STORE QUALITY IMAGE AND THE ‘RATIONAL INATTENTION HYPOTHESIS’:

advertisement

STORE QUALITY IMAGE AND THE ‘RATIONAL INATTENTION HYPOTHESIS’:

AN EMPIRICAL STUDY OF THE DRIVERS OF $9 AND 9¢ PRICE-ENDINGS

AMONG INTERNET-BASED SELLERS

Mark Bergen

Professor, Marketing and Logistics Management

Robert J. Kauffman

Director, MIS Research Center and

Professor and Chair, Information and Decision Sciences

Dongwon Lee

Doctoral Candidate, Information and Decision Sciences

Carlson School of Management

University of Minnesota

E-mail: {mbergen, rkauffman, dlee}@csom.umn.edu

Last revised: September 20, 2004

Note: This paper was accepted for presentation in the 2004 INFORMS Conference on

Information Systems and Technology, Denver, Colorado, October 23-24, 2004.

ABSTRACT

Prior research shows that 9¢, 99¢, $9 and $99 in retail prices occur far more than expected. We

investigate the extent to which these “‘9’ price-endings” occur in Internet-based selling, and

explore what drives the observed variations. In particular, we explore theories based on

customer perceptions of store quality image and rational inattention to price-endings. To

accomplish this, we specify and test a discrete choice model for price-endings using more than

1.9 million daily observations on multiple categories of products sold by hundreds of Internetbased retailers. Our results show that a firm’s online reputation, its average price in a product

category, the relative price levels within a product category, and the total number of digits in the

product’s price have significant effects on the chosen price-endings with respect to different

product categories. The results support an image theory of store quality, and suggest other

behavioral and operations theories to explore in future work. We obtain mixed support for the

theory of rational inattention. We also explore the role of information technology (IT) in firm

price-setting, and offer new insights for marketers who wish to optimize price-setting decisions

in the competitive online environment of Internet retailing.

KEYWORDS: E-commerce, economic analysis, empirical research, Internet-based selling,

online reputation, price-endings, rational inattention, seemingly unrelated regression, strategic

pricing, technology impacts, threshold pricing.

Acknowledgments. The authors wish to thank the anonymous reviewers for the 2004

INFORMS Conference on Information Systems and Technology, as well as co-chairs, Chris

Forman, Hemant Bhargava and D. J. Wu, for their helpful input on an earlier version of this

paper.

1

INTRODUCTION

In the United States, sellers tend to choose the rightmost digits of a price so that it falls just

below a round number (Friedman, 1967; Schindler and Kirby, 1997; Twedt, 1965). These last

digits commonly are called “9” price-endings, and reflect the common use of 9¢, 99¢, $9 and

$99 as in $19.99 or $199 (Schindler and Kibarian, 2001). The use of “9”-endings has also

received considerable attention in public discussions in several European countries also, as they

convert from local currencies to the Euro (Folkertsma, et al., 2002). In addition to a tendency to

use “9”-ending prices, several surveys on price-endings report that firms use 0¢, 5¢ and 9¢ in

posted prices more than 74% of the time—and even up to 99% of the time (Stiving and Winer,

1997). According to Blinder, et al. (1998, p. 26), practitioners’ belief in these kinds of price

points “… is part of the folklore of pricing…” In an interview study of 200 large U.S. firms,

they find that 88% of the firms in the retail industry and 47% of the firms in non-retail industries

report substantial importance of these kinds of price points in their pricing decisions.1

This study investigates the extent to which threshold pricing occurs in Internet-based

selling.2 With the new retailing activities on the Internet, we expect to see changes that reflect

different technological underpinnings of the firm’s production process for prices (Dutta, et al.,

2003). Not only do the new technologies far surpass the capabilities that are available in

traditional bricks-and-mortar stores to adjust their own prices (Kauffman and Lee, 2004) and

track competitors’ prices (Kauffman and Wood, 2004), they provide the basis for consumers to

o

1

See Shapiro (1968) and Monroe (1990) for a review of earlier literature, and Anderson and Simester

(2003) for a review of more recent literature in Marketing.

2

This is also referred to as odd pricing (Monroe, 2003), psychological pricing (Lambert, 1975),

tantalizing pricing (Konieczny and Skrzypacz, 2003), and just-below-the-round-number-pricing

(Schindler, 1984), and psychological price points and threshold pricing (Kashyap 1995) in Marketing and

Economics.

2

make to-the-cent price comparisons (Bakos, 1998). The reduction in search costs for attractive

prices and bargains is accompanied by opportunities for sellers to implement algorithmic price

discrimination approaches, to segment customers based on customer relationship management

systems information and new data mining techniques. It is natural, then, that Internet-based

sellers will create new ways to set prices in e-commerce. With these changes of the Internetbased sellers’ capabilities and price setting strategies in mind, we propose the following research

questions:

□

What empirical regularities can be observed for firm-selected price-endings in Internetbased selling? Do they differ by product category? By price level?

□

What variables and drivers can explain the observed empirical regularities and variations

in price-endings in Internet-based selling? How is Internet-based selling different from

traditional bricks-and-mortar retailing? What theories help us to identify the drivers?

□

What kind of empirical model will enable us to test hypotheses about the drivers of

threshold pricing in the applied setting that we have chosen?

□

What new insights do the results provide to enable effective strategic pricing choices?

We view this research as an exploratory effort designed to provide an initial reading on one

aspect of strategic pricing on the Internet. We next describe our new e-commerce price-endings

data set and examine some first order, easy-to-see empirical regularities for product and category

price-endings. We compare them with empirical regularities for price-endings in traditional

bricks-and-mortar retailing, based on the existing literature. In the third section, we explore what

drives the observed variation in price-endings. We focus on two theories based: customer

perceptions of store quality image and rational inattention to price endings. This permits us to

lay out a theoretical model for price-ending strategies for e-commerce retailing and related

3

hypotheses. To check out the robustness of the theory, we specify and test a related empirical

binary choice model, a seemingly unrelated bivariate probit model that uses more than 1.9

million daily price observations in 2003 and 2004 for multiple categories of products. Finally,

we conclude with an interpretation of our empirical findings about alternate price-ending theories

for online selling in light of the underlying changes created by the new technologies of the

Internet. We also discuss several limitations of our findings.

EMPIRICAL REGULARITIES FOR THRESHOLD PRICE-ENDINGS ON THE NET

Previous research has focused on prices in print media and grocery scanner data (e.g., Stiving

and Winer, 1997 and Bergen, et al., 2003). We use price data collected from the Internet to

establish some observed empirical regularities of price-setting in Internet-based selling.

A New Internet-Based Selling Price-Ending Data Set

We obtained price-related data from BizRate.com (www.bizrate.com), a popular price

comparison site. We used a price information gathering agent, a data mining software tool

which automatically obtains information for multiple product categories and products sold by

Internet-based retailers, based on preset criteria. The selected product categories provide a

setting where the products in the price comparison samples are all identical. From a list of

products available at price comparison sites, we generated a large sample of unique product IDs

using stratified proportionate random sampling (Wooldridge, 2002). For each product, our tool

developed a panel of selling prices that cover products and stores over time, and qualitative

information (e.g., consumers’ ratings of stores, number of reviews), also collected from

BizRate.com.

Sometimes the Internet-based sellers’ (especially small firms) Web sites were inaccessible or

4

the required price information was not available. So, some data are missing in our original data

set. Taking this into account, we were careful to remove time-series data on products whenever

there was a total of 10% missing data. We examined if the prices the day before and the day

after were the same as on the middle day when a data point was missing. The software agent

filled in the price for the day with the missing data, so our time-series lengths are all identical.

Our data consist of 366 daily observations of retail prices in 10 different product categories

(CDs, DVDs, video games, notebooks, PDAs, software, digital cameras/camcorders, DVD

players, PC monitors, and hard drives) and 477 products sold by 317 Internet-based retailers,

covering one year from March 26, 2003 to March 25, 2004. Table 1 presents descriptive

statistics for our data set.

Table 1. Descriptive Statistics for the Internet-Based Sellers’ Price-Ending Data Set

CATEGORY

Music CDs

Movie DVDs

Video Games

Software

PDAs

Hard Drives

DVD Players

PC Monitors

Digital Cameras

Notebook PCs

Total

DATA

POINTS

172,752

256,566

179,340

283,650

126,636

197,640

180,438

262,788

208,986

66,426

1,935,042

PRODUCT STORE

COUNT COUNT

46

49

50

48

45

47

49

51

46

46

477

MEAN

PRICE

15

$12.90

20

$28.27

40

$33.36

87

$306.26

96

$346.02

77

$358.63

110

$385.80

91

$703.38

150

$797.60

47 $1,694.58

317

$387.96

STD.

