Buy-Price English Auction Zolt´an Hidv´egi • Wenli Wang • Andrew B. Whinston

advertisement

Buy-Price English Auction

Zoltán Hidvégi • Wenli Wang • Andrew B. Whinston

Center for Research on Electronic Commerce, MSIS Department, University of Texas at Austin, Austin, TX 78712

Decision & Information Analysis, Goizueta Business School, Emory University, Atlanta, GA, 30322

hgzoglgig@hgzoglgig.com • wgenglgig@wgenglgig.net • agbw

g@

g ugtsg.cc.utexas.edu

First version: August, 2002

Current revision: April 14, 2003

In English auctions, introducing a buy price, i.e., the seller’s maximum price bid at which any bidder at any

time can immediately win the auction, allows the seller to gain higher expected utility than that in a traditional

auction when either the seller or the buyers are risk-averse. If the seller sets the buy price high enough, the buyprice English auction is efficient and guarantees the highest bidder wins. Under this condition, the expected

utilities of uniformly risk-averse buyers with CARA utilities remain the same as in a traditional auction, and the

buy-price and traditional auctions are revenue equivalent when both the seller and the buyers are risk neutral.

A bidder with a valuation above the buy price follows one of three possible pure strategies: If his valuation is

very high, he would use the buy price unconditionally without trying to observe other bidders; If his valuation

is relatively high, he would use the buy price on the condition that there exists another competing bidder;

Otherwise, he would use the buy price when the current high bid reaches a threshold level between the reserve

and the buy price.

I.

We prove that the revenue equivalence theorem holds when

the seller and buyers are risk-neutral, that is, the seller’s expected

profit in a buy-price auction is the same as that in a traditional

auction. But when either the seller, the buyers or both are riskaverse, the seller can gain higher expected profit in a buy-price

English auction than a traditional one. A buyer, who is either

risk-neutral or has a Constant Absolute Risk Aversion (CARA)

(Brennan 1979) utility, is indifferent between buy-price and traditional auctions. In addition, buy-price English auctions are

efficient if the seller optimally sets the buy price high enough.

Our calculation provides such a lower bound.

A buy price does not affect the strategy of a bidder whose valuation is lower than the buy price, i.e., his dominant strategy is

to bid up to his valuation. But a bidder with a valuation above

the buy price has three pure strategies. We prove that there exist

valuations v and v̂, buy price < v ≤ v̂, such that a bidder with

a valuation above v̂ uses the buy price unconditionally (i.e., regardless there is competition or not), a bidder with a valuation

between v and v̂ uses the buy price on the condition that there

already exists a valid bid (i.e., at least one competing bidder exists), and a bidder with a valuation between the buy price and v

uses the buy price when the current high bid reaches a threshold

price (i.e., competition among bidders has reached to a level that

the bidder dare not to wait further).

Introduction

The popularity, scope and competitiveness of online auctions

have encouraged auctioneers to introduce various new schemes.

Particularly noteworthy is the use of a buy price in English auctions where a seller announces a maximum price bid at which

any bidder at any time can immediately win the auction. With

this new phenomenon, several questions follow: Can the seller

benefit from setting up a buy price? And if so, how does she

determine the optimal buy price? Can the buyers benefit from

attending auctions with buy prices and what are their optimal

strategies? Is a buy-price English auction efficient? To examine

these questions, we need a formal theoretical analysis.

This paper models the buy-price English auction where the

buy price remains during the entire course of the auction. Such

an auction, like that offered by Yahoo! and uBid, composes a

hybrid sales model, allowing a fixed-price sale within an auction. eBay’s buy-it-now feature, however, differs because it only

allows a fixed-price sale before an auction – once there is a valid

bid, i.e., a bid above or equal to the reserve, the buy-it-now option disappears1 .

1 Although eBay’s buy-it-now feature allows a seller to attract buyers from

both the auction and posted-price sales markets with only one listing fee, its

weaknesses outweighs such a benefit: (1) the seller does not enjoy the full benefit

of a posted-price sale because it can be easily stopped by any valid bid; and

(2) the seller reduces her expected profit from the auction because the auction

becomes inefficient (Ausubel and Cramton 1999), i.e., the highest bidder is no

longer guaranteed to win: bidders have to decide whether or not to exercise buy-

it-now without observing any bid, and their best symmetric strategy is to find a

valuation level above which they unconditionally exercise buy-it-now. Reynolds

and Wooders (2002) provide a formal discussion on the inefficiency of eBay’s

buy-it-now option.

1

II.

In addition to the three well-defined pure strategies that bidders with valuations above the buy price can easily follow,

threshold bidders’ equilibrium threshold prices also have nice

properties: (1) They can be calculated using the buy price and

the bidders’ utility functions and value distribution; (2) They are

above the reserve and strictly decreasing with valuations, i.e.,

the higher a threshold bidder’s valuation is the lower his threshold price. This leads to the situation that when the buy price

is set high enough so that there are only threshold bidders (i.e.,

no conditional or unconditional bidders), it guarantees that the

highest bidder wins and, hence, the equilibrium yields full efficiency. (3) The more risk-averse a threshold bidder is, the lower

is his threshold price. In other words, a more risk-averse bidder

tends to use the buy price earlier. Therefore, the seller can gain

higher expected profit with risk-averse buyers than with riskneutral buyers.

Since the use of buy prices in auctions only started in the year

2000, there is not much literature on these issues. Budish and

Takeyama (2001) modeled two bidders with two-point value distribution and Reynolds and Wooders (2002) modeled two bidders with uniform value distribution. Our analysis is the most

general one modeling n bidders with arbitrary continuous value

distribution. Although Budish and Takeyama (2001) using simpler model concluded that with properly set buy price the seller

facing risk-neutral buyers earns the same expected profit in a

buy-price auction as in a traditional auction and the seller facing

risk-averse buyers earns higher expected profit in a buy-price

auction than in a traditional auction, our unique contribution to

the literature is at least four-fold: (1) we introduce the general

model which can be easily extended for further studies; (2) we

clearly state and prove the bidders’ strategies that are easy to follow; (3) we compare behaviors of bidders with different degree

of risk aversion; and (4) we analyze the seller’s risk aversion and

its impact on the use of buy prices.

The remaining of the existing literature focused more on

eBay’s buy-it-now auctions. Reynolds and Wooders (2002)

mainly focused on eBay’s buy-it-now auctions and had an incomplete analysis of Yahoo! buy-price auctions. Mathews

(2003) extensively studied eBay’s buy-it-now auctions. Mathews (2002c) studied a two-stage game, a variation of eBay’s

model: Bidders can exercise buy prices at stage one and attend a

traditional auction at stage two. Mathews (2002b) extended the

two-stage game to allow multiple buy price stages followed by a

conventional auction. All these papers did not study the hybrid

sales model, which is of interest of this paper.

Wang (1993) concludes that for a seller an auction is always

better than a fixed-price sale when the auction is costless to the

seller. We further prove that embedding a fixed-price sale in an

auction is at least as good as a traditional auction for a seller if

the buy price is properly set.

This paper proceeds as follows: In Section II, we introduce

the model and characterize the buyers’ pure strategy equilibrium

and its properties. In Section III, we prove that the seller is not

worse off using buy prices. Section IV concludes the paper.

Bidder Equilibrium Strategy

A. The Model

This study assumes that there is one seller and n bidders in

a buy-price English auction of an indivisible good, only bids

above or equal to the reserve price are accepted, and the seller

has committed not to relist her item if she receives no valid bid.

