Insurance Billing for Sensitive Health Services

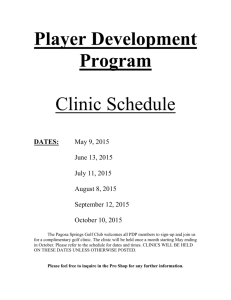

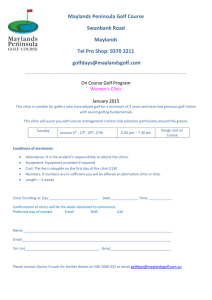

advertisement