DEV.

MIN.

PRICE

MAX.

PRICE

$3.42

$5.49

$35.48

$27.10

$5.58 $134.99

$12.57

$6.99

$57.89

$416.27

$5.50 $5,000.00

$191.54 $39.99 $956.95

$587.57 $38.57 $3,911.95

$275.25 $57.99 $2,300.00

$680.87 $85.78 $3,199.99

$781.24 $165.99 $6,478.00

$474.17 $699.00 $3,447.00

$582.80

$5.49 $6,478.00

Note: Internet retailers have many different categories of products (e.g., Amazon.com sells books, CDs,

DVDs, computer products and electronics), so the sum of the number of stores in each product category is

not consistent with the total number of stores in all product categories.

The price range of all the product categories is $5.49 to $6,478.00, and the mean values of

different categories vary from $12.90 to $1,694.58. Online retail prices are like those consumers

pay at the cash register, so if a product is on sale, our price data reflect the sale price as well.

Previous price-ending studies mostly focus on 9¢ price-endings because most prices in retail

5

grocery stores are less than $10.00. This may occur with pricier items too, where cents are less

often used in pricing (Bergen et al., 2003). So, we examine both 9¢ and $9 price-endings.

Price-Endings in Cents

As illustrated in Figure 1, 0¢, 5¢, and 9¢ price-endings are over-represented, with 31.9% for

9¢, 26.4% for 0¢, and 19.4% for 5¢, followed by 8.3% for 8¢. The other endings—1¢, 2¢, 3¢, 4¢,

6¢, and 7¢—are under-represented; they account for only 14.3%. The round amounts of 0¢ and

5¢ are highly accessible in memory (Baird et al., 1970); high cognitive accessibility may explain

their large proportions. These results are consistent with the patterns observed by Schindler and

Kirby (1997), who used U.S. print advertisement price data.

Figure 1. Frequency Distribution of Prices’ Last Digit in Cents: All Categories

Distribution of Last Digit in Cents (All Categories)

Percentage of Price Ending

35

30

25

20

15

10

5

0

0

1

2

3

4

5

6

7

8

9

Price Ending in Cents

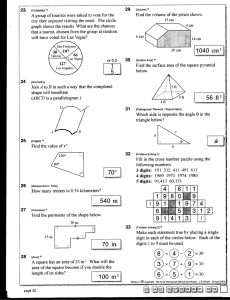

Table 2 shows frequency distributions for the last digit of the price data for each product

category. The table shows variation by product category, but 0¢, 5¢, and 9¢ endings are most

common. In some categories, such as music CDs, movie DVDs and video games, just a few

prices end with 0¢; instead, more prices end with 8¢ and 9¢. The price levels of these categories

tend to be much lower than those of other electronics products, based on the mean prices of CDs,

DVDs and video games at $12.90, $28.87 and $33.36, respectively, that we observed.

Internet-based retailers appear to use more 8¢ or 9¢ price-endings for lower-priced products.

6

To get a more complete picture of the empirical regularities associated with Internet pricing, we

also look at the price-endings by price level as a function of the number of price digits. As the

number of the digits increases, the proportions of 8¢ and 9¢ price-endings decrease, while the

proportion of 0¢-endings increases, as shown in Table 2. More than 60% of prices less than

$100 end with 8¢ or 9¢, whereas fewer than 10% end with 0¢. In contrast, when a product is

priced above $100, Internet retailers appear to use 0¢ price-endings almost 40% of the time—

relatively more than even the 9¢ price-endings. These results match findings in studies by

Heeler and Nguyen (2001) and Bock Interactive (2001) which showed that about 26% of

products sold at the Yahoo! Store had prices ending with 9¢ and $9, while 37% of the products

had 0¢ price-endings.

Table 2. Price-Endings in Cents by Product Category, Price Level for Last Digit in Price

DATA

0¢

1¢

CATEGORY

Music CDs

Movie DVDs

Video Games

Software

PDAs

Hard Drives

DVD Players

PC Monitors

Digital Cameras

Notebook PCs

All Products

POINTS

172,752

256,566

179,340

283,650

126,636

197,640

180,438

262,788

208,986

66,426

1,935,042

1.7%

3.3%

5.6%

36.1%

40.4%

28.7%

32.5%

33.8%

43.1%

52.2%

26.0%

PRICE LEVEL

Price (P) < 10

10 ≤ P < 100

100 ≤ P < 1,000

P > 1,000

P ≤ 387.96

P > 387.96

44,834

683,870

1,021,257

185,081

1,333,704

601,338

2.2% 1.25%

9.7% 2.0%

34.8% 2.0%

43.1% 1.1%

20.2% 2.0%

38.8% 1.8%

2¢

LAST DIGIT IN CENTS (%)

3¢

4¢

5¢

6¢

1.6% 1.3% 1.9% 2.2%

2.8% 3.2% 3.6% 5.1%

1.4% 4.7% 1.4% 1.3%

2.1% 1.4% 2.0% 2.6%

1.9% 0.7% 1.5% 2.7%

3.3% 2.9% 2.6% 3.2%

0.2% 0.8% 0.4% 3.4%

2.6% 2.9% 2.2% 2.7%

1.0% 0.55% 0.5% 2.1%

1.0% 1.45% 0.5% 0.6%

1.9% 2.1% 1.8% 2.85%

2.7%

2.9%

1.6%

1.8%

2.4%

1.5%

2.2%

2.3%

1.6%

1.5%

2.1%

1.2%

3.7%

3.0%

2.9%

1.9%

3.2%

2.1%

7¢

8¢

9¢

4.9%

11.1%

17.7%

29.5%

21.8%

24.4%

16.5%

27.7%

16.4%

12.3%

19.4%

3.6%

5.3%

2.1%

1.9%

1.7%

3.3%

3.4%

2.9%

1.5%

1.6%

2.9%

1.6% 31.1% 50.1%

3.4% 16.4% 45.8%

2.9% 5.1% 57.7%

2.5% 4.2% 17.7%

1.3% 3.6% 24.3%

3.2% 3.0% 25.5%

6.4% 2.8% 33.6%

2.7% 5.9% 16.6%

1.5% 3.6% 29.8%

1.0% 5.6% 23.9%

2.8% 8.3% 31.9%

10.1%

14.3%

22.9%

20.5%

18.7%

20.9%

4.2%

3.4%

2.7%

1.7%

3.2%

2.1%

4.2% 21.1% 48.3%

2.6% 14.3% 45.5%

3.0% 4.5% 24.0%

2.3% 4.5% 21.5%

2.9% 10.3% 35.0%

2.6% 4.0% 25.0%

Next, we consider the frequency distribution of the last two digits in cents from our price

data. Figure 2 shows the results for all the categories combined. The 00¢, 95¢ and 99¢ price-

7

endings are over-represented with 26.3% for 99¢, 21.2% for 00¢, and 16.0% for 95¢, followed

by 4.2% for 98¢. The other endings are under-represented, accounting for only 32.3%. These

results are somewhat different from those obtained by Schindler (2001), who also surveyed the

prices of multiple products at a variety of stores: 56.8% ended with 99¢, 6.3% with 97¢, 4.8%

with 49¢, 4.3% with 98¢, and 3.3% with 00¢. Based on these observations, we find that the

price-ending strategies of Internet-based sellers and traditional bricks-and-mortar stores may be

different.

Figure 2. Frequency Distribution of Last Two Digits of Prices in Cents: All Categories

Distribution of Last 2 Digits in Cents (All Categories)

Percentage of Price Ending

30

25

20

15

10

5

0

0

10

20

30

40

50

60

70

80

90

Price Ending in Cents

Similar patterns emerge for prices in individual product categories, as reported in Table 3.

Except for three categories—CDs, DVDs and video games—the 00¢, 95¢ and 99¢-endings occur

most frequently. Overall we find that 99¢ price endings are more common for lower-priced

product categories, including CDs at 34.4%, DVDs at 31.4%, and video games at 52.6% of the

total. Among higher-priced products though, 00¢ price-endings are more often observed, with

notebook PCs at 50.6%, digital cameras and camcorders at 39.9%, and PDAs at 36.3% of the

total.

