confined system is favorable at higher lamb prices. Also, the intermediate systems are less favorable at all lamb prices than the systems at either extreme of intensification. These results, however, differ from previous results in two ways. First, every system is capable of earning a return above the benchmark return at lamb prices within the range of recent lamb prices. Second, the benchmark prices of the different systems are closer together than the break even prices of previous studies. It is also noteworthy that the confined and accelerated system becomes the most profitable system at a lamb price less than two cents higher than the lowest benchmark price, which is the benchmark p1ice of the conventional system with the lambs on pasture.

An examination of the period by period balances for all systems in this base scenario reveals that, at their benchmark prices, none of the systems generates sufficient taxable income within the first fifteen years to utilize the investment credit. This indicates a potential for further reductions in the benchmark prices, if the investment credit could be used to offset tax liabilities generated by income from other sources.

The results presented in Table 10 are predicated on $15,000 of other income, which increases taxable income and cash flow. Changes in other income shift all of the curves including the benchmark value of invested funds. In these results the less steeply ,sloped curves of the conventional systems exhibit a larger change in their benchmark prices. There are several interacting forces generated by the other income which must be considered in explaining the comparative responses of the systems. First, the other income increases cash flow and decreases borrowing. Total capital and debt/ asset ratios are different for each system, and the constant $15,000 change in cash flow represents substantially different consequences for leverage in each system. Secondly, the tax implications of other income will vary by system as both the size and proportions of depreciable assets, interest expense, and other deductible expenses vary. Finally, the net effects from other income are distributed over the differing amounts of lamb which are produced for sale by each system.

Table 11. Scenario with $15,000 of Income From Other

Sources.

Interest rate

Inflation rate

Beginning equity

Other annual income

Fixed assets

Equipment

Variable expense

Lamb production

Start up coefficients

12%

7%

$50,000.00

$15,000.00

X 1

X 1

X 1

X 1

.70, .80, .90

Benchmark $2,408,250.37

Future Values From Operation

(millions of dollars)

Price of

Lamb*

$.50

.60

.70

.80

.90

Conventional Conventional Confined

Lambs on Lambs Early Annual

Pasture Weaned Lambing

1.464

2.459

3.269

4.010

4.711

-2.185

.753

2.137

3.058

3.877

-4.350

-.435

1.922

3.129

4.139

*Do liars per pound.

Confined

Accelerated

Lambing

-3.680

1.434

3.337

4.798

6.080

1 i

"I

•

•

\ V·

-;;; 2 c

2

M

M -g

~

4

w 0

~

:;!

~

~

-1

...

~

~ -2

Benchmark

(0"/

/ -

-·

_.-·

•

-~

.

CP-r:-.\

·o

./

~'"\<;l."o_./'

\~ ~

~o\'"'

· /

•

/ /

(./ ~·

/ . y /

/;/

;.

'

I .

;/

I

.

.50 .60 .70

Li\Mfl f'lUCF. 0;/Jh )

.80 .90 w w

34

In the next two tables, Tables 12 and 13, other income is increased to $30,000 and

$100,000 respectively. The results are predictable from the previous scenario. The benchmark prices of all systems continue to decrease with progresssively higher marginal tax rates. The Jess intensified, conventional systems exhibit larger responses per unit of output.

The benchmark prices of the first four scenarios in Table 9 illustrate the impact of increasing levels of other income. It must be remembered, however, that this other income truncates the lower end of the tax schedule for those situations in which the sheep enterprise is profitable. Therefore, as the sheep enterprise becomes profitable, its earnings will be subject to higher marginal tax rates than would have been the case in the absence of the other income.

The next four tables of results, Tables 14 through 17, may also be viewed as a set.

They explore the sensitivity of the results to variations in the initial investment. A $40,000 reduction in beginning equity, from $50,000 to $10,000, is posited in Tables 14 and 15. In the first scenario there is no other income, while in Table 15 there is $30,000 of other income. A complimentary variation is posited in Tables 16 and 17. Beginning equity is increased by $50,000, to a total of $100,000. Again, $30,000 of other income is posited in the second scenario, Table 17. Apart from other income, the variations in beginning equity have a small impact. The introduction of other income substantially removes all of these effects.

Tables 18 and 19 present the results of scenarios designed to test the sensitivity of the systems to changes in ewe fecundity. The concern is with changes in ewe fecundity, and not with changes in relative ability of different systems to exploit ewe fecundity. Therefore, the quantity of Jamb sold for each system is decreased by 20% in Table 18 and increased by 20% in Table 19. Referring to these scenarios in Table 9, the benchmark prices show an approximate shift of $.30 per pound across all systems. Ewe fecundity is not more critical for one system than another.