The no-resale constraint is a standard assumption and is naturally satisfied in cases of perishable or time sensitive goods like

flowers or tickets. We also assume that bidders have independent private valuations drawn randomly from the same cumulative probability distribution F , which is strictly increasing and

differentiable over its support [m, M ]2 . Let f = F 0 denote the

probability density. The private-value assumption is restrictive,

but auctions selling unique collectibles or used goods without

established market values come close to private-value auctions.

To simplify the analysis, we use a modified “English Thermometer Auction” where a price ticker starting at the reserve

price increases continuously and each bidder controls two buttons: “bid” and “buy.” At the start, each bidder willing to pay

at least the reserve price presses and holds down the “bid” button. Once a bidder releases the “bid” button, he no longer can

return to the auction. At any time, any active bidder can press

the “buy” button, i.e., bid at the buy price, to immediately win

and close the auction. When more than one bidder presses his

“buy” buttons simultaneously, the winner will be chosen randomly among them. During the auction, bidders do not know

how many bidders remain active. If no bidder presses the “buy”

button, the auction ends when either only one bidder is left holding the “bid” button or the price ticker reaches the buy price. In

the former case, the last bidder wins and pays the ticker price

(the price where the second highest bidder drops out), whereas,

in the latter case, the winner is chosen randomly among the remaining bidders.

B. Bidders’ Equilibrium Threshold Strategies

The pure and dominant strategy for a bidder with a valuation

below the buy price, like in a conventional English auction, is to

bid up to his valuation.

The strategy space for a bidder with a valuation above the

buy price is more complicated. When there are multiple bidders

with valuations above the buy price, the winner will be the one

who first commits to the buy price. If such a bidder knows that

there exists at least one bidder with a valuation above the buy

price, he would find the appropriate moment to press the “buy”

button before any other bidder uses the buy price. If he guesses

that no other bidder has valuation above the buy price, he should

simply keep bidding. Since there is no dominant strategy for

such a bidder, the best we can search for is a Bayesian Nash

equilibrium. Let r denote the reserve price, b the buy price. A

bidder with a valuation v, v > b, has three pure strategies from

which to choose:

2M

2

could be ∞

• Unconditional: Bid immediately at the buy price;

denote the seller’s utility when she sells the item and receives the

payment p. Both functions, we assume, are concave, twice continuously differentiable and strictly increasing. We allow u and

s to be linear, representing the utility of risk-neutral buyers and

seller. Let vs be the seller’s valuation for the good, assuming

u(0) = s(vs ) = 0 and u0 (0) = s0 (vs ) = 1. Since we are concerned of strategies for a bidder with v > b, let us calculate such

a bidder’s expected profit under the different strategies:

• Conditional: Bid but use the buy price immediately if

someone else submits a bid above or equal to the reserve;

• Threshold: Keep bidding until winning or a threshold

price t > r is reached. Once t is reached, bid immediately

at the buy price.

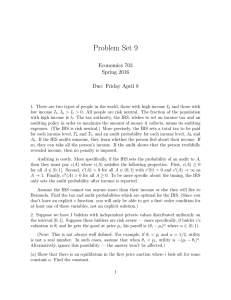

We will prove that the bidders’ equilibrium strategies (see Figure 1) are determined by function t(v, b) > r and constants v and

v̂, b < v ≤ v̂ ≤ M , such that bidders with valuation v would

use the:

1. Unconditional strategy:

A bidder using the unconditional strategy only competes with

bidders using the same strategy. The probability that a bidder

uses the unconditional strategy is 1 − F (v̂) and the probability

that there are exactly k − 1 other bidders

n) who also

(1 ≤ k ≤k−1

(1

−

F

(v̂))

F n−k (v̂).

use the unconditional strategy is n−1

k−1

Hence, an unconditional bidder’s expected profit, denoted by

Πu (v), is

n X

u(v − b)

n−1

(1 − F (v̂))k−1 F n−k (v̂)

Πu (v) =

k

k−1

• Dominant strategy, i.e., bid up to v, if v ≤ b

• Threshold strategy with threshold t(v, b) > r if b < v < v

• Conditional strategy if v ≤ v < v̂

• Unconditional strategy if v ≥ v̂

bidder’s

threshold price

k=1

(1)

b

n−1

u(v − b) X k

1 − F n (v̂)

u(v − b) =

=

F (v̂)

n(1 − F (v̂))

n

k=0

t(v, b)

2. Conditional strategy:

Dominant

strategy

Threshold

strategy

A bidder using the conditional strategy wins if there are no unconditional bidders and he is chosen randomly among the conditional bidders. A conditional bidder pays b if there is a valid bid

and pays r if there is no valid bids. We calculate his expected

profit Πc (v) by adding his extra profit when he pays only r to

his expected profit if assuming he always pays b:

n X

u(v − b)

n−1

+

Πc (v) =

(F (v̂) − F (v))k−1 F n−k (v)

k

k−1

Conditional Unconditional

strategy

strategy

r

r

b

v

v̂

bidder’s

valuation

Figure 1. Bidders in a buy-price English auction follow one of the four strategies

dependent on their valuations.

k=1

Note that the conditional and unconditional strategies can

be viewed as special cases of the threshold strategy where the

threshold price is equal to the reserve price and zero respectively. The dominant strategy can be regarded as having a threshold price equal to b, i.e., such a bidder never jumps to the buy

price. To simply the notations in the following proofs, we assume t(v, b) = b when v ≤ b even though t(v, b) is only used

when v > b.

Next we obtain the necessary and sufficient conditions for t,

v and v̂ to determine a symmetric Bayesian Nash Equilibrium.

We first calculate bidders’ expected profit under different strategies. We then establish two propositions regarding t, compute t,

and prove t indeed corresponds to a Bayesian Nash Equilibrium.

Furthermore, we prove the existence of unique v and v̂ and show

how to compute them.

Let u(x) denote the bidder’s von Neumann-Morgenstern utility function, where x is the difference between the buyer’s valuation and his payment if he wins and is zero if otherwise. Let s(p)

(2)

(u(v − r) − u(v − b))F n−1 (r)

n−1

u(v − b) X k

F (v̂)F n−k−1 (v) +

=

n

k=0

(u(v − r) − u(v − b))F n−1 (r)

3. Threshold strategy:

A bidder with a threshold price p wins and pays b if there are

no unconditional and conditional bidders and the current highest bid reaches p or wins and pays max{2nd highest bid, r} if

all other bidders have valuations below p. Let Gn−1 (p) be the

probability that a bidder with a threshold price p exercises the

buy price and wins the auction. We will show later how to calculate Gn−1 (p). A threshold bidder’s expected profit, denoted

by Πt (v, p), is

(3) Πt (v, p) = u(v − b)Gn−1 (p) +

Z p

u(v − x) dF n−1 (x) + u(v − r)F n−1 (r)

r

3

P ROOF. To show that t(v, b) = p∗ maximizes the expected

profit of a bidder with b < v < v, it is enough to show that

∂Πt (v,p)

is positive if p < t(v, b) and negative when p > t(v, b).

∂p

From the detailed proof in Appendix D, we get Πt (v, p) strictly

increasing for all p ∈ (r, t(v, b)) and strictly decreasing for

p ∈ (t(v, b), b). This proves that, as long as all other bidders

use the threshold strategy, p∗ = t(v, b) maximizes Πt (v, p) for

a given v, b < v < v; that is, the optimal threshold price of a

bidder with valuation v is t(v, b).

