Problem Hsieh and Klenow (QJE 2009) Set 3:

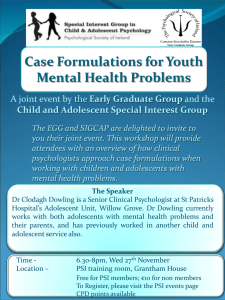

advertisement

Problem Set 3: Hsieh and Klenow (QJE 2009) This exercise goes through careful derivations of equations in the paper. (a) (1 point) Given the production function given in formula (3) of the paper, solve the cost minimization problem Ps Ys = min Ms X Psi Ysi i=1 subject to Ms X Ys = σ−1 σ ! σ−1 σ . Ysi i=1 Determine Ps . Solution: Set up the Lagrangian Ls = Ms X σ−1 σ Psi Ysi + λs Ys − Ms X σ −1 σ ! Ysi , i=1 i=1 where λs is the multiplier on the constraint. Taking first-order conditions yields ∂Ls σ − 1 − σ1 = Psi − λs Ysi = 0. ∂Ysi σ This shows that total costs are given by Ms X M s σ −1 σ−1X Psi Ysi = λs Ysi σ σ i=1 i=1 (9) and that the demand function is given by σ−1 Ysi σ = 1 σ−1 λs Psi σ σ−1 . (10) We are now going to solve for the multiplier λs . The demand function (10) implies σ σ ! σ− σ X σ−1 ! σ− 1 1 Ms Ms X σ−1 σ − 1 1 σ Ys = Ysi = λs σ Psi i=1 i=1 (11) This implies that the multiplier λs is given by 1 σ−1 λs = Ysσ σ σ−1 Ms X 1 Psi i=1 1 1 ! σ−−1 . (12) Plugging this in (9) yields Ms X Psi Ysi = λs i=1 σ − 1 σ−1 Ys σ σ 1 σ = Ys = Ys (13) σ−1 !− σ−1 1 Ms X σ −1 1 Ys σ Psi i=1 1 σ−1 !− σ−1 Ms X 1 Psi i=1 So, finally we arrive at Ps = Ms X ! 1−1 σ 1−σ Psi . (14) i=1 Ps is the price index to buy the composite good Ys . More specifically: if the M individual goods σ P σ −1 σ−1 Ms M σ costs Ps , if each have prices [Psi ]i=1 , then one unit of the composite good Ys = Y i=1 si individual variety Ysi is bought in the efficient proportions. Ps is sometimes referred to as the ideal price index and in many models Ps is used as the numeraire. (b) (1 point) Show that the profit maximization of firm i in industry s is max Y si,Lsi,Ksi (1 − τYsi ) λs σ −1 σ−1 (Ysi ) σ − wLsi − (1 + τKsi ) RKsi σ (15) αs 1−αs subject to Ysi = Asi Ksi Lsi . Solution: Given the demand curve (10) Psi = λs σ − 1 − σ1 Ysi , σ after-tax revenue of firm si is (1 − τYsi ) Psi Ysi = (1 − τYsi ) λs σ−1 σ−1 (Ysi ) σ . σ Hence, (15) is the appropriate profit maximization problem. Note that λs is an endogenous variable as seen in (12). It depends on the prices of all other firms and on aggregate demand (the market size Ys ). Note also that λs is taken as given by firm si, although it depends on Psi (and hence on Ysi via the demand function). This is the essence of monopolisitc competition - firms recognize their market power in their variety i, but they take economywide aggregates as given. (c) Use the solution to the firm maximization problem and the expression of Ps to derive the formula (15) in the paper. Solution First of all, sorry we had to make you go through this, but take it as a lesson for life ... and enjoy the fact that you are never going to do this again. To derive the result, we use the 2 following alternative definitions of sectoral average marginal products of labor and capital (instead of the ones proposed in page 1409) 1 M P RLs = 1 M P RK s = Ms X i=1 Ms X i=1 1 Psi Ysi M P RLsi Ps Ys (16) 1 Psi Ysi M P RKsi Ps Ys Profit maximization on the firms’ behalf implies the first order conditions σ−1 σ−1σ−1 (1 − αs ) Ysi σ σ σ σ−1 σ−1σ−1 (1 − τYsi ) λs