Table I 2. Scenario with $30,000 of Income From Other

Sources.

Interest rate

Inflation rate

Beginning equity

Other annual income

Fixed assets

Equipment

Variable expense

Lamb production

Start up coefficients

12%

7%

$50,000.00

$30,000.00

X 1

X 1

X I

X 1

.70, .80, .90

Benchmark $3,965,757.75

Future Values From Operation

(millions of dollars)

Price of

Lamb*

$.50

.60

.70

.80

.90

Conventional

Lambs on

Pasture

3.452

4.179

4.870

5.517

6.129

*Dollars per pound.

Conventional Confined

Lambs Early

Weaned

2.249

3.150

3.954

4.697

5.399

Annual

Lambing

1.477

2.805

3.844

4.775

5.628

Confined

Accelerated

Lambing

1.737

3.531

4.949

6.211

7.391

7

6

'/

, c.?<:-/

.. ,(.. +

">:-'/

/

...

/

•

/

. , } /

; 7

' / /

, / / , / ,&;·/'

....

~

~

~

~

~

M

M

~

5

.

/ "' ·--

.

, /

/

\.• ·. e c?':/ /

/ /Yeo'>'''

"

~--L

/

~

/~.'"

Benchmark

+ / fJ

//

3

.

.

/ / /

,./

/ • I

/ / .

2 J '

'

'

'

I

'

/

,,. .w .m

--...........-----

.M .~

LMI!l !'HH!. (":/!1•.) w

V>

Table 13. Scenario with $100,000 of Income From Other

Sources.

Interest rate

Inflation rate

Beginning equity

Other annual income

Fixed assets

Equipment

Variable expense

Lamb production

Start up coefficients

12%

14%

$50,000.00

$100,000.00

X I

X 1

X 1

X 1

.70, .80, .90

Benchmark $9,871,904.25

Price of

Lamb*

$.50

.60

.70

.80

.90

Conventional

Lambs on

Pasture

9.731

10.280

10.828

11.375

11.921

*Dollars per pound.

Future Values From Operation

(millions of dollars)

Conventional

Lambs Early

Weaned

8.968

9.558

10.144

10.730

11.313

Confined

Annual

Lambing

8.627

9.358

10.090

10.817

11.542

Confined

Accelerated

Lambing

8.755

9.862

I 0.966

12.064

13.157

8

11

,.

.c/·

,.

/ i:l

1' ii:

9

12

/ /

.

. •

, }

/ ct//

-

,-:-,11

~

~ ~

"

/

.

-

/ ___ / ,<$>'",/

,?~//

~-<v,·

.

(_.0<;>11/

/

<.· r__. /

....--: "=->""

/'11/(,0~·

._

-7

.

/ /

J

------Ben~

/ / '

, / /

/ • /

;/

7

.so .no

. 70 l.i\'!11 "!'HT (S/ib.,

.!ill .<JO w

0\

Table 14. Scenario with Lower Initialllwestment.

Interest rate

Inflation rate

Beginning equity

Other annual income

Fixed assets

Equipment

Variable expense

Lamb production

Start up coefficients

12%

7%

$10,000.00

$-O-

X I

X I

X 1

X I

.70, .80, .90

Benchmark $116,069.20

Future Values From Operation

(millions of dollars)

Price of

Lamb*

$.50

.60

.70

.80

.90

Conventional Conventional Confined

Lambs on Lambs Early Annual

Pasture Weaned Lambing

-5.5 31

-2.565

.356

1.871

2.795

-10.087

-6.932

-3.776

-.621

1.554

-12.253

-8.338

-4.423

-.508

1.890

*Dollars per pound.

Confined

Accelerated

Lambing

-11.583

-5.651

.242

2.833

4.392

4

3

0

/

/

'

•

/

Benchmarl:_ _____

/

•

/

, r !l: ,,; t

--·--·---0-~~7?-----

/

."/'

.-

/

;:;_1

~-' ~---r-

5

~~

~

:': ii:

-4~

-5

-6j

(

-7< i

I

'-

'

.

/j

• + • .§ v .t I

0

'--

---:1 (

I

Jt

+

I

I c9~

'

'

I

. + i

. .

1

I I

• _§, •

I "./I

I /._

! ·.· o v

I'?

"

~§

. 0

/

1

-8.1 ,-

,f i ' - -

"'

.-70.

LMm Finn: (<:/lb. l

:so-· --_____,.

.90 w

-...)

Table 15. Scenario with Lower Initial Investment and

$30,000 Income From Other Sources.