8

Table 3. Top 10 Highest Frequencies of Last Two Digits of Prices in Cents

VIDEO

GAME

CD

DVD

AVG. PRICE

$12.90

$28.87

$33.26 $306.26 $346.02 $358.63 $385.80

99¢

34.4%

98¢

15.9%

48¢

7.3%

49¢

4.4%

89¢

3.2%

18¢

2.6%

19¢

2.0%

78¢

1.5%

96¢

1.4%

65¢

1.3%

99¢

31.4%

98¢

11.1%

95¢

6.3%

49¢

3.5%

39¢

1.9%

24¢

1.6%

48¢

1.6%

19¢

1.5%

29¢

1.5%

79¢

1.5%

99¢

52.6%

95¢

13.8%

88¢

3.6%

82¢

3.5%

97¢

2.3%

50¢

2.0%

49¢

1.6%

96¢

1.4%

05¢

1.1%

45¢

1.1%

RANK

1

2

3

4

5

6

7

8

9

10

SW

00¢

31.8%

95¢

26.3%

99¢

15.1%

98¢

1.8%

90¢

1.0%

50¢

1.0%

97¢

0.9%

94¢

0.9%

49¢

0.8%

75¢

0.7%

PDA

HARD

DVD

PC

DRIVE PLAYER MONITOR

CATEGORY

00¢

36.3%

99¢

22.1%

95¢

18.2%

98¢

1.7%

85¢

1.5%

90¢

1.5%

88¢

1.3%

94¢

1.0%

80¢

1.0%

41¢

0.7%

00¢

24.1%

99¢

21.6%

95¢

20.6%

50¢

1.3%

89¢

1.1%

49¢

0.8%

60¢

0.7%

76¢

0.7%

30¢

0.6%

14¢

0.6%

99¢

31.8%

00¢

23.8%

95¢

14.8%

90¢

6.5%

97¢

5.3%

96¢

2.7%

88¢

1.8%

94¢

1.8%

50¢

1.5%

44¢

1.0%

DIGITAL

CAMERA

NOTEBOOK

PC

TOTAL

$703.38

$797.60

$1,694.58

$387.96

00¢

30.8%

95¢

24.2%

99¢

13.2%

98¢

2.8%

75¢

1.0%

79¢

0.9%

88¢

0.9%

50¢

0.8%

22¢

0.6%

25¢

0.6%

00¢

39.9%

99¢

28.1%

95¢

13.8%

90¢

1.9%

98¢

1.6%

85¢

1.4%

94¢

1.1%

49¢

0.9%

88¢

0.9%

96¢

0.8%

00¢

50.6%

99¢

22.5%

95¢

11.5%

98¢

3.5%

96¢

1.1%

90¢

1.1%

88¢

0.6%

02¢

0.6%

48¢

0.5%

84¢

0.5%

99¢

26.3%

00¢

21.2%

95¢

16.0%

98¢

4.2%

49¢

1.5%

90¢

1.3%

97¢

1.2%

88¢

1.1%

48¢

1.0%

96¢

0.9%

Price-Endings in Dollars

We also consider the distribution of the price-endings in dollars for all the product categories.

As illustrated in Figure 3, $9 price-endings are over-represented at 37.1%, followed by $4 at

9.9% and $5 with 9.3%. So, almost four times more prices end in $9 than with the next most

frequent price-ending, $4. Only 5.6% of prices end with $0, despite the high cognitive

accessibility of this round amount. This is similar to what Bergen, et al. (2003) found in

supermarkets.

In Table 4, we present the frequency distributions of the last digit of price by product

category. As expected, $9 price-endings are most common in almost all categories. In some

categories (e.g., CDs and DVDs), $3, $4 and $5 price-endings are common. Why? Because

prices of these product categories are often between $13 and $16, $9 price-endings don’t make

sense. In some high-priced categories, 60% of all prices end with $9, including PCs at 72.7%

9

and digital cameras at 60.1%. Also, for high-priced products whose prices are greater than the

mean (i.e., $387.96) of all the product categories, we observed price-endings with $9 more than

50% of the time.

Figure 3. Frequency Distribution of Last Digit in Dollars for Prices: All Categories

Distribution of Last Digit in Dollars (All Categories)

40

Percentage of Price Ending

35

30

25

20

15

10

5

0

0

1

2

3

4

5

6

7

8

9

Price Ending in Dollars

Table 4. Price-Endings in Dollars by Product Category

DATA

POINTS

CATEGORY

Music CD

172,752

Movie DVD

256,566

Video Game

179,340

Software

283,650

PDA

126,636

Hard Drive

197,640

DVD Player

180,438

PC Monitor

262,788

Digit. Camera

208,986

Notebook PC

66,426

1,935,042

All Products

PRICE LEVEL

Price(P) < $10

44,834

683,870

$10≤ P < $100

$100≤P<$1000 1,021,257

P > $1000

185,081

1,333,704

P ≤ 387.96

601,338

P > 387.96

$0

5.4%

10.7%

2.1%

5.9%

4.9%

6.8%

2.8%

8.0%

2.4%

2.0%

5.6%

$1

9.0%

11.9%

1.2%

4.6%

3.8%

7.8%

1.3%

5.3%

1.9%

2.4%

5.4%

0.0%

6.5%

5.4%

4.7%

6.1%

4.5%

0.0%

8.1%

3.9%

4.8%

6.3%

3.4%

LAST DIGIT OF PRICES IN DOLLARS (%)

$2

$3

$4

$5

$6

10.9% 16.7% 22.2% 12.3% 5.7%

10.2%

9.5% 14.0% 12.2% 7.7%

2.4%

2.2%

6.8%

6.0% 7.3%

5.9%

5.4%

8.4% 10.3% 6.2%

3.9%

4.6%

8.3%

7.6% 3.3%

7.9%

8.0%

9.3%

9.9% 8.1%

3.4%

4.5%

8.2%

8.4% 2.7%

7.0%

7.1%

8.3%

9.2% 6.8%

2.3%

2.5%

6.8%

7.7% 4.1%

3.3%

1.6%

4.5%

5.0% 1.5%

6.1%

6.6%

9.9%

9.3% 5.8%

0.0%

8.3%

5.2%

4.2%

7.1%

3.9%

0.0%

9.4%

5.5%

4.2%

7.7%

4.0%

0.0%

14.3%

8.2%

5.7%

11.3%

6.9%

3.8%

10.5%

9.1%

7.5%

9.6%

8.6%

9.2%

6.8%

5.4%

4.0%

6.5%

4.5%

$7

4.6%

7.4%

10.7%

7.5%

5.9%

8.7%

5.3%

5.9%

4.2%

3.5%

6.7%

$8

3.7%

4.7%

10.7%

9.2%

7.7%

8.9%

7.3%

7.9%

8.0%

3.3%

7.5%

$9

9.5%

11.6%

50.5%

36.6%

50.1%

24.6%

56.0%

34.6%

60.1%

72.7%

37.1%

16.1% 14.8%

7.2%

6.3%

6.5%

8.2%

3.9%

5.9%

7.5%

7.7%

5.0%

6.9%

56.1%

22.6%

42.7%

55.1%

30.2%

52.4%

We conjecture that Internet retailers use more $9 price-endings for high-priced products. As

the number of the digits increases, the proportion of $9 price-endings also increases, although

products less than $10 show a high proportion of $9 price endings. (See Table 4.) This occurs

10

because prices in our data are at least $5. So, it is appropriate to ignore these observations of $9

price-endings. A better data set would track prices down to $1, which would affect the results.

We also analyze the frequency distribution of the last two digits in dollars. Figure 4 shows

results for all categories combined. Most prices have “9” price-endings, such as $99, $89, or $09.

But more prices end with $99 than any other “9” price-endings, and more than 10% end with $99.

