Kennewick School District No. 17 Washington State Auditor’s Office Benton County

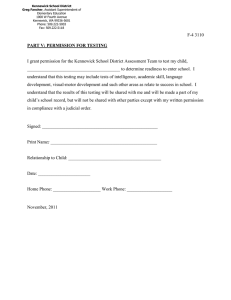

advertisement