PS1 Q3 Solution David Ronayne 24 October 2011

advertisement

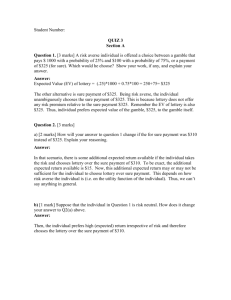

PS1 Q3 Solution David Ronayne 24 October 2011 Hi guys, here is the solution to Q3. The intuition is as we discussed in class. But I give it again here. Read however much you need to understand. If you think you get it just look straight at the ‘exam answer’ at the end. Intuition When I asked you if you wanted a lottery (a gamble) between £0 and £1 (by tossing a coin probabilities 0.5 heads 0.5 tails), or taking 50p for sure, some people said they’d rather have 50p. People who prefer the expected outcome (here 50p) to the lottery, are called risk averse. Now for those people, some of them may not like risk a lot. Indeed, they may be willing to accept less than 50p for sure, for example 40p, 30p or even maybe 20p! We are interested in measuring just how risk averse people are. One way to measure that in our example is to see how little you can offer them, and they are still willing to accept it to avoid the gamble. The amount below 50p that they are willing to go is what Q3 wants you to find out for different utility functions. You will find that one guy is risk averse (will take 50p for sure), one guy is risk neutral (is indifferent between gambling and 50p), and one guy is risk loving (prefers the gamble to the 50p). What you need to find is the Γ for how much less than 50p you can get them to be indifferent between the gamble and the 50p. Notice that Γ is positive for the risk averse (RA) guy, 0 for the risk neutral (RN) guy, and negative for the risk loving (RN) guy. Formally (from your lecture notes) RA, RN and RL preferences are defined 1 accordingly to whether you prefer the expected outcome or the gamble:1 i is strictly RA ∶ E p [x] ≻ p i is RN ∶ E p [x] ∼ p i is strictly RL ∶ E p [x] ≺ p The tricky bit is that the gamble in the question is not the same as the coin toss example. It is true that the expected outcome of both is 0.5, so no change there. But, the coin toss example has 2 outcomes £0 or £1, the gamble in Q3 could have any number in the interval [0,1] as an outcome. So, calculating the expected utility is not as simple as in the coin toss example, and is done with an integral (a mathematical tool that will consider every point in the interval we specify, here [0,1]) - the one I put on the board. √ The next section answers the question for the risk averse guy u(x) = x graphically, step by step with the accompanying maths. You only need to know the maths, but I imagine the graph will help you understand what is going on. I expect you to be able to apply the same method with the other 2 utility functions in the question and do it yourselves. Steps Follow these steps and we’ll have the answer: (i) Find the expected outcome of the lottery. (ii) Find the utility from the expected outcome. (iii) Find the expected utility from the lottery. NB: ii and iii are NOT necessarily the same (iv) Find the amount you could give him for sure that gets him to the same level of utility as giving him the lottery. (v) Find how much you can decrease the amount you offer for sure below the expected outcome of the lottery such that the person is made indifferent between the lottery and the offer. 1 There is a technical distinction you should appreciate between bring RA or RL and strictly RA or strictly RL, as defined in your lecture notes/slides. In Q3 there is one strictly RA, one RN and one strictly RL guy. I omit the word ‘strictly’ when discussing it. Do not get hung up on this point. 2 Solution (i) What is the expected outcome of this lottery (call it lottery p)? Well if x is uniformly distributed between [0,1] i.e. x ∼ U[0, 1] then E p [x] = 21 , just the midpoint of the two bounds 0 and 1. This is shown as the blue dot on Figure 1. (ii) What is the expected utility of the expected outcome? Just plug √ in the expected √ 1 outcome to the utility function, i.e. u(E p [x]) = E p [x] = ≈ 0.71. So this 2 is the utility from being given 21 . But we do not need this to calculate Γ hence it is not on Figure 1. The reason I am doing it is to highlight that in general u(E p [x]) ≠ E p [u(x)], do not make the mistake of thinking they are the same!!! (iii) What is the expected utility of the lottery? It is NOT the same as what we calculated in (ii)!! Indeed, unless you have a linear utility function u(E p [x]) ≠ E p [u(x)])? It is found in the following way: 1 E p [u(x)] = ∫ u(x) dx 0 1 = ∫ √ x dx 0 3 1 2x 2 ] 3 0 2 3 = [ = This is the expected utility from the lottery. You cannot read it off the graph and need to calculate it yourself. Once you have it, put it on your graph, it is shown as a red dot on Figure 1 on the axis for utility. What it is helpful to note now is that if we offered this guy the lottery p or 12 , he would strictly prefer 21 , just look √ 1 at the axis for utility and see that > 23 , so this guy is not going to gamble if 2 he’s offered E p [u(x)] = 1 2 as an alternative. Another way to think about this is if 1 2 for sure, or the lottery?’ we ask him: ‘Will you take he will answer: ‘I will take 12 ’ 3 or in our language, we ask: ‘ 12 ≺ or ≻ or ∼ p?’ and he will answer: ‘≻’ (iv) If you give him the lottery he gets utility of E p [u(x)] = 23 , can we offer him an amount y for sure such that he would get utility of 32 ? Yes, √ 2 3 2 3 4 9 = u(y) y = y = You can find this from the graph by going across to the curve then down to the axis for wealth (x), this is done with red lines and the answer by a second red dot in Figure 1. (v) So if we ask him: ‘Will you take 4 9 for sure, or the lottery?’ he will answer: ‘I am indifferent’ or in our language, we ask: ‘ 49 ≺ or ≻ or ∼ p?’ and he will answer: ‘∼’ If you offer this guy any x ∈ [ 94 , 12 ], he’ll take it rather than gamble. So, we can see that this guy will pay up to Γ = anything in [0, Γ], accepting Γ= 1 18 1 2 1 2 − 4 9 = 1 18 to avoid the lottery, he’d pay − Γ rather than the lottery. The most he’d pay is because this would equate E p [u(x)] = 2 3 1 and u( 12 − 18 )= 2 3 (we assume he accepts when indifferent). Graphically, Γ is the space between the red and blue dots on the axis representing wealth. 4 uHxL 1.0 0.8 2 E@uHxLD= 3 0.6 0.4 0.2 4 1 E@xD= 9 0.2 2 0.4 0.6 0.8 Figure 1: Picturing the Problem 5 1.0 x Exam Answer In an exam I would give the following answer full marks. You should now understand each line of this and do it yourself. Make sure you can: Define lottery p as x ∼ U[0, 1] u(E p [x] − Γ) √ = E p [u(x)] 1 E p [x] − Γ √ √ = ∫ u(x) dx 0 1 √ 1 −Γ 2 = ∫ 1 −Γ 2 2x 2 = [ ] 3 0 1 −Γ 2 2 2 = ( ) 3 1 4 = − 2 9 1 = 18 Γ x dx 0 3 1 I would like you all compute Γ for the other 2 utility functions now, and be able to explain the intuition for why a risk-averse guy has Γ > 0, a risk-neutral guy has Γ = 0 and a risk-loving guy has Γ < 0. 6