Figure 4. Frequency Distribution of Last Two Digits of Prices in Dollars

Distribution of Last 2 Digits in Dollars

(Without 3 Categories)

Distribution of Last 2 Digits in Dollars

(All Categories)

16.0

Percentage of Price Ending

Percentage of Price Ending

12

10

8

6

4

2

14.0

12.0

10.0

8.0

6.0

4.0

2.0

0.0

0

0

10

20

30

40

50

60

70

80

90

0

10

20

30

40

50

60

70

80

90

Price Ending in Dollars

Price Ending in Dollars

Table 5. Top 10 Highest Frequencies of the Last Two Digits of Prices in Dollars

RANK

1

2

3

4

5

6

7

8

9

10

CD

$14

21.2%

$13

15.8%

$15

11.4%

$12

9.8%

$11

8.0%

$09

6.9%

$10

5.1%

$16

3.8%

$07

2.8%

$19

2.6%

DVD

$15

8.9%

$14

7.7%

$11

6.4%

$10

6.1%

$13

5.3%

$22

5.1%

$16

4.5%

$09

4.2%

$19

3.8%

$12

3.7%

VIDEO

GAME

$19

15.8%

$49

15.6%

$29

12.6%

$39

4.8%

$45

4.0%

$46

3.8%

$28

3.7%

$27

3.5%

$18

3.0%

$47

2.9%

SW

$99

11.8%

$89

5.2%

$79

4.0%

$19

3.4%

$49

2.9%

$59

2.3%

$69

2.2%

$29

2.2%

$97

2.2%

$98

2.1%

PDA

$99

13.4%

$49

11.0%

$79

5.0%

$19

4.7%

$59

3.5%

$89

3.4%

$69

2.9%

$29

2.8%

$39

2.2%

$94

1.8%

HARD

DVD

DRV. PLAYER

$09

$99

3.5% 14.3%

$99

$49

3.0%

8.7%

$79

$19

2.6%

5.5%

$59

$29

2.5%

5.1%

$19

$39

2.5%

5.1%

$49

$69

2.5%

5.0%

$29

$79

2.3%

5.0%

$39

$89

2.1%

3.6%

$69

$59

2.0%

2.6%

$95

$89

1.7%

2.2%

PC

MONITOR

$99

11.5%

$49

5.0%

$29

3.4%

$39

2.8%

$79

2.5%

$19

2.4%

$59

2.4%

$69

1.7%

$09

1.6%

$35

1.5%

DIGITAL NOTEBOOK

CAMERA

PC TOTAL

$99

$99

$99

30.3%

40.0% 10.5%

$49

$49

$49

7.6%

11.6%

5.7%

$79

$29

$19

4.4%

5.3%

4.4%

$14

$89

$39

4.0%

3.3%

3.5%

$69

$79

$29

3.1%

3.1%

3.4%

$15

$39

$09

2.6%

2.3%

2.8%

$94

$29

$79

2.6%

2.2%

2.6%

$19

$19

$09

2.1%

2.1%

2.5%

$13

$59

$89

1.9%

1.9%

2.4%

$09

$59

$89

1.5%

1.6%

2.3%

THREE

CATEGORIES

REMOVED

$99

15.2%

$49

6.0%

$79

3.8%

$19

3.2%

$89

3.2%

$29

3.1%

$69

2.6%

$39

2.5%

$59

2.4%

$09

1.8%

11

We find similar price-ending patterns from individual product categories, as reported in

Table 5. The $99 price-ending is more common than any other two-digit price-endings, including

the other $9-endings. The exceptions are CDs, DVDs and video games, whose prices are less

than $100. As shown in Figures 1 and 4 and Table 5, after removing these three categories, all

the $9 price-endings are included among the top ten frequencies of the last two price digits.

These findings are in synch with Bergen, et al. (2003), who found this to be true for cents.

Comparisons with Previous Studies

Table 6 reports the findings of previous studies on observed price-endings. Most studies

indicate that retail price-setters in the U.S. tend to choose the rightmost digits or endings of a

price so that the price falls just below a round number. In addition, some studies show that 0¢

and 5¢ are commonly for the rightmost digits of a price. With the empirical regularities we

observed, the patterns of price-endings in Internet-based retailing are almost similar in U.S. print

ads and supermarket scanner data. Thus, we see that Internet-based retailers appear to frequently

use 9¢ or $9 price-endings, just as traditional bricks-and-mortar stores do.

Table 6. Previous Findings for the Distribution of Price-Endings in Cents

RESEARCH

Twedt (1965)

Friedman (1967)

Schindler and

Kirby (1997)

Stiving and Winer

(1997)

Heeler and Nguyen

(2001)

Naipaul and Parsa

(2001)

Bergen et al. (2003)

PRODUCT

Meat

Groceries

Food

Multiple products

Tuna

Yogurt

Online retail

products

Fine-dining food

Quick-service food

Groceries

DATA

POINTS

0¢

30,878 1.0%

2,597 4.0%

3,326 3.5%

1,415 27.2%

1¢

1.0%

2.0%

8.9%

0.9%

PRICE-ENDINGS IN CENTS (%)

2¢

3¢

4¢

5¢

6¢

1.0% 9.0% 0.0% 19.0% 0.0%

1.0% 7.0% 4.0% 15.0% 1.0%

3.6% 14.3% 3.3% 18.6% 1.6%

1.7% 0.8% 2.2% 18.5% 2.0%

7¢

3.0%

6.0%

9.9%

6.6%

8¢

2.0%

3.0%

2.5%

9.4%

9¢

64.0%

57.0%

33.8%

30.7%

24,770 0.0%

2,464 10.9%

243 42.8% 0.0% 0.0%

N/A

50.5%

N/A

36.1%

0.0% 1.2% 8.2% 2.5% 0.0% 7.8% 37.4%

3,290 30.5% 0.0% 0.0%

2,878 30.1% 0.0% 0.0%

9,800,000 5.0% 2.5% 2.5%

0.0% 0.0% 56.5% 0.0% 0.0% 0.0% 13.0%

0.0% 0.0% 36.9% 0.0% 0.0% 0.0% 33.0%

4.0% 3.0% 11.0% 2.0% 3.0% 2.0% 65.0%

12

EXPLANATION FROM EXISTING THEORIES

Various theories attempt to explain “9” price-endings: operations theory (Stiving and Winer,

1997), perceived gain effect theory (Schindler and Kirby, 1997), rational inattention theory

(Bergen et al., 2003), and quality image theory (Stiving and Winer, 1997). Internet technologies

create new capabilities for pricing strategy. So this may change the drivers of firm choices of

price-endings, as well as consumers’ responses to them, and require us to find alternative

theories to be able to explain the phenomena that we observe. So, we provide an overview of

existing theories to better understand “9” price ending phenomena on the Internet.

Operations Theory

Operations theory revolves around procedural issues internal to the firm that reduce

monitoring costs (Stiving and Winer, 1997). Historically, odd pricing was developed to control

employee theft from cash registers, by requiring change to be given to the customer so the sale

was recorded (Ruffle and Shtudiner, 2003; Schindler and Kirby, 1997). But Internet

technologies obviate the need for charging odd prices; transactions now are made with credit

cards and online payment services (e.g., PayPal, MSN BillPay and iTransact). Still, firms can

algorithmically adjust posted prices. This theory raises other questions about IT impacts in the

production process for price-setting. To maintain a manageable level of complexity in the

presentation of product and pricing information, does it make sense for vendors to the dollar,

instead of to penny? Do shopbots’ price search capabilities produce listings that are ordered by

the dollar, but not by the penny? Does this change firm choices of price-endings?

Perceived Gain Effect Theory

It is widely recognized that rounded numbers are more accessible in memory. Firms exploit

high cognitive accessibility with “0” and “5” price-endings. They are reference points in price

13

evaluation. Consumers frame prices as round numbers along with a small gain (Schindler and

Kirby, 1997). According to prospect theory (Kahneman and Tversky, 1979), perceptions of

gain/loss are disproportionate to the small size of a perceived gain (Thaler, 1985). So, pricesetters should favor 9¢ and $9, as we see in the U.S. retail market (Schindler and Kirby, 1997).

In Internet-based selling, customers use shopbots to locate the cheapest products in 1¢

increments Brynjolfsson and Smith, 2000). So, instead of round numbers, consumers may focus

on the lowest reported prices. Due to lower search and menu costs, Internet retailers may set

price-endings other than “9.” We see this with retail giant, Wal-Mart, which posts many prices

with 8¢ endings (Bergen et al., 2003; Bockstedt, Kauffman and Riggins, 2004). But, is

perceived gain effect theory is as applicable to e-commerce consumers, as it is elsewhere?