We now establish two properties of t.

PROPOSITION 1: t(v, b) is strictly decreasing in v for b < v <

v.

P ROOF. See Appendix A.

PROPOSITION 2: t(v, b) is continuous in v for b < v < v.

P ROOF. See Appendix B.

COROLLARY 1: If the function t defined by equation (4) satisfies

lim t(v, b) ≥ r

v→M

then it is an equilibrium that all bidders with valuation v > b

use the threshold strategy with t(v, b) as their threshold price.

In the interest of simplicity, we assume for the remainder of

the paper that t is continuously differentiable in both variables

so long as it is above r.

Using the above two propositions we can show the following

theorem.

P ROOF. Proposition 3 with v = M shows that a bidder cannot

improve his profit by using a different threshold strategy. We

still need to show that he cannot improve his profit by switching

to the conditional or unconditional strategies, and for this it is

sufficient to show that

THEOREM 1: Any threshold price function t(v, b) corresponding to an equilibrium satisfies the following differential equation:

Πt (v, t(v, b)) > u(v − b)(1 − F n−1 (r)) + u(v − r)F n−1 (r)

0

(4)

The right side above is the bidder’s maximum possible profit if

using the conditional strategy: a conditional bidder reaches his

maximum possible expected profit when he pays r if everyone

else has a valuation below r and pays b otherwise. It is higher

than the maximum profit possible using the unconditional strategy, which is u(v − b).

When all other bidders follow the threshold strategy, by

Proposition 3, we have

F n−1 (v)

u(v − t(v, b))

−1+

= 0, t(b, b) = b

u(v − b)

∂1 (F n−1 ◦ t)(v, b)

P ROOF. See Appendix C.

This is an ordinary differential equation for t(·, b) with the

boundary condition t(b, b) = b. The equation always has a

unique solution of t(v, b). Although we cannot express the general solution explicitly, bidders in practice can apply (4) to calculate their optimal threshold prices once the characteristics of

an auction market (e.g., bidders’ value distribution, utility functions and the seller’s buy price) become known. We will soon

demonstrate the use of (4) when a bidder has a CARA utility.

Since u(v − t(v, b)) > u(v − b), from (4) we get

Πt (v, t(v, b)) > lim Πt (v, p)

p→r

and using (3) and Gn−1 (p) = F n−1 (v) − F n−1 (p), we have

lim Πt (v, p) = u(v − b)(1 − F n−1 (r)) + u(v − r)F n−1 (r). p→r

COROLLARY 2: If the function t defined by equation (4) satisfies

lim t(v, b) ≥ r

0

u(v − t(v, b))

F n−1 (v)

=1−

<0

0

n−1

u(v − b)

F

(t(v, b))∂1 t(v, b)

v→M

then the highest bidder will win, and when all the buyers and

the seller are risk-neutral, the buyers’ and the seller’s expected

profits are the same as in the no-buy-price English auction.

which implies ∂1 t(v, b) < 0. This further verifies Proposition 1

that t is strictly decreasing in v when b < v < v.

Now we prove that the threshold function defined by (4) is the

best response threshold value.

P ROOF. By Corollary 1, all bidders follow the threshold strategy with a threshold strictly decreasing with the valuation, which

means the the highest bidder will reach his threshold first, thus

the highest bidder will win the auction. This, by the revenue

equivalence theorem by Myerson (1981) and Riley and Samuelson (1981) implies that the buy-price auction yields the same

expected revenues to both the buyers and the seller as the traditional English auction.

PROPOSITION 3: Let t be the function defined by (4) and let

v > b satisfy that for all x < v that t(x, b) > r. If all other

bidders with valuations x, b < x < v, follow the threshold

strategy t(x, b), then the optimal threshold strategy of a bidder

with valuation v, b < v < v, is to use t(v, b) as his threshold

price.

4

Πt

Πc

Πu

When limv→M t(v, b) < r, there is no equilibrium where

everyone uses a threshold strategy, but the following theorem

holds:

THEOREM 2: Let t(v, b) defined by

0

u(v − t(v, b))

F n−1 (v)

−1+

= 0, and t(b, b) = b.

u(v − b)

∂1 (F n−1 ◦ t)(v, b)

There exists b < v ≤ v̂ ≤ M s.t., it is an equilibrium that all

bidders with valuation v use the threshold strategy with t(v, b)

if b < v < v, use the conditional strategy if v ≤ v < v̂, and

use the unconditional strategy if v̂ ≤ v. All bidders with v > b

follow the threshold strategy, i.e., v = M , if and only if

v

v̂

lim t(v, b) ≥ r

v→M

Figure 2. The relationship among the slopes of the profit functions guarantees

the existence of v and v̂.

P ROOF. By COROLLARY 1, all bidders with v > b following

the threshold strategy is an equilibrium when limv→M t(v, b) ≥

r. Now we need to prove that when limv→M t(v, b) < r, v <

M.

We can calculate the equilibrium v̂ and v using (1) and (2).

First, find the equation that gives v̂ for a given v.

Either Πu (v) ≥ Πc (v) for all v ≥ v or Πu (v) ≤ Πc (v) for all

v ≥ v or v̂ satisfies Πu (v̂) = Πc (v̂) which leads to

when v is large, s.t., t(v, b) → r. First consider the case where

v → b:

lim Πu (v) = 0

v&b

lim Πc (v) = (b − r)F n−1 (r)

v&b

(5)

n−1

X

F k (v̂)(1 − F n−k−1 (v)) = n

k=0

u(v̂ − r)

u(v̂ − b)

− 1 F n−1 (r)

lim Πt (v, t(v, b)) =

v&b

(6)

k=0

n−1

X

k=0

u(b − x) dF n−1 (x) + (b − r)F n−1 (r)

r

lim Πt (v, t(v, b)) = (u(ṽ − r) − u(ṽ − b))F n−1 (r) +

v→ṽ

(1 − F n−k−1 (v)) ≤ n

u(M − r)

− 1 F n−1 (r)

u(M − b)

u(ṽ − b)F n−1 (ṽ) ≤ Πc (ṽ) ≤ Πd (ṽ)

Therefore, there exists a v ∈ (b, ṽ] satisfying Πt (v, t(v, b)) =

Πd (v) and v < M .

To show that t, v and v̂ correspond to an equilibrium, we will

need the following proposition:

in which case Πu (v) ≤ Πc (v) for all v ≥ v; therefore, v̂ =

M and all bidders with valuation over v prefer the conditional

strategy. Or,

(7)

b

which shows that for v → b, Πt (v, t(v, b)) > Πd (v) holds.

Let ṽ satisfy t(ṽ, b) = r. Note that ṽ < M exists here because

limv→M t(v, b) < r. We have

For a given v, the right-hand-side above is strictly decreasing in

v̂, while the left-hand-side is strictly increasing. Therefore, there

is either one unique v̂ solution, v̂ > v, or no v̂ > v solution,

which in turn implies one of the following must hold:

n−1

X

Z

F k (v)(1 − F n−k−1 (v)) ≥ n

u(v − r)

u(v − b)

PROPOSITION 4: For all v > b and r < p < b,

− 1 F n−1 (r)

Π0u (v) ≥ Π0c (v) ≥

which takes place when Πu (v) ≥ Πc (v) for all v ≥ v; thus, v̂ =

v and all bidders with valuation over v prefer the unconditional

strategy.