αs Ysi σ σ σ (1 − τYsi ) λs = wLsi = (1 + τKsi ) RKsi . Using the definition of λs (see (10)), we get that (1 − τYsi ) σ−1 (1 − αs ) Psi Ysi = wLsi σ and σ−1 αs Psi Ysi = (1 + τKsi ) RKsi σ First, look at firms’ labor demands. Using equation (10) in the paper M P RLsi = (1 − τYsi ) Lsi = = = w 1−τYsi , we obtain 1 σ−1 (1 − αs ) Psi Ysi M P RLsi σ 1 Psi Ysi σ − 1 (1 − αs ) Ps Ys M P RLsi Ps Ys σ 1 Psi Ysi σ − 1 (1 − αs ) θs P Y, M P RLsi Ps Ys σ where the last equality Ps Ys = θs P Y follows from the Cobb-Douglas structure of final demand expenditure shares across sectors are equal to the share parameter θs . Using this, we get X X 1 Psi Ysi σ − 1 Ls = Lsi = (1 − αs ) θs P Y M P RLsi Ps Ys σ i i X σ−1 1 Psi Ysi (1 − αs ) θs P Y = σ M P RLsi Ps Ys i ≡ σ−1 1 (1 − αs ) θs P Y , σ M P RLs where M P RLs is defined in (16). Rearraning terms yields 1 M P RLs Ls σ−1 = P Y. σ (1 − αs ) θs 3 (17) Using the labor market clearing condition L = Ls = P s Ls , (17) implies that 1 (1 − αs ) θs M P RLs LP 1 (1 − αs0 ) θs0 M P RLs0 (12’ HK) Similarly, consider the firms’ capital demands Ksi = = 1 1 − τYsi σ − 1 αs Psi Ysi R 1 + τKsi σ 1 σ−1 αs Psi Ysi M RP Ksi σ Therefore, by definition of M P RK s , we have Ks = X Ksi = 1 σ−1 αs θs P Y. M P RK s σ We also obtain 1 s Ks = K P M P RK 1 αs θs M P RK s0 αs0 θs0 (13’ HK) From the definition of the sectoral average marginal product of labor and capital (see (17)) we have M P RLs Ls = so σ−1 (1 − αs ) Ps Ys ; σ Ps Ys σ 1 = M P RLs . Ls σ − 1 1 − αs Similarly M P RK s Ks = so (18) σ−1 αs Ps Ys ; σ Ps Ys σ 1 = M P RK s . Ks σ − 1 αs (19) We are now in the position to derive (15) of the paper. First of all note that by definition (see (14) in the paper) Ys T F Ps = αs 1−αs . Ks Ls Using (18) and(19) this implies that α 1−αs Ys Ps s Ys Ps 1 Ks Ls Ps αs 1−αs σ M P RKs M P RLs 1 = σ−1 αs 1 − αs Ps 1 = T F P Rs . Ps T F Ps = 4 Now recall that 1 ! 1−σ Ps X = 1−σ Psi , i which implies that 1 = Ps X i as T F P Rsi = Asi T F P Rsi 1 σ−1 ! σ−1 Psi Ysi αs 1−αs Ksi Lsi , = Psi Asi . Hence, T F Ps = T F P Rs = T F P Rs 1 Ps X i X = i Asi T F P Rsi T F P Rs Asi T F P Rsi σ−1 ! σ−1 1 1 σ−1 ! σ−1 , which is the required equation. (d ) There is a large literature trying to link the distortions (τYsi , τKsi ) to financial frictions individual firms face. To see the relation between these exogenous taxes and credit constraints, suppose that there are no taxes (i.e. τYsi = τKsi = 0) but firm i faces a credit constraint of the form wLsi + ζRKsi ≤ W (zsi , η) , where zsi is a firm characteristic (e.g. wealth), η parametrizes the financial system and ζ parametrizes how much of capital expenses can be pledged. Suppose that W is increasing in both argument, i.e. wealthy firms are less constrained and better financial system are associated with higher values of η. Derive the firm’s factor demands taking factor prices as given and aggregate demand as given. What are the firm-specific “taxes” in this framework? Which firms face high “output-taxes τYsi ”? Under what conditions would a researcher conclude that τKsi = 0? Solution: The firm solves the problem given in part (b) with τYsi = τKsi = 0 but facing the credit constraint. I.e. the profit maximization problem is given by max Y si,Lsi,Ksi λs σ−1 σ−1 (Ysi ) σ − wLsi − RKsi σ s subject to Ysi = Asi L1−α K αs and the constraint si wLsi + RKsi ≤ W (zsi , η) . 