Underestimation and Rational Inattention Theory

Prices that end in 9¢ or $9 are associated with price under-estimation by the consumer

(Schindler and Kirby, 1997). Also called level effect theory by Stiving and Winer (1997), underestimation theory states that consumers round price numbers down due to limited memory

capacity (Basu, 1997; Lambert, 1975). So, consumers may perceive an actual price of $999.99

as $999 or $990—or possibly even $900—instead of $1,000 (Shy, 2000). Bergen et al. (2003)

also argue that it may be rational for consumers to be inattentive to the rightmost digits because

they often face large amounts of costly and hard-to-process information but are constrained by

time, resource, and information processing constraints. Thus, firms have an incentive to make

the last digits as high as possible. Along the same line with the perceived gain effect theory, we

are unsure if online consumers are rationally inattentive to price-endings. Shopbots reduce

information processing costs, making it possible for consumers to easily compare prices. But do

price comparison capabilities actually lead to purchase decisions that favor higher-valued price-

14

endings?

Store Image Quality Theory

Image effects transmit signals that enable consumers to infer something (in terms of

“images”) about a product or store based on the last digits of the price. Consumers may think a

product with a 99¢ or $99 price-ending is on sale (Shy, 2000). These price-endings have two

effects: price image effect and quality image effect (Stiving and Winer 1997). Price image effect

theory argues that product prices ending in 9¢, 99¢, $9 or $99 provide signals that products are

on sale (Schindler and Kibarian, 1996), prices have been cut (Schindler, 1984), or the price is

the lowest price (Schindler and Kibarian, 1996). A favorable price image signals a low price

(Schindler and Kibarian, 2001). In quality image effect theory, odd prices are a sign of low

quality, while even prices indicate high quality (Stiving and Winer, 1997). An unfavorable

impression of a store’s or a product’s quality might occur as a result of the use of 9¢ or $9 priceendings. But online consumers care about other non-price aspects, such as seller reputation,

delivery locations and times, contract lengths, etc. Non-price competition offers new ways to

compete and requires firms to formulate new business rules. But will non-price drivers of priceending choices be observed in Internet-based selling? Will quality play a key role? Will the

drivers be the same across product areas and industry sectors? How about over time?

IDENTIFYING THE DRIVERS OF THRESHOLD PRICING PRICE-ENDINGS

Our next goal is to explore what may be causing the variation in the use of the “9” priceendings that we observe across stores and product categories. The literature in marketing and

economics guided our effort to identify what variables may be the drivers. We examine two

theories in depth: consumers’ perceptions of store quality image and rational inattention. We

15

also present hypotheses that flow from each theory related to the variables we collected. We end

with a figure summarizing our research model for “9” price-endings on the Internet.

Model Development

Our choice of the theories was driven by two considerations. First, we focused on the

elements that IT changes (i.e., the Internet, and online price-discovery and price-setting tools).

There is increasing evidence that the reputation and quality image of online sellers has a

significant effect on consumer purchases (Hansell, 2003; Piller, 1999). Similarly, the costs of

attention to price information are impacted by IT, and should affect the degree of rational

inattention exhibited by consumers. Second, we focused on variables that can be collected by

Internet-based data collection tools and other related ITs. This directed us to observable,

detectable and consistently-collectible variables such as price, or other system-based information

related to Internet Web sites. This also pushed us away from variables and theories that would

more naturally be tested using lab experiments or survey methods.

Consumer Perceptions of Store Quality Image

With many products in the traditional market, it is difficult for consumers to observe quality

even at the time of purchase, because they are imperfectly informed about the product or store

characteristics (Stiglitz, 1987). Rao and Monroe (1989) observe that consumers may use prices

as a cue for assessing quality. Image effects transmit signals that enable consumers to infer

something (in terms of “images”) about the product or store based on the rightmost digits of the

price (Stiving and Winer, 1997). In particular, focusing on quality images, some authors have

suggested that odd prices are a sign of low quality products or low quality stores, while even

prices indicate high quality products or high quality stores (Stiving and Winer, 1997). So an

16

unfavorable impression of a store’s or a product’s quality might occur as a result of low price

image associated with 9¢ or $9 price-endings (Schindler and Kibarian, 2001).

Notice that the Internet gives consumers access to different information about products and

retailers than has ever been available before. Moreover, it has changed the set of retailers and

the ways customers interact with Internet retailers. As a result, it may facilitate the development

of store images in new ways. We also know that the Internet has impacted both price

competition and non-price competition between firms (Clay, et al., 2002). Online consumers

may care about seller reputation, delivery locations and times, contract lengths, and so on. These

may lead to different ways for consumers to assess store quality, and impact the role that

threshold prices play in the marketplace. Internet-based retailers are increasingly concerned with

effectively positioning their image.

Stiving (2000), in his study of price-endings at twelve department stores, find that retailers

with a relatively elegant image, such as Nordstorm and Macy’s, are among the most likely to use

prices that end in “0.” They also tend to avoid prices that end with a “9” so as not to signal

lower quality. We expect higher quality Internet retailers to exhibit similar pricing. We next

present four hypotheses related to the effects of store quality image on the use of “9”-endings by

Internet-based retailers.

We looked for proxies of store quality that are accessible in the kind of data that our data

collection agent was able to collect. In general, higher quality stores tend to have higher product

quality, service levels, product assortment and support. As such they may face higher costs

and/or charge higher margins for their products. This leads to higher prices for higher quality

stores. One advantage of our data collection agent is the quality of pricing data that we can

access. What is not as clear with its use is whether absolute or relative price level data, or both,

17

are more effective ways to identify high quality stores. This leads to our first two hypotheses.

□

Hypothesis 1 (The Relative Store Price Level – Store Quality Hypothesis). Similar to

traditional retailing, Internet-based sellers that charge higher prices will use “9” priceendings less frequently than the lower-priced sellers to signal their high quality.

□

Hypothesis 2 (The Relative Product Price Level – Store Quality Hypothesis). Also

similar to traditional retailing, firms will use “9” price-endings for higher-priced online

products less frequently than for the lower-priced online products.

Another advantage of our data collection approach is that we can access information that is

systematically collected and posted on the Web. There is one source of information on store

reputation that can be used as a proxy for store quality. Like prices, there are variants of this

information that can be used, which leads to our next two hypotheses. On the Internet,

information asymmetries prevail. It is rare for buyers to be able to inspect product quality before

they purchase because buyers and sellers are geographically separated and cannot interact faceto-face as they transact. Also, it is doubtful that Internet retailers with low online prices will be

the most reliable (Kauffman and Lee, 2004). So, digital intermediaries, such as trusted third

parties or an online reputation mechanism (Dellarocas, 2003), will play a significant role in

building trust between buyers and sellers to “perfect” business processes associated with

Internet-based transaction making (Dai and Kauffman, 2005).

There is also increasing evidence that the reputation of online sellers has a significant effect

on consumer purchases (Hansell, 2003; Piller, 1999). As a result, online marketers must

understand the importance of consumer reviews or ratings on their stores as a proxy for the

consumer’s perceptions of the quality of the store. Most all reported image effects relate to the

digits “0” and “9,” the two most commonly used price-endings. “0” has been suggested as a

signal of higher quality while “9” signals both a lower quality for the store and a good price.

This leads us to assert a third hypothesis:

18

□

Hypothesis 3 (The Store Reputation Hypothesis). In Internet-based selling, higherquality firms, based on store reputation, will choose “9” price-endings less often than

lower-quality firms.

The Internet provides unprecedented opportunities to collect data on more subjects with

lower costs, fewer strict assumptions, and greater realism (Kauffman and Wood, 2003).

However, with these new opportunities also come challenges. If the research data come from

online reputation mechanisms where participants are anonymous and the researcher does not

control the instrument design, then issues of data reliability may be of concern.

According to the price image effect theory, the use of the “9” price-endings creates the

impression of a price that is relatively low, which may affects sales increases (Anderson and

Simester, 2003; Schindler, 1996, 2001). This leads us to assert:

□

Hypothesis 4 (The Store Popularity Hypothesis). In Internet-based selling, more

popular firms in terms of the number of reviews will use “9” price-endings more

frequently than less popular firms.