Define Πd (v) = max{Πc (v), Πu (v)}. v is the valuation limit

where bidders switch from the threshold strategy either to the

conditional or unconditional strategies; thus, Πt (v, t(v, b)) =

Πd (v). Since both sides are continuous, in order to demonstrate

that there is a solution to this equation, it is sufficient to show

that Πt (v, t(v, b)) is greater for v → b, but Πd (v) is greater

∂Πt (v, p)

∂v

P ROOF. See Appendix E.

This means that for all p, Πt (v, p) − Πd (v) is non-increasing in

v. For any v < v,

Πt (v, t(v, b)) − Πd (v) > Πt (v, t(v, b)) − Πd (v)

≥ Πt (v, t(v, b)) − Πd (v) = 0

5

which implies that bidders with valuation below v cannot improve their expected utility by switching to the conditional or

unconditional strategies. For any v > v and for any p,

Πt (v, p)−Πd (v) ≤ Πt (v, p)−Πd (v) ≤ Πt (v, t(v, b))−Πd (v) = 0

which implies that bidders with valuation above v following the

better of conditional and unconditional strategies cannot gain by

switching to a threshold strategy.

Proposition 4 also implies that Πu (v) − Πc (v) is nondecreasing. Therefore, if Πc (v̂) = Πu (v̂), then for all v ∈ [v, v̂)

bidders prefer the conditional strategy and, for all v > v̂, bidders

prefer the unconditional strategy. If there is no v̂ that satisfies

Πu (v̂) = Πc (v̂), then either (6) or (7) holds, i.e., one of the two

strategies is always strictly better than the other.

Now we have shown that t, v and v̂ indeed determine an equilibrium.

F n−1 (t2 (v, b)) is strictly increasing in v for α < v ≤ β. And

since F n−1 (t1 (α, b)) = F n−1 (t2 (α, b)), F n−1 (t1 (v, b)) >

F n−1 (t2 (v, b)) is only possible if t1 (v, b) > t2 (v, b) for all

α < v ≤ β, which is a contradiction.

D. Bidder’s Choice: Buy-price or Traditional Auction?

When a bidder needs to choose between a buy-price and traditional English auction, which one should he prefer? To decide,

we need to compare his expected profits. For a bidder with a

valuation below or equal to b, the two auctions are equivalent

because his equilibrium strategy remains the same. For a bidder

with valuation above b, he follows the same strategy as in the

traditional auction as long as the second highest bidder’s valuation is below the threshold price. But if the second highest

bidder’s valuation is x > t(v, b), then his expected extra gain

from attending a buy-price auction, instead of a traditional one,

is

Z v

(8)

(u(v − b) − u(v − x)) dF n−1 (x)

We can prove that v and v̂ are unique and the equilibrium described in theorem 2 is the only pure strategy symmetric equilibrium of a buy-price English auction. The proof is not difficult and uses similar techniques as does the proof of theorem 2.

Since the proof does not provide any more economical insights,

we choose to omit it in this paper.

t(v,b)

Next, we calculate the bidder’s gains when he is risk-averse or

risk-neutral, respectively. Suppose the bidder has CARA utility

ua (x) = (1 − e−ax )/a, where a > 0 is the absolute level of

risk aversion. If the bidder is risk-neutral, a = 0, u0 (x) =

lima→0 ua (x) = x. Subsequently whenever we mention CARA

utilities we also include the linear utility function. The CARA

utilities satisfy the following

C. Threshold Prices and the Absolute Level of Risk Aversion

Now we examine the relationship between a bidder’s threshold

price and his absolute level of risk aversion. Assuming that

the bidder’s valuation unchanged, the following theorem proves

that the more risk-averse a bidder is, the lower is his threshold

price. In other words, the more risk-averse a bidder is, the sooner

would he use the buy price in order to avoid the risk that someone else may use it before him.

ua (x) − ua (y)

= ua (x − y) for all a ≥ 0, x, y ∈ R

u0a (y)

ua (−x) = −

ua (x)

for all a ≥ 0, x ∈ R

u0a (x)

Applying them in (4), we get

THEOREM 3: Let u1 , u2 be concave or linear utility functions,

t1 , t2 be the corresponding threshold-price functions, and a1 =

−u001 /u01 , a2 = −u002 /u02 be the absolute level of risk aversion.

If a1 (x) ≤ a2 (x) for all x ≥ 0, then t1 (v, b) ≥ t2 (v, b) for all

v ≥ b.

0

0

ua (b − t(v, b)) F n−1 ◦ t(·, b) (v) = ua (b − v)F n−1 (v)

Solving it with the boundary condition t(b, b) = b yields

Z

P ROOF. Prove by contradiction: assume that for all x ≥ 0,

a1 (x) ≤ a2 (x), but there exists β > b such that t1 (β, b) <

t2 (β, b). Let α = max{v : v < β ∧ t1 (v, b) = t2 (v, b)}. α exists because the set over which we take the maximum is closed,

bounded from above, and non-empty (e.g., includes b). Then for

all v, α < v ≤ β, t1 (v, b) < t2 (v, b).

Using Lemma F1 from Appendix F, the following inequalities

hold:

t(v,b)

ua (b − x) dF

n−1

b

Z

(9)

(x) =

Z

v

ua (b − x) dF n−1 (x)

b

v

ua (b − x) dF n−1 (x) = 0

t(v,b)

Using equation (9), a bidder with CARA utility can calculate his

threshold price t(v, b).

Rewriting (8) and using (9), we get

Z v

(ua (v − b) − ua (v − x)) dF n−1 (x) =

u1 (v − t1 (v, b))

u2 (v − t1 (v, b))

u2 (v − t2 (v, b))

≥

>

u1 (v − b)

u2 (v − b)

u2 (v − b)

t(v,b)

This, combined with equation (4), implies ∂1 (F n−1 ◦t1 )(v, b) >

∂1 (F n−1 ◦ t2 )(v, b), which means that F n−1 (t1 (v, b)) −

−u0a (v

6

− b)

Z

v

ua (b − x) dF n−1 (x)

t(v,b)

= 0

Hence, a bidder with CARA utility and a valuation b < v < v

gains zero expected profit from attending a buy-price auction

rather than a traditional one. Combining this with our earlier

discussion of bidders with v ≤ b and v ≥ v, we reach the conclusion that regardless of his valuation and risk preference, a

bidder with CARA utility is indifferent between buy-price and

traditional English auctions.

THEOREM 4: In a buy-price English auction, if both the seller

and buyers are risk-neutral and the buy price is at least as high

as the expected value of the maximum valuation among (n − 1)

buyers on the condition that at least one of the (n−1) buyers has

a valuation above or equal to the reserve, the seller’s expected

profit is the same as that in a traditional auction and the auction

is efficient.

THEOREM 5: In a buy-price English auction, if the seller is

risk-neutral, the buyers are risk-averse, and the buy price is at

least as high as the expected value of the maximum valuation

among (n − 1) buyers on the condition that at least one of the

(n − 1) buyers has a valuation above or equal to the reserve,

the seller’s expected profit is higher than that in a traditional

auction.

III. Seller’s Gains from Using Buy Prices

A. Risk-neutral Sellers

Define tM = limv→M t(v, b). We have seen that when tM ≥ r,

in equilibrium, all bidders follow the threshold strategy with a

strictly decreasing t, ensuring that the highest bidder win. The

revenue equivalence theorem, which is true only when both the

seller and the bidders are risk-neutral, implies that a risk-neutral

seller’s expected profit in a buy-price auction is the same as that

in a traditional auction. On the other hand, when tM ≥ r does

not hold, bidders with valuations above v follow different strategies that no longer guarantee the highest bidder win.