Interest rate

Inflation rate

Beginning equity

Other annual income

Fixed assets

Equipment

Variable expense

Lamb production

Start up coefficients

12%

7%

$10,000.00

$30,000.00

X 1

X 1

X 1

X 1

.70, .80, .90

Benchmark $3,766,432.62

Price of

Lamb*

$.50

.60

.70

.80

.90

Conventional

Lambs on

Pasture

3.185

3.938

4.639

5.300

5.927

*Dollars per pound.

Future Values From Operation

(millions of dollars)

Conventional

Lambs Early

Weaned

1.856

2.856

3.700

4.468

5.175

Confined

Annual

Lambing

.842

2.472

3.574

4.533

5.408

Confined

Accelerated

Lambing

1.232

3.243

4.721

6.003

7.194

7

.c· , / c"/

~·

/

.. o~ + v'

6

1

•

/ v

~·

51 / t

D··

/

I

/

•

/

(,0-o:-,

•· #,;"/

, ... /

/ o<- /

()

..... ,,.

/~.

::: w

"

> iii

'"

..,

""

-;;; c

0

~

~

~

~ e

I

.

~

.

, I //.

'

' /

} /.

.

/

~o

/ /

..../

/

'Y<uo<-'"

Benchmark

't'

'

. '

. I

I

;_~/ t' ___

-:hl;-· .

,,,----~-----:9()

f.f\_'·11: I'HIC!· (.'~/I!>.)

/ w oc

Table 16. Scenario with Higher Initial Investment.

Interest rate

Inflation rate

Beginning equity

Other annual income

Fixed assets

Equipment

Variable expense

Lamb production

Start up coefficients

12%

7%

$100,000.00

$-O-

X 1

X 1

X 1

X 1

. 70, .80, .90

Benchmark $881,224.91

Price of

Lamb*

$.50

.60

.70

.80

.90

Conventional

Lambs on

Pasture

-2.835

.131

1.739

2.627

3.410

*Dollars per pound.

Future Values From Operation

(millions of dollars)

Conventional Confined

Lambs Early Annual

Weaned Lambing

-7.391

-4.236

-1.080

1.347

2.446

-9.556

-5.642

-1.727

1.408

2.741

Confined

Accelerated

Lambing

-8.886

-2.955

1.720

3.499

4.922

•

/

_./

•

/

4

3

~

~

"

2 ll Benchmark

0

~

-1

5

=

~

-2

:l

-3

"

-4

-5

-6

"

(

+

. I

I

(/.

I I

I tl I

!.f

I I /&"'

•

1/ j

'/

•

I

!

•

•

• tl ...... •

. ...-I

•

/

/ . ·

/1

_/

"'

"'-<·/ ~-~ ()

'1

&"' • eo· /

I

• 0 •

.

.

/

.-

•

/

.---

+

.---·

. i j

-~

.

' /

/

-7

-a

' I

.So

'

.

I

/ ..

I /

• •

0

;/

.to ·------·:77!----·-·--ro-~9n

!.Mlf{ I'I{JCE (~;/Jh.) w

'!)

Table 17. Scenario with Higher Initial Investment and

$30,000 Income From Other Sources.

Interest rate

Inflation rate

Beginning equity

Other annual income

Fixed assets

Equipment

Variable expense

Lamb production

Start up coefficients

12%

7%

$! 00,000.00

$30,000.00

X 1

X 1

X 1

X 1

.70, .80, .90

Benchmark $4,214,730.37

Price of

Lamb*

$.50

.60

.70

.80

.90

Conventional Conventional Confined

Lambs on

Pasture

Lambs Early

Weaned

Annual

Lambing

3.762

4.478

5.146

5.774

6.371

2.643

3.481

4.252

4.984

5.666

2.044

3.167

4.156

5.054

5.893

*Dollars per pound.

Future Values From Operation

(millions of dollars)

Confined

Accelerated

Lambing

2.246

3.860

5.228

6.463

7.633

\_.· /

-:.9::

+

/

.

.::...·

":-"'•

.. c

0

•

;:

~

~

E

~

!

6

5

! --

. _.

. ·;·

/1'

' '

~·

..

\.:,::....-/

,· /~

/ / . .(:-'>/ / o:;: ·v:~:..·

__..·

/ cp.>·

..p;,·/

• 0

/

l-:/ -

,

-<-" ,.

·~~"

~3~!

2

•

' j / .

I /

'

/

•

.

+,---·~-

• 'j(l ,60

........ -"'""::::-

. 70

-~ l.M11~

!'H!I:I·: (S/!I>,J

,Qil

;!5

Table 18. Scenario with Ewe Fecundity Reduced 20%.

Interest rate

Inflation rate

Beginning equity

Other annual income

Fixed assets

Equipment

Variable expense

Lamb production

Start up coefficients

12%

7%

$50,000.00

$-O-

X I

X I

X I

X .8

.70, .80, .90

Benchmark $487,949.37