Rational Inattention Theory

Rational inattention theory (Bergen et al., 2003; Sims, 2003) argues that it may be rational

for consumers to be inattentive to the rightmost digits because they are constrained by time,

resources, and information processing constraints. Since many consumers appear to ignore the

last digit of the price, firms have an incentive to make it as high as possible at $9 or 9¢ (Basu,

1997; Shy, 2000). The rational inattention theory of pricing suggests that consumers tend to pay

less attention to the rightmost digits of a “9”-ending price. The longer the string of digits, the

more important is the leftmost digit relative to the rightmost digit. We define price length as the

number of digits in a price, inclusive of dollars and cents.

The Internet makes more marketing information available than before, which may create

greater information overload, amplifying this effect. At the same time, computers and shopbots

19

make the ability to search and evaluate information easier, decreasing the impact of this effect.

To explore the role of rational inattention in this environment, we propose the following

hypothesis for Internet-based retailing:

□

Hypothesis 5 (The Price Length Hypothesis). As with traditional retailing, as the

length of a product price increases in terms of the number of digits in the price, Internetbased sellers will use “9”-ending prices more often.

This leads us to propose the model, illustrated in Figure 5, whose predictions we will test.

Figure 5. A Research Model for “9” Price-Endings in Internet-Based Selling

Quality Image Drivers

Relative

Store Price

H1 ( )

Relative

Product Price

Store

Reputation

H2 ( )

H3 ( )

Store

Popularity

H4 (+)

“9” Ending

Prices

H5 (+)

Price

Length

Rational Inattention Driver

DATA AND MODELING METHOD

The Data

Since we focus on the extent to which the technological environment of Internet-based

selling affects firm choices about price-setting strategy, it is natural for us to explore how online

reputation and price images appear to relate to price-ending choices. To support this exploration,

we selected data on the sellers’ online reputation from the original data set. Refer to Table 1

20

again. We define online reputation as the overall rating for each store averaged over the set of

individual ratings used to produce it.3 So, we sampled data from stores with greater than or

equal to 100 reviews to control for response biases. Our data collection approach yielded

1,210,728 daily observations for 449 different products sold by 116 Internet-based retailers, as

reported in Table 7.

Table 7. Descriptive Statistics for the Data (for Sellers with Number of Reviews ≥ 100)

CATEGORY

DATA

POINTS

NUMBER OF

PRODUCTS

Music CDs

Movie DVDs

Video Games

Software

PDAs

Hard Drives

DVD Players

PC Monitors

Dig. Cameras

Notebook PCs

115,290

178,608

126,270

192,516

83,448

127,368

69,540

170,922

115,290

31,476

46

49

49

48

44

42

45

50

43

33

1,210,728

449

Total

NUMBER OF

STORES

MEAN

PRICE

STD.

DEV.

15

$5.49

$26.98

$13.81

12

$5.76 $134.99

$28.20

23

$6.99

$57.89

$32.73

41

$9.95 $5,000.00 $320.99

47 $39.99 $956.95 $355.89

36 $49.00 $3,168.99 $360.32

40 $59.94 $1,069.00 $359.54

41 $87.87 $3,199.99 $711.65

69 $189.00 $6,000.00 $719.70

17 $699.00 $2,998.00 $1,726.22

$3.44

$27.20

$12.94

$494.12

$197.05

$560.51

$227.38

$703.55

$602.80

$419.24

116

MIN.

PRICE

MAX.

PRICE

$5.49 $6,000.00

$356.89 $551.41

Defining the Variables for the Empirical Model

To examine what drivers are most important in explaining price-endings in e-commerce, we

used a binary coding for each of the prices collected in this study as either a “9” or “not a 9.” 4

Although it is not difficult to figure out what “9” price-endings are supposed to look like, we

actually attempted to identify two different categories of “9” price-endings: 9¢ and $9 priceendings. Consumer perceptions of “9” price-endings may be different for different price levels

o

3

This measure is susceptible to self-reported sample biases, so the number of reviews is critical for

evaluating the quality of our model’s results. If the overall rating is based on only a few reviews, the

results may be unreliable. The larger the number of reviews, the more accurate is the overall rating.

We sampled our original data set to identify stores with a large enough number of reviews (about 100) to

control response bias. The number of reviews is a proxy for store popularity, since the greater the number

of reviews, the more products the store will have been sold and the more customers will have been served.

4

The prices are the actual selling prices without any shipping or handling fees, adjusting any promotions

or discounts.

21

of the products. For example, $1,999.00 may be a “9”-ending price, just as $10.99 would be. So,

we define two different dependent variables: NineCents and NineDollars, as described in Table 8.

Table 8. Definitions of the Dependent and Independent Variables in the Empirical Model

VARIABLE

DEFINITION

Dependent Variables (“9” Endings)

NineCents

Binary variable indicating rightmost digit in cents is “9”; coded as 1, and 0 otherwise.

NineDollars

Binary variable indicating rightmost digit in dollars is “9”; coded as 1, and 0 otherwise.

Independent Variables

RelativeStorePrice

Store’s average price for each product category divided by average price for each product

category for all stores.

StoreReputation

Store’s online reputation, proxied by consumers’ average rating of the store.

NumReview

Ln(number of consumer reviews for each Internet-based retailer).

RelativeProductPrice Price of each product divided by the average price for the product category across stores.

PriceLength

The number of digits in price, including the decimal point.

We operationalize five potential drivers of observed firm choices for price-endings in

Internet-based selling. (1) We defined RelativeStorePrice as a relative measure of the prices

charged by each Internet-based seller. Some retailers sell many different categories of products,

so we calculate an average price for each category-store combination. Then, we divide the

average price by the mean price of each product category to produce a store’s relative price for

each product category. (2) We also created an explanatory variable, RelativeProductPrice, to

capture the relative price of each observation within its product category, defined as the price of

the product, divided by the average price for the product category. (3) To measure the quality of

the store in terms of consumer ratings, we averaged the ratings provided by BizRate.com,

collected once a week. The values of the average number of reviews lie between 100 and

900,000. So, we transformed the number of reviews to reduce outlier effects with a logarithm.

A large number of reviews will not have the same proportional effect on the decision of priceendings as small number of reviews. We operationalized two explanatory variables,

StoreReputation and NumReview, to measure the effects of online reputation and popularity for

22

Internet-based retailers. (4) Finally, to measure the extent of the consumer’s rational inattention,

we define PriceLength as the number of price digits including the decimal point. Table 9

provides descriptive statistics for the explanatory variables.

Table 9. Descriptive Statistics for Key Variables

VARIABLE

RelativeStorePrice

RelativeProductPrice

StoreReputation

NumReview

PriceLength

DATA POINTS

1,210,728

1,210,728

1,210,728

1,210,728

1,210,728

MEAN

1.29

1.00

8.09

4.17

5.65

STD. DEV.

4.40

1.02

1.10

0.88

0.67

MIN.

0.18

0.03

1.68

2.00

4.00

MAX.

71.00

15.58

9.47

5.95

7.00

Table 10 presents pairwise correlations between all the explanatory variables. The highest

absolute value of any pairwise correlation is 0.448, which is below the frequently-used threshold

of 0.6 suggested by Kennedy (1998). We also calculated variance inflation factors (VIFs) to

detect multicollinearity among the explanatory variables. The highest VIF is 1.311. Values in

excess of 20 would be a concern (Greene, 2003).

Table 10. Correlations among Variables: All Categories (N=1,210,728)

RelativeStorePrice

RelativeProductPrice

StoreReputation

NumReview

PriceLength

RelativeStorePrice

RelativeProductPrice

StoreReputation

NumReview

PriceLength

1.000

-0.001

-0.058

0.037

0.041

1.000

0.003

0.013

0.448

1.000

0.032

0.085

1.000

0.041

1.000

The Seemingly Unrelated Probit Regression (SUPR) Method

We assume that Internet-based retailers are profit maximizers with respect to choices

between “9” and “not 9” price-endings. This decision can be modeled with a binary choice

model. Specifically, to explore the effects of Internet-based sellers’ quality images and

consumers’ rational inattention on the sellers’ price-ending strategies, we employ a binary

probit model. This general model permits us to define the probability that a firm i chooses a “9”

23

price-ending (9¢ or $9) for product j on a specific day t as:

P (NineEnding = 1) = f (RelativeStorePrice, RelativeProductPrice, StoreReputation,

NumReview, PriceLength)

As with the linear probability model, the disturbance terms in a probit model exhibit

heteroskedasticity (Gujarati, 2003). So instead of using ordinary least squares (OLS), we use

maximum likelihood estimates (MLE) to correct this defect. The full form of the binary probit

model is:

P( NineEndingi , j ,t = 1) = β0 + βRelativeStorePrice RelativeStorePricei , j ,t + β RelativeProductPrice RelativeProductPricei , j ,t

+ βStoreReputation StoreReputationi , j ,t + β NumReview NumReviewi , j ,t + βPriceLength PriceLengthi , j ,t + ui , j ,t

As the two dependent variables used in this study (i.e., NineCents and NineDollars) are not

likely to be mutually exclusive, any inferences drawn from the comparison of the regression

coefficients on the basis of the two equations may suffer from some level of confounding

problems. That is, the error terms may be correlated across the two equations for the same

observation but will be uncorrelated across different observations (Greene 2003). So, we use a

seemingly unrelated probit regression (SURP) for bivariate dependent variables to resolve this

potential problem. In addition, some of the explanatory variables— RelativeStorePrice,

StoreReputation and NumReview—do not vary by store. If these variables are being used across

repeated observations, this may lead to the inflation of the standard errors. So, to correct for

repeated observations, we adjust the standard errors by clustering our data at store level.