When bidders have CARA utility and tM ≥ r, we can derive

the following from equation (9)

Z M

Z M

0=

ua (b − x) dF n−1 (x) ≤

ua (b − x) dF n−1 (x)

tM

P ROOF. Theorem 4 says that a risk-neutral seller gains no extra

expected profit with risk-neutral buyers in a buy-price auction.

Theorem 3 says that the more risk-averse buyers are, the lower

their threshold prices. This increases the seller’s expected profit

because more buyers will pay the buy price instead of the second highest bidder valuation. But in a traditional auction, the

seller’s expected profit does not change with the buyer’s level

of risk aversion, as buyers bid up to their valuations regardless.

Therefore, when buyers are risk-averse, a risk-neutral seller is

better off in a buy-price auction.

r

which implies

(10)

lim t(v, b) = tM ≥ r ⇐⇒

v→M

Z

M

B.

ua (b − x) dF n−1 (x) ≥ 0

r

Let us now calculate the expected profit of a risk-averse seller

with risk-neutral buyers. The calculation presented below is similar to that of Riley and Samuelson (1981) except that the seller’s

utility function s(x), where x denote the sale price, is more general because the seller under analysis can be either risk-neutral

or risk-averse: s(x) = x if the seller is risk-neutral and s(x) is

strictly concave if the seller is risk-averse.

At the equilibrium, the seller’s expected profit from a bidder

with a valuation below b is the same as in a traditional auction.

It is given by the equation (8b) in Riley and Samuelson (1981):

Z v

P0 (v) = s(r)F n−1 (r) +

s(x) dF n−1 (x)

Zr v

n−1

= s(v)F

(v) −

s0 (x)F n−1 (x) dx

When buyers are risk-neutral, i.e., a = 0 and ua (b − x) =

b − x, the condition of (10) is equivalent to

Z M

Z M

b dF n−1 (x) ≥

x dF n−1 (x)

r

r

which can be rewritten as

Z M

(11)

b≥

x

r

Risk-averse Sellers

dF n−1 (x)

1 − F n−1 (r)

Inequality (11) is important because it helps the seller to

choose appropriate buy prices. In order to obtain an expected

profit at least equivalent to that of a traditional auction, the seller

should choose a buy price at least as high as the expected value

of the maximum valuation among (n − 1) bidders, on the condition that at least one of those bidders has a valuation above or

equal to the reserve. For example, when the bidders are riskneutral and have a uniform [0, 1] distribution, and the seller’s

valuation is 0, the optimal reserve price is 0.5. If there are two

bidders, then the lowest buy price that still results in a revenue

equivalent to that of a traditional auction is 0.75. As the number

of bidders increases, the buy price should also increase in order

to ensure the revenue equivalence.

We can conclude our findings on risk-neutral sellers in the

following theorems:

r

Assuming that limv→M t(v, b) ≥ r, i.e., v = M . The seller’s

expected profit from a bidder with a valuation v > b is:

P (v, b) = P0 (t) + s(b)(F n−1 (v) − F n−1 (t))

Hence, the seller’s overall expected profit from all n bidders,

denoted by Πs (v, b), is:

(12) Πs (v, b) = n

7

Z

b

P0 (v) dF (v) +

r

Z

M

P (v, b) dF (v)

b

Since we can regard no buy price in a traditional auction as have

a b, b → ∞, to prove that a risk-averse seller is better off in a

buy-price auction with risk-neutral buyers is equivalent to showing that the b-derivative of Πs (v, b) is negative. The b-derivative

of Πs (v, b) is

∂2 Πs (v, b)

= n

= n

Z

Z

Our paper shows that buy-price auctions offered by Yahoo!

and uBid are, in theory, more beneficial to both sellers and buyers than the “buy-it-now” auctions offered by eBay, especially

for unique and used items where buyers have private valuations

and face relatively high risk. While the positive network externality has contributed significantly to the popularity of eBay,

features in Yahoo! and uBid auctions also have their own competitive advantages.3

An extension of this model would consider the time factor.

With the pace of transactions getting faster and the Internet’s

around-the-clock operations allowing random arrival of traders,

the temporal property of a trade becomes increasingly important.

We suspect that time-averse auction sellers and buyers are more

likely to use buy prices and the shortened auction cycles increase

the market liquidity. Mathews (2002a) modeled eBay’s buyit-now auction with a time discount and showed that the seller

would use a buy price that will be exercised with positive probability because even when the seller and buyers are risk-neutral

buyers are willing to pay more to get the item sooner and/or the

seller is willing to give up some of his expected profit to get

the payment sooner. In contrast to their eBay model with uniform bidder distribution, a more general model would be in need

to analyze Yahoo!-like buy-price auctions with arbitrary bidder

distribution.

Another research direction is to study how the seller uses buy

prices as signaling devices. Too high a buy price may alienate

buyers from bidding. Too low a buy price may convey information on adverse quality. It might even be possible to embed a

Dutch auction within an English auction by allowing decreasing

buy prices.

M

∂2 P (v, b) dF (v)

b

b

Mh

(s(t) − s(b))∂2 (F n−1 ◦ t)(v, b) +

i

s0 (b)(F n−1 (v) − F n−1 (t)) dF (v)

Differentiating (9) by b with a = 0, i.e., ua (x) = x, we get:

(13) F n−1 (v) − F n−1 (t) = (b − t) ∂2 (F n−1 ◦ t) (v, b)

Applying (13) and s(b)−s(t) ≥ s0 (b)(b−t) due to the concavity

of s, we get

∂2 Πs (v, b) ≤ 0.

The inequality shows that as long as (11) holds, i.e., the buy

price is set high enough that no one uses a conditional or unconditional strategy, a risk-averse seller is strictly better off in

a buy-price auction than in a traditional auction. The equality

holds if and only if the seller is risk-neutral, implying that the

seller’s expected profits from a buy-price is the same as in a traditional auction. Moreover, risk-averse buyers even further increase the seller’s expected profit in a buy-price auction. Hence,

the following theorem holds:

THEOREM 6: In a buy-price English auction, if either the

seller or the buyers are risk-averse and the buy price is at least

as high as the expected value of the maximum valuation among

(n − 1) buyers on the condition that at least one of the (n − 1)

buyers has a valuation above or equal to the reserve, the seller’s

expected profit is higher than that in a traditional auction.

Appendix A. Proof of Proposition 1

PROPOSITION 1: t(v, b) is strictly decreasing in v when b <

v < v.

Therefore, we can conclude that regardless of whether the

seller is risk-neutral or risk-averse, he cannot lose by using buy

prices in English auctions.