5 Letting µ (zsi , η) be the multiplier on the credit constraint, the first order conditions characterizing the firm’s factor demand are given by 2 σ−1 1 σ−1 1 + ζ µ (zsi , η) λs αsi Ysi σ = RKsi 1 + µ (zsi , η) σ 1 + µ (zsi , η) 2 σ −1 1 σ−1 λs (1 − αsi ) Ysi σ = wLsi 1 + µ (zsi , η ) σ Substituting the expression for λs , factor demands are 1 σ−1 1 + ζµ (zsi , η) αsi Psi Ysi = RKsi σ 1 + µ (zsi , η) 1 + µ (zsi , η) 1 σ−1 (1 − αsi ) Psi Ysi = wLsi . 1 + µ (zsi , η) σ The corresponding demand in Hsieh-Klenow are given by (1 − τYsi ) σ−1 (1 − αs ) Psi Ysi = wLsi σ and σ−1 αs Psi Ysi = (1 + τKsi ) RKsi σ Hence, taxes play exactly the role of the Lagrange multplier of the firm’s problem. In particular, the solutions to these problem is identical if (1 − τYsi ) 1 − τYsi = and 1 + τKsi = 1 1 + µ (zsi , η) 1 + ζµ (zsi , η) . 1 + µ (zsi , η) Clearly, a high τY firm is one where µ (zsi , η) is high, i.e. which has a high shadow value of internal funds. With parametrization given above, µ is decreasing in zsi (i.e. if you have more capital to pledge your shadow value of internal funds is lower) and η (as good financial institution e.g. allow you to borrow more against each dollar of collateral). Hence, poor firms and firms in underdeveloped regions face binding constraints and will be identified as firms facing high output distortions. Similarly, τKsi is equal to zero, whenever ζ = 1, i.e. if capital and labor are “equally pledgable”, the relative tax on capital is zero. If ζ < 1, τK < 0, i.e. capital is the relative unconstrained factor and the firm acts as if capital is cheap. Basically: you can borrow against capital but not agains labor. As the production function allows some substitution between labor and capital, the firm will produce as higher capital intensities, which Hsieh and Klenow would identify as the firm receiving a subsidy of capital. 6 [Part II] This part concerns the analysis of equations in Appendix I in the paper. P Li (a) Show that T F P = T F P R Pwγ in which T F P R = M i=1 L T F P Ri Soln Firm i solves max πi = (1 − τi ) P Ai Lγi − wLi . Li The FOC is (1 − τi ) P Ai γLγ−1 = w i so that firm i’s output is given by Yi = w 1 Li . P γ 1 − τi Aggregate output is given by Y = X Yi = w X 1 Li . Pγ i 1 − τi As a result, Y w X Li 1 = L Pγ L 1 − τi w X Li = T F P Ri L Pγ w = T F P R. Pγ TFP = (b) Suppose (1 − τi ) = a A1i . Using the labor market clearing condition, show that PM Ai 1 T F P = γ i=1 1 γ − M L independent of a. Give a concise interpretation why aggregate TFP is independent of a. What is the crucial assumption for this result? Solution The firms’ labor demand equation (20) implies aP γLγ−1 = w, i so that Li = aP γ w 1 1−γ . Market clearing implies L= M X Li = M i=1 aP γ w 1 1−γ , so that equilibrium wages are given by w = aP γ M L 1−γ . MIT OpenCourseWare http://ocw.mit.edu 14.772 Development Economics: Macroeconomics Spring 2013 For information about citing these materials or our Terms of Use, visit: http://ocw.mit.edu/terms.