EMPIRICAL ESTIMATION AND RESULTS

We used Stata 8.0 (www.stata.com) to estimate two regressions with the same explanatory

variables, allowing the disturbance terms in both regressions to be correlated with each other.

We used both likelihood ratio (LL) statistic and the count-R2 to validate the results. The countR2 is defined as the number of correct predictions divided by total number of observations

24

(Gujarati, 2003). In binary choice regression, however, goodness of fit is of secondary

importance. There is no universally-accepted goodness of fit measure for binary choice models,

unlike R2 for linear regression (Kennedy 1998). What matters is the expected signs of the

regression coefficients and their statistical, logical and practical significance (Gujarati, 2003).

Empirical Results for All Categories of Data

We first examine the empirical model using all the data available, as reported in Table 7.

The results of the SURP regression for each dependent variable are as follows:

□

NineCents:

□

NineDollars:

Pi *, j ,t = 0.485 − 0.006 RelativeStorePricei*, j ,t + 0.127 RelativeProductPricei*, j ,t

+ 0.053StoreReputationi*, j ,t + 0.342 NumReviewi*, j ,t − 0.517 PriceLengthi*, j ,t

Pi *, j ,t = −2.063 − 0.014 RelativeStorePricei*, j ,t − 0.058RelativeProductPricei*, j ,t

− 0.055StoreReputationi*, j ,t + 0.099 NumReviewi*, j ,t + 0.328PriceLengthi*, j ,t

Table 11 shows the coefficients of the variables and the robust standard errors. First, the

effects of RelativeStorePrice on the choice of “9” price-endings are negative and significant in

each model for the different dependent variables. This is consistent with the Relative Store Price

Level - Store Quality Hypothesis (H1), which states that Internet-based sellers that charge higher

prices will use a “9” price-ending less frequently than the lower-priced sellers to signal their high

quality. The effects of RelativeProductPrice show mixed results. In the NineDollars model the

estimated coefficients show negative and marginally significant effects on “9” price-ending

decisions. However, in the NineCents model we obtained an unexpected result: positive and

significant effects on the decision to use “9”-endings. This result indicates that Internet-based

sellers, rather counter-intuitively, may use more 9¢-endings but fewer $9-endings for high-priced

products. We conclude that the Relative Product Price Level – Store Quality Hypothesis (H2) is

supported only in NineDollars Model.

25

Table 11. Results of Seemingly Unrelated Probit Model: All Categories

NINECENTS MODEL

NINEDOLLARS MODEL

COEFF.

ROBUST S. E.

COEFF.

ROBUST S. E.

***

***

Constant

0.485

0.8844

-2.063

0.7953

0.0021

RelativeStorePrice

-0.006***

0.0029

-0.014***

RelativeProductPrice

0.127***

0.0339

-0.058***

0.0361

***

StoreReputation

0.053

0.0673

0.055***

0.0477

0.1150

0.099***

NumReview

0.0972

0.342***

0.1064

PriceLength

-0.517***

0.1250

0.328***

Note: Bivariate probit (maximum likelihood estimation); 1,210,728 data points; Wald test of

ρ=0: χ2(1) = 10.52, P=0.001; -2LL = 2,940,565; Robust standard errors assume clustering at

the store level; significance levels: *** = 0.01, ** = 0.05, * = 0.10; estimated coefficients in bold

indicate consistent results with the hypotheses.

VARIABLE

The effects of StoreReputation are not significant (p=0.429 and 0.250, respectively) in

support of the Store Reputation Hypothesis (H3) in both models. In addition, we obtained an

unexpected opposite result—positive effects of StoreReputation on the choice to use a “9” priceending. This result indicates that Internet sellers with high reputation tend to use more 9¢ and $9

price-endings than the other price endings. We also assessed the relationship between the

number of reviews and “9” price-ending decisions. We found significant and positive effects for

NumReview (the number of consumer reviews) on “9”-ending prices for each of the two

dependent variables. This provides strong support for the Store Popularity Hypothesis (H4).

Apparently the more popular retailers on the Internet use “9” price-endings more frequently,

which, in turn, may result in increased consumer purchases. (It requires data on actual sales to

nail down if purchases actually increase.)

Finally, we assess the implications of rational inattention in terms of the estimated

coefficients of PriceLength in each model. As predicted by the Price Length Hypothesis (H5),

the estimated PriceLength variable should be positive, and this was true for in NineDollars

model. But PriceLength shows significant and negative effects on “9”-ending price decisions in

the NineCents model, the opposite of our prediction.

26

In a nutshell, our results show that the proposed model is well supported in the NineDollars

model except for StoreReputation, which indicates that the Internet-based retailers are less

attentive to 9¢-endings. Instead, they focus on $9-endings just as traditional retailers (e.g., retail

grocery stores) are more attentive to 9¢-endings to maximize their profits.

For the measurement of the goodness-of-fit of our model, we conducted concordant pairs

analysis using count-R2, which assesses the accuracy model in predicting the dependent variables

(Agresti, 2002; Gujarati, 2003). Count-R2s, the percentage of concordant pairs in the total

observations, for the three models are 73.4% and 62.7%, respectively, as reported in Table 12.

In addition, the sums of the percentage of the correct predictions in each category of our models

(i.e., 131.7% and 104.8%, respectively) are greater than 100%, which is the threshold suggested

by McIntosh and Dorfman (1992).

Table 12. Concordance Pairs Analysis Using Count-R2: All Categories

PREDICTED

NINECENTS MODEL

0

1

Correct

85,358

89.3%

OBSERVED

0

714,028

237,099

42.4%

1

174,099

Count-R2

73.4%

Note: The cutoff value for concordance is 0.5.

NINEDOLLARS MODEL

0

1

Correct

41,362

94.5%

711,735

410,444

10.3%

47,187

62.7%

Additional Results for Hypothesis Tests of Rational Inattention with Price Length

Because three explanatory variables, RelativeProductPrice (H2), StoreReputation (H3) and

PriceLength (H5) in the NineCents model exhibit somewhat contradictory results for the

proposed hypotheses, we conducted further analyses on the NineCents model with PriceLength.

Testing for the significance of this variable constitutes a Rational Inattention Hypothesis in this

research.

27

First, we analyzed the lowest-priced level products, whose price digits equal 4. As reported

in Table 13, the estimated models show a reasonable fit with the data by showing the count-R2 as

72.1%. With the exception of the StoreReputation Hypothesis, the results show the consistency

with the proposed hypotheses. However, only the Number of Reviews Hypothesis is strongly

supported. The results indicate that, among the drivers of the “9”-ending prices, the quality

image drivers, i.e., RelativeStorePrice (H1) and RelativeProductPrice (H2) have negative but no

significant effects on the Internet-based retailers’ “9¢”-ending price decisions for low-priced

products. In addition, these results are somewhat consistent with existing empirical research on

price endings (Stiving, 2000), which found that higher-priced stores use more round prices than

lower-priced stores and higher priced products within a product category tend to be priced using

round numbers.

Table 13. Results of Binary Probit NineCents Model by Price Length (Number of Digits)

4 DIGITS

5 DIGITS

6 DIGITS

7 DIGITS

VARIABLE

COEFF.

S. E.

COEFF.

S. E.

COEFF.

S. E.

COEFF.