P ROOF. We first prove that t(v, b) is non-increasing in v for all

v ≥ b. Prove by contradiction: assume t(v, b) is increasing in v

for all v ≥ b, that is, for some v0 < v1 , t0 = t(v0 , b) < t1 =

t(v1 , b). Since we assume F is strictly increasing, every bidder

would have a unique valuation and there will not be randomdraw cases. When the auction ticker reaches t0 , a bidder with a

valuation v1 can either jump to the buy price immediately for a

guaranteed u(v1 −b) profit, or continue bidding and wait to jump

at t1 . Since by our assumption t1 is this bidder’s equilibrium

IV. Concluding Remarks

This paper analyzes buy-price English auctions of an indivisible good with the general setting of n bidders with continuous,

independently distributed private valuations. We prove that if

the seller and bidders are risk-neutral, buy prices would not affect the auction outcome. The revenue equivalence theorem still

applies and the auction is efficient. If the seller is risk-averse,

or if the seller is risk-neutral but the bidders are risk-averse, a

buy-price English auction can actually provide the seller higher

expected profit than can a traditional English auction. Auctioneers can conduct market research on the players’ degree of risk

aversion in different markets and recommend buy-price options

to auction sellers.

3 In addition to the buy-price feature, Yahoo! and uBid have some other advanced technical features. Yahoo! Auctions and uBid authenticate buyers more

rigorously than eBay by requiring valid credit card information for registration.

Yahoo! even asks for two passwords for authentication purpose, which reduces

the number of non-paying winners and the fraud of shill bidding (Wang, Hidv´egi

and Whinston 2002). Yahoo! also allows a seller to specify the automatic extension of an auction if a bid is made within the last five minutes before the

auction ends, which helps to prevent last-minute bidding (Roth and Ockenfels

forthcoming). Moreover, Yahoo! currently attracts sellers with no listing fees

and an option of automatic relisting.

8

threshold price, jumping at t1 should give him expected profit

no less than jumping at t0 :

Z t1

u(v1 −b)Gn−1 (t1 )+

u(v1 −x) dF n−1 (x) ≥ u(v1 −b)Gn−1 (t0 )

t0

(A1)

Z

t1

u(v1 − x)

t0

Gn−1 (t1 ) dF n−1 (x)

≥ u(v1 − b) 1 −

Gn−1 (t0 )

Gn−1 (t0 )

to jump earlier, i.e., when the ticker reaches t0 − ε instead of

t0 for some arbitrarily small ε, he can avoid this random-draw

gamble and increase his chance of winning. Doing so, he can

increase his expected profit and only suffer at most ε additional

loss. Clearly, if ε is small enough, he can be better off by jumping earlier. Therefore, pooling cannot be an equilibrium. Thus,

t(v, b) is strictly decreasing when b < v < v, i.e., t(v, b) > r. On the other hand, for the buyer with valuation v0 , jumping to

Appendix B. Proof of Proposition 2

the buy price at t0 is at least as good as continuing bidding and

jumping at t1 :

PROPOSITION 2: t(v, b) is continuous in v when b < v < v.

Z t1

P ROOF. We first prove t(v, b) is right-continuous in v when b <

u(v0 −x) dF n−1 (x)

u(v0 −b)Gn−1 (t0 ) ≥ u(v0 −b)Gn−1 (t1 )+

v

< v, i.e., t(v, b) > r. Let v0 > b, t0 = t(v0 , b), v > v0 ,

t0

and t+ = limv&v0 t(v, b). The monotonicity of t(v, b) implies

t+ ≤ t0 . Since t(v, b) is the equilibrium threshold, for the buyer

Z t1

dF n−1 (x)

Gn−1 (t1 ) with a valuation v, jumping to the buy price when the auction

u(v0 − x)

≥

(A2) u(v0 − b) 1 −

Gn−1 (t0 )

Gn−1 (t0 )

t0

ticker reaches t(v, b) ≤ t0 is at least as good as jumping at t0 :

Since u is concave, x ≤ b =⇒ u(v1 − x) − u(v0 − x) ≤

u(v1 − b) − u(v0 − b). Together with (A1), (A2), we have

Z t1

Gn−1 (t1 )

dF n−1 (x)

≥1−

G

(t

)

G

n−1 0

n−1 (t0 )

t0

u(v − b)Gn−1 (t(v, b))

(B1)

≥ u(v − b)Gn−1 (t0 ) +

Z t0

u(v − x) dF n−1 (x)

t(v,b)

Let T (p) denote the cumulative distribution function of t(v, b),

i.e., the probability that a bidder uses the unconditional, conditional or threshold strategy with a threshold price below or equal

to p:

T (p) = 1 − F (v) + Prob(t(v, b) ≤ p)

F n−1 (t1 ) − F n−1 (t0 ) ≥ Gn−1 (t0 ) − Gn−1 (t1 )

Gn−1 (t) is defined to be the probability that a bidder with

threshold t exercises the buy price and wins the auction. Lowering the threshold from t1 to t0 increases the chance of successfully using the buy price by at least the probability that there is

another bidder with valuation between t0 and t1 , i.e.,

t(v, b) is strictly decreasing in v implies that T is continuous and

Gn−1 (p) can be expressed as

F n−1 (t1 ) − F n−1 (t0 ) ≤ Gn−1 (t0 ) − Gn−1 (t1 )

Gn−1 (p) = (1 − T (p))n−1 − F n−1 (p)

Hence Gn−1 (t0 )−Gn−1 (t1 ) = F n−1 (t1 )−F n−1 (t0 ), and (A2)

becomes

Z t1

u(v0 − x) dF n−1 (x)

u(v0 − b)(F n−1 (t1 ) − F n−1 (t0 )) ≥

Gn−1 (p) is the probability that a bidder with threshold price p

uses the buy price and wins, which occurs if no one else has

a threshold price lower than or equal to p excluding the case

in which the bidder wins without using the buy price because

everyone else has a valuation less than p.

The continuity of T and F implies that G is also continuous,

therefore taking the limit in (B1) as v & v0 we get

t0

0≥

Z

t1

t0

u(v0 − x) − u(v0 − b) dF n−1 (x)

which implies F (t0 ) = F (t1 ). Since F is strictly increasing,

t0 = t1 must hold, contradictory to our assumption. Therefore,

we have proved that t(v, b) is non-increasing in v for all v ≥ b.

Now we further prove that t(v, b) is strictly decreasing when

b < v < v, i.e., t(v, b) > r. Again, prove by contradiction. Assume that for t0 > r and some b ≤ v0 < v1 ,

∀v(v0 ≤ v ≤ v1 =⇒ t(v, b) = t0 ), i.e., all bidders with

valuations between v0 and v1 pool at the same threshold price

t0 . This implies a positive probability that more than one bidder with valuations between v0 and v1 would jump to the buy

price simultaneously when t0 is reached and the winner would

be chosen randomly among them. But if one of them decides

u(v0 − b) ≥ u(v0 − b)

Gn−1 (t0 )

+

Gn−1 (t+ )

Z

t0

u(v0 − x)

t+

dF n−1 (x)

Gn−1 (t+ )

Since t(v, b) is non-increasing in v and now v & v0 , t(v, b)

cannot take any value between t+ and t0 . Since t(v, b) is

strictly decreasing when above r, when t+ > r we have

T (t+ ) = T (t0 ). Using it in the definition of Gn−1 , we have

Gn−1 (t0 ) − Gn−1 (t+ ) = −(F n−1 (t0 ) − F n−1 (t+ )). Therefore,

Z t0

dF n−1 (x)

F n−1 (t0 ) − F n−1 (t+ )

u(v0 −x)

0≥

−u(v0 −b)

Gn−1 (t+ )

Gn−1 (t+ )

t+

9

0≥

Z

t0 u(v0 − x) − u(v0 − b)

t+

dF n−1 (x)

Therefore, we have

Gn−1 (t+ )

∂Πt (v, p)

∂p

Since t < b, u(v0 − x) − u(v0 − b) > 0. If t0 > t+ , the integral

on the right side would be strictly positive. Therefore, the above

formula can only hold if t+ = t0 . This completes the proof of

the right-continuity of t(v, b) with regard to v when t(v, b) > r.