S. E.

Constant

-3.561***

1.651 -2.831***

0.926 -1.943***

0.761 -1.340***

1.297

0.004

0.014***

RelativeStorePrice

-0.454***

1.166

0.127***

0.205 -0.011***

0.005

***

***

***

RelativeProductPrice -1.535

1.122

0.308

0.117

0.136

0.062

0.075***

0.035

0.103 -0.074***

0.208

StoreReputation

0.207***

0.091

0.084***

0.074 -0.002***

0.260

0.210

0.098

0.202

NumReview

0.396***

0.285***

0.183***

0.715***

-2LL

41,005.3

590,381.5

660,566.1

89,680.0

Count-R2

72.1%

67%

76%

82.5%

N (Obs.)

35,584

457,511

618,001

99,632

Note: Binomial probit (maximum likelihood estimation); Robust standard errors assume clustering at store

level; price length includes the decimal point; significance levels: *** = 0.01, ** = 0.05, * = 0.01; estimated

coefficients in bold indicate consistent results with the hypotheses; PriceLength variable omitted.

Among the online reputation drivers, the popularity of the store (based on number of

reviews) has positive and significant effects on “9¢” price endings in almost all the digits of

prices. Only the NineCents model in 7-digits of prices shows a marginally consistent result, as

reported in Table 13. So, the Store Popularity Hypothesis (H4) is well supported.

28

But the Store Reputation Hypothesis (H3) is not supported in all price digits for the

NineCents model. However, as the lengths of prices increase, the coefficients of StoreReputation

show negative effects on “9¢”-ending prices (including 6 and 7 digits), also reported in Table 13.

These results suggest that Internet-based retailers with high online reputation tend to use “9¢”endings often for low-priced products, while they less frequently use “9¢”-endings for highpriced products to signal their quality.

DISCUSSION AND CONCLUSION

We began by examining some first order, easy-to-see empirical regularities for product and

category price-endings present in our online retail price data. We compared them with the wellknown empirical regularities for price-endings that are observed among traditional bricks-andmortar retailers, based on the existing literature, setting up for additional exploration to gain an

understanding of the observed variations in price-endings. We find that Internet-based retailers

appear to frequently use 9¢ or $9 price-endings just as traditional bricks-and-mortar stores do.

This is very interesting findings in that we believe that firms today are able to flexibly manage

and optimize prices by reducing the managerial costs and menu costs through the intensive use

of IT. By combining supply chain management systems with revenue yield management, for

example, firms now possess the capability to achieve refined pricing decisions that are in line

with both current demand and current supply. So, we go on to explore drivers of the variation

we observed in the use of “9” price-endings across retailers and product categories. On the

whole, we find evidence that “9” price-endings are not set as often by higher quality stores. This

lends support for theories of “9” price-endings that suggest that they are associated with lower

quality offerings in the marketplace (Stiving and Winer, 1997). Therefore, managers on the

29

Internet should be wary of the signals associated with threshold pricing approaches, especially if

they are competing on quality. This also lends support to suggestions that firms are competing

on quality on the Internet, and not just on price. Moreover, it is possible the high quality firms

are winning. Consider the following quotation about price-endings at the Yahoo! Store:

“Does it matter whether your product price is $19 or $20? According to a recent Yahoo!

Store study, yes, but not in the way you would expect. Yahoo! Store determined that

around 21% of merchant products have prices which end in ‘9’, suggesting that many

merchants expect the slightly lower price to influence sales. In contrast, [] products with

prices ending in ‘0’ accounted for almost half of that: 11%. However, when it came to

what actually sold, the ‘9’-ending products were 26% of all orders, but the ‘0’-ending

products were nearly 37%. The implication is that, all things being equal, people prefer

to buy products with rounded prices like $40 or $80 instead of $39 or $79. The price is

right.” (Bock Interactive, 2001, www.bockinteractive.com/newsletter5.html)

We obtained mixed support for the Rational Inattention Hypothesis. It is only true for $9endings. It does not hold for 9¢-endings in our data set. This may be due to other behavioral

considerations. Schindler and Kirby (1997) argue that with longer price length, one should

expect there to be a decrease in the relative size of the one-unit differences between a “9”-ending

price and “0”-ending price, which may be used as a consumer’s reference price of the product.5

As consumers may perceive smaller gains as price length increases, price-setters are less likely to

favor the use of the “9” price-endings in cents (Schindler and Kirby, 1997). This may also be

due to firms’ costs of price adjustment, suggesting that they also choose to be rationally attentive

to dollars, but not to cents. This offers a new heuristic to handle the complexity of pricing from

the perspective of the Internet-based retailer. Consumers on the Internet can easily compare

prices as well as trace product information through price comparison sites or search engines.

The technology itself provides a basis for the consumer being able to achieve a higher level of

o

5

Schindler and Kirby (1997) provide the following example: a one unit difference between the two-digit

price of $39 and $40 is 2.5% of $40. However, the one unit difference between the three-digit price of

$439 and $440 is only 0.23% of $440. Kauffman and Wood (2003) make a similar argument in terms of

the proportional differences that occur in follow-the-leader pricing in e-commerce.

30

attention to price—if they use it. So, in spite of the earlier arguments in favor of rational

inattention to price endings, shopbots may actually “flatten” some of the potential behaviors that

would support this theory. Therefore, we believe that exploring these issues in terms of

marketing and economic theory promises to be an interesting direction for future IS research.

At a minimum our results highlight the kinds of opportunities arising from the new kinds of

data being generated in IS from price information-gathering agents. At one time, the empirical

findings in this area were largely based on small numbers of prices in carefully constructed data

sets. Many of the authors of the studies actually collected their data by hand, as they had no

other choice. But the advent of scanner data sets allowed studies of “9” price-endings in larger

scale (Bergen, et al. 2003). Today, sophisticated software tools for data collection allow an

assessment of the patterns of price endings with a scale and scope unimagined by previous

generations of researchers. We have focused on the use of “9” price-endings on the Internet.

But clearly, application of these tools for collecting interesting new data sets extends far beyond

this narrow topic. Indeed, massive quasi-experimental data mining of the kind that we have

implemented, subject to the appropriate analysis, has the capacity to answer the questions that

many marketing analysts never have thought to ask (Hahn and Kauffman 2003). As a result, the

theories of price rigidity, asymmetric pricing, asynchronization, and other issues seem ripe for

analysis with price-gathering software agents.

This is not to say that our analysis is without limitations. The data on prices are stunning in

the scale of price information available. They permit us to assess the use of “9” price-endings

across a wide variety of products, product categories, stores and time periods. But data on

related issues, such as sales volume, operating costs, wholesale prices, and so on do not become

“magically” available using these methods. Nor is direct information about customer

31

perceptions and information processing. This suggests that data-collecting agents are best suited

to test theories that lead to direct implications of pricing patterns across products, categories,

stores or time. To go substantially beyond these questions, the data available from the Internet

will need to be subsidized by additional data on firms (their costs, policies with respect to the use

of technology for the production of prices, etc.) or a laboratory experiment (e.g., consumers with

similar demographics and other factors were presented with the same goods at different prices

(or price-endings) and to have seen what their choice process was), to be most effective in the

future.

Furthermore, there are a wide range of theories that can be explored—for example, the

behavioral and operational theories—that may be fruitfully explored in future work. We have

only begun to explore differences in these theories based on the Internet versus the bricks-andmortar worlds. In our future work, we hope to design and implement critical tests to understand

which theories work better to explain these observed findings.

REFERENCES

Agresti, A. Categorical Data Analysis (2nd Edition), John Wiley and Sons, New York, NY,

2002.

Anderson, E., and Simester, D. “Mind Your Pricing Cues,” Harvard Bus. Rev., 81 (9),

September 2003, 96-103.

Baird, J., Lewis, C., and Romer, D. “Relative Frequencies in Numerical Response in Ratio

Estimation,” Perception and Psychophysics, 8, November 1970, 358-362.

Baker, W., Marn, M., and Zawada, C. “Price Smarter on the Net,” Harvard Bus. Rev., 79 (2),

February 2001, 122-127.

Bakos, Y. "Towards Friction-Free Markets: The Emerging Role of Electronic Marketplaces on

the Internet," Comm. of the ACM, 41 (8), August 1998, pp. 35-42.

Basu, K. “Why Are So Many Goods Priced to End in Nine? And Why This Practice Hurts the

Producers,” Economics Letters, 54 (1), January 1997, 41-44.