Using similar arguments, we can prove the left-continuity of t.

0

= u(v − p)F n−1 (p) +

0

F n−1 (w(p, b))

0

− F n−1 (p)

u(v − b)

∂1 t(w(p, b), b)

0

Dividing by u(v − b)F n−1 (p) > 0 preserves the sign of the

above formula, and we get

0

Note that the continuity of t(v, b) in v is only true when

t(v, b) > r; it is possible that t has discontinuity at some point

where t suddenly drops to r.

(C2)

F n−1 (w(p, b))

u(v − p)

−1+

u(v − b)

∂1 (F n−1 ◦ t)(w(p, b), b)

When t is the equilibrium threshold function, i.e., p∗ = t(v, b)

and w(p∗ , b) = v, the above is zero:

Appendix C. Proof of Theorem 1

0

F n−1 (v)

u(v − t(v, b))

−1+

=0

u(v − b)

∂1 (F n−1 ◦ t)(v, b)

THEOREM 1: Any threshold price function t(v, b) corresponding to an equilibrium satisfies the following differential equation:

And clearly, t(b, b) = b, since a bidder with valuation b cannot

get any surplus by bidding the buy price.

0

F n−1 (v)

u(v − t(v, b))

−1+

= 0, t(b, b) = b

u(v − b)

∂1 (F n−1 ◦ t)(v, b)

Appendix D. Proof of Proposition 3

P ROOF. In equilibrium, when all other bidders follow the

threshold strategy determined by t, the optimal threshold price

of a bidder with valuation b < v < v is t(v, b), i.e., p∗ = t(v, b)

maximizes Πt (v, p). Differentiating a threshold bidder’s expected utility function (3) in p, we get

(C1)

For the proof we will need the following lemma:

LEMMA D1: For any x > 0 and d > 0,

decreasing in x.

∂Πt (v, p)

0

= u(v − b)G0n−1 (p) + u(v − p)F n−1 (p)

∂p

P ROOF. Let x < y.

u(x + d)

−1 =

u(x)

Differentiating Gn−1 (p) gives

0

G0n−1 (p) = −(n − 1)(1 − T (p))n−2 T 0 (p) − F n−1 (p)

≥

Because t(v, b) is strictly decreasing and continuous in v when

b < v < v, its inverse function in the first variable, denoted by

w(·, b), exists:

t(w(p, b), b) = p

>

=

Using w, T (p) can be expressed as

and we have

f (w(p, b))

∂1 t(w(p, b), b)

Replacing T (p) and T 0 (p) in G0n−1 (p), we get

G0n−1 (p) = (n − 1)F n−2 (w(p, b))

P ROOF. To show that t(v, b) = p∗ maximizes the expected

profit of a bidder with b < v < v, it is enough to show that

(v,p)

(C2), having the same sign as ∂Πt∂p

, is positive if p < t(v, b)

and negative when p > t(v, b). Since w(·, b) is the inverse of

t(·, b), w(t(v, b), b) = v. w(·, b) is strictly decreasing; therefore,

w(p, b) < v if p > t(v, b) and w(p, b) > v if p < t(v, b).

f (w(p, b))

0

− F n−1 (p)

∂1 t(w(p, b), b)

0

=

u(x + d) − u(x)

u(x)

u(y + d) − u(y)

because u is concave

u(x)

u(y + d) − u(y)

because u is increasing

u(y)

u(y + d)

−1

u(y)

PROPOSITION 3: Let t be the function defined by (4) and let

v > b satisfy that for all x < v that t(x, b) > r. If all other

bidders with valuations x, b < x < v, follow the threshold

strategy t(x, b), then the optimal threshold strategy of a bidder

with valuation v, b < v < v, is to use t(v, b) as his threshold

price.

T (p) = 1 − F (w(p, b))

T 0 (p) = −

u(x + d)

is strictly

u(x)

F n−1 (w(p, b))

0

− F n−1 (p)

∂1 t(w(p, b), b)

10

Since u is concave, u0 (v − r) ≤ u0 (v − b). So we have (u0 (v −

r) − u0 (v − b))F n−1 (r) ≤ 0. Together with F (v) ≤ 1, we get

Π0u (v) ≥ Π0c (v).

A threshold bidder wins only if there are no unconditional

or conditional bidders. Therefore, his probability of winning

is at most F n−1 (v). A bidder with a threshold price p wins if

either all other bidders have valuations below p, which has a

probability F n−1 (p), or he successfully exercises the buy price,

which has a probability Gn−1 (p). This implies

First consider the case when p is in the range of t, i.e., v =

w(p, b) < v and t(w(p, b), b) = p. Substitute v = w(p, b) into

(4):

0

F n−1 (w(p, b))

u(w(p, b) − t(w(p, b), b))

= 1−

n−1

∂1 (F

◦ t)(w(p, b), b)

u(w(p, b) − b)

u(w(p, b) − p)

= 1−

u(w(p, b) − b)

Substituting this into (C2) we get

F n−1 (p) + Gn−1 (p) ≤ F n−1 (v)

u(v − p) u(w(p, b) − p)

−

u(v − b)

u(w(p, b) − b)

(D1)

Applying u0 (v − b) ≥ u0 (v − x), for all x ≤ b, with the above

inequality, we get

Z p

∂Πt (v, p)

u0 (v − x) dF n−1 (x)

= u0 (v − b)Gn−1 (p) +

∂v

r

+u0 (v − r)F n−1 (r)

≤ u0 (v − b)Gn−1 (p) + u0 (v − r)F n−1 (r) +

Applying Lemma D1 with d = b − p, x1 = v − b, and x2 =

w(p, b) − b, we can see that (D1) is positive if w(p, b) > v,

i.e., p < t(v, b), and negative if w(p, b) < v, i.e., p > t(v, b).

This shows that t(v, b) maximizes the expected profit from the

threshold strategy as long as the threshold is in the range of t.

Since t is continuously decreasing and t(b, b) = b, the range of

t(v, b) for b < v < v is an interval (t, b).

When p is not in the range of t, i.e., r < p ≤ t and no other

bidder will use a threshold price below or equal to p, using the

threshold price p, a bidder can only lose to conditional or unconditional bidders. Therefore,

u0 (v − b)(F n−1 (p) − F n−1 (r))

≤ (u0 (v − r) − u0 (v − b))F n−1 (r) +

u0 (v − b)(F n−1 (p) + Gn−1 (p))

≤ (u0 (v − r) − u0 (v − b))F n−1 (r) +

Gn−1 (p) = F n−1 (v) − F n−1 (p)

(E1)

Applying it in (C1) we get

u0 (v − b)F k (v̂)F n−k−1 (v)

∂Πt (v, p)

0

= (u(v − p) − u(v − b))F n−1 (p) > 0

∂p

The average of (E1) over k = 0, . . . , n − 1 is exactly Π0c (v),

which leads to

which implies that Πt (v, p) is strictly increasing for all p ∈ (r, t].

Combining this with the case in which p ∈ [t, b), we get

Πt (v, p) strictly increasing for all p ∈ (r, t(v, b)) and strictly

decreasing for p ∈ (t(v, b), b). This proves that, as long as all

other bidders use the threshold strategy, p∗ = t(v, b) maximizes

Πt (v, p) for a given v; that is, the optimal threshold price of a

bidder with valuation v is t(v, b).

∂Πt (v, p)

≤ Π0c (v)

∂v

LEMMA F1: Let u1 : R+ 7→ R+ , u2 : R+ 7→ R+ be twice

differentiable utility functions, u1 (0) = u2 (0) = 0, and u01 (x) >

0, u02 (x) > 0 for all x ≥ 0. Let a1 = −u001 /u01 and a2 =

−u002 /u02 be the absolute level of risk aversion. If a1 (x) ≤ a2 (x)

for all x ≥ 0, then the following inequality holds:

!

u1 (x)

u2 (x)

∀x, y 0 < y < x =⇒

≥

u1 (y)

u2 (y)

PROPOSITION 4 For all v > b and r < p < b,

Π0u (v) ≥ Π0c (v) ≥

∂Πt (v, p)

∂v

P ROOF.

=

When ∃y (0 < y < x) such that the equality holds, there is a

constant λ such that u1 (z) = λu2 (z) for all 0 ≤ z ≤ x.

n−1

u0 (v − b) X k

F (v̂)

n

k=0

0

Π0c (v)

=

u (v − b)

n

n−1

X

Appendix F. Comparing utility functions

based on the level of risk-aversion

Appendix E. Proof of Proposition 4

Π0u (v)

u0 (v − b)F n−1 (v)

≤ (u0 (v − r) − u0 (v − b))F n−1 (r) +

P ROOF. Let λ = u1 (x)/u2 (x). Part I: We want to prove that

∀x, y, 0 < y < x

F k (v̂)F n−k−1 (v) +

k=0

u1 (y)

u1 (y)

u1 (x)

≥

⇐⇒ λ ≥

⇐⇒ λu2 (y) − u1 (y) ≥ 0

u2 (x)

u2 (y)

u2 (y)

(u0 (v − r) − u0 (v − b))F n−1 (r)

11

Prove by contradiction:

Suppose ∃y R0 < y < x ∧ λu2 (y) −

y

u1 (y) < 0 , that is, ∃y 0 < y < x ∧ 0 (λu02 (v)−u01 (v)) dv <

0 . Together with u1 (0) = u2 (0) = 0, it implies that there is a

z, 0 < z < y, s.t., λu02 (z) − u01 (z) < 0, that is, u01 (z)/u02 (z) >

λ.

Note that a1 = −u001 /u01 = (− ln u01 )0 and a2 = −u002 /u02 =

(− ln u02 )0 . Thus for all v ≥ 0:

a2 (v) − a1 (v) =

u0 (v)

ln 10

u2 (v)

0

REFERENCES

Ausubel, Lawrence M. and Cramton, Peter. “The Optimality

of Being Efficient,” June 1999. Working Paper

http://www.cramton.umd.edu/papers1995-1999/98wpoptimality-of-being-efficient.pdf.

Brennan, Michael J. “The Pricing of Contingent Claims in

Discrete Time Models.” Journal of Finance, 1979, 24,

53–68.

Budish, Eric B. and Takeyama, Lisa N. “Buy prices in online

auctions: irrationality on the Internet?” Economics Letters,

2001, 72, 325–333.

Mathews, Timothy. “The Impact of Discounting on an Auction

with a Buyout Option: a Theoretical Analysis Motivated by

eBay’s Buy-It-Now Feature.,” July 2002. Working Paper.

http://buslab5.csun.edu/tmathews/pdf/eBayPaper.pdf.

. “Improving Upon a Buyout Option with a Fixed Buyout

Price,” October 2002. Working Paper.

http://buslab5.csun.edu/tmathews/pdf/multistagepaper.pdf.

. “The Role of Varying Risk Attitudes in an Auction with a

Buyout Option,” June 2002. Working Paper.

http://buslab5.csun.edu/tmathews/pdf/BuyoutPaper.pdf.

. “A Risk Averse Seller in a Continuous Time Auction with

a Buyout Option.” Brazilian Electronic Journal of

Economics, January 2003, 5 (2).

http://www.beje.decon.ufpe.br/v5n2/mathews.html.

Myerson, Roger B. “Optimal Auction Design.” Mathematics

of Operations Research, February 1981, 6 (1), 58–73.

Reynolds, Stanley S. and Wooders, John. “Ascending Bid

Auctions with a Buy-Now Price,” August 2002. Working

Paper.

Riley, John G. and Samuelson, William F. “Optimal

Auctions.” The American Economic Review, June 1981,

pp. 381–392.

Roth, Alvin E. and Ockenfels, Axel. “Last-Minute Bidding

and the Rules for Ending Second-Price Auctions: Evidence

from eBay and Amazon Auctions on the Internet.” American

Economic Review, forthcoming.

Wang, Ruqu. “Auctions versus Posted-Price Selling.” The

American Economic Review, September 1993, 83 (4),

838–851.

Wang, Wenli; Hidvégi, Zoltán and Whinston, Andrew B.

“Shill Bidding in English Auctions,” January 2002. working

paper.

≥0

This means that u01 /u02 is non-decreasing. Therefore,

∀v v ≥

0

0

0

0

z =⇒ u1 (v)/u2 (v) > λ =⇒ λu2 (v) − u1 (v) < 0 . Hence

λu2 (x)−u1 (x) = λu2 (y)−u1 (y)+

Z

x

y

(λu02 (v)−u01 (v)) dv < 0

which contradicts to the definition of λ = u1 (x)/u2 (x). Therefore, the following must hold:

!

u1 (x)

u2 (x)

∀x, y 0 < y < x =⇒

≥

u1 (y)

u2 (y)

Part II: Assume ∃y 0 < y < x ∧ λu2 (y) − u1 (y) = 0 , that is

Z

y

0

(λu02 (v) − u01 (v)) dv = 0

Note that u01 /u02 is non-decreasing. In order to satisfy

the above,

either ∀z 0 < z < y =⇒ λu02 (z) − u01 (z) = 0 or ∃z1 , z2 0 <

z1 < z2 < y ∧ λu02 (z1 )−u01 (z1 ) > 0 ∧ λu02 (z2 )−u01 (z2 ) < 0 .

But the later case means that ∀v(z2 ≤ v ≤ x =⇒ λu02 (v) −

u01 (v) < 0), thus

Z x

λu2 (x)−u1 (x) = λu2 (y)−u1 (y)+

(λu02 (v)−u01 (v)) dv < 0

y

which contradicts to the definition of λ = u1 (x)/u2 (x). Thus

the earlier case ∀z 0 < z < y =⇒ λu02 (z) − u01 (z) = 0 must

be true. Consequently, together with u1 (0) = u2 (0) = 0, we get

∀z 0 < z < y =⇒ λu2 (z) − u1 (z) = 0 .

For ∀z, y < z < x, applying the inequality result in Part I, we

have

u1 (z)

u2 (z)

λu2 (z)

≥

=

u1 (y)

u2 (y)

λu2 (y)

u1 (y)

u1 (z)

≥

=1≥0

λu2 (z)

λu2 (y)

λu2 (z) − u1 (z) ≤ 0

Also, Part I says that ∀z 0 < z < x =⇒ λu2 (z)−u1 (z) ≥ 0 .

Therefore, ∀z y < z < x, =⇒ λu2 (z)−u

1 (z) = 0 , therefore

∀z 0 < z < x =⇒ λ = u1 (z)/u2 (z) .

12